Lawrence Glass

Most investors know the US cannabis market has been tough this year due to tough regulations and inflationary pressures hurting consumer spending on discretionary items. Curaleaf Holdings (OTCPK:CURLF) continues to feel the pressure, but the stock isn’t accurately priced for the growth opportunity ahead. My investment thesis remains ultra Bullish on the large MSO (multi-state operator) trading at a cheap valuation heading into some potential regulatory changes.

Tough Q3

Curaleaf reported Q3’22 revenues grew 7% to reach $340 million. The MSO reported operating cash flows of $60 million with adjusted EBITDA of $84 million for 18% growth from last year.

The company even technically had headwinds in New Jersey and Florida during the quarter. The Bordentown, New Jersey store didn’t finally open until November 2 and Hurricane Ian impacted Florida sales in both September and October.

The MSO saw Q3 transactions grow 7% sequentially led by 2 million online transactions while sales only grew 1%. The company sees this issue more of inflation reducing the basket size of consumers and not due to pricing pressures reducing the total market size.

The good news is that Curaleaf grew sales 7% YoY even during a tough quarter. Adjusted EBITDA did dip $2 million sequentially, but the MSO still hit $84 million in the quarter for margins of 25% In total, Curaleaf is facing 570 basis points of pressure from the growth markets such as Europe.

The company only guided to Q4 revenues of $353 to $355 million despite the addition of the Bordentown store and the Tryke deal. The Tryke acquisition adds 6 stores in Arizona and Nevada with an estimated $18 million in quarterly revenues while the New Jersey store alone could add as much as $14 million in quarterly revenue from just 2 months of sales.

If one just assigned $10 million in Q4 sales to the new New Jersey store, Curaleaf is facing a scenario where the Q3 base sales are falling by up to 4% sequentially. The biggest issue with cannabis sales is not fully understanding the seasonal impact in a normalized environment and the Bordentown ramp probably won’t reach such levels during Q4 being so late to the New Jersey market launch. As such, Curaleaf is probably facing a base decline of somewhere around 2% in the quarter.

World Class Position

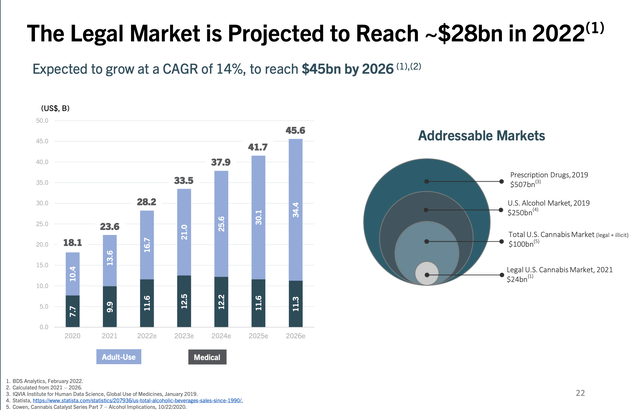

Not many growth sectors offer the leading stock trading below 10x forward EBITDA targets. The US cannabis sector is still forecast to grow at a 14% annual clip to reach $33.5 billion in 2023 on a path to $45.6 billion in 2026.

Source: Curaleaf Q3’22 presentation

Curaleaf is poised with operations in Connecticut, New York, Maryland and other key states to play the advancement of recreational cannabis in the US. The company doesn’t have access to the Virginia market, but management appeared to suggest the plan going forward is to focus on operational excellence in the US and growth opportunities in Europe.

On the Q3’22 earnings call, Chairman Boris Jordan supported the above growth targets of the cannabis sector where Curaleaf should obtain their portion of the business going forward:

While the U.S. economy is projected to see virtually no GDP growth next year, the U.S. cannabis industry is projected to grow 13% in 2023 according to Headset. Let’s not lose sight of where cannabis is in its maturity curve. I firmly believe cannabis as a multiyear double-digit growth industry with many more long-term catalysts that will drive increased consumer adoption and Curaleaf is at the center of it all. Our growth prospects are further enhanced by our European strategy and Germany’s forthcoming legalization.

Chairman Johnson actually sounds ultra bullish on cannabis in a positive sign US legislation in the form of the SAFE Plus Act might actually pass:

With respect to the SAFE Act, we are the closest we have been in Congress passing this crucial piece of favorable cannabis legislation. I am optimistic as ever about SAFE’s chances in the lame duck session. Both Democrats and Republicans have put forth a tremendous amount of time and effort into crafting the right legislation necessary for the industry to thrive. My team is in full sprint for the next 2 months to ensure the ball is carried over the goal line.

An investor wouldn’t want to be on the sidelines in a scenario where Curaleaf got the ability to uplist to the major stock exchanges. The stock currently trades with a market cap below $4 billion and the adjusted EBITDA target is ~$400 million.

With the cannabis sector set to grow over the next few years, a Curaleaf focusing on cost cuts and stronger operations versus pure growth will only grow EBITDA margins going forward. A business forecast to generate $1.6 billion in revenues next year could easily generate $480 million in adjusted EBITDA profits with a 30% margin.

The stock is just too cheap at 8x normalized adjusted EBITDA facing a scenario where federal legalization could occur. At the least, the company could gain access to upset the stock to a major exchange.

Takeaway

The key investor takeaway is that Curaleaf is a cheap stock with or without legislation. Though, investors sitting on the sidelines could well miss out on a great opportunity ahead in the cannabis space, if the company is correct on the passage of the SAFE Plus Act in the next few months.

Be the first to comment