gilaxia/E+ via Getty Images

MSC Industrial (NYSE:MSM) management appears to be making real progress on multiple self-improvement initiatives – something I’ve been skeptical/critical of for some time – but that progress is coming at a time when investors have become considerably more cautious about economically-sensitive names (and stocks in general). While the shares may not be benefiting in the short term from the company’s progress, and I do think cycle/economic risk is relevant, an improved long-term margin profile would certainly be a net positive.

MSC shares are down about 15% since my last update in April, slightly outperforming the average industrial stock, and the shares have likewise outperformed the industrial sector since I went positive in late February (outperforming by around 700bp); the shares have likewise modestly outperformed the S&P 500. Although I think there’s still more room for growth from the company’s industrial customer base, and a lot of bullishness has come out of the industrial space, I do think there are opportunities to shop around in the current market environment.

A Margin-Driven Beat In Fiscal Q3

As someone who is routinely pretty critical of management, I have to say that MSC’s third quarter results hit all of the marks I was looking for, and I would call this a good result. I was particularly impressed with the margin performance, though key questions remain as to how much of the present-day performance is a byproduct of the inflationary environment and how much will be sustainable through the inevitable downturn.

Revenue rose almost 11% as reported and a little more than 10% in organic terms, matching Street expectations. While government sales declined 10% on lower janitorial and sanitation (or “jan-san”) sales due to waning COVID-19 demand, national account sales growth accelerated sequentially to high teens, while core account growth also accelerated to low double-digits. I’d also note that CCSG sales grew at a mid-teens rate, suggesting healthy demand from short-cycle industrial customers.

Gross margin improved 60bp from the year-ago quarter and 40bp from the prior quarter, ending up at 42.9%, or about 30bp better than the Street expected. As I’ve previously noted, MSC (and other industrial distributors) typically enjoy better margins in inflationary environments, and indeed management noted that pricing and vendor rebates were important drivers of this strong result.

Management delivered good operating leverage, with the gross margin benefits complemented by further progress in the company’s “Mission Critical” efficiency efforts. Operating income rose 28%, with operating margin rising two points yoy and three points qoq to 14.6%, with an incremental margin of over 33%. With this strong margin performance, EPS came in four cents above the Street-high estimate.

Healthy Demand… For Now

There’s no question that the pace of recent demand isn’t sustainable; ISM new orders have pulled back below 50 and investors are already speculating on what the downturn will look like. That is valid, and I myself have said earlier this year that order growth rates weren’t sustainable, but the current demand environment is still a healthy one.

June monthly sales were up around 13% (on a 15%-plus comp), after 13.7% growth in May, 5.5% growth in April (on a +16% year-ago comp), and 12.5% growth in March. Given recent comments from industrial companies (sell-side conferences and whatnot) as well as data points from companies like MSC, Fastenal (FAST), and Grainger (GWW), current industrial demand remains quite strong, as companies continue to go all out to catch up on orders and run down backlogs. With that, management noted that business is tracking to the “upper end” of its guidance range, and Street revenue expectations for FY’22 are now a little higher.

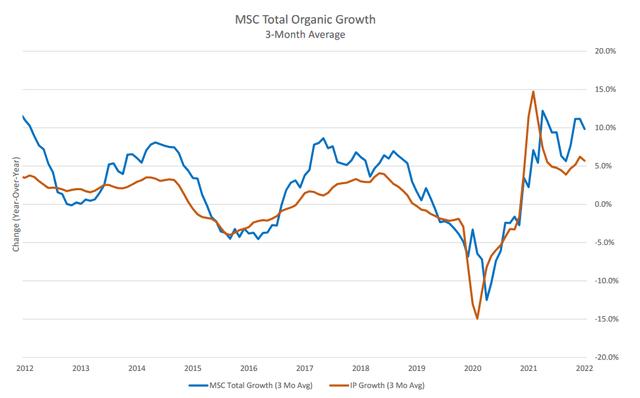

MSC is also doing reasonably well gaining share in this period. Although the company’s graph of organic growth relative to industrial production (or IP) is a little misleading, particularly given the 6% benefit from price/mix, the reality is that 6.5% growth in volume ex-jan-san is still comfortably above the recent IP growth rate. With management advancing several efforts to gain share by improved service offerings (including tool selection aids and stronger in-stock performance), these gains should be something the company can hold on to during the inevitable downturn in demand.

How well the company can hold onto margins is a harder question to answer. MSC has done a good job of securing gross margin leverage through this inflationary period, and there is still meaningful uncertainty as to when inflationary trends will abate/normalize. Likewise, the company has done well with its efforts to reduce core operating expenses, and I’m gaining confidence that more of these benefits may be sustainable through the next downturn, with the company possibly going from low-to-mid-teen incremental margins in prior downturns to mid-teens or higher the next time around.

The Outlook

I still believe that MSC, like other industrial distributors, is looking at inevitable long-term declines in gross margin; there’s simply too much competition and too much price/cost visibility for customers for me to believe in an upward long-term trend. That said, the company may see a longer run of inflationary pricing than I expected and may likewise reap more benefits from efforts to increase its service mix.

My core assumptions haven’t changed all that much. I’m still looking for long-term revenue growth in the neighborhood of 4% and double-digit FCF growth, with long-term normalized FCF margins in the high single-digits (no real change from my prior expectations). There is some upside potential here if there are greater long-term operating margin leverage opportunities that I forecast, but then also downside risk from even more pressure on gross margin.

The Bottom Line

Stock multiples in the industrial space have shrunk considerably throughout 2022, and MSC looks undervalued based on both my long-term discounted cash flow model and a margin/return-driven multiple-based approach (using a 12.25x forward EBITDA multiple). I see more than 20% undervaluation in the shares now, and the prospect of long-term total annualized returns in the high single-digits, but investors should be aware of the risks of buying industrial stocks ahead of an anticipated downturn; some of it is already in the share price, but the market has a way of overshooting in both good times and bad times.

Be the first to comment