Torsten Asmus

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 24th.

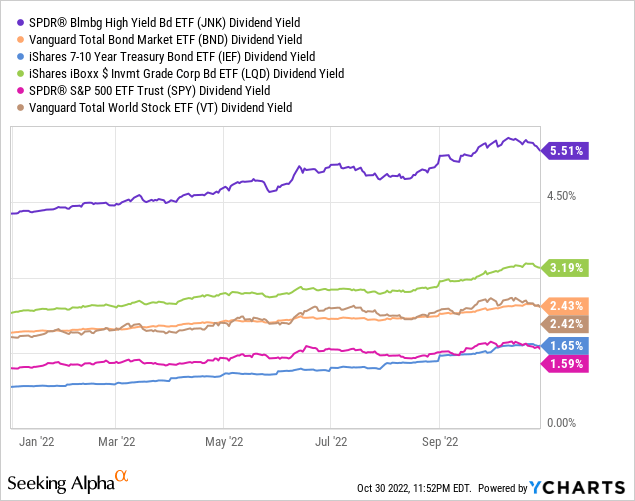

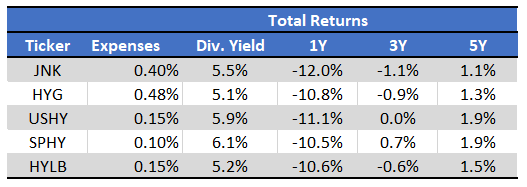

The SPDR Bloomberg Barclays High Yield Bond ETF (NYSEARCA:JNK) is a simple high yield corporate bond index ETF. JNK offers investors a reasonably strong, growing 5.5% dividend yield, but the fund’s expenses are quite a bit higher than average, with a 0.40% expense ratio. Although there is nothing significantly wrong with the fund, there are other broadly similar, but cheaper and higher-yielding, alternatives out there. These include the SPDR Portfolio High Yield Bond ETF (SPHY), with a 6.3% dividend yield, and the iShares Broad USD High Yield Corporate Bond ETF (USHY), with a 6.1% dividend yield. These funds offer investors a broadly similar, but slightly stronger, value proposition to JNK, and make for more compelling investment opportunities. As such, I would not be investing in JNK at the present time.

JNK – Basics

- Investment Manager: State Street

- Underlying Index: Bloomberg High Yield Very Liquid Index,

- Expense Ratio: 0.40%

- Dividend Yield: 5.51%

- Total Returns CAGR 10Y: 2.50%

JNK – Overview

JNK is one of the largest high yield corporate bond ETFs in the market, with over $5 billion in assets. The fund tracks the Bloomberg High Yield Very Liquid Index, an index of these same securities.

It is a relatively simple index, including all dollar-denominated corporate bonds from developed-country issuers with non-investment grade credit ratings (BB or less, but mostly BB). The index only invests in three securities per issuer, the largest ones based on amount outstanding. Larger issues tend to be more liquid, hence the ‘very liquid’ in the index’s name, but I don’t find the difference to be all that material: most bond index funds exclude illiquid issues too. It is a market-cap weighted index, with a 2.0% issuer cap meant to ensure diversification. In my opinion, JNK’s underlying index is simple, has no material shortcomings, and does not significantly differ from those of its peers.

JNK is reasonably well-diversified, with investments in over 1,000 different securities, from hundreds of issuers. Concentration is quite low too, due to the aforementioned issuer cap.

JNK

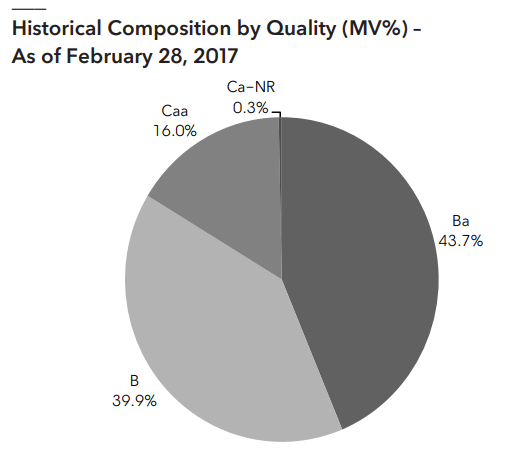

JNK exclusively focuses on high yield corporate bonds. These are relatively risky securities, issued by companies with relatively weak financials, balance sheets, and credit ratings.

JNK’s underlying holdings sport an average credit rating of Ba according to Moody’s, equivalent to BB in S&P’s more well-known credit rating system. These are the highest non-investment grade credit ratings available, so credit risk is high, but not significantly so. Credit ratings are extremely similar to those of its peers, including SPHY and USHY.

Bloomberg Barclays US High Yield Very Liquid Index

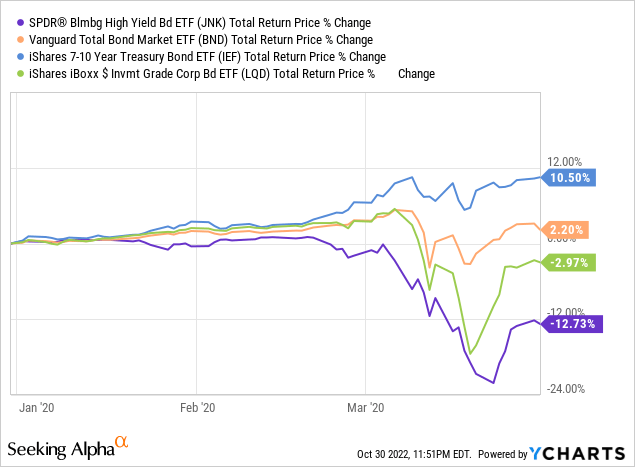

JNK’s underlying holdings are relatively risky investments, and strongly exposed to economic and market conditions. When conditions worsen, the issuers of these securities might have issues meeting their financial obligations, leading to increased default rates and lower bond prices. Expect above-average losses, at least relative to most other bond sub-asset classes, during downturns and recessions. This was the case during 1Q2020, the onset of the coronavirus pandemic, as expected.

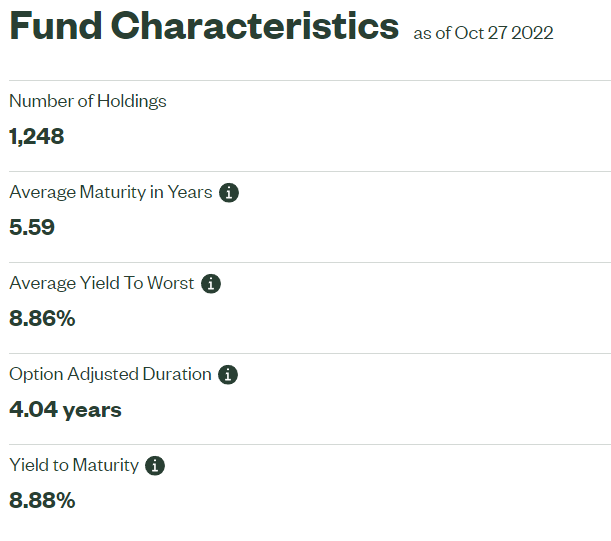

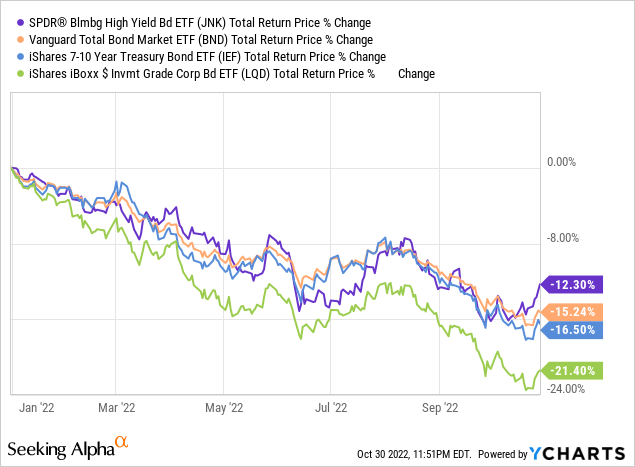

On a more positive note, JNK’s holdings have relatively short maturities, duration, and interest rate risk, with a weighted average duration of just 4.1 years. Duration is lower as issuers with weak credit ratings rarely issue long-term debt: too risky for underwriters and investors, plus interest rate payments might prove prohibitively expensive.

JNK’s relatively low duration means the fund outperform its peers when interest rates rise. This has technically been the case YTD, but barely so, as economic conditions have also worsened in the recent past.

JNK provides investors with a reasonably good 5.5% dividend yield. It is a good yield on an absolute basis, and higher than the yield offered by most other bond sub-asset classes, as well as equities.

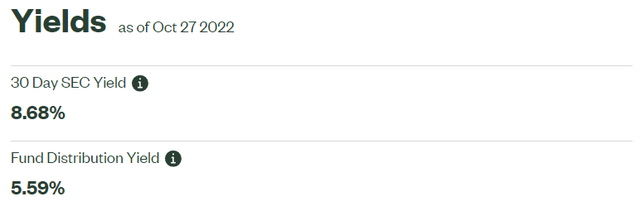

JNK’s dividends are more than fully covered by underlying generation of income, as evidenced by the fund’s 9.0% SEC yield. Said metric is a standardized measure of short-term generation of income, and indicative of the actual income generated by a fund’s holdings.

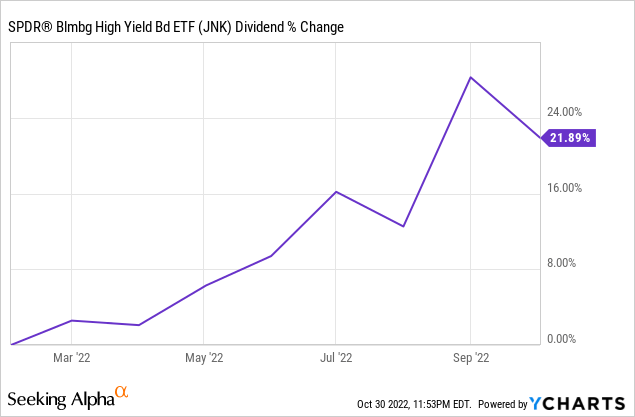

ETFs tend to distribute any and all income to investors as dividends, and JNK is no exception. As such, JNK’s dividends should see healthy grow until the fund’s yield reaches 8.7%, assuming bond interest rates and yields remain constant. It could be years until yields reach 8.7%, but dividends should see steady growth more or less immediately. JNK’s dividends have grown 21.9% YTD, and future growth is likely, at least if current conditions persist. For reference, annualizing the latest monthly dividend payments nets you a 6.2% forward yield.

JNK offers investors a good, covered, growing 5.5% dividend yield. Although this is a reasonably good benefit, the fund’s expenses make it a broadly subpar choice. Let’s have a look.

JNK – Expenses Analysis and Peer Comparison

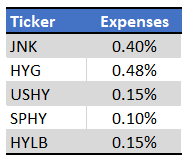

JNK is a relatively expensive fund, with a 0.40% expense ratio. Although said expenses are not that high on an absolute level, they are higher than that of most of its peers. Most notable exception is the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the largest high yield corporate bond ETF in the market, with a 0.48% expense ratio.

SeekingAlpha – Chart by Author

Expenses directly reduce a fund’s dividends and expected returns. The impact is more pronounced for more expensive funds, like JNK, less so for cheaper funds, like SPHY.

Focusing on the high yield corporate bond ETFs, it seems that JNK has a lower yield, and lower realized returns, than its cheaper peers, as expected. One exception: the Deutsche X-trackers USD High Yield Corporate Bond ETF (HYLB), which is cheaper than JNK, but yields a bit less. HYLB does have higher returns, as expected.

SeekingAlpha – Chart by Author

JNK’s higher expenses have led to comparatively weak dividends and returns in the past and will, I believe, continue to do so in the future. As JNK does not significantly differ from its peers in any way, but is quite a bit more expensive than most, I simply see no reason to invest in the fund at the present time. No reason to overpay for a simple index fund, especially not one without any key advantages or differentiators.

Conclusion

JNK offers investors a reasonably strong, growing 5.5% dividend yield. Although there is nothing significantly wrong with the fund, there are other broadly similar, but cheaper and higher-yielding, alternatives out there. As such, I would not be investing in JNK at the present time.

Be the first to comment