Justin Sullivan/Getty Images News

Multichannel European retailer Hennes & Mauritz (OTCPK:HNNMY) saw its Q3 2022 results weighed down by the challenging operating conditions, with a miss on sales and EBIT (excluding the one-off costs from winding down its Russian operations). While FX-neutral sales declined yet again, the key issue was the gross margin, which was down a steep ~280bps YoY. The near-term guidance called for more margin weakness through Q4 as well, partially offset by better September sales numbers, so more downward revisions could well be on the cards for the year. Plus, the full extent of the current macro headwinds and their impact on discretionary consumer spending decisions has yet to be felt, presenting further downside risk to the outlook.

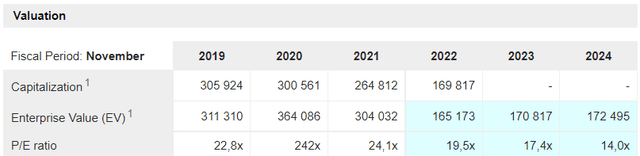

On a forward basis, H&M trades slightly above key peer Inditex; yet, its outsized exposure to areas with more challenged macro/consumption backdrops heading into the winter (e.g., the Italy, Germany and Eastern European markets) leaves it at a relative disadvantage.

Broadly Weaker P&L Numbers In Q3 2022

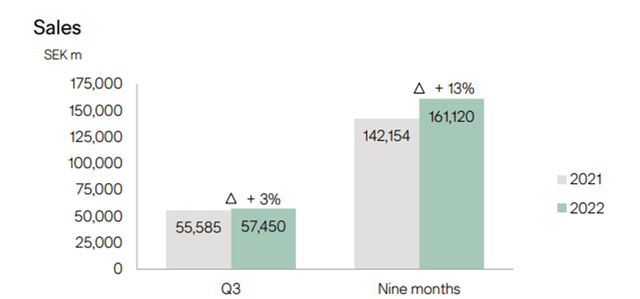

For its latest quarter, H&M saw slightly weaker than expected sales numbers at +3% YoY and -4% YoY on a constant currency basis (or -8% FX-neutral vs. pre-COVID levels). This was in stark contrast to that reported by Inditex during the corresponding period, as its Russian exposure remains a net drag. For context, adjusting out the Russia impact would imply underlying sales growth at a more palatable +4% relative to pre-COVID levels.

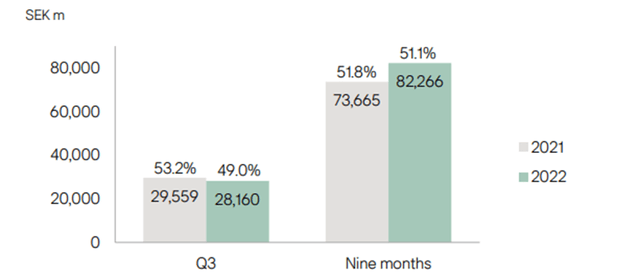

The weaker revenue print led to a wider-than-expected gross margin decline of ~280bps YoY, even after excluding the one-time costs related to Russia. On a reported basis (i.e., including the SEK769m one-off Russia charge), the gross margin fell ~420bps YoY to 49%. Key drivers include H&M’s lack of pricing power to fully offset the increased raw materials and shipping prices, as well as a strong USD.

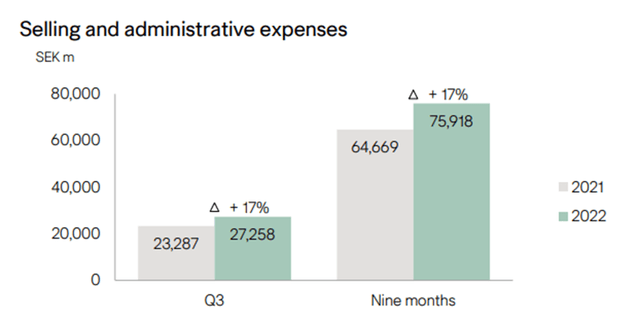

Markdowns also weighed on the margin by ~50bps YoY (below the flat YoY guidance), with inventories up ~14% YoY on an FX-neutral basis. At ~22% of trailing sales, the inventory number was well ahead of trend, as H&M accelerated stock inflows to counter supply chain delays. Meanwhile, selling and admin expenses as well as overall opex (adjusted for the Russia impact) rose ~17% and ~11% YoY, respectively on higher energy prices and increased delivery costs (also due to efforts to mitigate supply chain disruptions). All this led to EBIT of SEK 3bn or a steep operating margin decline of ~610bps YoY to 5.2%.

Downward Revision To Guidance Indicates More Weakness Ahead

In contrast with the Q3 numbers, sales in September rose +7% YoY on a constant currency basis, implying +4% vs. pre-COVID levels. While there was likely some minor benefit from the temporarily reopened stores in Russia (~1% or so), this was still a very positive trading result. The sustainability of this growth is less clear – per management, the improved performance was driven by the colder European weather in September, as well as its relatively attractive pricing (recall H&M opted to limit its price hikes in Q3, resulting in outsized gross margin pressure). Clothing spend is discretionary, though, and could see more volatility heading into a weaker macro outlook in the coming quarters. Thus, I would be hesitant to extrapolate the September growth pending further visibility. The updated guidance for the cost of markdowns to increase “slightly” in Q4 amid elevated inventory levels points toward suboptimal growth as well.

At the gross margin line, the Q3 update also highlights the potential risks ahead. H&M seems focused on maintaining its status as a ‘value’ retailer, which means limited pricing power offset, while continued USD strength could intensify the COGS impact in the coming quarters. To recap, H&M has guided for external gross margin drivers to be “very negative” in Q4 on sustained USD strength (vs prior commentary for Q3 external factors to be a “negative” drag). Plus, cotton and other raw material costs remain headwinds and given the limited ability or willingness to pass through these increases, there could well be more downward revisions on the horizon. Coupled with pressure on opex from wages, utilities, and outbound logistics amid the ongoing supply chain disruptions, the near-term earnings setup is far from compelling, in my view.

Turbulence Ahead

H&M’s persistent underperformance through a strong consumer environment in recent years (despite its investments), does not bode well for its outlook heading into a weaker consumer environment. Q3 numbers were a miss across the board and while September sales positively surprised at +7% YoY on the colder weather in Europe, I would be mindful of extrapolating this strength. Not only are clothing market generally volatile, but given peer Next (OTCPK:NXGPF) lowered its sales guidance for the back half of the year (despite also seeing a pick-up in September), I suspect the September numbers could reverse in the following months. Its exposure to USD strength could also entail more gross margin pressure heading into FY23, as the macro continues to be challenged. The stock trades richly as well at the current forward high-teens P/E valuation, which could mean material downside risk over the next few quarters.

Be the first to comment