megaflopp/iStock via Getty Images

Investment Thesis

It has been over a year since my last post for Seeking Alpha on AstraZeneca (NASDAQ:AZN), the Anglo / Swedish Pharmaceutical giant. I gave the company a buy recommendation and shares have risen in value by 11% since then, trading at a price of $65, resulting in a market cap valuation of almost exactly $200bn.

Over a five-year period, AstraZeneca stock is up more than 90%, providing an attractive return for investors. That compares favorably with most of the “Big 8” US pharmas, Johnson & Johnson (JNJ), Eli Lilly (LLY), Pfizer (PFE), AbbVie (ABBV), Merck (MRK), Bristol Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD) – of these, only Eli Lilly, +288%, and AbbVie, +98%, have performed better.

AstraZeneca earned $37.8bn of revenues in FY21, which is more than Amgen, Gilead, and Eli Lilly, but lower than the remaining “Big 8” US pharmas, and its dividend yield of 2.2% ($2.9 per annum) is lower than all but Eli Lilly. By my count, the company earned blockbuster (>$1bn per annum) sales from no fewer than 13 drug products in 2021, as total revenues increased by an impressive 38% year-on-year.

What’s even more impressive is that much of this growth was organic, although AstraZeneca’s $39bn acquisition of rare disease specialist Alexion added $3bn of new revenues in 2021, while sales of COVID vaccine Vaxzevria came in at $3.9bn, having earned just a couple of million dollars in 2020.

In Q122, the good news story continued, as AstraZeneca announced revenues of $11.4bn in total – up 60% year-on-year, and EPS of $1.89, up 20% year-on-year. Management has guided for high-teen percentage year-on-year growth in 2022, meaning revenues ought to exceed $43bn this year, and mid-to-high twenties percentage growth in core EPS, which implies a figure of ~$6.7, making a forward price to earnings ratio of <10x, which would be lower than any of the “Big 8” US pharmas.

As such, arguably, AstraZeneca shares’ five-year bull run looks set to continue for the foreseeable future, with management promising “durable growth” up to and beyond 2025. There are a few concerns in relation to the company – net debt is set to grow in 2022, from $24.3bn, to $25.2bn, and GAAP operating profit was just $1.05bn in FY21, operating margin 2.8% and GAAP EPS $0.08.

Usually, a large discrepancy between GAAP and non-GAAP reporting can be interpreted as a red flag, but in this case, it’s largely down to AstraZeneca’s acquisition of Alexion. With Q222 earnings due in a few days’ time, now seems like a good time to take a closer look at the pharma’s product portfolio, pipeline, tailwinds and headwinds, and speculate about a target share price.

Oncology Portfolio: 4 (and a half) Blockbuster Assets And Several Mega-Blockbusters In Waiting

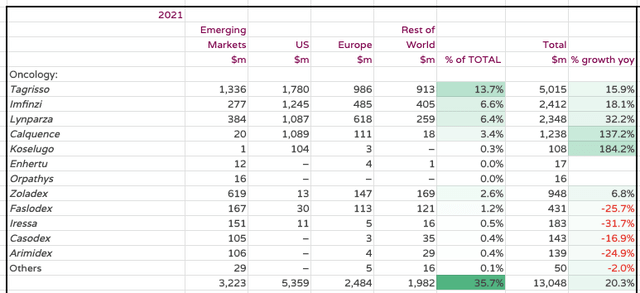

portfolio sales 2021 (10K)

AstraZeneca’s largest division is oncology, which contains 12 major products and generated $13bn revenues in FY21, or 36% of all revenues. The division grew by 20% year-on-year in FY21. The next largest is Cardiovascular, Renal and Metabolism – $8bn of revenues in 2021 and 22% of all revenues, up 13% year-on-year.

Respiratory & Immunology generated $6bn of revenues in FY21, which represented 17% of all revenues, and a 13% year-on-year growth, COVID-19 (Vaxzevria and Evusheld, an antiviral combo) generated $4bn, accounting for 10% of revenues, and Rare Diseases generated $3bn, or 8.5% of revenues. Other Products accounted for the remaining 6.5% of revenues, $2.3bn, and was down -8.5% year-on-year.

There are four blockbuster assets within the Oncology division. Tagrisso leads the way, with just over $5bn of revenue generation last year. The drug for EFGR-mutated Non Small Cell Lung Cancer (“NSCLC”) and I discussed it in some depth in my last post, including analyst forecasts that it could one day generate ~$16bn in peak sales, thanks to its approval in the early “adjuvant” setting, after a study showed it cut the risk of disease recurrence or death by 83% compared to placebo, as well as in the metastatic setting.

That’s a huge figure, and perhaps a little over-optimistic – an alternative forecast for $8bn revenues by 2030 is perhaps more realistic, based on a patient pool of ~30k. Tagrisso sales “only” grew by 11% year-on-year in Q122, and actually fell sequentially, from $1.314bn to $1.304bn, but there are more study readouts due in 2023 in 1st line NSCLC, and unresectable NSCLC, which could expand the label further. There’s also potentially no patent expiry until next decade, although AstraZeneca is already fighting off challenges from generic drug manufacturers, including Pfizer-owned Wyeth.

Imfinzi – indicated for advanced bladder cancer, and later stage NSCLC, and SCLC, generated $2.4bn of revenues in FY21 – up 18% year-on-year, and $599m in Q122, up ~8%. Roche’s Tecentriq is its main rival – recent studies have shown that Imfinzi – an immunotherapy – in combo with chemotherapy demonstrated a statistically significant and meaningful improvement in pathologic complete response (“PCR”) compared to chemo alone, meaning the drug’s peak sales years remain ahead of it.

Lynparza, approved for ovarian, prostate and breast cancer is another drug that analysts feel could challenge the magic $10bn per annum revenue mark, although $5bn is a more realistic figure. Sales of $2.3bn in FY21 were up 32% year-on-year, and the $617m generated in Q121 was up ~15% year-on-year. Calquence, approved in 2019 for Chronic Lymphocytic Leukemia (“CLL”), is another exciting growth prospect having outperformed AbbVie’s (ABBV) >$5bn per annum selling Imbruvica in a head-to-head trial, while Zoladex, used to treat prostate and breast cancer is very close to blockbuster territory, racking up $950m sales in FY21m and $247m in Q122m up 10% year-on-year.

In short, AstraZeneca’s oncology division is one of the strongest of any pharma and it appears to be a few years away from realizing its full potential. Q222 earnings ought to provide further evidence of this, and I’d expect to see strong performance.

CardioVascular, Renal and Metabolism

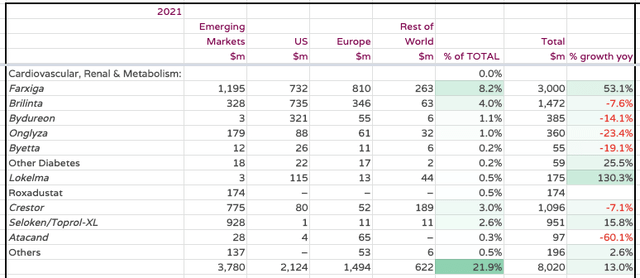

Sales of Cardiovascular, Renal and Metabolism division FY21. (10K Submission)

Source: AZN 10K submission 2021.

The key asset to look out for here is Farxiga, which drove revenues by 53%, to $3bn in FY21, and a stunning $1bn in Q122 – ~20% ahead of consensus. The SGLT2 inhibitor is indicated for type 2 diabetes, heart failure and chronic kidney disease. The drug faces some stiff competition, however, from the likes of Eli Lilly’s Jardiance, and its much hyped GIP and GLP-1 receptor agonist Tirzepatide, approved in Type 2 Diabetes in May, and Novo Nordisks’ Ozempic / Semaglutide.

These latter two are forecast for >$10bn sales per annum, and as such, the performance of Farxiga may prove to be a bellwether for the direction of AstraZeneca’s share price – if it can keep pace with its newest rivals, Farxiga itself could become a double-digit-billion selling asset.

Elsewhere in this division, Briinta’s patent expiry arrives in 2024, meaning sales of the stroke therapy have only one more year’s peak sales left, while Crestor, a one-time >$5bn per annum selling statin, has already lost its exclusivity, further underlining Farxiga’s importance to AstraZeneca.

Respiratory and Immunology

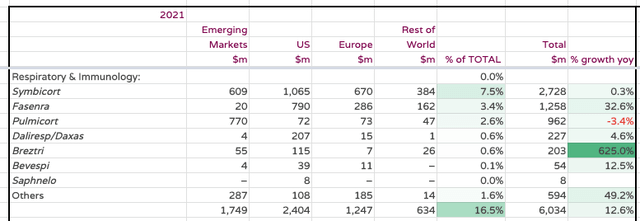

Sales of Respiratory & Immunology division FY21. (10 K Submission)

Sales of Respiratory & Immunology division FY21. Source: AZN 10K submission 2021.

Within this division, there are reasons to be both cheerful and fearful. The double digit year-on-year growth in FY21 was impressive, although the division grew by just 2% in Q122. This due to Symbicort’s loss of patent protection, and generic drug specialist Viatris’ (VTRS) launch of a first generic version of the drug, meaning Symbicort’s sales are likely now in terminal decline. Asthma treatment Fasenra’s sales surged 33%, to $1.2bn, and the biologic looks to be the division’s best hope for growth, although a pipeline product developed alongside French pharma Sanofi (SNY), Nirsevimab, is edging toward approval in respiratory syncytial virus, with a $500m milestone payment on the table plus a share of sales, and Eplontersen, developed in collaboration with Ionis Pharmaceuticals (IONS) could be a $1.5bn peak seller in transthyretin amyloidosis (ATTR).

Rare Disease and The Rest

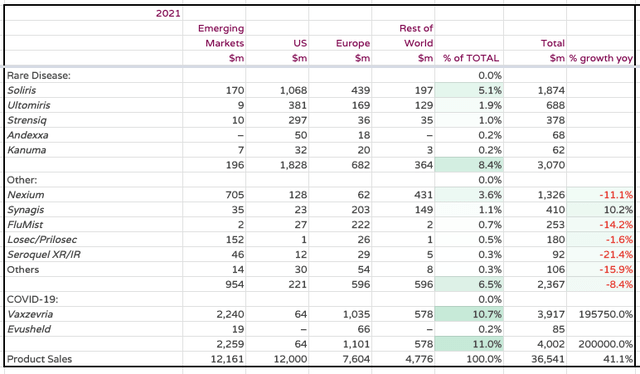

AZN Rare Disease and other portfolio assets sales FY21. (10K submission)

AZN Rare Disease and other portfolio assets sales FY21. Source: AZN 10K submission 2021.

Soliris was the only blockbuster in the Rare Disease portfolio, obtained via the $39bn acquisition of Alexion – although these figures reflect sales from July only – as such, the deal looks to be a good one, if there are >$6bn p.a. of revenue generation on the table, and apparently, prior to the acquisition Alexion management expected to drive ~$9bn sales per annum by 2025.

Ultomiris is a long-term replacement for Soliris – both drugs are C5 inhibitors, and Ultomiris’ latest approval came as recently as April, in Myasthenia Gravis, to add to approvals in Paroxysmal Nocturnal Hemoglobinuria and Atypical Hemolytic Uremic Syndrome. Soliris and Ultomiris racked up revenues of $990m and $410m in Q121, up respectively 9% and 4% per annum. I would look for further improvements in these two drugs sales in Q222 if AstraZeneca is going to see a spike in its share price when earnings are announced on Friday.

On the flipside, Vaxzevria sales seem unlikely to grow beyond 2022, although Q121 performance was surprisingly strong, as the vaccine earned revenues of $1.1bn, and Evusheld also performed well, earning $469m. If the global pandemic does eventually draw to a close, the disease will likely become endemic, and there will be a private vaccine market.

This seems likely to be dominated by the messenger-RNA vaccine developed by Pfizer (PFE) and Moderna (MRNA), although it’s also likely that some people will express a preference for Vaxzevria based on its more traditional approach, and there may be more than >$1bn per annum of sales from this division perhaps until the end of the decade. Again, Q222 results ought to provide some clues.

Nexium, a proton pump inhibitor indicated for acid reflux diseases, has been off-patent for some time, but continues to perform well sales wise. I’m tempted to wonder if AstraZeneca would consider spinning out its legacy brands into a separate entity, as Merck and Pfizer have done recently through Organon (OGN) and Viatris (VTRS). It would help streamline the company, and increase a profit margin that is suffering as a result of the Alexion acquisition.

Conclusion – Don’t Expect AZN Share Price To Surge On Q222 Results, But Do Consider Owning This Stock Long Term

Hopefully this whistle-stop tour of AstraZeneca’s drug product portfolio has provided some useful insight and guidance ahead of Q222 results, which will be announced on 29th July – this Friday.

I’m expecting the company to perform well. I would expect Q222 earnings to closely mirror Q122, with the Oncology Division driving some strong growth, although perhaps not >10% year-on-year, as sales of legacy assets offset growth. The Farxiga readout, as I have mentioned, is of key importance, and I also would pay close attention to Symbicort and the Alexion assets.

I would be a little cautious around results providing a share price boost as the 60% growth in Q121 was largely due to Soliris, Ultomiris et al, and the oncology division has aggressive growth trajectories to adhere to, while competition in these markets will always be fierce.

With that said, long term the promise of these drugs ought to be realized, and when we consider that AstraZeneca ought to deliver FY22 sales >$43bn, we’re looking at a price to sales ratio of ~5x. That’s almost exactly in line with the average of the “Big 8” US pharmas, and the sector as a whole has generally delivered strong value across the past five years, and 12 months, despite prevailing bear market conditions, and I expect this to continue.

AstraZeneca’s debt is a little troubling, but the Alexion deal appears to make good business sense, helping AstraZeneca grow at a rate of ~5% per annum until 2025 at least, and perhaps until the end of the decade.

Profitability ought to recover, and based on the forward PE <10x, if we were to increase it to 15x – more in line with the US giants – then we’d be looking at a share price target of ~$100, or an upside opportunity of >50%.

Realistically, an end of 2022 high that beats the previous 2022 high of $71, achieved in April (shortly before Q121 earnings were released) is probably the best that can be hoped for. Headwinds in the Chinese market – of significant importance to AstraZeneca – are being felt, and rising interest rates and inflation may also damage profitability and lead to tough, unpopular pricing decisions.

A downgrade from investment bank UBS damaged AstraZeneca’s share price in June, dragging it <$60. The bank pointed to a lack of catalysts, and it’s true that the pharma’s pipeline is dominated by label expansion opportunities for already approved drugs, as opposed to brand new opportunities.

Nevertheless, that only serves to justify the wisdom of the Alexion deal, and it’s easy to forget how much potential growth there is in the current portfolio.

AstraZeneca is likely a stock you can buy without losing too much sleep, but Q222 earnings are unlikely to be a major upside catalyst in my view. Expect ongoing, long-term, incremental growth, however, using the past five years as your guide, and collect the dividend while you wait.

Be the first to comment