Michael Vi

Due to concerns about the company’s stock-based compensation (SBC) and risks to its sales growth, I initiated a short position in Palantir Technologies Inc. (NYSE:PLTR) in May via put options.

Now that the software company has abandoned its 30% sales growth target indefinitely due to a slowdown in its core business, the stock is at risk of falling to my fair value target of $2.50. Palantir should be avoided because it is still grossly overvalued.

Fundamentally Unsound Business

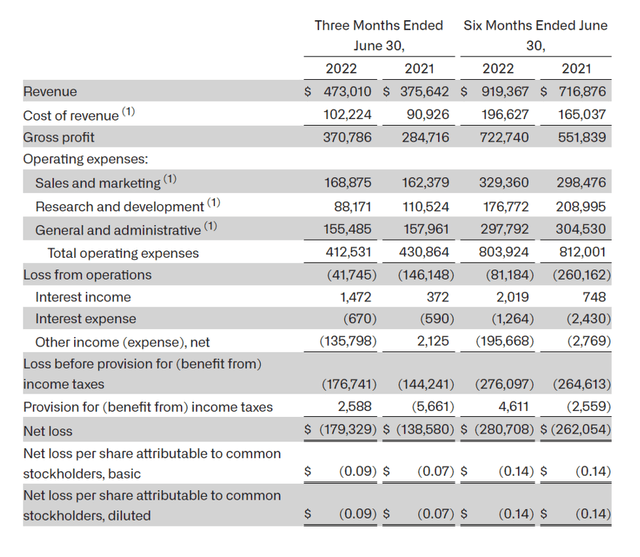

Palantir’s net losses were $101.4 million in 1Q-22. Palantir’s net losses in 2Q-22 were $179.3 million, a 77% increase QoQ.

For quite some time, I have been concerned about Palantir’s lack of underlying profitability and have stated here that Palantir is running a fundamentally unprofitable software business that appealed to investors primarily because of Palantir’s reliance on government contracts.

Palantir’s sales growth slowed further in the second quarter, posing a new problem for the company’s overvalued software division. Palantir’s sales in 2Q-22 were $473.0 million, up 26% YoY, as the software company gained more commercial customers. Having said that, I see no way for Palantir to generate profitable sales growth.

Net Losses (Palantir Technologies)

I think Palantir is plagued by two major issues.

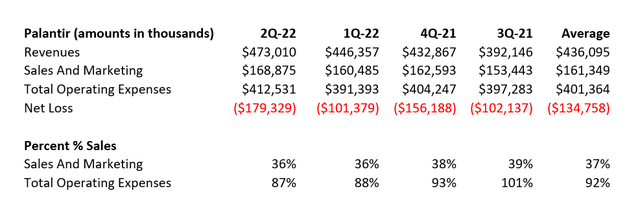

The first issue is that Palantir invests a lot of money in sales and marketing. Palantir’s sales and marketing expenses accounted for 36% of sales dollars in 2Q-22, which is roughly in line with what the company has previously paid for sales growth.

Importantly, total operating expenses remained widely inflated at 87% (down from 88% in 1Q-22), making profit impossible for Palantir. The allocation of stock-based compensation remained a significant driver of Palantir’s costs in the second quarter.

Sales/Marketing And Total Operating Expenses (Author Created Table Using Quarterly Earnings Reports From Palantir Technologies)

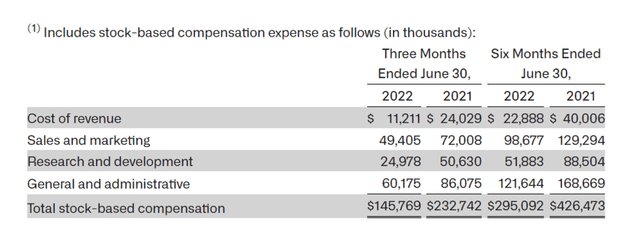

Palantir allocated $145.8 million in stock-based compensation to its cost categories, with 92% going to operating expenses and 8% going to revenue costs.

Palantir’s executive compensation has added $295.1 million to various expense categories year to date, which I consider generous given the company’s total loss of $280.7 million. In other words, if not for stock-based compensation, Palantir would have made a net profit of $14.4 million this year.

The majority of executive compensation consists of long-term equity incentives (options, restricted stock units), so Palantir’s management should be well compensated.

However, SBC compensation is not Palantir’s only issue. Palantir’s accumulated deficit as of June 30, 2022 was $5.77 billion, representing the company’s lifetime losses. With such high historical losses, Palantir must still demonstrate that it has a viable business model that promises the benefits of scalability. Given Palantir’s large loss base and high SBC, I don’t believe the company would be an appealing acquisition target.

Stock-Based Compensation (Palantir Technologies)

Palantir Scraps Guidance Remains Hopelessly Overvalued

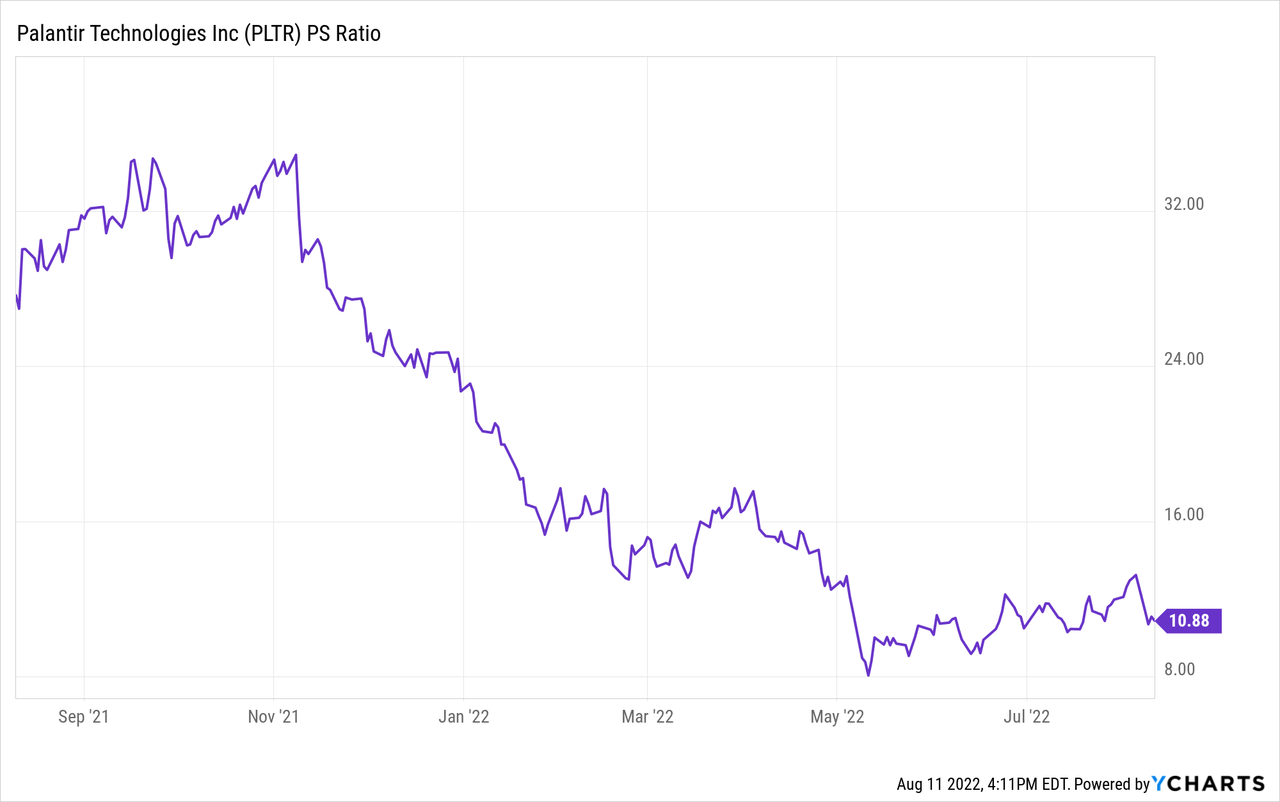

Palantir’s new revenue forecast for 2022 is $1.9 billion, representing 23% YoY growth, and the software company is no longer predicting 30% annual sales growth. This is a significant departure from previous quarters, when investors emphasized Palantir’s projected annual sales growth of 30%.

In my opinion, the software company has an indefensible sales multiple of 10x based on $1.9 billion in sales. I think the sales multiple is unjustifiable because Palantir has flawed fundamentals (inflated operating expenses), overpaid executives, and faces a slowing core consulting business.

Change To My Short Position

I made a minor change to my Palantir short position by extending the expiration date of my puts from January 2023 to March 2023.

The longer duration of the put options reduces my capital risks while also giving Palantir’s stock price more time to fall towards my $2.50 stock price target. My put options continue to have a strike price of $6.

Why Palantir Stock Could Increase

Palantir’s guidance may have some upside in the sense that government sales may pick up towards the end of the year, and Palantir could, in theory, deliver better-than-expected sales growth if new contracts are signed with various government agencies.

With that said, I believe it is safe to say that the 30% growth target is effectively off the table for the time being, and investors must make do with potentially much lower growth rates in the future.

Because Palantir continues to incur higher net losses, I am not optimistic that the company will be profitable this year or next.

My Conclusion

Palantir’s poor 2Q-22 business update makes it much more likely that PLTR will fall towards my $2.50 stock price target that I set for the software company in my last article on Palantir in May 2022. Palantir is not everything that investors thought it was, and reality is slowly sinking in.

Scrapping the much-touted 30% growth target strongly suggests that the odds are stacked against Palantir at this point, and in my view, Palantir should be avoided because it is still grossly overvalued.

Be the first to comment