Liudmila Chernetska/iStock via Getty Images

We would like to start this column by stating unequivocally that we have owned AT&T (NYSE:T) stock for a long time. One of our longest holdings, to be frank. This stock has ebbed and flowed, but mostly, we have been on a slow death spiral lower. Earlier this month we discussed the stock’s implosion and why we were bearish in the short-term. We discussed that this is one of the most indebted companies in the world, and that this major risk helps keep the stock pinned. The key tenets of the column were that this stock is never going to be a growth name while its internal metrics continue to suffer, especially with debt-to-EBITDA over 3.2X, cash flow issues, and the need to invest heavily in capital spending. We wanted to follow up because many of our readers were left feeling like they should just sell and move on. It is our opinion that despite the pain of the stock, which has basically gone nowhere in 30 years, does have a place in an income portfolio, especially at these low levels. It is a dead money type stock, but from here, should be stable for income. In this column, we will highlight why the dividend is your friend, and really, it is the only reason to own AT&T stock, and to encourage you to “create your own” cash flow.

The dividend is AT&T’s saving grace

The thing is with the dividend being paid by AT&T this whole time, we did not lose anything holding this stock for so many years, because the cash returned eventually made up for the entire initial investment. However, if you factor in the amount of time this has taken, you may have lost, due to inflation. Just a fact. Or at least, you need more of those dividends to actually “break even”. Anyway, the current AT&T trades at $18, and currently pays $1.12 a year dividend, good for a 6.1% yield. While the stock has been weak since the spinoff of WarnerMedia, it is still an income name.

The issue with the company is that while it clearly has staying power, the debt is massive and cash flow is weakening, for now. We have to stress that this really is an issue. While the cash flow is likely to improve after the company ramps up its spending to acquire more customers, there is a risk that this does not pan out, or adds to debt. However, we think the dividend, while somewhat unsafe short-term will never be cut from here because it would be the biggest negative catalyst for the stock. But if cash flow cannot pay down debt big time, the possibility of a dividend hike becomes minimal. That is also an issue. For years, the company raised its dividend every year. At these levels, if you buy, and if you can wait nearly two decades, you will not lose money, if the dividend is never cut. But that is pretty dead money to sit around and wait, overall. Makes a good income name if cash flow can rebound, but for now, it looks tough.

Why there is concern here in the medium-term

The company’s recently reported results showed management is taking proactive measures, such as selective pricing adjustments, to address as much of the very real inflationary pressures that are out there. The economy is shaky.

With the rampant inflation out there AT&T is seeing terrible, massive cost pressures in its business.

In Q2 AT&T actually experienced a $1 billion attributable increase in costs than it thought it would have. Ouch. This is a new and challenging time for the company. While AT&T has been working to better its financial position, these new trying times could weigh.

We continue to strongly believe that management has to accelerate cost savings programs. On top of that, AT&T is going to go heavy on its promotional efforts to attract customers. With that said, the results suggest that the company had a good quarter, but the costs are an issue.

Top-line was strong

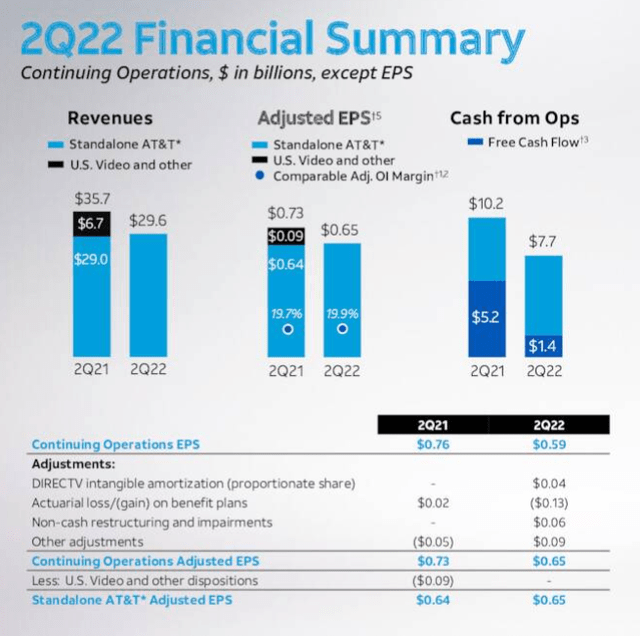

Analysts covering the company had a consensus expectation of $29.47 billion for Q2. We thought $29.75-29.8 billion in revenue was more likely. The top line actually came in at $29.60 billion, a beat of nearly $130 million vs. consensus.

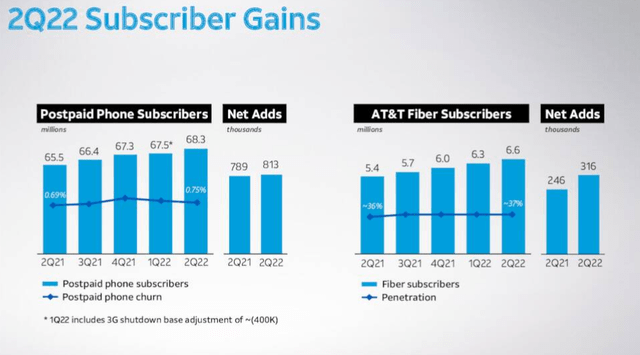

This all came as AT&T had the best Q2 for postpaid adds in a decade with wireless postpaid growth of 0.813 million adds and another 316,000 Fiber net adds. These are major positives that have been lost in the chaos of recent trading in the stock. They are taking customers from other competitors.

5G has been a great source of growth

Look, if we are owning this for income then anything that helps the company grow operationally is a win. And 5G is a win. We have to say, 5G has been a great source of growth. AT&T is now on track to hit 100 million people in its 5G world. That is pretty awesome, especially when the initial goal for year-end was 70 million. Impressive. Even earnings were strong.

The bottom line would have made you think all was well

You know what is interesting is that the strong top line revenue performance helped drive the bottom line to a nice beat versus consensus.

The analyst consensus was for $0.62. With the results, consensus was beaten by $0.03, as the bottom line hit $0.65. The problem is that expenses are too high and look like they are set to grow. What this will do is start offsetting the revenue as we move forward. We expect a major increase in operating expenses. In Q2, operating expenses were $24.7 billion.

The astute reader will not that these operating expenses is down from last year. But you have to understand of course there have been some major divestitures in the last year. All that said, operating income fell to $5 billion, though adjusting for one-time and special items the operating income really expanded slightly to $5.9 billion from $5.7 billion, accounting also for the divestitures. While that all seemed great, it was the all important free cash flow metric that has us seeing the stock as dead money. The stock has been acting as a zombie. It has been dead money for many weeks, and the issue is that free cash flow suggests the dividend is not covered.

Free cash flow collapsing

Look, this is still an income stock with a day-to-day trade that is dead money. But if you are relying on dividends, you are going to need to follow the free cash flow generation of the company. In the graphic above, we note the drop in operating cash, though this was due to divestitures. That said, free cash flow is everything here.

The stock is not moving because free cash flow is shriveling. But why does it even matter. For years, the dividend was being comfortably covered by free cash flow. We thought Q2 free cash flow would be in the range of $2.0 to 2.5 billion, considering cash from operating activities of $7.0-$7.5 billion and capex spending of $4.5 billion. In reality cash from operating activities were $7.9 billion, and capex was way up to $4.9 billion, while total capital investment from operations was so much higher than expected at $6.7 billion.

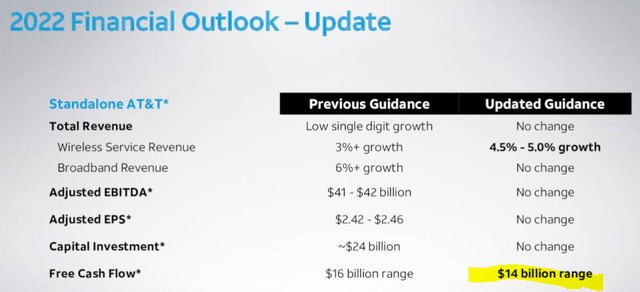

That all meant free cash flow collapsed to $1.4 billion. And in Q2 dividends paid were $2.09 billion, so there was about a $700 million shortfall. As an income investor for the long-term this is just a bad sign. But should you panic and sell? No! So you must watch to see if cash flow generation improves from here. That is a huge drop. Now it was not just this quarter. While revenue is very likely improve free cash flow was guided by management to be just $14 billion for the year.

That is trash when you consider where this stock was, or should have been anyway.

The good news

Despite the gutting to free cash flow, if we see this figure or higher, this should still cover the dividends to be paid of about $4.2 billion for H2 2022, considering free cash flow thus far was $4.2 billion in the year. That means we can expect another $9.8 billion in free cash flow if the forecast is correct, meaning the dividend will be covered, but the margin of safety is razor-thin.

This is why the stock fell so much and has been dead money. The market has no clue if things will improve. But if they do not, the stock could trickle even lower.

Dead money doesn’t mean no money

The stock has been stuck for a bit, especially since earnings. The market has rallied hard but AT&T’s stock has not really moved. But does this mean no money can be made? Well, we get our dividend. But we would encourage you to “create your own cash flow.” What? What does that mean? When you have a bit of a dead money zombie stock like AT&T has been, you can take advantage of the trading range to sell call options or even sell put options if you want to buy more stock or simply collect premium. Our members enjoy a lot of education on these topics but there is a lot of free resources to learn about this. If you are an income investor and are not selling call options against your positions on big price spikes, you are leaving money on the table. Likewise, if you are going to average down on drops, selling puts on big red days can bring in extra cash, and help define entry if assigned at expiration. Generate your own cash flow.

Where to buy

We still think $15 is where we would be heavy buyers. Long-term this could be a solid buy, but, if free cash does not improve, the stock could suffer. Still, the dividend yield of over 6% is strong. It may take 15 years or more to get all of your money back in dividends, but, as long as the dividend does not get cut. We think if the dividend got cut, this stock will plummet. We do not see it happening. The dividend is all this stock has, but you can also create some of your own cash flow here.

Be the first to comment