Daniel Megias/iStock via Getty Images

Jumia Technologies (NYSE:JMIA) is an African eCommerce company that flew high in light of the 2021 meme stock mania and has since crashed 90%. The company has a significant cash burn problem. I believe it could be headed toward bankruptcy, with the ability to refinance becoming harder in this environment and dilution not a viable option anymore at this valuation.

Jumia performance (google)

Operating in a growing industry

Jumia operates in an attractive but challenging market. African E-Commerce is expected to grow at an 18% CAGR up to $72 billion in 2025. By then, 520 million people are expected to use eCommerce services or a 39.5% penetration. ECommerce is texted to reach a 3% penetration compared to offline commerce by then, significantly lagging the rest of the world and leaving a significant opportunity.

African eCommerce market expectations (Statista)

Although this leaves ample opportunity, we must acknowledge that Africa is a vast and diverse continent with thousands of languages spoken. Expanding into new countries isn’t as simple as it sounds and involves a lot of costs, especially if you are fulfilling orders.

Diversity in Africa (Medium (Jessica Innis))

What does Jumia do?

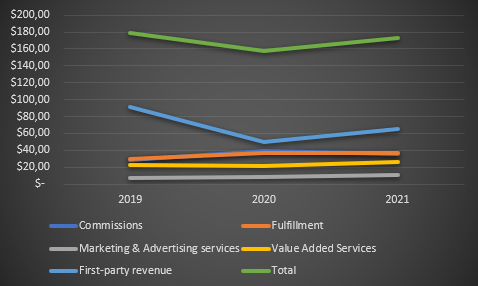

Jumia has five main revenue streams: Fulfilment of orders for third-party sellers, commissions from third-party sellers, Marketing & Advertising services, Value-added services and first-party sales. Revenues have stagnated over the last four years, while most eCommerce companies saw exponential growth.

Jumia revenue by segments (Authors model, Data from 10K)

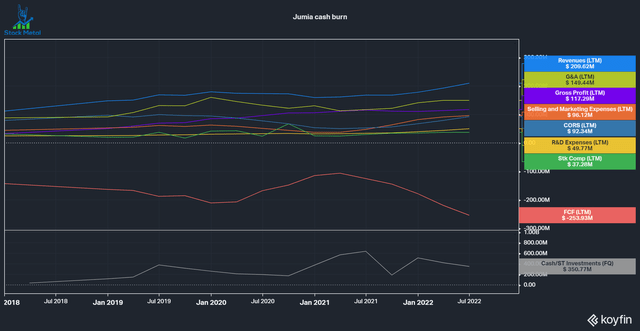

In 2022 revenue growth did pick up and revenues increased to over $200 million. Still, costs continued to rise, amounting to a Cash outflow of $254 million (keep in mind that FCF doesn’t include the $37 million in stock-based compensation, which doesn’t burn cash but dilutes the value each share represents in the company).

Jumia Cash burn (Koyfin)

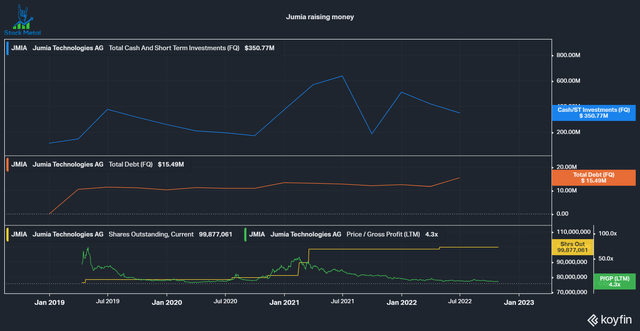

We have to give management some credit for using the manic share prices in 2021 when the company traded at almost 50 times gross profit and raised cash. The company raised around $244 million in 2020 and $349 million in 2021, diluting shareholders by around 25% in total. The company currently has a market cap of $509 million and would have to dilute shareholders substantially to raise money.

Jumia cash raised (Koyfin)

Path to profitability

The company’s plan to reach profitability has six points:

- Continue to grow gross merchandise volume (GMV) by at least 15%.

- Accelerate monetization to increase gross profits by 27-44%.

- Reduce Sales & Advertising costs by 18-37% to $35-45m for H2 22.

- They see Q4 21 as the peak for losses at $70m adjusted EBITDA (I hate adjusting an already heavily adjusted number like EBITDA).

- They expect a YoY reduction of 12-29% in costs for H2 22 compared to H1 22.

- FY 22 guidance of Adjusted EBITDA loss between $200-220 million and a decreasing Adjusted EBITDA loss in FY 2023.

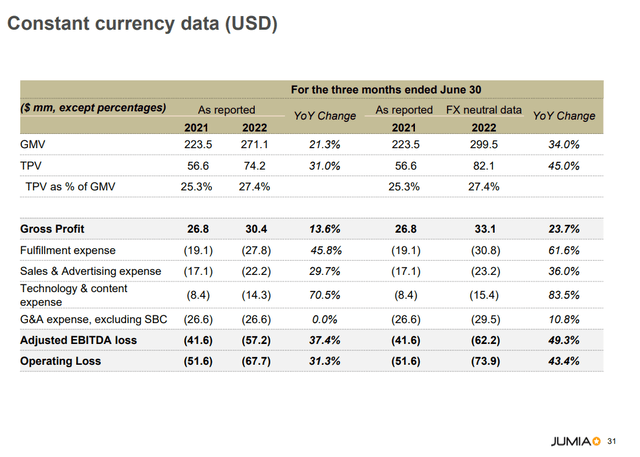

I do not believe this is enough to turn this ship around. If we look at the data below, we can see that GMV grew by 34%, while Gross Profit only grew 23% and Operating loss increased by 43% for the quarter. The company made $33.1 million in gross profit and had already spent over 90% on fulfillment expenses. So basically, after just delivering the orders, the company was already losing money on their business without factoring in all the other costs. Especially G&A expenses stand out. The company spends a lot of stuff here just to run their business, $29.5 million without even including the $7.3 million in stock-based compensation. The company has had higher G&A costs in 17/18 quarters on record (the one quarter where gross profit was higher saw $27.26 million versus $26.17 million). I do not see how this business is working out.

Jumia Constant Currency Data (Jumia Q2 presentation)

Let’s assume that they manage to curb costs by 40% each year, which I do not find realistic given their plan to “profitability” they would need to raise cash in 2024/2025 at the latest. According to gurufocus, Jumia has a cost of capital of 16.7%, so taking on debt is very expensive and issuing shares is likely not an option due to the small market cap compared to their expected losses.

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Total Cash/Equivalents | $350 | $171 | $44 | -$47 | -$112 | -$159 |

| losses (40% improvement each year) | $250 | $178 | $127 | $91 | $65 | $46 |

Comparison to Sea Limited

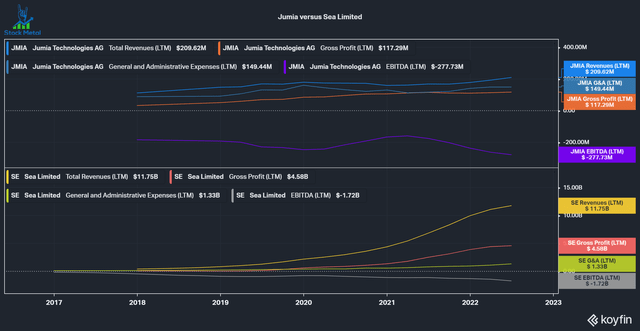

Sea Limited (SE) is another high-flying growth stock running on significant losses this year. Sea Limited also burned through a lot of cash, but the difference is that they also grew exponentially. Jumia loses over 100% of revenues to grow around 20%. This leads to ballooning costs, as we see with G&A. If we compare G&A as a percentage of revenue for Sea Limited, we can see that they increasingly got operating leverage. No such trend is seen with Jumia. Another key difference is that Sea Limited had one very profitable segment with Garena, its gaming segment that posted hundreds of million in operating cash flow. This was a great cushion to help against the aggressive loss-making expansion into eCommerce. Jumia doesn’t have such a segment and instead loses money everywhere.

JMIA vs SE (Koyfin)

What about liquidation?

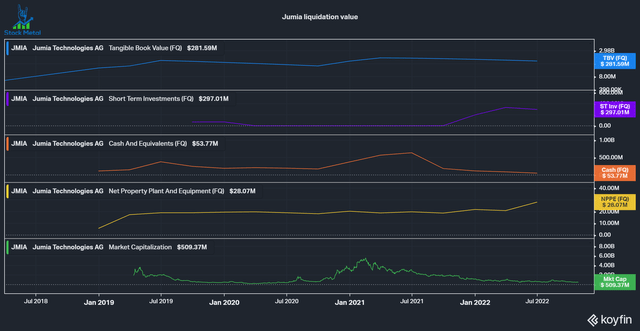

As I explained in the previous segments, I do not see the business model working out with their unit economics, so the only option is liquidation. In the charts below, we see that the Tangible Book value of Jumia is at $281 million, just 1.8 times less than the market cap. The company has a lot of cash and short-term investments, but they are being eaten away quickly. If we look out three years, they will have eaten through all of these cash reserves, reducing possible liquidation value to around $50-100 million if we credit them $28 million in PPE and give some value to their annual active consumers (8 million in FY 21) and active quarterly consumers (3.4 million in Q2 2022, so these customers purchase relatively infrequently).

The best course of action would be to seek liquidation or a takeover bid from a company like Walmart (WMT) while they still have a lot of substance to the business via the $350 million in liquidity. I do not see how the company can turn a profit with its lack of cost control and bad unit economics. Even after a 90% fall, the downside from here is still substantial.

Jumia Liquidation value (Koyfin)

Be the first to comment