Justin Paget

Thesis

Investors in leading US solar energy company First Solar, Inc. (NASDAQ:FSLR) have benefited tremendously from the momentum surge attributed to the passing of the monumental Inflation Reduction Act (IRA).

However, we believe it’s critical for investors to recognize that the market had already anticipated the successful passage of the IRA, as FSLR’s price action consolidated resiliently in July. Notably, FSLR has struggled for further upward momentum since late August as its buying cadence stalled.

Our analysis indicates that the market has drawn in buyers rapidly since its July lows. Furthermore, recent price action in FSLR has increased our conviction that the market has been setting up FSLR for massive digestion of its unsustainable gains. Therefore investors are urged to be very cautious here if they decide to add at the current levels.

We believe the near- and medium-term upside in FSLR has been captured in its current valuation. The company is expected to benefit tremendously from the IRA through the production tax credits (PTC) as it scales its domestic manufacturing prowess. Coupled with technology-enabled improved cost-per-watt (CPW) reduction through 2025/26, it should improve its profitability markedly from the current levels.

However, we parse that FSLR’s valuation is not sustainable at the current levels. We deduce that the premium demanded at the current levels suggests near-perfect execution through 2025/26. Therefore, we believe the overvaluation in FSLR has increased the risks of market underperformance over the next few years.

Accordingly, we urge investors sitting on massive gains to consider rotating some exposure out of FSLR to protect gains. New investors are encouraged to wait patiently on the sidelines for the momentum spike to be digested significantly first.

We rate FSLR as a Sell.

First Solar’s Valuation Is Perched Dangerously High

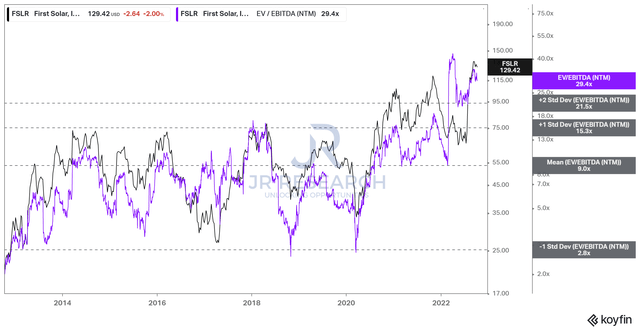

FSLR NTM EBITDA multiples valuation trend (koyfin)

As seen above, FSLR’s NTM EBITDA multiple of 29.4x is perched dangerously high above the two standard deviation zone over its 10Y mean. Sure, some investors could argue that First Solar is expected to benefit markedly from substantial profitability gains ahead, which the market has likely priced in.

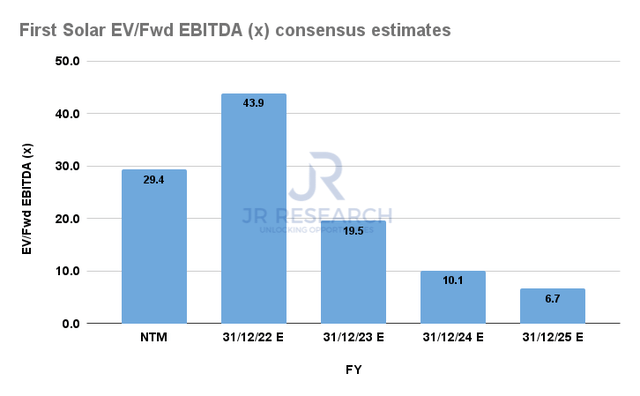

FSLR Forward EBITDA multiples trend (S&P Cap IQ)

Also, our analysis indicates that investors buying into FSLR at the current levels are assuming near-perfect execution, with an extremely high level of conviction in management.

As seen above, FSLR last traded at FY25 EBITDA multiples of 6.7x, below its 10Y mean of 9x. However, it’s still above its peers’ NTM median multiple of 5.56x (according to S&P Cap IQ data). Therefore, we postulate that investors adding at the current levels are willing to go without a considerable margin of safety, which is not advisable.

Investors Are Buying Into FY25 Profitability

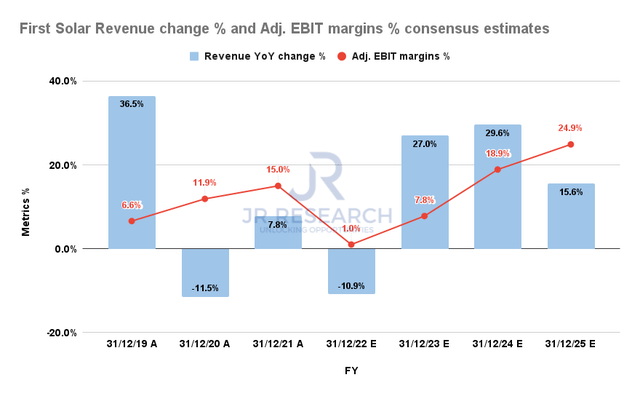

First Solar Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

Investors need to note that First Solar’s current valuation assumes high execution risks, given its unproven profitability.

As seen above, the consensus estimates (bullish) suggest an adjusted EBIT margin of 1% (based on EBIT of $27.1M) in FY22, even as revenue is expected to fall about 11%. The estimates are within the lower range of the company’s adjusted EBIT guidance of $5M-$70M.

Therefore, we assess that investors buying at the current levels are looking way ahead toward its FY25 margins estimates of 24.9%, assuming that First Solar can ramp up its manufacturing successfully.

However, we believe investors still need to be cautious about making such assumptions, as the company’s domestic ramp might not yield meaningful benefits over the next 24 months. Hence, investors are urged to apply a healthy dose of skepticism over the company’s fixed costs leverage by not under-discounting its execution risks.

Is FSLR Stock A Buy, Sell, Or Hold?

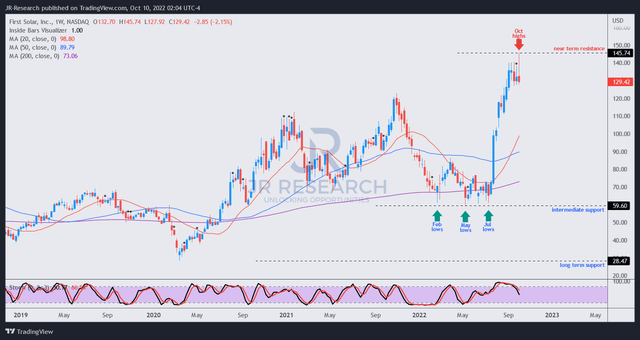

FSLR price chart (weekly) (TradingView)

We urge investors to be extremely cautious about adding FSLR at the current levels.

Our assessment indicates a bull trap in its long-term chart, which is also corroborated by the price action in its medium-term chart, as seen above.

Therefore, the market has drawn in investors rapidly from its intermediate support in July, but its buying momentum has likely stalled decisively.

Therefore, we see tremendous risks in adding at these levels and expect massive digestion ahead. As a result, we expect its intermediate support to hold for now but would observe for an initial steep sell-down that could consolidate at levels above its intermediate support zone.

Hence, we urge investors to wait for the current spike to be digested first, as the market forces late buyers to capitulate. That would help to de-risk the entry levels offering less aggressive entry zones for investors bullish on FSLR to hop on board.

As such, we rate FSLR as a Sell and urge investors sitting on massive gains to take some exposure away and rotate to other beaten-down stocks.

Be the first to comment