Scott Olson

Thesis

DraftKings (NASDAQ:DKNG) shares are down some 40% year to date, and 75% from all-time highs. But in my opinion, the shares are still far from attractively valued. Investors should consider that DraftKings has not yet achieved operating profitability, business growth is lower than what the sports betting-hype implies, and competition in the industry remains fierce.

Seeking Alpha

Reflecting on DKNG’s risk/reward, I initiate with a ‘Sell’ rating. Personally, I would not buy DKNG shares at levels higher than x1 EV/Sales, which would imply that DraftKings stock could have an additional 50% downside.

Thoughts On Sports Betting

On the backdrop of sport-betting legalization in many US states, the industry has enjoyed a growth boom. As a consequence, lots of capital has been allocated to support the leading names — including DraftKings, FanDuel, Penn National Gaming (PENN) and Caesars Entertainment (CZR) — expand their business. But accordingly, competition for new customers has been fierce, as uneconomic marketing spending has been chasing low-profitability sports betting dollars.

Jim Chanos, one of the world’s most famous and successful short-sellers, has said that he is betting against DraftKings. Chanos said that “the business model is flawed” and argued that sports betting is not only an unattractive low-margin business, but also a “commodity” with little opportunity for differentiation.

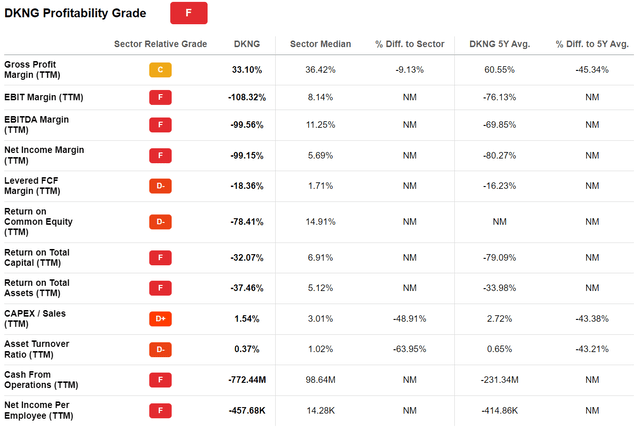

Profitability Challenged

Looking at DraftKings’ fundamentals, Chinos appears to be perfectly right. From 2020 to 2022 (TTM reference), DraftKings expanded revenues from $614 million to $1,569 million, an increase of more than 155%. Over the same period, however, gross profit increased only by about 94%, from $267 million to $519 million.

But the revenues versus gross profit dispersion doesn’t even capture the real issue of the business model — which is operating expenses due to high marketing and selling expenses: From 2020 to 2022, DraftKings Selling General & Admin Expenses jumped from $906 million to $1,926 million.

Reflecting on the above numbers, investors should consider that for every $1 dollar spend on marketing, DraftKings generates only about $0.25 cents of gross profit (pre-tax). And accordingly, it should come to no surprise that the business is burning cash at a scary rate — $724 million for the trailing twelve months.

Seeking Alpha

Thoughts On Growth

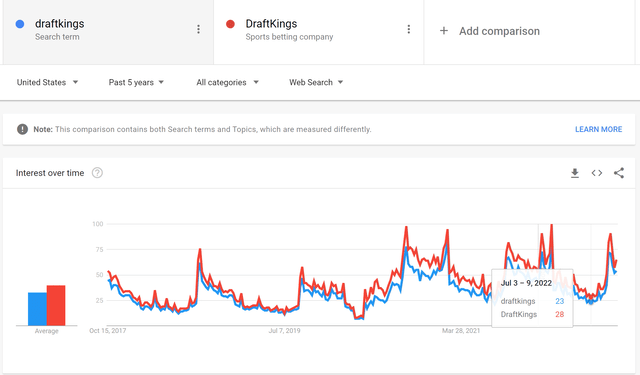

DraftKings does show strong growth. But as I have outlined in the previous section, the growth is arguably driven by non-economic marketing spending, and less by organic consumer interest.

As of June 2022, DraftKings operates in 17 U.S. states, which cumulatively cover approximately 36% of the U.S. population. According to the company’s Q2 results, Monthly Unique Payers for the business increased to 1.5 million and Average Revenue per MUP increased to $103, which represents a 30% year-over-year increase for both metrics.

But I doubt that DraftKings’ business expansion is truly explosive. Below is a screenshot of the search interest on Google for DraftKings (search term, blue) and DraftKings (the business, red) respectively. Seasonally adjusted I believe the interest versus 5 years ago has not increased by more than 30% – 40%.

Google Trends

Valuation

Despite non-existent net profitability (1) debatable growth in an industry that is highly competitive (2), and a share price depreciation of more than 75% from all-time highs, investors are still required to pay an absurdly high price for DKNG shares, in my opinion.

As of 9th October 2022, DKNG shares are valued at a one-year forward EV/Sales of x3.5 and P/B of x5.7. Note that is not possible to consider an EV/EBITDA or P/E multiple, given non-existent profitability.

In my opinion, in order to get an attractive risk/reward opportunity, DraftKings should be valued at no more than x1.5 EV/Sales. With such a valuation, assuming DraftKings would manage to structure an acceptable 10% EBIT margin, DKNG stock would return a yield of about 6.6% (EBIT/EV).

Risks To My Thesis

DraftKings stock is popular with retail investors. And as a consequence, the stock’s price action can be considered unpredictable and aggressive. If the market re-discovers its appetite for loss-making companies, and there is a new wave of meme-stock price action, then DraftKings could be well positioned to see strong buying interests.

Secondly, investors might also consider that the online sports betting industry could consolidate, given either M&A activity and/or bankruptcies due to challenging business fundamentals. In such a scenario, if DraftKings would assume a winning position, the company’s business fundamentals would undoubtedly improve.

Conclusion

As long as DraftKings business fundamentals remain challenged with non-economic marketing spending as compared to the company’s gross profit expansion, I believe investors are well advised to avoid investing in DKNG stock. As I see it, given rising interest rates and depressed investor sentiment towards risk assets, the next 6 – 18 months could be tough for long-duration and high-speculation bets such as DraftKings. Also, investing is a relative discipline. And why would an investor invest in non-profitable DKNG with x3.5 EV/Sales, when most of the highly profitable FAANG stocks now trade at these levels? I initiate coverage on DraftKings with a “Sell” rating.

Be the first to comment