Michael Vi/iStock Editorial via Getty Images

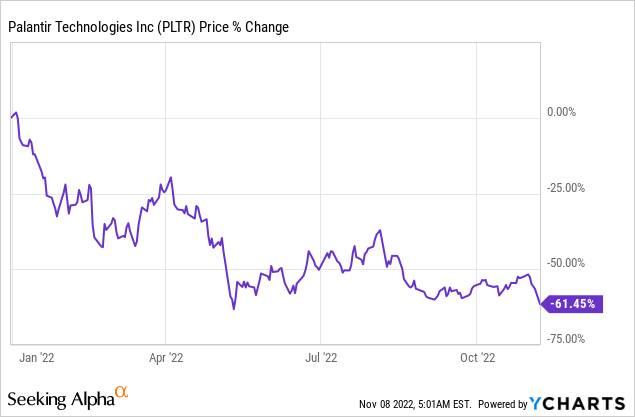

Palantir (NYSE:PLTR) submitted its earnings card for the third-quarter yesterday which caused the stock price to plunge more than 11%. Year to date, shares of Palantir have lost 61% of their value, in part due to expectations of slowing top line growth. Although client acquisition remained strong in the third-quarter, Palantir has seen a sharp slowdown in the commercial segment which has driven the company’s commercial performance in the last couple of quarters. With sentiment turning against Palantir in recent days and with growth targets getting more challenged, investors unfortunately have to expect an extended down-leg for Palantir’s shares!

Palantir’s Q3’22

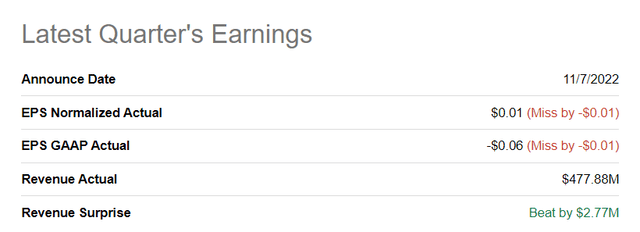

The software analytics company reported $0.01 per-share in adjusted earnings for the third-quarter compared to a prediction of $0.02 per-share. Regarding revenues, Palantir did slightly better than the prediction with actual results of $478M compared to a consensus of $475M.

Seeking Alpha: Palantir Q3’22 Results

Commercial segment challenges and slowing top line growth

Palantir’s reported third-quarter revenues of $478M, which beat the company’s guidance of $474-475 million and showed a year-over-year growth rate of 22%. In the second-quarter, Palantir grew its revenues 26% year over year so the firm’s top line growth unfortunately decelerated. While it is great that Palantir generated $3M more in revenues than its top-end forecast, the software analytics company grew slower than 30%… which is Palantir’s long-term revenue growth target.

A key problem that has emerged in the third-quarter is that revenue growth in the commercial segment, which has driven Palantir’s entire commercial and financial performance in FY 2021 and FY 2022, has sharply decelerated. The commercial segment generated a mere 17% year over year revenue growth in Q3’22 compared to 46% in Q2’22… and it was the second straight quarter of top line deceleration for Palantir’s commercial business due to slowing demand for software analytics services, especially in Europe. Palantir’s commercial segment actually was overtaken again by its government segment in the third-quarter which saw top line growth of 26% year over year. The slowdown in growth is, I believe, a major risk for Palantir and especially for the firm’s FY 2023 guidance.

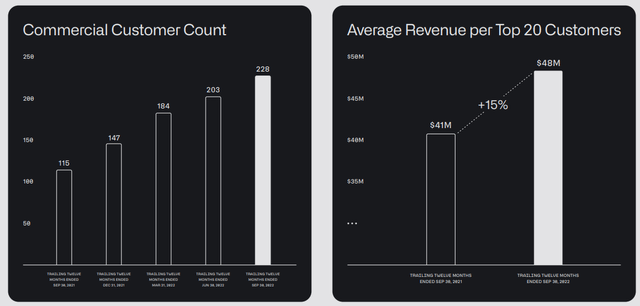

Continually strong customer acquisition

Palantir continued to add a good amount of new customers in Q3’22, however, on a net basis. The software company added 33 net new clients in the third-quarter which brought Palantir’s total client count to 337, showing an 11% increase quarter over quarter and a 66% increase year over year. Client acquisition remained robust in the commercial segment as well, which is where Palantir added 25 net new customers in the third-quarter. Customer monetization for the top twenty largest customers improved as this group increased its platform-spend from an average of $46M in the second-quarter to $48M in the third-quarter.

Source: Palantir

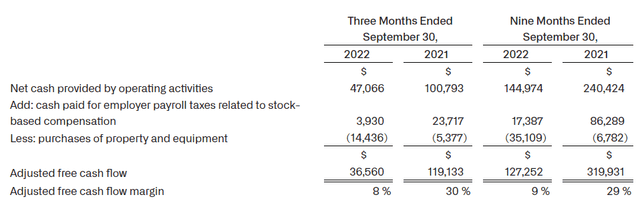

Free cash flow

Palantir unfortunately again disappointed regarding free cash flow. The software analytics company generated free cash flow in the amount of $36.6M in the third-quarter, showing a decrease of 69% year over year. My expectation for Palantir’s Q3’22 free cash flow was $62M which the company wildly under-performed. For this reason and because commercial revenue growth is slowing down sharply, Palantir can’t be more than a hold for me right now.

Source: Palantir

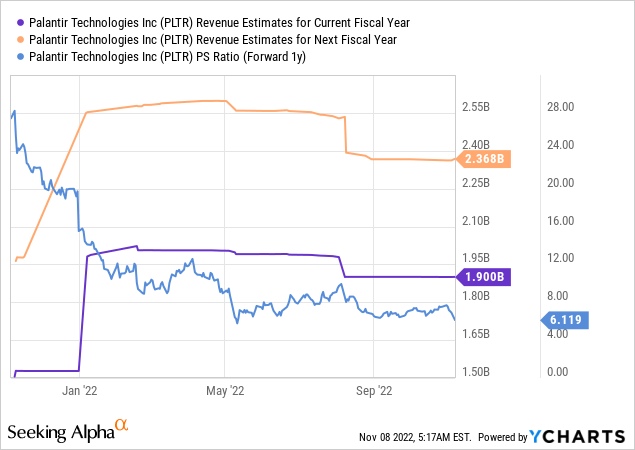

Headwinds for Palantir’s valuation

Palantir’s valuation factor could be set to come under further pressure due to headwinds in the commercial segment and more reluctant spending habits of commercial customers. Palantir is currently valued at a P-S ratio of 6.1 X, based off of a revenue estimate of $2.36B in FY 2023. Since Palantir is not profitable yet, there is also a considerable risk that investors lose their patience with the software company if Palantir fails to generate profits soon. Revenue estimates have trended down broadly as investors price in the possibility of moderating growth next year.

Outlook for Q4’22

Palantir sees headwinds from the strong USD in the current year, but nonetheless confirmed its top line guidance for FY 2022: the software company continues to see $1.900-$1.902B in revenues which translates to a 23% year over year growth rate. The projection implies that Palantir will grow 7 PP less than stated by the firm’s long-term average annual revenue growth target of 30%.

Risks with Palantir

The biggest risk for Palantir, as I see it, is that the software company will grow at significantly slower growth rates in the commercial business where customers are cutting back on spending and a recession may accelerate this trend next year. Palantir already lowered growth expectations for FY 2022 by down-grading this year’s revenue growth target from 30% to 23% in the second-quarter. Unfortunately, there is a risk that Palantir will also see weaker top line growth in FY 2023 if the economy slows down and, potentially, governments curb spending as well.

Final thoughts

Palantir’s earnings card for Q3’22 was another disappointment. Although the software company improved its customer monetization and added new clients, Palantir’s commercial slowdown is something to worry about because the company may not achieve its 30% annual revenue growth target next year.

Palantir’s shares are largely evaluated by the company’s prospects for revenue growth. Considering that Palantir’s revenue growth is decelerating, the risk here is clearly that shares go into an extended down-leg… they already dropped more than 11% yesterday and, as much as I like Palantir, investors may turn even more bearish on the company going forward, especially if Palantir were to cut its growth targets for FY 2023!

Be the first to comment