solarseven

Galaxy Digital Holdings Ltd. (OTCPK:BRPHF) is a financial services leader in digital assets and blockchain technologies. The company captured the massive growth in the space over the last several years across a diversified operation that includes Trading, Asset Management, and Investment Banking. While 2021 was a record year for the company, the environment more recently has been defined by the sharp correction in crypto and broader macro headwinds. Galaxy Digital shares are off more than 70% over the past year, highlighting the extreme volatility.

We last covered the stock back in 2021 with an upbeat view while noting that the trends in cryptocurrencies were the main risk to consider. A lot has happened over the period, and we reiterate a positive long-term outlook, recognizing some reset expectations. The key to recognizing is that the opportunities in Web3 like payments, Defi, and the metaverse are still in the early stages of adoption. Galaxy Digital can benefit from themes that go beyond any single cryptocurrency. A planned U.S. listing on Nasdaq compared to its current primary trading on the Toronto Stock Exchange could be positive for the stock going forward.

Galaxy Digital Key Metrics

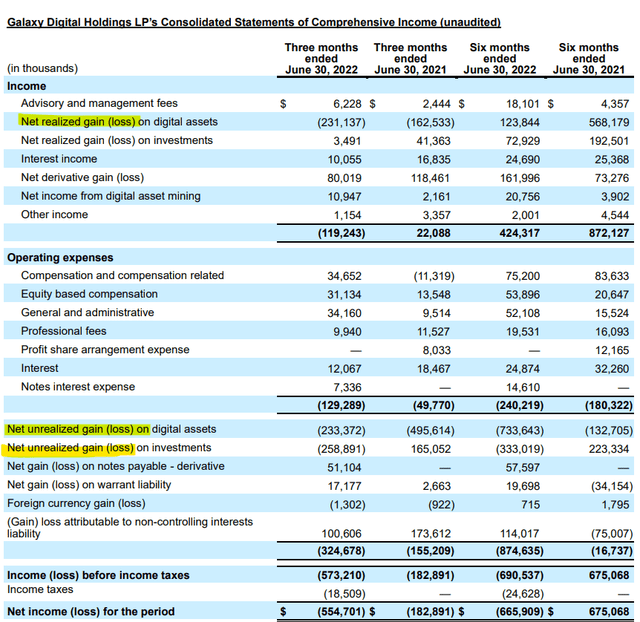

The company last reported its Q2 earnings in August, headlined by a net loss of -$555 million. The context here considers the deep selloff in related cryptocurrencies and the value of over 215 portfolio companies. The company’s digital assets and investments were marked down by -$492 million on a net unrealized basis.

There was an additional -$231 million realized losses from digital assets during the quarter related to the trading of Bitcoin (BTC-USD) and Ether (ETH-USD). The company also had some exposure to the “Terra Ecosystem” (LUNC-USD) which collapsed during Q2 and created some contagion effects towards other parts of the crypto market. On this point, CEO Mike Novogratz noted during the conference call that the crash worked to accelerate a necessary deleveraging across the sector in Q2, with the liquidations leading to a better sense of stability into Q3 compared to fear and uncertainty back in May.

Elsewhere from the results, there were some strong points. Core advisory and management fees reached $6.2 million, up from $2.4 million in the period last year. Galaxy Digital has also been moving forward with its proprietary Bitcoin and digital asset mining operation which delivered a $10.9 million net income in Q2 compared to just $2.2 million in Q2 2021.

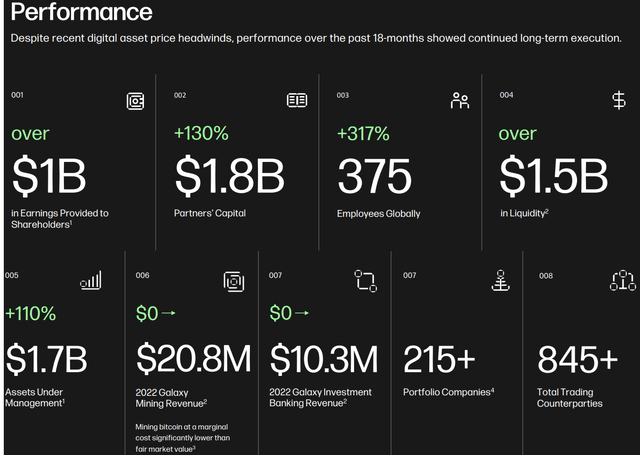

The company is focusing on its performance over the past 18 months, which confirms the transformation of the operation over the period. Asset Management AUM at $1.7 billion, is up 110% based on momentum from several fund products and investment vehicles. Partner’s Capital, effectively the company’s net equity under the current structure, at $1.8 billion has increased by 130% compared to the end of 2020. The company ended the quarter with over $1.5 billion in liquidity, including over $1.0 billion in cash compared to $425 million in long-term notes payable.

Canceled BitGo Acquisition

A key development came in August when Galaxy Digital announced it was terminating its planned acquisition of BitGo, an institutional digital assets service provider. The original $1.2 billion deal disclosed back in March between cash and stock was expected to generate synergies by adding ancillary business lines and complementing Galaxy’s current offerings. Fast-forward, BitGo allegedly failed to deliver an audited 2021 annual report by July 31st, which was cited by Galaxy as a breach of the agreement.

There is some controversy because reports suggest BitGo is attempting to sue Galaxy for $100 million as an “improper repudiation” of the merger. CEO Mike Novogratz is already on record claiming the lawsuit is without merit and plans to defend the company in court. The first point to cover is that if the allegations are true, it appears Galaxy Digital has a strong case for walking away from the deal, as BitGo simply did not comply with a basic regulatory requirement.

In our view, the termination ends up being positive for Galaxy considering the timing of the original terms from March in Q1 was reached under an elevated crypto market pricing environment. In other words, if it wins the lawsuit, Galaxy may have simply gotten lucky with the opportunity to walk away from a major deal that became undermined following the Q2 market selloff.

It remains to be seen how the lawsuit from BitGo moves forward, although the upside is that Galaxy Digital could now head into 2023 with a stronger balance sheet and presumably some room to seek out new deals at attractive prices.

What’s Next For Galaxy Digital?

The key takeaway from diving into Galaxy Digital’s financials is that getting past the quarterly asset price volatility, the underlying financial services group is profitable with ongoing growth opportunities. While there are parts of the business that are correlated to cryptocurrency price trends, the real attraction of the stock is its broader diversification into related blockchain technologies.

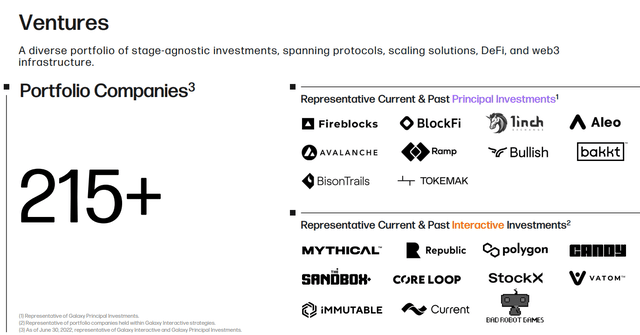

Among venture capital portfolio companies, exciting start-ups and emerging players are uniquely positioned to take advantage of the market shakeup to consolidate their leadership in Web3 services and solutions. It’s still possible that one of these investments evolves into a major global corporation over the next five to ten years as a windfall for Galaxy Digital shareholders.

The silver lining from the large Q2 losses and selloff in the stock is to consider that the digital assets/ crypto market has at least stabilized into Q3. For reference, the current price of BTC at around $19,000 is just slightly below the level at the end of Q2 on June 30th at $19,500. Other cryptocurrencies like ETH have outperformed with a strong rebound.

This means that by assuming the “crypto winter” has already run its course, there is a case to be made that the correction in shares of Galaxy Digital has more than priced in some of the worst-case scenarios through a reset of valuation.

In the near term, a sustained rally in the BRPHF would likely need the challenging macro setup to cooperate. We can look forward to some confirmation that inflation has peaked globally over the next few months, potentially opening the door for a resurgence of global growth expectations. Crypto is one side of “tech” that we believe can lead higher. From there, Galaxy Digital is the type of high-beta momentum name that can outperform to the upside.

A rebound in the leading cryptocurrencies can add volumes to trading activity as a positive for operating and financial metrics. We want to see BTC make a move above $25k as the first level of technical resistance to support a more sustained rally in the sector. On the other hand, all eyes need to be on the Q2 low for Bitcoin when it briefly traded under $18,000 as a measure of sector sentiment. A return to that level would likely put BRPHF’s cycle low of $3.59 back into play as the downside risk.

Final Thoughts

A solid balance sheet coupled with a best-in-class asset management platform keeps Galaxy Digital interesting. While the events of the past year have included several surprises, we argue that the company has weathered the storm and is ready to emerge stronger. Into the Q3 earnings release expected sometime in November, key monitoring points will be trends in the core fees-based advisory and asset management business along with cash flow trends. We want to see operating expenses controlled with some effort to focus on profitability.

In our view, the stock can trade higher through 2023 in a scenario where the crypto sector rebounds and blockchain technologies gain momentum. An update from management regarding progress in the reorganization into a U.S. Delaware incorporated company along with a timetable for the Nasdaq listing can support a structurally higher valuation multiple for the stock as an upside catalyst.

Be the first to comment