PhonlamaiPhoto/iStock via Getty Images

Livent Corporation (NYSE:LTHM) stock price increased by 44% in the past month as lithium carbonate prices jumped again. The company’s 3Q 2022 financial results were strong, and the company expects its full-year 2022 adjusted EBITDA to be between $350 to $370million, compared with an adjusted EBITDA of $70 million in 2021. Due to the hiked lithium carbonate prices and surging demand for lithium batteries (as a result of increasing EV sales), Livent’s financial results in the upcoming quarters will be strong. I am bullish on LTHM.

Quarterly results

In its 3Q 2022 financial results, Livent Corporation reported revenues of $232 million, compared with 3Q 2021 revenues of $104 million. LTHM’s cost of sales increased from $85 million in 3Q 2021 to $112 million in 3Q 2022. The company’s gross margin increased by 561% YoY to $119 million in the third quarter of 2022 (from $18 million in the third quarter of 2021). LTHM reported a net income of $78 million, or $0.37 per diluted share in 3Q 2022, compared with a net loss of $13 million, or $0.08 per diluted share in 3Q 2021. The adjusted EBITDA of Livent increased by 640% YoY to $111 million in the third quarter of 2022 (from $15 million in the third quarter of 2021). The company’s cash provided by operating activities in the first nine months of 2022 was $328 million, compared with $41 million in the first nine months of 2021. Due to its strong revenues, LTHM’s net debt decreased from $127 million on 31 December 2021 to $44 million on 30 September 2022. The company’s total assets increased by 67% to more than $2 billion on 30 September, from $1.2 billion on 31 December 2021. LTHM’s cash and cash equivalents at the end of the third quarter of 2021 were $195 million. It increased significantly to $212 million on 30 September 2022.

“Lithium demand has remained robust despite some near-term supply chain disruptions and global macro concerns,” the CEO commented. “Published lithium prices moved higher in the third quarter amid continued favorable market conditions. Livent achieved higher realized prices and delivered increased volumes to customers,” he continued.

The market outlook

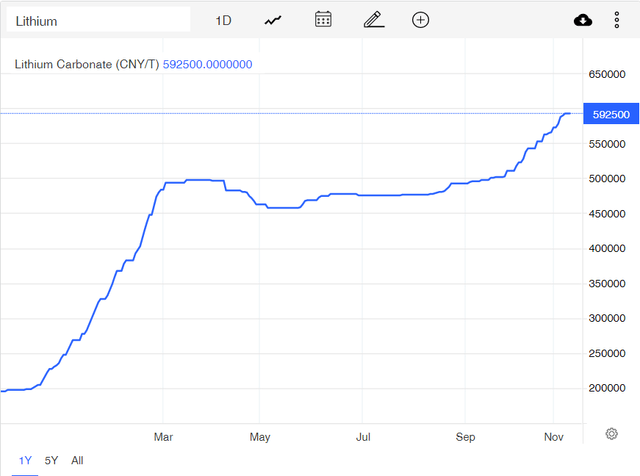

Lithium prices have tripled in the past year and due to the long-term supply shortage of this chemical element, which is used in batteries for EVs, Lithium prices are expected to remain high. Figure 1 shows that lithium carbonate prices in China increased significantly from November 2021 to March 2022. From March 2022 to August 2022, lithium carbonate prices didn’t experience significant changes; however, in the past months, lithium prices hiked due to climbing demand and tight supply. As decarburization goals in China caused local governments to pass cash incentives for the purchase of electric cars, EV sales in September 2022 were 80% more than in September 2021. Meanwhile, to expand the manufacturing of batteries for EVS, the Biden administration announced granting $2.8 billion to 20 companies to build and expand commercial-scale facilities in 12 states to extract and process lithium, graphite, and other battery materials. “Producing advanced batteries and components here at home will accelerate the transition away from fossil fuels to meet the strong demand for electric vehicles, creating more good-paying jobs across the country,” said the U.S. Secretary of Energy. The increasing demand for electric vehicles supports lithium prices. According to Mordor Intelligence, the market for lithium hydroxide is expected to grow at a CAGR of over 10% from 2022 to 2027, due to surging demand for rechargeable batteries used in electric vehicles which are subsidized significantly by the U.S. and Chinese governments.

Figure 1 – Lithium carbonate prices in China

In the third quarter of 2023, LTHM completed its 5 thousand metric tons expansion of lithium hydroxide in Bessemer City. As a result of this recent mechanical completion, LTHM is in the early stages of producing and qualifying products with customers at its new hydroxide facility. The company expects the production in Bessemer City to ramp up in 1Q 2023. Moreover, by the end of the year 2022, the first 10000 metric tons expansion of lithium carbonate in Argentina will be mechanically completed, and in 1Q 2023, the production will be started. By the end of 2023, Livent will add the next 10000 metric tons of lithium carbonate capacity in Argentina. Thus, by the end of 2023, Livent’s total available lithium carbonate equivalents (LCE) will be 100% more than in 2021. Furthermore, the company started adding an additional 15000 metric tons of lithium hydroxide capacity in China, which is expected to be mechanically complete by the end of 2023.

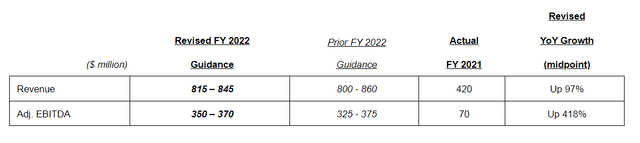

Also, Livent holds a direct 50% ownership interest in Nemaska (an integrated hydroxide project located in Canada). With 34000 metric tons of nameplate capacity of battery-grade lithium hydroxide and with over 30 years of mine-life, Nemaska is expected to be the largest lithium hydroxide production location in North America. The mechanical completion of Nemaska is planned to happen at the end of 2025. With its current and future developments, LTHM is able to benefit significantly from the increasing demand for lithium. The company expects its full-year 2022 revenue to be between $815 to $845 million, at least up 94% over 2021. Also, LTHM’s full-year 2022 adjusted EBITDA is expected to be between $350 to $370 million, at least up 400% over 2021.

Figure 2 – LTHM’s full year 2022 guidance

Performance outlook

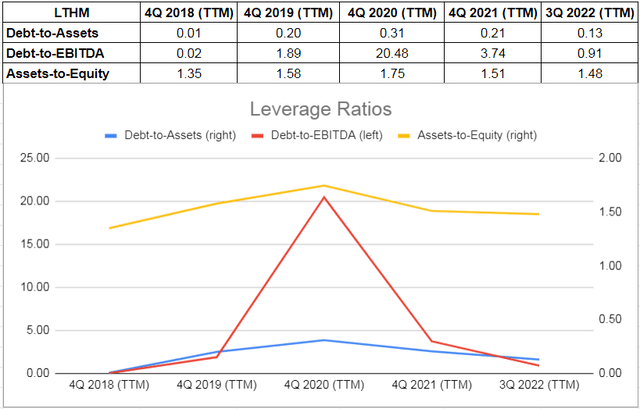

The debt-to-assets ratio is one of the significant calculations that measure the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. The higher the ratio, the greater the degree of leverage and financial risks. The company’s debt-to-asset ratio jumped from 0.01 in 2018 to 0.20 in 2019 and increased further to 0.31 at the end of 2020. However, due to hiked lithium prices and higher demand for its products, LTHM’s debt-to-asset ratio decreased. The company’s debt-to-asset ratio was 0.21 at the end of 2021 and 0.13 on 30 September 2022. LTHM’s debt-to-EBITDA ratio (which determines the probability of defaulting on debt) plunged from 20.48 at the end of 2020 to 3.74 at the end of 2021. It decreased further to 0.91 on 30 September 2022. Finally, LTHM’s asset-to-equity ratio increased from 1.35 at the end of 2018 to 1.58 at the end of 2019 and 1.75 at the end of 2020. Due to better performance as a result of better market condition, LTHM’s asset-to-equity ratio decreased to 1.51 at the end of 2021 and 1.48 on 30 September 2022. The decreasing assets-to-equity ratio during the past years indicates that the company has been using lower debt to finance its assets. Due to its recent developments and plans, and the promising market outlook for the lithium market, LTHM’s leverage ratios will improve in the upcoming quarters. The leverage ratios of LTHM show that the company can meet its current and future obligations (see Figure 3).

Figure 3 – LTHM’s leverage ratios

Summary

As the demand for electric vehicles increases, the demand for lithium carbonate goes up. Lithium carbonate prices are supported by the surging demand for lithium batteries, tight supply, and U.S. and Chinese governments’ grants and subsidies to lithium producers. Due to considerable developments, which have increased its production capacity, the company will make huge profits in the following years. The stock is a buy.

Be the first to comment