Noah Berger

With Amazon, R&D is key

This article is going to give tips on how to evaluate Amazon (NASDAQ:AMZN), with some assistance from the Nomad Partnership letters. For those unfamiliar with Nick Sleep and Qais Zakaria, they ran their fund from 2001-2014 and had a total return of over 900% during that period. This was a value fund, with its sole intention at heart to buy a dollar for .50 cents. It later became a quality fund, looking for internal compounding growth and economies of scale as its targets. Both Sleep and Zakaria are secretive and low-key, it is near impossible to find a documented interview of either manager. These letters are one of the only reliable resources to study their methodologies

Methodologies for finding values include references to Buffett, Munger, Graham, Peter Lynch, Joel Greenblatt, and Bill Miller. Like Bill Miller, Nomad Partnership staked a large portion of its capital into Amazon, accounting for a big chunk of their total returns. Another famous value investor, Mohnish Pabrai has stated that the study of Nomad had a great effect on his thought process and remains friends with Nick Sleep to this day.

A previous article, I wrote addressing my price target on Amazon, goes over some general sleuthing on how to look under the hood on fast-growing companies not showing a ton of earnings. Using an adjusted PEG ratio formula substituting EBITDA for net earnings, we saw that Amazon has been growing EBITDA at a rate of 32.15% compounded for the past 5 years. We used 32.15 as our multiplier and $5 per share in EBITDA as our multiplicand. The adjusted price target came out to $160 as fair value. This did not take into account the massive R&D spend that Amazon takes every year.

My thesis is Amazon is a buy. The analysis provided below reinforces my belief that the future of Amazon’s earnings also has hidden buffers already built into it.

Nick Sleep’s notes on Amazon

A paperback version of the Nomad letters can be found here with commentary by the author under the pseudonym the “rational cloner”. A good analysis of Amazon can be seen in their December 31st, 2006 letter to shareholders:

Take for example the current controversy at Amazon.com. Last year the company reported free cash flow of just over U$500m, indeed it has been around this number for the last few years. What is important is that the U$500m is after all investment spending on growth initiatives such as capital spending, but also research and development, shipping subsidy, marketing and advertising and price givebacks.

A bit later in the letter, Nick Sleep’s analysis points out:

By our estimates these discretionary investments, over and above that required to maintain the business are in the region of a further U$500m, excluding price givebacks. This is our subjective assessment of the discretionary investment spend and implies the management could, if so inclined, cancel the discretionary growth spending and instead return around U$800m per annum to investors after taxes. – Nick Sleep December 31st, 2006

He determined that if free cash flow was actually including discretionary spending, the free cash flow number would be much higher, thus commanding a higher price with a change in the multiple and (free cash flow). The problem with typical assessments of growth companies using standard formulas to evaluate them discounts the fact that the highest R&D spenders in the world purposely show lower net income. This provides a compounding effect where they are subsidized through tax loopholes to continue their growth in revenue and by economies of scale, providing price givebacks to their customers.

Price givebacks

Part of the virtuous cycle of Amazon’s growth process has to do with being a low-cost leader. Through smart investments in tax-beneficial vehicles, Amazon can grow and control pricing to a greater and greater extent over time. Instead of trying to increase margins on these businesses, they instead lower the cost to you and create a more loyal customer. The Nomad letters point out that large, low-margin businesses can be very attractive indeed.

Scale of economics shared operations are quite different. As the firm grows in size, scale savings are given back to the customer in the form of lower prices. The customer then reciprocates by purchasing more goods, which provides greater scale for the retailer who passes on the new savings as well. Yippee.- Nick Sleep December 31st, 2008

If you’re a first mover in a given business segment, it becomes better to gain less and less in margins over time and increase revenue vs increasing margins by price gouging customers. The lower margins deter competition. By the time an entrant tries to compete with you on price, they may be cutting below their cost. Game over.

How much does Amazon spend on R&D?

The most current fiscal year saw Amazon R&D spend at $62 Billion. That’s an enormous amount, more than Apple (AAPL) or Google (GOOGL) (GOOG). Let’s pretend for a moment that this optional item was canceled, what would be reflected in EBITDA and cash flow then? With another $62 Billion added to those items, it would effectively cut the price to free cash flow or EV/EBITDA multiples in half. An extra $62 Billion would be more than their current EBITDA and be a top 2 or 3 amount of free cash flow in the stock market. I do realize that some of the R&D spending was borrowed money, rather than taken out of cash from operations. That being said, there are only a handful of companies out there where this type of analysis even applies.

Further benefits to R&D

The following is a snippet from the most recent Amazon form 10-K:

Intangible assets acquired in a business combination that are in-process and used in research and development activities are considered indefinite-lived until the completion or abandonment of the research and development efforts. Once the research and development efforts are completed, we determine the useful life and begin amortizing the assets.

This points out a very interesting compounding effect of research and development that provides additional tax benefits. If a company is effective in using its research and development expense, they then create a valuable intangible asset. When this asset is created, they then move this asset to the balance sheet to be amortized, providing further tax deductions.

Amortization expense for acquired finite-lived intangibles was $565 million, $509 million, and $512 million in 2019, 2020, and 2021.

Thus, on top of the R&D tax credit, Amazon is also carrying forward an additional half a billion dollars a year in amortization expenses. The delayed gratification in realized earnings is certainly building in a lot of tax sheltering for future use.

Changes to the laws

Some future R&D expense tax law items were also brought to light in the most recent Amazon 10-K:

Tax benefits relating to excess stock-based compensation deductions and accelerated depreciation deductions are reducing our U.S. taxable income. U.S. tax rules provide for enhanced accelerated depreciation deductions by allowing the election of full expensing of qualified property, primarily equipment, through 2022. Our federal tax provision included the election of full expensing of qualified property for 2019 and a partial election for 2020 and 2021. Cash taxes paid (net of refunds) were $1.7 billion and $3.7 billion for 2020 and 2021. Effective January 1, 2022, research and development expenses are required to be capitalized and amortized for U.S. tax purposes, which will delay the deductibility of these expenses and potentially increase the amount of cash taxes we pay.

The main item that sticks out here is “Effective January 1, 2022, research and development expenses are required to be capitalized and amortized for U.S. tax purposes, which will delay the deductibility of these expenses and potentially increase the amount of cash taxes we pay.” The change requiring capitalization of R&D expenses will force Amazon and other companies like them to show more net income as a result. Regarding the share price, it might be a catalyst. For long-term investors of the stock, it will be viewed as a negative.

Amazon construction spending spree

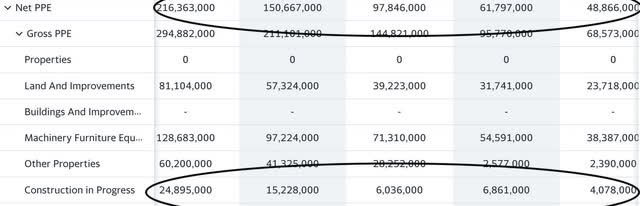

Amazon 5-year PPE (Yahoo Finance)

Cracking open the balance sheet, 2 items stand out. Net PPE (property plant and equipment) have increased 4.5 X in 5 years. Construction in progress of real property has increased 6 X in the same span. This increase is irregular in the history of Amazon’s growth. This is certainly a spurt to be noted, possibly due to the Covid e-commerce wars and expansion of AWS server farms, but possibly due to something else.

If Amazon was privy to the eventual change in the way R&D was going to be expensed in 2022 and beyond, why not build as much as you can while interest rates are low? Even if this space is not being fully utilized at the moment, one day they will grow into it. Borrowing was so cheap in this time frame that it was almost a subsidy. Better yet, they will now get increased depreciation expenses that will make up for some of the lost deductions due to R&D capitalization. Brilliant if they jumped out ahead of this one.

Valuation

Reiterating my previous article’s price valuation, I am using 32.15 as my multiplier as Amazon has grown EBITDA at a 32.15% CAGR over the past 5 years. This is a modified version of the PEG ratio substituting EBITDA for earnings.

Using an EBITDA to EV (enterprise value) ratio instead of a price-to-earnings ratio, the enterprise currently sits at 27 X EBITDA. If we divide 27 by 32.15, we get a reworked PEG ratio of .83. With Amazon EBITDA at $52.6 Billion and net income at $11.6 Billion in FY 2022, EBITDA is 4.48 X greater than net earnings. With TTM EPS at $1.12 a share, EBITDA is 4.48 X more, or about $5 per share in EBITDA. If are willing to use the above ratio and 32.15 as our multiplier, we would get a fair value of 32.15 X $5 = $160 a share.

Now, if we take a look at adding some of the R&D expense back into EBITDA, let’s see what that would do to the multiple. At even a conservative 30% of the $62 Billion in R&D spend (assuming 70% was borrowed), that would make EBITDA $52.6 Billion + $18.6 Billion=$71.2 Billion in EBITDA. This is 6.1 X greater than net income, meaning we would now have an adjusted EBITDA of $6.8 a share. Using $6.8 as our multiplicand and 32.15 as the multiplier, this would give us an upper-end price target of $218. While I personally always defer to my lowest assumption being that I am a value investor, I love having a buffer built in.

Stock catalysts

As mentioned above, Amazon doesn’t pencil when using a variety of traditional valuation metrics. Amazon continuously looks for new ways to scale using tax-efficient methods to get ahead of competitors. This increases revenues and as Nick Sleep puts it:

Increased revenues begets scale savings begets lower costs begets lower prices begets increased revenues.- Nick Sleep December 31st, 2008

However, interest rates have risen and tax laws are changing. This could force Amazon to report higher earnings, not because of increased efficiencies, but because of changes to tax laws. This would in turn begin to reveal some of the earnings that traditional models have been missing and may pull in more traditional investors than it used to. The rising interest rates, particularly as it relates to construction should also slow the growth of the expanding real estate portfolio. Again, reducing future deductions and increasing earnings as a result.

Conclusion

Analyzing a few of my favorite manager’s 13 F filings combined with Nick Sleep’s insights have reinforced my belief that Amazon is a good deal. Currently being down 26% over the past 52 weeks presents a good opportunity to accumulate. I’m not so bold as to directly add R&D expense to EBITDA or FCF and raise my price target, but it is an added buffer of future earnings potential to come. Something that helps me sleep well at night. I will be buying Amazon at $160 and below.

Be the first to comment