Alex Wong

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) is set to release earnings after the markets close tomorrow. There’s a lot riding on its release, because Google is the biggest of all the major ad-tech companies by market cap. Last week, when the relatively tiny player Snap (SNAP) missed estimates, it triggered an enormous selloff in all ad-tech names, including Google, Meta Platforms (META) and Twitter (TWTR).

Google’s release could have an even bigger impact than Snap’s, because its ad platform is much larger than Snap’s and, therefore, more representative of the industry as a whole. Google has 4.3 billion users across all of its products, representing a broad swath of humanity. Snap only has a few hundred million users, and its user base skews young. If Google’s guidance is bad, then ad-tech as a whole is likely to do poorly in the coming quarter, as Google is a bellwether for the industry.

It’s logical to ask, then, whether Google is likely to do well in the coming quarter. Many people think that we’re currently in a recession, and ad spending dips in recessions. That would tend to argue for a poor showing from Google. On the other hand, GOOG benefitted from Apple’s (AAPL) privacy changes, which shifted ad spend away from Meta and toward Google ads. In its fourth quarter earnings call, Meta said that Apple’s ATT policy pushed customers toward Google, whose ad platforms don’t depend on tracking as much as Meta’s. If that’s correct, then Google’s earnings could defy the industry-wide slowdown by taking share from a competitor.

For this reason, I’m expecting Google’s revenue to be satisfactory. I can’t predict whether it will beat or miss estimates, but it is likely to grow on a year-over-year basis. Google’s competitive position improved due to Apple’s privacy changes, and Apple is not budging an inch on the changes it made. Therefore, we should expect Google to gain share from competitors that were seriously harmed by ATT.

When it comes to the bottom line, it’s a bit of a different story. Google owns a vast portfolio of equity investments, many of which are publicly listed. Among Google’s investments, you’ll find names like:

All of these stocks are down over the last 12 months. MGTA, in particular, has taken an extreme beating, falling 75% in a year.

Why does this matter? Because publicly traded assets don’t just affect a company’s balance sheet, they affect its earnings, as well. When a stock goes down, you have to deduct the price decline from net income, even if you didn’t sell. This rule means that Google has a lot of stock market volatility baked into its earnings.

In the past, this didn’t matter much. Analysts usually know quite a bit about financial reporting, and are aware that GAAP net income doesn’t always represent operating performance. However, the reaction to Google’s previous release was quite negative, despite a significant beat on revenue and positive growth in cash flows. It appears that investors aren’t taking chances, and are taking GAAP earnings to heart. For this reason, it’s quite possible that Google will experience volatility after earnings, even though its stock is an incredible value from a long term perspective.

Alphabet – the Bullish Case

Before getting into why Google’s earnings release could trigger volatility, we first need to establish the bullish case. I’ve rated the stock a strong buy, and for those who genuinely have long time horizons, it is a great value. The “earnings risk” I speak of mainly applies to short term traders aiming to profit off tomorrow’s earnings release, which I believe is a very risky trade.

As for the long term, there are few stocks I like more than Google. It’s the most heavily weighted stock in my portfolio, and I’m looking to add more.

One of the biggest reasons to be bullish on Google is its competitive position. As mentioned already, Apple’s privacy changes had the effect of sending advertisers from Meta and other social media companies to Google. Google was already the #1 ad platform on earth before ATT, it solidified its position afterward.

But there’s more to Alphabet than just advertising. It also owns Android, the #1 smartphone OS by installations, in second place by revenue. There are few players in the smartphone OS space other than Google and Apple. The few that exist are open source, and aren’t really competing with the incumbents for app fees. Given the nature of smartphone operating systems as a duopoly, it’s reasonable to expect that Android will generate strong profits for the foreseeable future. Minimal competition in a popular product category is a recipe for success.

Beyond advertising and smartphones, Google has a variety of other businesses, some of which are very promising. Take cloud computing for example. Google Cloud is Alphabet’s cloud computing platform, which lets developers host apps and websites remotely. Google Cloud grew at 44% in the most recent quarter. It’s still losing money for the time being, but it is rapidly gaining in popularity, and has an obvious selling point as the infrastructure on which Google’s popular Drive products are hosted.

Financials

Armed with information about Google’s operations, we can turn to its financials. Google is a highly profitable business with strong growth and piles of free cash flow. In the most recent 12 month period, it delivered:

-

$270 billion in revenue.

-

$153 billion in gross profit.

-

$82.3 billion in operating income (“EBIT”).

-

$74.5 billion in net income.

-

$5.53 in diluted EPS.

-

$52 billion in free cash flow.

Overall, these were very strong results. Revenue grew by double digits, cash flow also experienced solid growth, and net income only declined due to losses on equity investments. Looking at Google’s results from the last 12 months, there are many reasons for optimism. The case for optimism is strengthened when we look at the company’s balance sheet. As of the most recent earnings release, Google’s balance sheet boasted:

-

$20 billion in cash.

-

$177.8 billion in current assets.

-

$61.9 billion in current liabilities.

-

$357 billion in assets.

-

$103 billion in liabilities.

-

$254 billion in equity.

-

$12.8 billion in long term debt.

These balance sheet metrics suggest high liquidity and solvency. From them, we get a current ratio of 2.87 (extremely high liquidity) and a debt-to-equity ratio of 0.05 (high solvency).

Given Alphabet’s solid earnings and balance sheet, you’d think it would be expensive, but think again. According to Seeking Alpha Quant, GOOG trades at 19.5 times earnings, 5.3 times sales, 5 times book value, and 14.5 times operating cash flow. The multiples to book value and sales are still a little high, but the earnings and cash flow multiples are quite low. Assuming GOOG can continue its strong historical growth in the future, then it will prove to have been a good buy at today’s prices.

The Big Risk to Short Term Traders

Given my “strong buy” rating and glowing praise of GOOG, you’d think I’d be running out to recommend it to everyone. It’s both a great company and a cheap stock, so it’s an obvious buy, right?

For long term investors, I would say yes, it is.

For short term traders, it’s a different story. This week’s earnings release presents risks to traders both short and long, and I do not believe that it is wise to play the stock’s release hoping for quick gains.

One reason has to do with accounting rules.

Under GAAP financial reporting rules, companies have to report any gains or losses on stocks as part of net income. It doesn’t matter whether you sell or hold: the decline in balance sheet assets is immediately recorded in other comprehensive income.

We can illustrate how this works with an example. Let’s say you ran a company and you did $100,000 in free cash flow, $0 in depreciation, and had a stock portfolio worth $1 million at the start of the quarter. Given the lack of depreciation, you’d think that net income would be pretty close to free cash flow. However, if the stocks went down by $100,000 in the quarter, you’d have a $100,000 “loss” that would reduce net income to $0. At least, you’d have such a loss if your company was publicly listed and reported earnings to the public. These stock portfolio losses don’t affect what the IRS considers to be your profit, but it does affect the profit you announce to the public. So, you’d have $0 in on-paper earnings in the hypothetical we just explored.

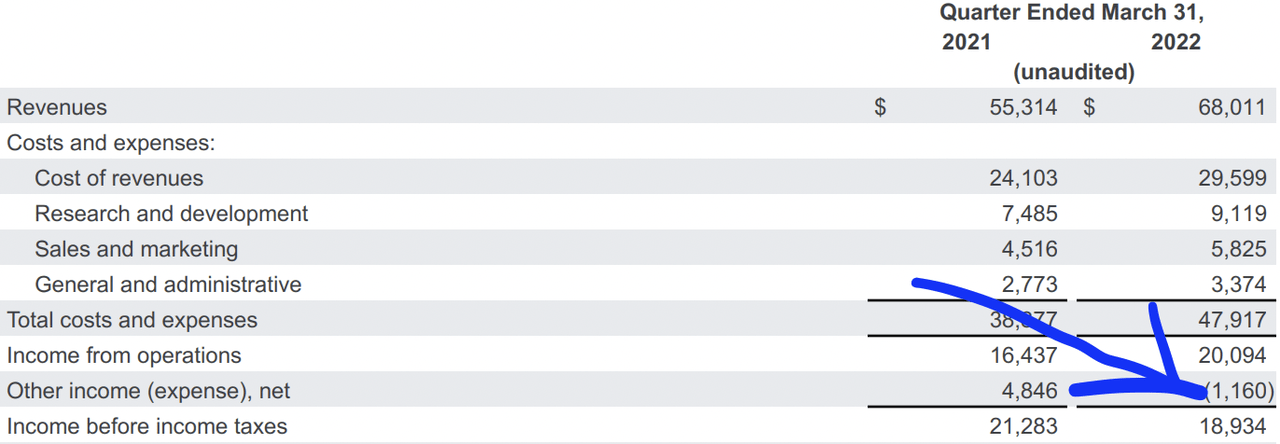

Exhibit A: stock losses take huge bite from GOOG’s earnings (Alphabet)

How does this apply to Google?

Well, the company has stocks on its balance sheet, and they took a bite out of net income last quarter (see image above). Further, they could take an even bigger bite this quarter. The decline in CrowdStrike stock from April 1 2021 to April 1 2022 was 21.83%. The decline from July 2 2021 to July 3 2022 was 35%. CRWD is one of Google’s portfolio stocks, and it looks like it will take a bigger bite out of Q2 earnings than it did from Q3 earnings. After Google’s Q1 earnings came out, it sold off after hours, as investors reacted to the earnings decline instead of the strong operating cash flow growth. If investors haven’t yet adjusted their earnings expectations, then GOOG could decline again after the coming release.

Uncertainty about all this is one reason why GOOG is a risky play for short term traders heading into earnings. All we know about a stock is its publicly available data. We don’t know precisely what investors are thinking, nor what they have “priced in.” If they’re not yet aware that the Q2 year over declines in tech stock prices were worse than those in Q1, they may get a shock from Google’s earnings.

There are risks to shorts, as well. If the majority of analysts covering Google are aware of the things I explained in the previous paragraphs, then the possibility of an upside surprise is very real. Shortly after its Q1 results came out, Meta Platforms rallied, even though the release only saw a tiny beat on earnings and a miss on revenue. The release was mixed, and earnings declined, but investors took the news well anyway, perhaps because they subconsciously expected worse than what analyst estimates suggested. You can’t discount the possibility of something similar happening after Google’s release. Short term earnings plays are always risky, and this year, with so many different variables affecting stock prices, it pays to take a long term view.

Be the first to comment