akinbostanci

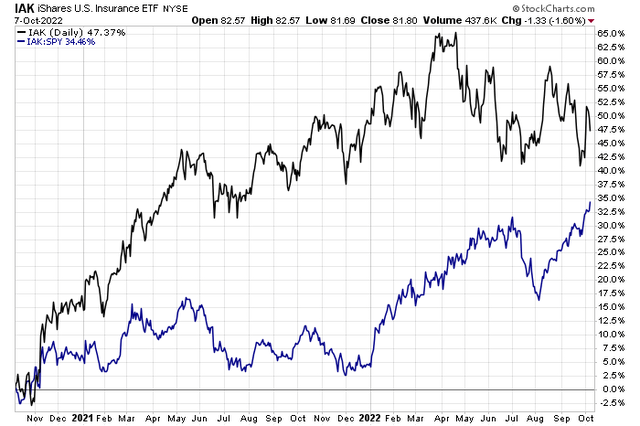

Insurance stocks are a rare bright spot in the S&P 500 this year. The iShares U.S. Insurance ETF (IAK) is nearly flat for 2022 but up almost 50% (total return) in the last two years.

Compared to the S&P 500 ETF (SPY), IAK is ahead by about 30% year-to-date. The fund’s second-biggest component has an earnings date this Thursday, and shares are trending up.

Insurance Stocks Keep Working in 2022, New Highs vs SPY

According to Fidelity Investments and Bank of America Global Research, The Progressive Corporation (NYSE:PGR), an insurance holding company, provides personal and commercial auto, personal residential and commercial property, general liability, and other specialty property-casualty insurance products and related services in the United States. It operates in three segments: Personal Lines, Commercial Lines, and Property. Progressive derives most of its business from personal auto insurance policies. PGR operates in standard and preferred auto and is expanding distribution channels, which include direct distribution and internet.

The Ohio-based $71.3 billion market cap insurance industry company within the Financials sector trades at a high 86.9 trailing 12-month GAAP price-to-earnings ratio and pays a small 0.3% dividend yield, according to The Wall Street Journal. Just last week, Jefferies upgraded the stock to Buy on widening margins and net interest income gains despite some negative impacts from Hurricane Ian. Investors should be aware that PGR is known to pay large annual dividends at year-end.

PGR’s three business lines are seeing impressive growth right now, but there are downside risks from rising interest rates potentially causing a loss of PGR’s currently strong earnings power. Moreover, as seen recently with Hurricane Ian, natural disasters and catastrophes are always a risk. In the auto space, ride-sharing and autonomous vehicles also could lead to EPS risks.

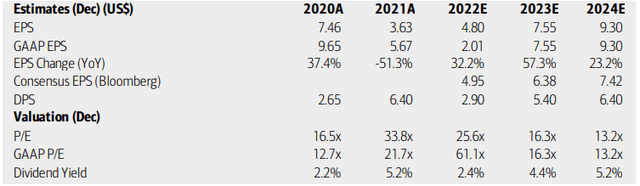

On valuation, analysts at BofA expect Progressive’s earnings to grow sharply in 2022 and surge in its next fiscal year. The Bloomberg consensus forecast is not as sanguine, though. Still, dividends are seen as climbing next year through 2024 while its operating P/E retreats to attractive levels.

PGR: Earnings, Valuation, Dividend Forecasts

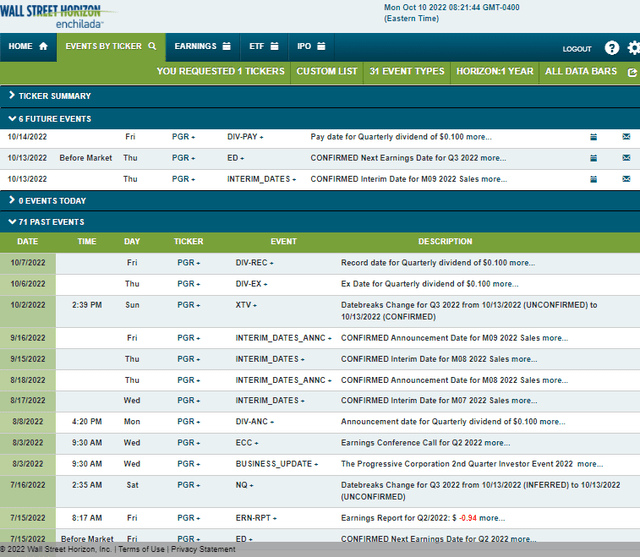

Looking ahead, data from Wall Street Horizon show a confirmed Q3 earnings date of Thursday, Oct 13 BMO with a dividend payment date this Friday.

Corporate Event Calendar

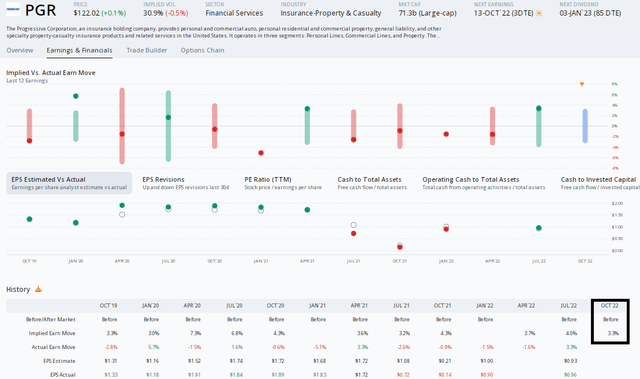

Digging into the earnings situation, the consensus EPS forecast for this week’s release is $1.44 according to Seeking Alpha while the revenue estimate is $13.4 billion. In the last 90 days, there have been 13 positive EPS revisions and just 3 to the negative side. PGR has a mixed recent earnings beat-rate history with significant misses in four of the past five reports.

The Options Angle

Options data from Option Research & Technology Services (ORATS) show an implied stock price move of just 3.3% using the nearest-expiring at-the-money straddle. The stock does not usually move much post-earnings, so implied volatility is low compared to other stocks reporting this week. Moreover, ORATS data show the biggest share price swing after a quarterly report is just 3.3% since Q1 of last year. Given that, investors shouldn’t have much to worry about in terms of a monster move Thursday.

A Small Earnings Move Expected

The Technical Take

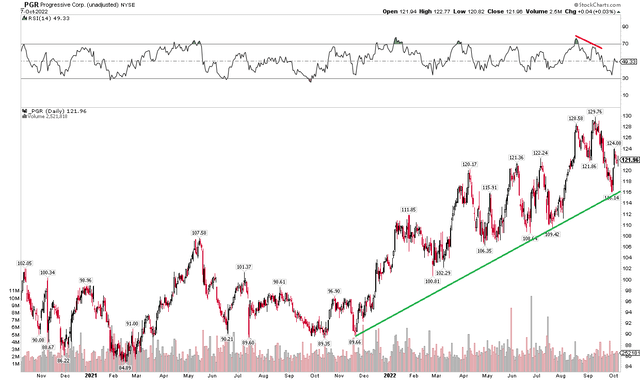

Progressive continues to press higher. Shares have rallied from about $90 a year ago to above $120 today. While PGR pulled back about 10% from its September high just shy of $130 to $116 last week, buyers stepped to the plate despite broad market volatility. That correction made sense given a bearish momentum divergence on the RSI indicator above the price chart. Divergences sometimes indicate a trend change, but it’s also common that they are just a corrective pattern, and the trend of a larger degree will soon take over. That might be the case here.

I see trendline support that comes into play in the high $110s. Being long into earnings makes sense based on the trend, but a stop under, say, the July-August low in the $108 to $110 range might be prudent.

PGR: Shares Correct After Bearish Divergence, Trend Remains Higher

The Bottom Line

Progressive’s valuation looks attractive despite a high trailing GAAP earnings multiple. Strong EPS growth is expected, and the stock has strong absolute and relative momentum. I like this one heading into its earnings report, but traders might consider stepping away if the stock breaks below its summer lows.

Be the first to comment