Maria Vonotna

STORE Capital Corporation (NYSE:STOR) is a high-quality REIT in which I recently increased my position. The real estate investment trust is well-managed by a team of executives who are steadily expanding the trust’s portfolio footprint and investment locations.

In my opinion, STORE Capital is an excellent REIT investment that allows investors to participate in the trust’s long-term funds from operations growth.

A Dividend As Safe As It Gets

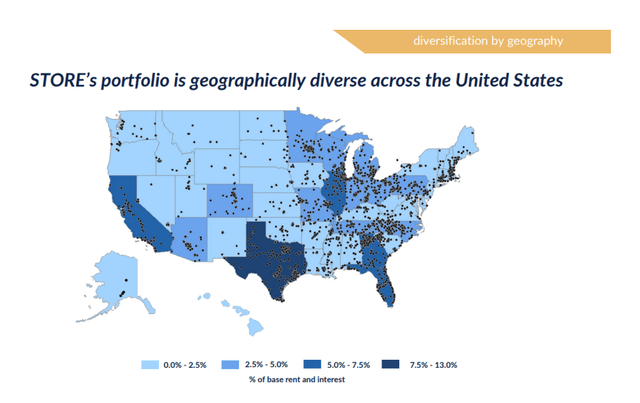

STORE Capital has grown into a true REIT behemoth, investing billions of dollars in mostly service-oriented retail and manufacturing properties throughout the United States. STORE Capital had properties in 49 states as of June 30, 2022, making it a truly national real estate investment trust.

Geographically Diverse Portfolio (STORE Capital Corp)

As of the end of 2Q-22, the real estate investment trust had over 3,000 investment locations and rented its properties to tenants in 124 industries. All of STORE Capital’s properties have long-term lease structures that provide the trust with consistent lease income and cash flow visibility.

The trust’s focus on high-quality properties and tenants has resulted in a 99.5% occupancy rate, which is particularly impressive. Because there is always some kind of turnover in a real estate portfolio, the occupancy rate is extremely high, demonstrating how well the trust is managed.

Realty Income Inc. (O), another REIT I hold in high regard, had a 2Q-22 occupancy rate of 98.9%. Realty Income and STORE Capital are both extremely well-managed companies with nearly full portfolio utilization.

Portfolio At A Glance (STORE Capital Corp)

Acquisitions Are Driving STORE Capital’s Growth

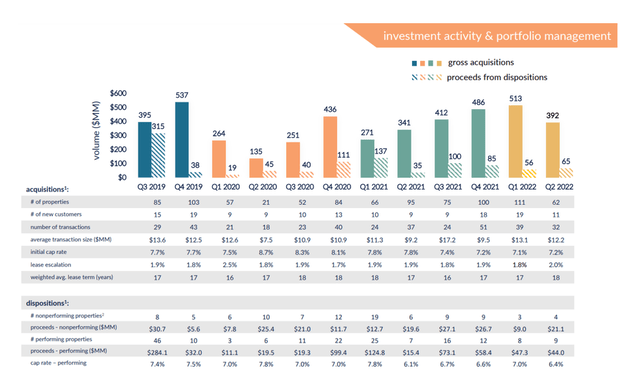

The constant acquisitions of STORE Capital result in a slowly but steadily growing national real estate platform. So far this year, the trust has acquired 173 properties worth $904.4 million, with transactions completed at a weighted average capitalization rate of 7.1%. During the same time period, the trust sold $117.2 million in non-performing real estate assets.

In terms of dispositions, STORE Capital earned a net profit of $19.7 million from the sale of 24 properties. STORE Capital’s acquisition volume ranges between 50-100 properties per quarter, with 2Q-20 being an exception due to the uncertainty in real estate markets caused by Covid-19.

Investment Activity (STORE Capital Corp)

STORE Capital Vs. Peers

Acquisitions by STORE Capital help the company increase its funds from operations and dividend. The trust’s real estate assets generated $163.8 million in adjusted funds from operations, or $0.58 per share, in 2Q-22, representing 16% YoY growth due to a robust return of demand to real estate markets following the pandemic.

STORE Capital earned $0.58 per share in adjusted funds from operations in 2Q-22, more than enough to cover the $0.385 per share dividend.

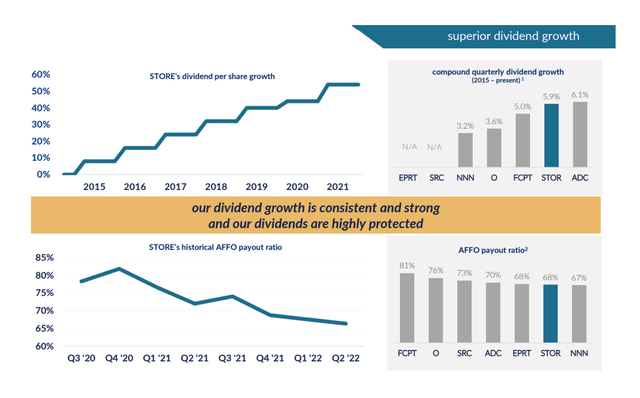

STORE Capital has a lower pay-out ratio (68%) than Realty Income (76%), which is widely regarded as the gold standard in the REIT industry due to its exceptionally long track record.

The trust could afford to increase its dividend significantly due to STORE Capital’s strong acquisition-driven growth in funds from operations. STORE Capital, in fact, has outperformed all but one of its large retail trust peers in terms of dividend growth, with an annual rate of 5.9% since 2015.

Superior Dividend Growth (STORE Capital Corp)

2022 Guidance Raise And AFFO-Valuation

STORE Capital increased its adjusted funds from operations guidance from $2.20-$2.23 to $2.25-2.27 and plans $1.3-1.5 billion in net full-year real estate acquisitions. Based on this guidance, STORE Capital’s stock trades at a 12.9x expected AFFO multiple.

Realty Income, STORE Capital’s closest competitor and comparable in terms of portfolio quality, forecast adjusted funds from operations of $3.84 to $3.97 per share (no change).

The stock trades at an AFFO multiple of 18.9x based on Realty Income’s AFFO expectations for this year. Based on the potential for long-term AFFO growth, I believe Realty Income is slightly overvalued and STOR Capital is undervalued.

Why STORE Capital Could See A Lower Valuation

STORE Capital is not in jeopardy. In 2Q-22, the trust earned its dividend, which was well-covered by the trust’s funds from operations. A bigger risk for STORE Capital would be the emergence of a more severe recession, which could result in higher vacancy rates and slower funds from operations and dividend growth in the future.

Since STORE Capital handled the previous recessions well, I don’t believe this is a high-risk factor that investors should be concerned about.

My Conclusion

STORE Capital is a very well-managed real estate investment trust, and the company’s strategy of purchasing properties across the country in small increments has resulted in the creation of one of the largest and most diverse retail-focused REITs in the United States.

Because the company is acquiring so many properties across the country, the trust’s funds from operations are increasing. The pay-out ratio is very low and superior to the retail REIT industry’s competitors’ ratios.

At the current price, there is nothing I dislike about STORE Capital. It has a covered 5.3% yield, a healthy portfolio, and a low valuation.

Be the first to comment