kynny

In my Semiconductor Deep Dive Marketplace newsletter to subscribers yesterday on cloud capex cuts by hyperscaler companies, I discussed the impact on two points: (1) Cloud revenues and capex and (2) Micron’s (NASDAQ:NASDAQ:MU) actual financial metrics compared to main competitors Samsung Electronics (OTCPK:SSNLF) and SK hynix (OTC:HXSCL).

However, in this abridged article to non-subscribers, I still want to address cloud revenues and capex. But instead of competitive financial metrics, I want to refute the report from Bank of America today that cuts by hyperscalers will benefit Applied Materials (AMAT) and Lam Research (LRCX).

Cloud Revenues and Capex

Micron’s CEO Sanjay Mehrotra has been touting the company’s Cloud performance since the last downturn of 2019. In the company’s previous F3Q 2022 earnings call on June 30, 2022, he reported:

“Data center fiscal Q3 revenue grew by a double-digit percentage sequentially and well over 50% year over year. Data center end demand is expected to remain strong in the second half of calendar 2022, driven by robust cloud capex growth. Despite the strong end demand, we are seeing some enterprise OEM customers wanting to pare back their memory and storage inventory due to non-memory component shortages and macroeconomic concerns.”

In addition to reiterating previous cloud performance in the recent F4Q 2022 earnings call, Mehrotra admitted that MU’s data center revenues were down, stating:

“In fiscal Q4, data center revenue was down both sequentially and year-over-year, driven primarily by declines in ASP. In fiscal 2022, we set a new revenue record for our cloud revenues, which grew more than 30% year-over-year. Cloud end demand remains healthy, driven by secular growth in AI and the digital economy.

However, the data center market, including both cloud and enterprise, continues to face some supply constraints that are limiting server bills and customers are reducing memory and storage inventory due to macroeconomic uncertainties.”

Part of the strength previously reported by Micron is the increasing cloud capex by global hyperscaler companies. Similar to semiconductor manufacturers whose capex spend is a combination of equipment and building construction, cloud capex spend is a combination of computers (servers) containing memory chips and the real estate to house them.

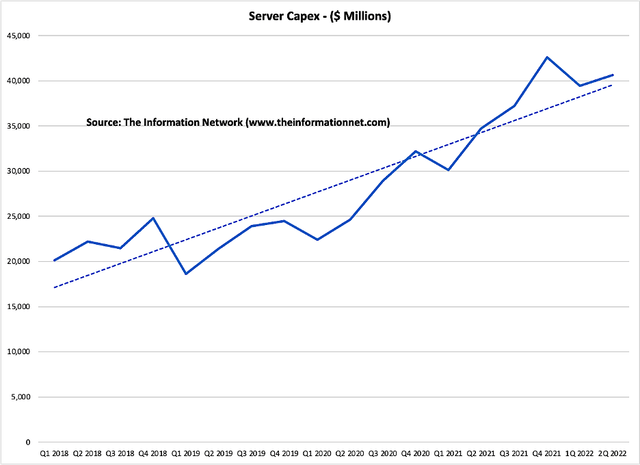

Chart 1 shows cloud capex spend between Q1 2018 and Q2 2022. QoQ spend varies considerably, but the trend is positive as shown by the dotted trendline. Capex spend increased in Q1 2020 at the start of the COVID pandemic as work/study/stay at home lockdowns forced hyperscalers to increase capacity to handle needed bandwidth as videoconferencing replaced in-person meetings.

The Information Network

Chart 1

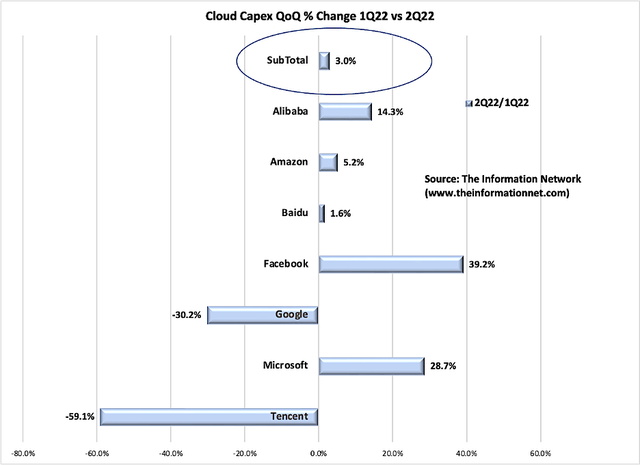

Chart 2 shows 2Q 2022 QoQ growth in cloud capex for leading hyperscalers. The subtotal for all companies increased just 3.0% QoQ. By way of comparison, over the past 10 quarters, between Q1 2020 and Q2 2022, the average QoQ growth was nearly double that at 5.6%, according to our report entitled “Hot ICs: A Market Analysis of Artificial Intelligence (“AI”), 5G, Automotive, and Memory Chips.”

The Information Network

Chart 2

An obvious observation of data in Chart 2 shows the underperformance of Chinese hyperscalers, particularly Tencent (OTCPK:TCEHY) (-59.1% QoQ) and Baidu (BIDU) (+1.6%). Chinese companies have been hit by COVID lockdowns and will be impacted by U.S. restrictions on AI GPUs from Nvidia (NVDA) and AMD (AMD) into China, which I discussed in a September 6, 2022 Seeking Alpha article entitled “Nvidia: Biden Targeting China On The AI Front.”

Outside China, enterprise customers are delaying their data center purchases due to mounting economic uncertainties, while others continue to struggle with persistent supply challenges. On an individual hyperscaler basis, Google (GOOG) (GOOGL) (-30.2%) announced plans to shut down its Stadia cloud gaming service. Stadia games run on servers at Google data centers around the world, with the video footage streamed to a TV or mobile device.

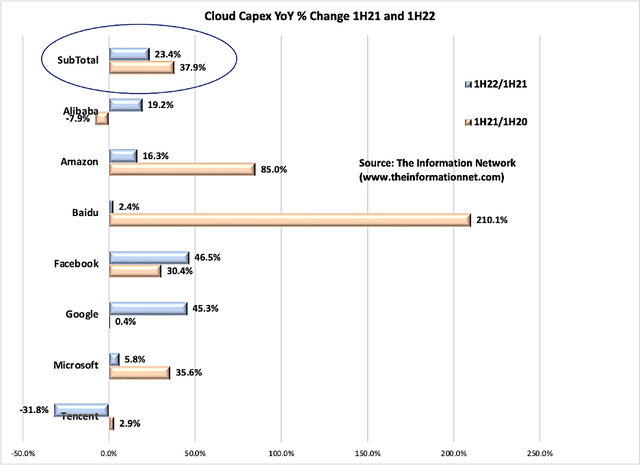

Chart 3 shows another perspective of cloud capex growth, a comparison of capex spend in 1H 2021 and 1H 2022. It shows 1H2021 vs 1H 2020 growth (blue bars) and 1H 2022 vs 1H 2021 growth (orange bars). Here we see a degradation in the subtotal of the hyperscaler companies, dropping HoH from 37.9% in 2021 to 23.4% in 2022.

The Information Network

Chart 3

On an individual company basis, we can see the impact of China lockdowns in 1H 2022 that significantly impacted Baidu, dropping from 201.1% in 1H 2021/1H 2020 to 2.4% in 1H 2022/1H 2021. We also see how Tencent growth dropped from 2.9% in 2021 to -31.8% in 2022.

Cloud Capex Spend Won’t Help Equipment Suppliers

In an Oct. 3, 2022, news article in Seeking Alpha entitled “Applied Materials, Lam Research spur broad chip-sector gains,” SA News Editor Rex Crum noted:

“Chip-equipment leaders such as Applied Materials and Lam Research spearheaded advances across the semiconductor sector, Monday, and tech investors looked to start off October with strong gains.

Applied Materials shares rose 4.7%, while Lam climbed by more than 5%, KLA (KLAC) was up by 4.4% and Teradyne (TER) shares also rose 4% in early trading. The chip sector, on the whole, was on the upswing in the wake of some positive sentiment from Bank of America Vivek Arya regarding the opportunities for chip companies in the cloud-computing market.

Arya said in a research report that while chip sector is likely to see some “volatile” trends in the near term, prior declines have historically led to customer spending rising by more than 30% on an annual basis, and that chip leaders should also benefit from new product cycles in the next year and beyond.”

I nearly choked on my second cappuccino when I read the headlines because it raises a big question – where’s the money coming from?

I question the motivation of BofA’s Vivek Arya in making this statement because he stated “chip leaders should also benefit from new product cycles in the next year and beyond,” which…

(1) the “next year” is a “historic” average and neglects the cyclical nature of cloud capex spend as can be seen in Chart 1 with lowest points in Q1 of each year, and

(2) Micron in its F4Q 2022 earnings call announced significant cuts to fiscal 2023 capex and by reducing utilization in its fabs.

MU’s CEO Mehrotra noted on the call:

“We made significant reductions to capex and now expect fiscal 2023 capex to be around $8 billion, down more than 30% year-over-year. Capex would be lower if it were not for more than doubling our construction.

WFE capex will decline nearly 50% year-over-year and reflects a much slower ramp of our 1-beta DRAM and 232-layer NAND vs. prior expectations.”

Samsung Electronics and SK hynix are planning to curtail their investments in the memory business in the coming months with the intention of adjusting the balance between supply and demand. According to Doh Hyun-woo, analyst at Mirae Asset Daewoo Securities during an online seminar.

“Due to the expected reduction in memory demand, companies are planning to cut back on their capital expenditure for the rest of the year, and at least until the end of first half of next year.”

Japan’s Kioxia Corporation announced in a press release production adjustments at its Yokkaichi and Kitakami flash memory plants. The company will reduce its wafer start production volume by approximately 30%, starting from October this year.

Investor Takeaway

A key factor slowing global growth is the widespread tightening of monetary policy, driven by the greater-than-expected underestimation of inflation and the rapid reaction by the Fed to curtail it.

Earnings have been significantly revised down to reflect lowered bit growth projections (drops in PC/smartphone) and DRAM/NAND price outlooks. A slowdown in cloud capex will impact recovery of MU, but as I explain below, have no impact on share price.

The uncanny similarity of financial metrics among Micron, Samsung Electronics, and SK hynix presented in my Semiconductor Deep Dive Marketplace article substantiate the claim that macroeconomic factors are at play for the weak earnings and guidance.

Micron dominates the memory industry technologically with its industry-leading 1-alpha DRAM and 176-layer NAND nodes introduced in fiscal 2022, and a 232-layer NAND In fiscal Q4. Yet financial metrics compared with competitors are overshadowed by a macro-driven environment.

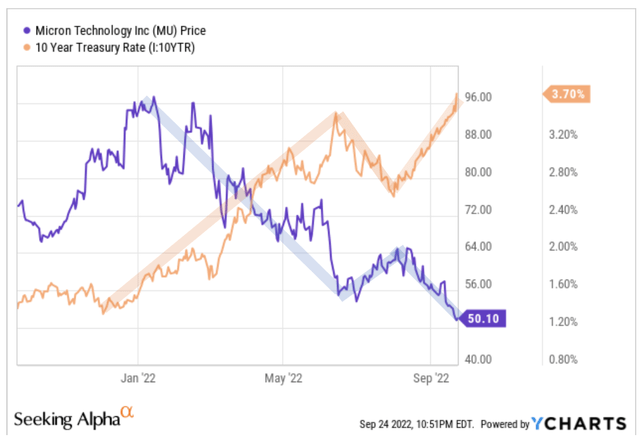

Chart 4 shows the inverse relationship between Micron’s share price and the 10-year treasury rate. Nearly all technology stocks can be substituted for Micron in this chart with similar results.

YCharts, The Information Network

Chart 4

This relationship has been extremely strong in 2022. As can be seen in Chart 4, the sharp ascent in the 10-year throughout this year has directly led to a strong drop in tech stocks.

This correlation has been strong in 2022. Although analysts at Morningstar found minimal correlation between the 10-year treasury and technology stocks over a 15-year period, since January 2022 the rise in the 10-year due to inflation fears has significantly impacted technology stocks.

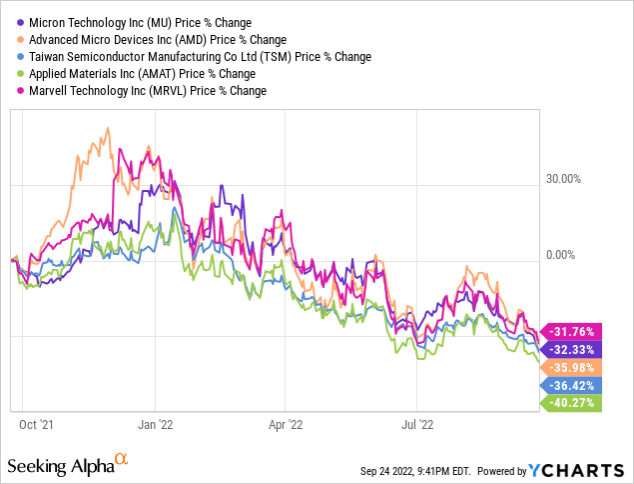

Until this correlation ends, investors will have the option of either sitting tight or move out of technology stocks. Investors/traders are buying and selling these stocks as a sector, and over the past year, share performance is somewhat indistinguishable, which I illustrate in Chart 5.

YCharts

Chart 5

MU’s shares have outperformed many of its peers in the past one-year period. MU (-32.33%) outperformed Advanced Micro Devices (-35.98%), Taiwan Semiconductor (TSM) (-36.42%), and Applied Materials (-40.27%), and slightly underperformed Marvell (MRVL) (-31.76%).

Clearly, the only relationship MU has with the rest of the companies in Chart 5 is that it is a technology stock, yet the share price spread is just 8.5% after a one-year period, which is astonishing.

Be the first to comment