DKart

Blank check company Digital World Acquisition (NASDAQ:DWAC) is working on a business combination that will see new social media upstart Truth Social go public. However, the timeline for the completion of the go-public transaction has been thrown into disarray on the back of a series of subpoenas from the SEC and the U.S. Department of Justice. This presents the most salient risk for bulls as the merger could get terminated if the regulatory burden gets insurmountable. A scenario that would most likely see shares of DWAC immediately revert back to the $10 SPAC reference price, a nearly 70% drop from current levels.

Truth Social, which made its official app store debut back in February, has made a fight for First Amendment protections its core mission. The company wants to challenge the current social media orthodoxy which sees control of the landscape by a small group of mostly California-based companies who have been criticized for being partisan in their approach to content moderation. As Truth Social’s user interface is not dissimilar to Twitter (TWTR), the company’s bull case is built on its capitalization of the malaise faced by disgruntled users of the latter.

Whilst Truth Social wants a platform that encourages conversations without implicit bias against any political ideology, the company is likely to appeal to supporters of the 45th President of the United States. Donald Trump sits on the board of Truth Social’s holding company and is also mentioned 87 times in the company’s go-public presentation to investors. Hence, the company does stand to capture a segment of the social media sphere who feel that the current platforms are not conducive to their outlook and values.

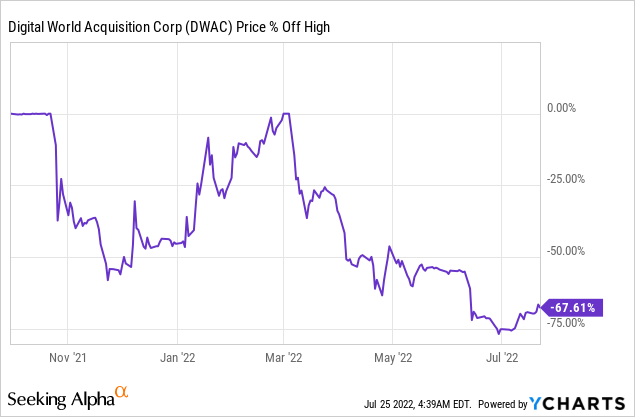

Digital World is about 68% off its 52-week highs as the previous euphoria that drove its common shares to extreme levels has moderated on the back of material uncertainty being embedded into the completion of the go-public transaction. Those considering buying shares now will be betting that Truth social’s management is able to navigate separate federal investigations to consummate the merger.

Encouraging Open And Free Global Conversations

Truth Social enters a crowded space for its self-proclaimed ambition to reclaim the American people’s right to free expression. There are a number of startups like Parler, MeWe, Gettr, and Rumble in what is fast becoming a crowded field for First Amendment-type startups with significantly laxer approaches to content moderation. As there is a strong overlap in users between all platforms, Truth Social will find itself in heavy competition in what remains quite a market niche. Most of Truth’s target market will likely remain on Twitter due to the network effect. Essentially, as more people use a product, the value to everyone increases. This snowballs to create an increasingly greater gravitational pull that creates bottlenecks to new platforms being able to pull users.

Also, whilst Twitter’s content moderation policies have been criticized by bears as being overly partisan, the company still allows a wide variety of different political viewpoints on its platform. Truth Social cannot be dependent on just Trump to pull in users, and these other ‘power users’ are unlikely to abandon their large audience base for a new platform with no inherent benefit. Hence, Truth Social’s goal to reach tens of millions of active users within the next few years could prove to be somewhat Sisyphean.

Twitter’s current malaise does present tailwinds for Truth Social. With Elon Musk having terminated his proposed acquisition, a scenario which Twitter’s management described as a nightmare, the company will find itself floundering as the advertising space faces headwinds. Some analysts have priced in a potential downside for Twitter’s common shares to $11, a 72% decline from current levels. The company’s credibility with investors, weakness in the advertising market, and fake users and bot issues have also impacted overall sentiment in the stock. The breakdown of Musk’s proposed buyout presents a strong boost to Truth Social as it was widely expected that Musk would reduce content moderation policies to allow back accounts previously banned by the platform.

Truth Social is also expected to raise significant cash when it closes its merger transaction. There will be $293m in cash available from the SPAC trust with a further $1bn in PIPE financing. This would make Truth Social the best capitalized of its peers and put the company on a good footing to take on Twitter.

Championing Less Moderated Speech

Truth Social’s entire bull case is being built on an inherent abandonment of the First Amendment by the larger social media companies. Whilst Twitter would argue that content moderation of its platform is necessary to prevent it from spiraling entirely out of control, its critics say this has been at times vague and perhaps too seemingly partisan. Twitter could also of course revert its ban on Trump and blunt the potential of Truth Social to act as a challenger. Further, if the Elon buyout does eventually proceed at a materially lower valuation, the use case for Truth Social could get watered down.

More competition is definitely a great thing for all, but I would question the ability of Truth to pull its targeted user base away from Twitter in material numbers due to the aforementioned network effect. Shares would ever only be a buy on a potential pop from the merger closing, but the longer term poses far too many risks for most investors.

Be the first to comment