fcafotodigital

Investment Thesis

Fortune Brands Home & Security, Inc. (NYSE:FBHS) is the #1 seller of cabinets, locks, and faucets in North America by market share, and generates the bulk of their earnings by servicing the United States home restoration and renovation (R&R) market. FBHS’ vertically integrated supply chain and efficient wholesale distribution channels are best-in-class and have enabled it to achieve industry-leading margins against a backdrop of high inflation.

FBHS has seen challenges in recent quarters, with working capital (“WC”) going from $773M to $1.6B. These WC buildups have put pressure on free cash flow (“FCF”) in 2022, which has declined 70% over the past twelve months. However, I anticipate that as supply chain issues ease, this excess working capital will be squeezed out, and a $920M tailwind to FCF will result.

Better WC management, strong EBITDA generation, and the capacity to reinvest in the business at high returns on capital will together enable FBHS to organically generate $24/share of cash through 2024 on a $55 stock.

2022 Has Been Challenging

To put it mildly, 2022 has been a challenge for Fortune Brands, with possible demand destruction from a declining housing market (which I went over in my article on NVR) and working capital woes chief among those issues.

Temporary Demand Destruction

Throughout the first nine months of 2022, the housing market had a tough time: inventories and interest rates are up, and home equity values look to be softening. As Fortune’s biggest customer base is homeowners, a declining housing market is bad for business.

Nicholas Fink, CEO of Fortune, remains optimistic:

Now I’d like to add some additional thoughts on the current housing market. As I’ve said before while the timing of housing can be discretionary housing itself is not. There has been no change to the fundamental need for millions of more houses to be built in order to satisfy household formation in growth trends over the coming years. However, persistently high inflation and aggressive interest rate increases by the Fed has begun to impact the pace of buying and selling homes.

I tend to agree with Nick’s take, as even if people are feeling poorer, the need for Fortune’s products doesn’t change. Additionally, since R&R spending is already on the lower end as a historical percentage of GDP, any sustained decline in spending is unlikely. I believe the market is overreacting.

Working Capital Woes

As with many businesses who rely on an integrated supply chain to time inventories and receivables, Fortune has been hit hard by COVID-related disruptions, with working capital as a percent of revenue going from 8.5% in 2019 to 20% in the most recent quarter. Getting WC down to the 8.5% range would free up somewhere on the order of $920M.

FBHS is keenly aware of the issues surrounding their WC management, with CFO Pat Hallinan mentioning them on the most recent conference call:

And you put it in a dimension from a balance sheet perspective, probably on the order of $250 million to $300 million of working capital reduction […] We’ll start backing our working capital back down to more traditional levels and we would expect to be doing that throughout the back half of this year and as we head into next year.

A Good Core Business

Before delving further into the cash generation of Fortune, I want to remind readers that while the crux of my investment thesis is predicated on pure cash flow generation from the business, these cash flows originate from a stable of enduring, well-known brands that generate returns on invested capital exceeding 30%, excluding goodwill.

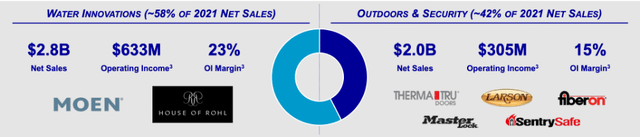

Within Fortune Brands, there are three companies: Water Innovations, Outdoors & Security, and Cabinets.

Water Innovations and Outdoors & Security have had tremendous growth since 2018, expanding their top-lines at a 16% CAGR and growing EBIT at a 19% CAGR. These results have been driven by secular growth in markets and accretive acquisitions, most of which were executed at sub-12x EBITDA. Many of the brands in these two segments are well-known (Master Lock, American Lock, Moon, etc.).

Water Innovations and Outdoors & Security Summary (FBHS Investor Presentation)

Cabinets is a low-quality segment and has no brand value, or “moat,” surrounding its business. One has to only ask themself if they can recall the brand of cabinets in their kitchen to prove my point. However, this hasn’t stopped the segment from growing nicely since 2018, with revenue increasing at a 5.7% CAGR, and EBIT growing at a 7.3% CAGR.

Path To $24/share Of Cash Generation

Now that I’ve broken down the business and the working capital opportunity, I can explain how I get to the $24 per share of distributable cash number.

Through 2024, I anticipate that FBHS will:

- Organically generate $4.1B of EBITDA at a 16% margin

- Pay an effective tax rate of 21%

- Deploy $740M on capital expenditures

- Free up $920M of working capital (down to 8.5% of revenue).

Some back-of-the-envelope math off these assumptions computes to $3.5B of cumulative free cash flow generation. Subtract $360M of anticipated interest payments and we’re looking at distributable cash earnings of $3.1 billion, or $24/share.

What To Do With The Cash

Now, what will Fortune Brands do with this $3.1 billion? They have several options: acquire other companies, pay dividends, and/or buy back stock.

Acquisitions

Fortune Brands has an excellent record of acquiring competitors to grow earnings and increase bargaining power with key customers, often taking out peers at multiples in the sub-12x EBITDA range.

In fact, Fortune Brands today is largely the product of acquisitions, helping to explain where the $3.8B of goodwill on their balance sheet comes from.

Since going public in 2011, the company has deployed ~$3B on acquisitions, according to their investor presentation, which averages out to ~$275M a year spent on acquisitions. Over the next three years, it’s fair to assume that Fortune will spend $825M of the $3.1B available to them on acquisitions, netting annual incremental EBITDA of $85M.

Dividends

Fortune Brands, like many mature, high cash flow businesses, pays a dividend (2% yield on a forward basis). According to Seeking Alpha, Fortune’s grown the dividend at a 9.5% rate over the past 5 years and raised it by 8% over the past year.

The dividend is manageable and cost the company just $144.6M over the past year. I expect the dividend to grow at ~8% per year over the next three years, costing the company ~$450M.

Share Buybacks

Now we get to my favorite method of capital return when a company’s stock is undervalued: share buybacks. After deploying $825M on acquisitions and $450M on dividends over three years, there would still be $1.825B in extra cash on the balance sheet. Since debt repayment isn’t an issue with the company at 2.4x net leverage, a buyback is appropriate.

With the stock at $55/share, Fortune Brands has a $7.2B market cap. $1.825B of buybacks is enough to buy back 25% of the company’s market cap, taking shares outstanding from 130.81M today, to 98.1M at the end of 2024.

These aren’t pie-in-the-sky calculations. Fortune Brands has signaled a willingness to be aggressive with buybacks, having already gone through $505M of a $750M buyback they initiated in March, which had been in addition to the existing $135M authorization. I expect another buyback authorization/increase will be announced imminently.

Assessing the Spinoff

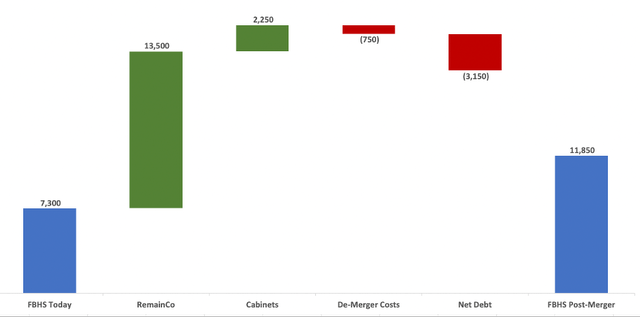

Back in April 2022, Fortune announced their intention to split into two companies: RemainCo (which will consist of Water Innovations and Outdoors & Security) and SpinCo (which will consist of Cabinets). My assessment of the spinoff is that it will likely catalyze a meaningful amount of value creation, however, since the business is already undervalued based on pure cash flow generation, the spin is inconsequential to my overall thesis.

If you’re curious though, here’s my back-of-the-envelope math:

- RemainCo has $900M of EBIT. It’s a growing, high ROIC business and deserves to trade at the same level of other high ROIC industrial product businesses. 15x EV/EBIT is reasonable.

- SpinCo has $300M of operating income. It’s a cyclical, highly cash generative business, that I’m not interested in at anything more than 7.5x EV/EBIT, so that’s the multiple I’ll assign it.

- De-merger costs, which aren’t really an issue because the business is so decentralized, are estimated at an aggressive 10% of EBIT, and I estimate the NPV of those at $750M over a ten-year period.

Adjusting for net debt of $3.15 billion, I reach an estimated equity value for FBHS of $11.85B, or $90/share based on a SOTP assessment.

FBHS Spinoff Valuation (Author’s Own Work)

For those who would like to learn more about the spinoff, the company has an informative PowerPoint presentation explaining it.

Valuation

In the most recent conference call, management noted that they believe free cash flow will come in at $590-$630M for 2022. Subtracting the $120M of expected interest on $3.5B of debt, and we arrive at a levered FCF number, assuming no net debt repayment, of $3.60/share. Peers such as Masco (MAS), Armstrong World Industries (AWI), Lennox (LII), and Mohawk Industries (MHK) trade at 15-20x normalized FCF, depending on the market environment. Attaching a 15x multiple to FBHS would support a stock price of $54 share on trough levels of FCF – 20x supports a $72 share price today.

By 2024, Fortune can be earning $1.4B of EBITDA, on which they can generate $750M of LFCF, enabling $7.65/share of FCF on their shrunken share base. Attaching a 15x multiple on that cash flow and the stock could reach $115/share in 2.5 years.

Risks to Consider

As with all investments, Fortune Brands Home & Security has risks. The primary risks are related to interest rates, commodity prices, and key customers.

- Interest Rates: FBHS has significant interest rate risk because their business benefits from low mortgage rates and their subsequent effect on home values.

- Commodity Prices Rise: FBHS has commodity risk in price volatility caused by supply conditions, the weather, geopolitical and economic variables, and other unpredictable factors. However, this risk is largely minimized as FBHS’ supply chain is decentralized.

- Key Customer Dependency: A large portion of FBHS’ revenues are derived from sales in The Home Depot (HD) and Lowe’s (LOW). Each company accounted for over 10% of FBHS’ revenue in 2021. If HD and LOW try to squeeze FBHS on price, that could be problematic for margins.

Takeaway

Fortune Brands is a high-quality, durable growth business with the potential to generate meaningful amounts of free cash flow relative to their market value over the coming 72 months. I’m a buyer at current levels and believe I can earn a 20% IRR through 2024 by purchasing the stock below $70/share.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment