Drew Angerer

Palantir (NYSE:PLTR) is a global software company that helps governments and large organizations solve their biggest challenges. Originally backed by the CIA, Palantir started as a platform for “terrorist hunting” and has since built on its best in class technology to help with a range of other applications from vaccine rollouts to supply chain improvements. In my previous post on Palantir, I discussed its business model in granular detail and the tailwinds from the Russia-Ukraine war. In this post, I’m going to break down its third-quarter financials, after the company beat revenue estimates in the quarter, with that being said let’s dive in.

Third Quarter Results

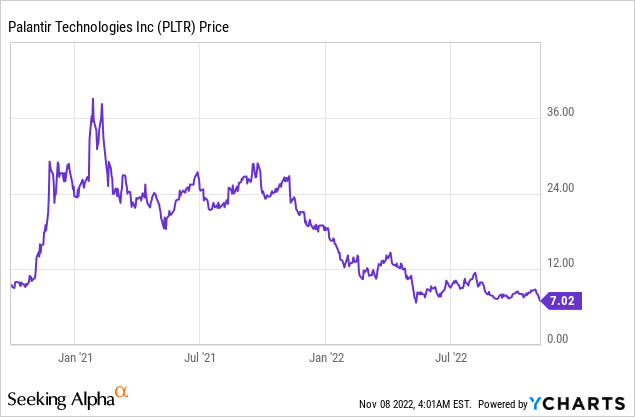

Palantir reported mixed financial results for the third quarter of 2022. Revenue was $477.8 million, which increased by 22% year over year and beat analyst expectations by $2.77 million. Total Billings, (which is the amount invoiced to customers), increased by a rapid 47% year over year to $509 million.

Palantir Revenue (Q3 Earnings Report)

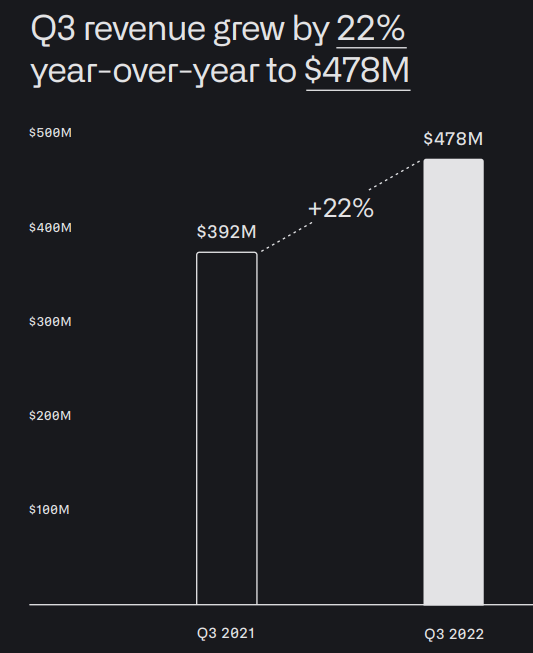

Palantir’s revenue growth was driven by solid Government revenue, which was $274 million, up 26% year over year. Government revenue surpassed $1 billion in the trailing 12 months and thus was a milestone for the company. Government contracts are some of the most highly sought-after contracts by software companies, as they offer strong consistency and plenty of upsell opportunities. U.S Commercial revenue also generated strong growth increasing by 53% year over year.

Government Revenue (Q3 Earnings)

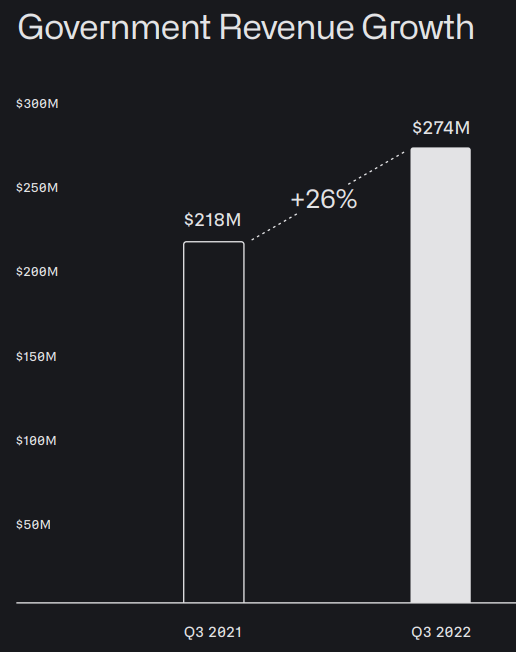

Palantir increased its overall customer base (including international customers) by 66% year over year to 337. U.S customers were the key growth driver in the quarter as these increased by 124% year over year to 132.

The beautiful thing about Palantir’s business model is it doesn’t require many customers to increase revenue substantially. Whereas most companies are spending their time catching small fish, Palantir is harpooning the whales of various industries. This means of the 293 deals Palantir closed in the third quarter, 19 of those deals had a contract value of $10 million, 32 of the deals were worth at least $5 million and 78 of the deals were worth approximately $1 million. Winning such large deals is no easy feat and requires a combination of industry-leading connections and a solid sales process.

Larger deals tend to have longer sales cycles overall, but for governments, especially extraneous events can accelerate the process. For example, during the pandemic, Palantir helped the National Health Service [NHS] in the U.K roll out its vaccine program. The Homes for Ukraine platform, which is powered by Palantir’s Foundry software as also helped to house over 100,000 Ukraine refugees in the U.K since the war began. Given the immense geopolitical tension and global warming, I expect many other humanitarian crises to occur in the future. When governments are backed into a corner and need to act fast, they can turn to Palantir software. This also gives the business a competitive advantage, as few software companies can say they have reacted fast and helped to complete such successful projects.

Customer Growth (Q3 Earnings Report)

Palantir has its roots in Military applications and in the third quarter, that trend continued. The company closed $1.3 billion in contracts in the quarter, with ~$1 billion from the U.S government alone. $229 million of these contracts was from the Department of Defense [DoD] for an Artificial Intelligence project.

The global artificial intelligence market was valued at $93.5 billion in 2021, this is forecasted to expand at a rapid 38.1% compounded annual growth rate up until 2030. Palantir has positioned itself as the go-to brand for Artificial Intelligence for military applications.

Palantir has helped to solve another macroeconomic challenge with 25 new supply chain projects. These include deals with Concordance Healthcare, Semiconductor chip manufacturer Micron, and a $20 million project with Hyundai Heavy Industries for shipbuilding. The company is also working with the FDA to improve food supply resilience and help prevent shortages that are becoming more commonplace. For example, in 2022, the U.S had a national shortage of infant formula which was driven by an Abbott product recall (in which two babies died) and supply chain shortages.

Profitability and Expenses

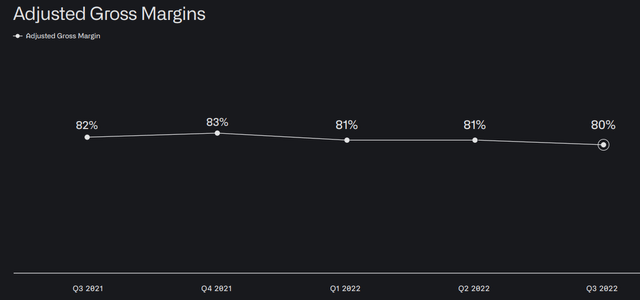

Palantir has a solid adjusted gross margin of 80%, which is down 2% from Q3,21 but still high overall.

Adjusted Gross Margins (Q3 Earnings Report)

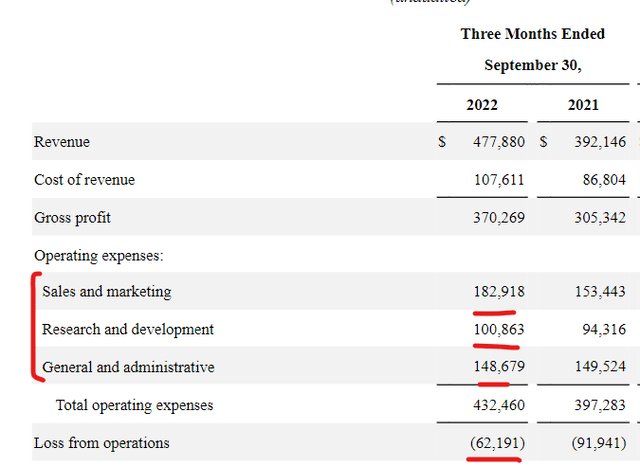

The issue for Palantir is with its earnings per share which was negative $0.06 in Q3,21, missing analyst estimates by $0.01. The company generated $62 million loss from operations. This was mainly driven by $183 million in Sales and Marketing expenses which increased by 18% year over year. I personally don’t think this is a bad sign overall as the company is aiming to scale aggressively. Over time I would like to see Sales and Marketing expenses making up a smaller portion of revenue and therefore operating leverage can take hold, and the growth can be profitable. For example in the third quarter of 2021, Sales and Marketing expenses made up ~39% of revenue, and in Q3,22 this percentage was ~38%. This is a positive sign but not a significant difference to identify a consistent trend yet. Research and Development costs of $101 million are not a major issue in my eyes, as companies that invest in R&D tend to produce greater shareholder value long term. General and Administrative expenses were $148.7 million which is down slightly from the $149.5 million but still has a long way to go.

Palantir Income statement (Q3 Earnings Report)

Palantir often reports in “adjusted” metrics which for some reason adds back stock-based compensation which was an eye-watering $140 million in the third quarter of 2022. This has decreased from $148.8 million in Q3,21 but still makes up around 30% of revenue which is substantial. As someone who has previously worked for large technology companies, I believe stock-based compensation is important to attract, retain and align the best talent. However, I believe companies should have a sustainable plan for paying its employees.

The good news is Palantir has a strong balance sheet with $2.4 billion in cash and cash equivalents and virtually no interest-bearing debt.

Advanced Valuation

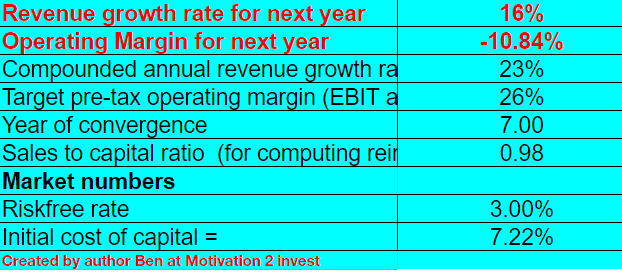

In order to value Palantir, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 16% revenue growth rate for next year, which is fairly conservative given the macroeconomic climate and aligns with management’s expectations. This also includes a $5 million foreign exchange headwind which has been estimated by management. In years 2 to 5 (third row on table below), I have forecasted a rebound in revenue growth to at least 23% per year, as economic conditions improve.

Palantir stock valuation 1 (created by author Ben at Motivation 2 Invest)

Palantir’s margins are fairly hard to predict, but given we are seeing slight signs of operating leverage, I forecast this to improve moving forward. In this scenario, I forecast the company to expand its operating margin to 26% over the next 7 years. This is higher than the 23% average for the software industry, as I believe the company’s lucrative government and enterprise contracts have many cross-selling opportunities.

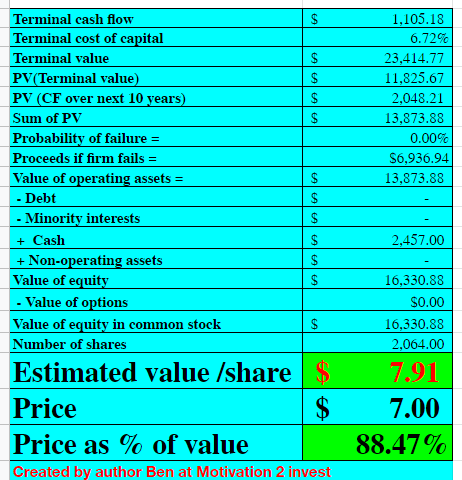

Palantir stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $7.91 per share, the stock is trading at $7 per share at the time of writing and is thus ~12% undervalued.

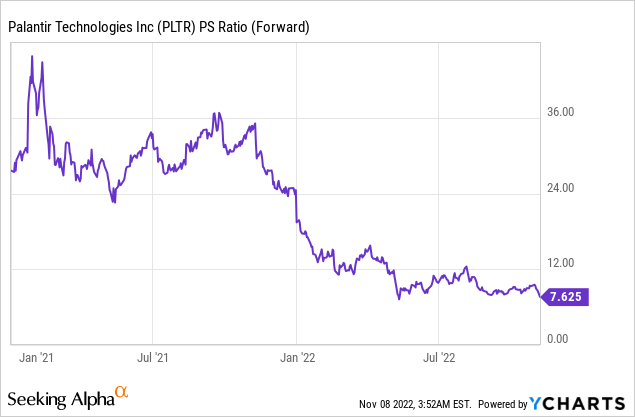

As an extra data point Palantir trades at a Price to Sales ratio = 7.6 which is cheaper than its 5 year average of over 24.

Risks

Stock-Based Compensation

As I discussed prior approximately one-third of Palantir’s revenue is spent on stock-based compensation. During times of high stock prices, the cost of capital for this kind of process is often cheap and economical for the company. However, with stock prices low, this is an expensive endeavor. Over time I would like to see this significant increase as a portion of total revenue.

Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. This many impact the company with longer sales cycles but we are not seeing major signs of this yet.

Final Thoughts

Palantir is a technology leader which is solving many of the world’s major issues from Vaccine rollouts to Military applications. The company is still growing the top line solid, but profitability still requires improvement. After the major declines in share price, the stock is undervalued intrinsically and relative to historic multiples.

Be the first to comment