Editor’s note: Seeking Alpha is proud to welcome Jarco Vianen as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Jeenah Moon

My investment strategy

There are many strategies to build wealth. My strategy is to buy high-quality dividend stocks with the intention to hold them forever. I truly believe that too much trading increases the probability of making potential mistakes, so I just buy & hold and let the compounding effect do its work. For adding businesses, I am looking for continuous growth at a reasonable price.

Why moats matter

Holding great businesses helps you to sleep well at night. The question is what makes a great business. For me, the ‘holy grail’ is to find businesses that:

- Generate strong and predictable cash flows.

- Have the ability to reinvest cash flows into the business.

- Achieve a high ROIC (Return on invested capital).

Strong and predictable cash flows enable companies to return capital to shareholders in the form of buybacks and dividends. At the same time, a company should be able to reinvest capital back into the business, preferably with a high ROIC to fuel future growth. The ROIC gives a sense how well a company is able to generate cash flows from reinvesting capital into the business.

After all, these aspects are protected by moats – abilities that give a business competitive advantages. Therefore, moats are essential for a business to generate great long-term returns. Today I’m taking you along in my journey to find businesses with wide moats. This article covers one of my favorites: Microsoft Corporation (NASDAQ:MSFT).

Microsoft Corporation in short

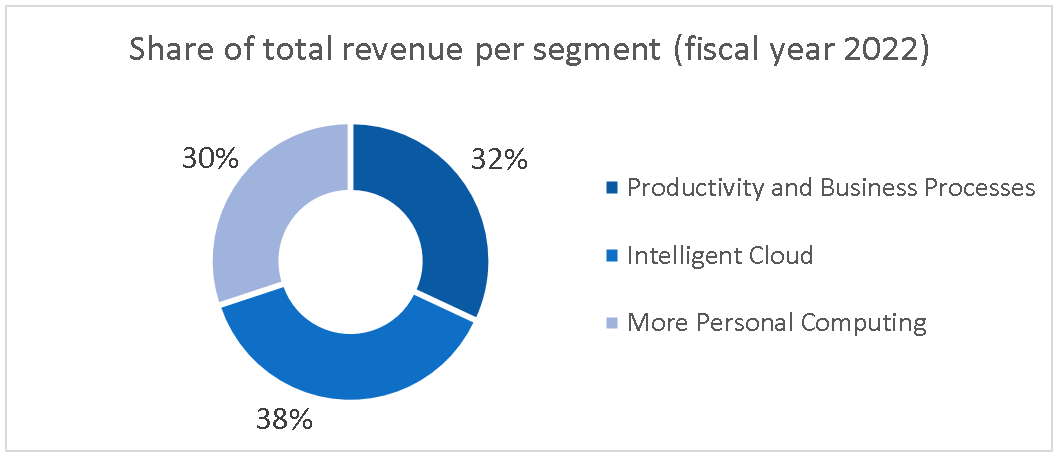

Microsoft Corporation develops and supports software, services, devices, and solutions that help drive productivity, competitivity, and efficiency of individuals and enterprises. Over fiscal year 2022 (which ended last June 30th), Microsoft was able to generate a whopping $198.3 billion in revenue. Total revenue is spread over three segments:

- Productivity and Business Processes ($63.4 billion).

- Intelligent Cloud ($75.3 billion).

- More Personal Computing ($59.7 billion).

Intelligent Cloud is responsible for most of total revenue with 38%, followed by Productivity and Business Processes with 32%, and finally More Personal Computing with 30%.

Microsoft Investor Relations

Before discussing Microsoft’s competition and moats, I will first go through the three business segments to get a better understanding of the individual products and services Microsoft sells.

Productivity and Business Processes

This segment consists of a very wide variety of productivity, communication, and information services. First of all, Microsoft sells many well-known services, such as Word, Excel, PowerPoint, Teams, Outlook, OneDrive, and Sharepoint under the Office Commercial and Office Consumer segments. Next, Dynamics provides on-premise and cloud-based business solutions, such as financial management, customer relationship management, and supply chain management. For all these services Microsoft benefits from the continued shift from on-premise licenses to subscriptions.

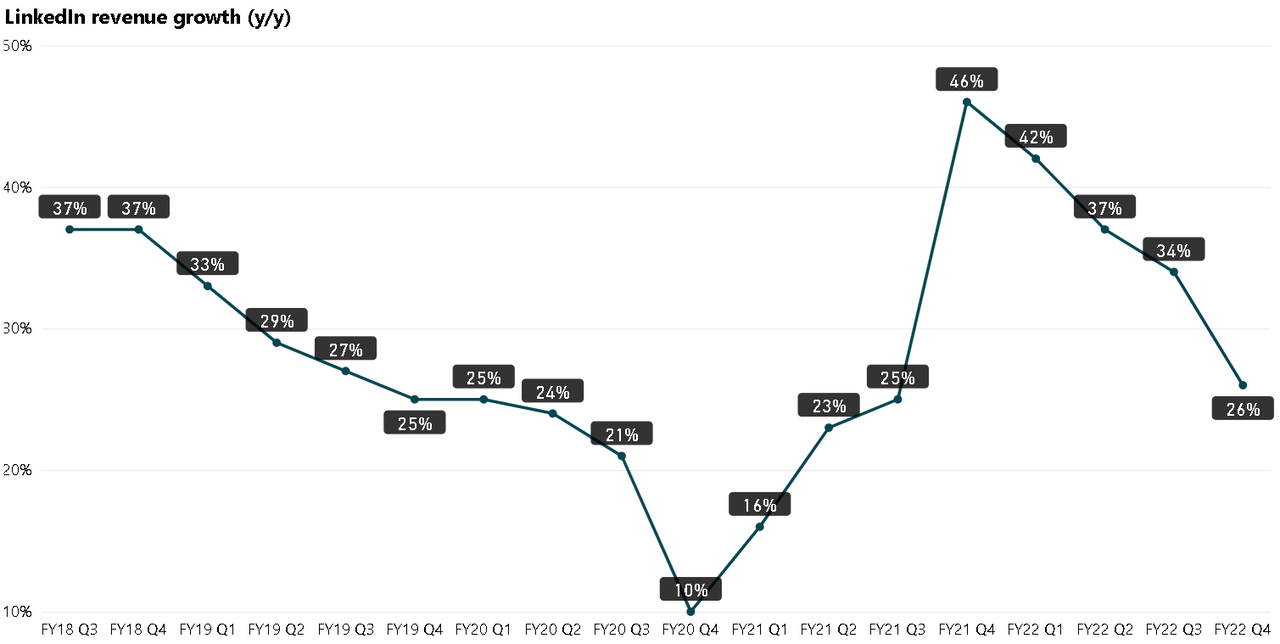

LinkedIn is also part of this segment. It is a well-known social media platform primarily used by professionals and enterprises. Many people use this platform for free, but Microsoft generates a lot of revenue through talent solutions, marketing, sales solutions, and premium subscriptions. Currently, the user base has grown to over 850 million members. LinkedIn has boosted revenue in this segment, growing >20% in 16 out of the last 19 quarters.

Microsoft Investor Relations

In the table below it can be seen that Microsoft has managed to grow revenues in this segment mid-teens on average over the past four years, which is pretty remarkable considering the massive cash flows. I expect the shift from on-premise licenses to subscriptions to continue in the coming years, although at a lower growth rate as the business matures.

|

Segment / Revenue ($ billion) |

2018 |

2019 |

2020 |

2021 |

2022 |

4Y CAGR |

|

Productivity and Business Processes |

$35.9 |

$41.2 |

$46.4 |

$53.9 |

$63.4 |

15.3% |

Intelligent Cloud

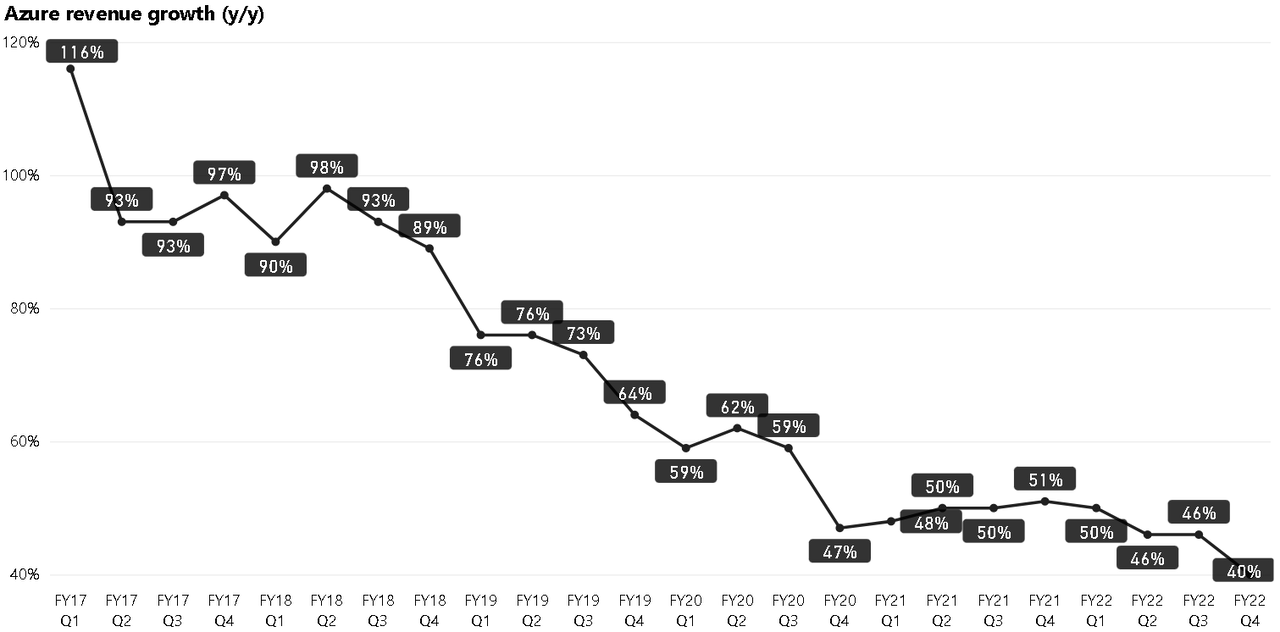

One of the most well-known and maybe most important service in this segment is Azure. Customers use Azure through a global network of datacenters for multiple purposes, such as cloud computing, storage, cloud security, artificial intelligence, internet-of-things, and machine learning. Reasons for a company to use a cloud service like Azure are that it works faster than on-premise servers, it offers scalability and flexibility, and it uses a worldwide network of datacenters. Azure is the main revenue driver for the Intelligent Cloud segment which is clearly visible in the Q4 FY22 earnings: Intelligent Cloud posted revenue growth of 20%, whereas Azure sales grew by 40%. The growth rate of Azure is declining (see figure below), but still holding up pretty well in the 40%-50% range. Also, Azure outgrew its main competitors AWS (33% growth) and Google Cloud (36%) in their most recent Q2 FY22 quarters.

Microsoft Investor Relations

Other services that compose this segment are Server Products, Github, Nuance, and Client Access Licenses to server products, such as SQL Server and Windows Server. Enterprise Services like Enterprise Support Services and Microsoft Consulting Services are also captured in Intelligent Cloud revenue.

The table below shows that the Intelligent Cloud segment has been growing even faster than Productivity and Business Processes, mainly thanks to Azure’s growth runway. In my opinion Azure will be Microsoft’s main revenue growth driver in the coming years, further increasing Intelligent Cloud’s share of total revenues.

|

Segment / Revenue ($ billion) |

2018 |

2019 |

2020 |

2021 |

2022 |

4Y CAGR |

|

Intelligent Cloud |

$32.2 |

$39.0 |

$48.4 |

$60.1 |

$75.3 |

23.7% |

More Personal Computing

Products and services in this segment are divided into four categories. The first category is called ‘Windows’, the operating system which is installed on many of your PCs. Windows OS licenses are sold to OEMs (original equipment manufacturers) which they pre-install on their devices. Windows licenses are also sold to enterprises, reflected by the number of workers.

Second, Devices consists of all Surface devices and PC accessories.

Third, Gaming is an important category with its gaming content and consoles. Game content is developed by Xbox Game Studios, a collection of first-party studios such as Mojang (from Minecraft) and World’s Edge (from Age of Empires). Games are the cornerstone of the Xbox Game Pass, a subscription service and gaming community with over 100 titles. Especially with the acquisition of Activision Blizzard (ATVI), Microsoft will gain exclusive ownership of some large and famous game titles, like the Call of Duty franchise, World of Warcraft, and Diablo.

The fourth and final category in this segment is Search and News Advertising. Microsoft has several partnerships with companies, such as Yahoo, to provide and monetize search queries.

The following table shows revenue development of More Personal Computing over the past four years. This segment has shown the least growth from all three business segments. Interestingly, in 2018 it was by far the largest business segment in terms of revenue, but this has changed quite drastically. Still, 9.0% average revenue growth is pretty good considering the size of the business. I view the gaming category as the main revenue growth driver for this segment. Acquiring more gaming studios will result in more exclusive content, which increases the incentive for people to subscribe to the Xbox Game Pass.

|

Segment / Revenue ($ billion) |

2018 |

2019 |

2020 |

2021 |

2022 |

4Y CAGR |

|

More Personal Computing |

$42.3 |

$45.7 |

$48.3 |

$54.1 |

$59.7 |

9.0% |

Competition

Microsoft sells a huge variety of products and services, resulting in competition with other companies in many ways. The following provides some examples:

- Companies like Apple (AAPL), Google (GOOG), and Zoom (ZM) compete with the Office suite as they offer productivity software, teamwork and collaboration software, and video conferencing solutions.

- Oracle (ORCL), Salesforce (CRM), and SAP (SAP) compete with the cloud-based and on-premise business solutions of Dynamics software.

- Azure faces fierce competition from cloud providers, such as Amazon (AMZN), Google, Oracle, and IBM (IBM).

- Surface devices compete with other hardware providers, such as Apple, Google, HP (HPQ), Lenovo (OTCPK:LNVGY) (which are also clients from Microsoft for the Windows OS system).

- Xbox and cloud gaming competes with other gaming ecosystems and streaming services, including those from Amazon, Apple, Google, and Tencent (OTCPK:TCEHY).

- Xbox hardware competes with console platforms from Sony (SONY) and Nintendo (OTCPK:NTDOY).

So which moats protect Microsoft’s business?

Now let’s talk about moats. A moat helps a company to maintain a competitive edge over competitors for its businesses. Moats can be defined in different ways. In the following, I will name a few moats that in my view give Microsoft competitive advantages.

- Brand: I think that Microsoft definitely has a moat from its brand. Opinions might differ on this one, but a lot of people and companies tend to use services like Word, Excel, and Teams for their daily operations. Apparently, these services have such pricing power that people are willing to pay for the Office suite rather than use free productivity services like Google Docs or Google Spreadsheets.

- Switching costs: once customers use services from Microsoft, it is not very likely that they will switch to other providers. For example, Excel is used for several types of business processes and many workers are specialized in using this program. Radically switching to other productivity suites would require capital and lots of time to train professionals with new software. Also, the Windows Server is the IT backbone of many large companies. Switching to other IT environments would take significant costs, time and risk – something which companies would like to avoid as much as possible.

- Networking effect: because Office 365 has such a large installment base, developers are more likely to develop products specifically for Office 365. Excel has numerous add-ins to integrate other data platforms. Besides, due to the user base of LinkedIn, new professionals are attracted to also join the platform as their co-workers and friends are on LinkedIn.

- Scale: scale or market share in itself is not a moat in many cases. But, for cloud services like Azure, scale might give a competitive edge. Azure and AWS (Amazon Web Services) are perceived to be the dominant cloud providers. Because the Azure cloud platform has obtained such a large scale in recent years, it has some cloud offerings which are cheaper compared to AWS. Moreover, Azure has the second largest worldwide datacenter footprint with over 200 physical locations – something not many companies can keep up with.

- Habit: like Warren Buffett consuming Coca Cola cans every day, all people have their own habits. In the case of productivity services, it is a habit for most people to use Word, PowerPoint, and Excel – they simply do not know any better.

- Dependency of customers: customers rely in many ways on Microsoft. Imagine a day in which the Azure cloud and all Office suites would not work. For the biggest share of the working population this would mean they cannot do their jobs.

Note that the list of moats is not finite and there may be different opinions on some of the examples mentioned above. Furthermore, some moats are related to each other. For example, the fact that so many people use Office on a daily basis automatically provides brand recognition.

Ultimately, the fact that I can easily identify six is actually pretty impressive for a company, which means Microsoft’s businesses are protected in many ways.

Visibility of moats in the financials

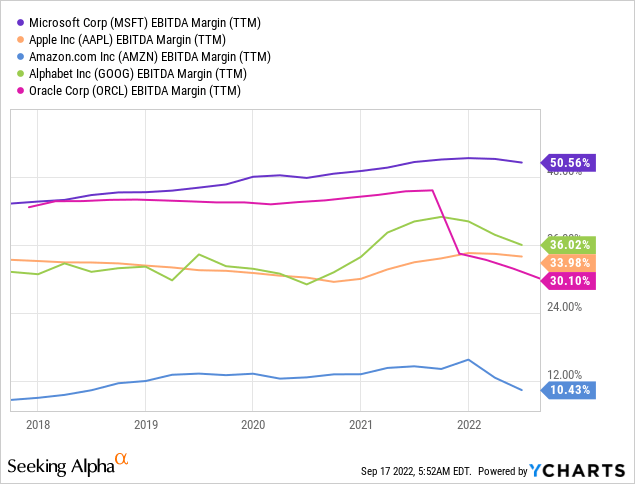

Before considering investing in a business, it is important to check if the moats also translate into great financials. The following figure shows that Microsoft has a great EBITDA margin, which has been also constantly growing due to the growth of cloud and subscription services. This translates into strong and predictable cash flows. Microsoft’s EBITDA margin is also significantly higher compared to its main competitors.

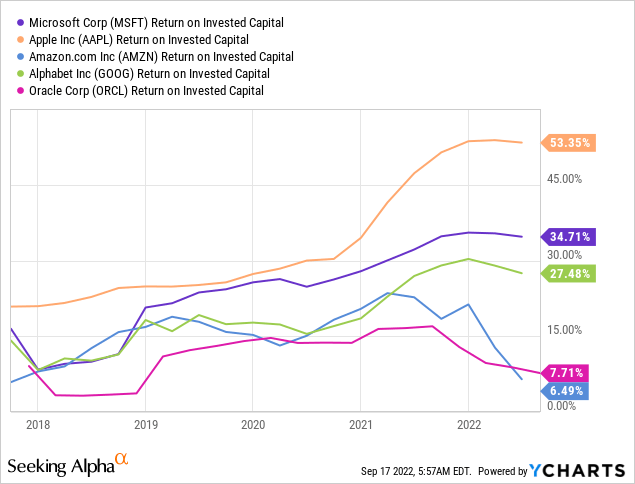

Microsoft is involved in some major growth trends, including digitalization, the on-going shift to cloud, and gaming. This provides ample opportunities to reinvest the cash flows back into the business. Looking at the graph below, it can be seen that Microsoft has achieved a ROIC of over 30% in the previous two fiscal years, so it is able to drive high returns on every dollar invested. Among Microsoft’s main competitors, only Apple managed to achieve a higher ROIC.

Bearish arguments against Microsoft

Microsoft has some wide moats and this is visible in its margins and ROIC. While its future looks bright, it is in my opinion essential to consider what the bears say and whether this changes my perspective.

- Momentum is slowing in the ongoing shift to subscriptions, particularly in Office, which is generally becoming a mature product. Growth will therefore likely slow down. However, it remains a huge cash cow for Microsoft with big margins. Supported by price increases, Office can subsidize other investments.

- Microsoft is not the top player in its key sources of growth, notably Azure and Dynamics. Azure however has been gaining market share in a fast-growing market for years now, so this might change in the future. Dynamics has also been gaining momentum over the last quarters.

- Generally, hardware does not really offer a moat to Microsoft. I believe however that the presence through Surface products is crucial for brand awareness. Moreover, Microsoft is focusing on its gaming unit by offering more exclusive software, which will offer a competitive advantage. Having hardware through the Xbox consoles also offers brand presence to customers.

All in all, I think that the maturing of some growth segments, and thus slowing of revenue growth might be the main threat for the Microsoft stock price.

Historical financial overview

To make reasonable assumptions for the future we take a look at Microsoft’s overall historical financial performance.

|

2018 |

2019 |

2020 |

2021 |

2022 |

4Y CAGR |

|

|

Sales ($ billion) |

$110.4 |

$125.8 |

$143.0 |

$168.1 |

$198.3 |

15.8% |

|

Gross profit ($ billion) |

$72.0 |

$82.9 |

$96.9 |

$115.9 |

$135.6 |

17.1% |

|

Gross margin (%) |

65.2% |

65.9% |

67.8% |

68.9% |

68.4% |

|

|

EBITDA ($ billion) |

$45.0 |

54.6 |

$65.3 |

$80.8 |

$98.0 |

21.5% |

|

EBITDA margin (%) |

40.8% |

43.4% |

45.7% |

48.1% |

49.4% |

|

|

EPS ($) |

$3.88 |

$5.06 |

$5.76 |

$8.05 |

$9.65 |

25.6% |

For such a large business, 15.8% sales growth on average is very impressive. This has been mainly driven by the Intelligent Cloud and Productivity and Business Processes segments. Increasing margins combined with share buybacks have resulted in a staggering 25.6% average annual growth of earnings per share. I have already mentioned that in my opinion these growth rates will not continue in the future considering maturing businesses.

Microsoft Balance Sheet

Besides financial performance, the balance sheet will give us information about the financial health of a company. Lower leverage gives a company more freedom to acquire new businesses and distribute capital to shareholders in the form of dividends and buybacks. In the case of Microsoft, the balance sheet is superb. Note that management has been deleveraging slightly over recent years, mainly driven by growing EBITDA. Together with Johnson & Johnson (JNJ), Microsoft is the only company in the world which has received an AAA credit-rating from S&P Global – net cash position all the way!

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Cash & Cash equivalents ($ billion) |

$133.7 |

$133.8 |

$136.5 |

$130.3 |

$104.7 |

|

Short-term & current debt ($ billion) |

$4.0 |

$5.5 |

$3.7 |

$8.1 |

$2.7 |

|

Long term debt ($ billion) |

$72.2 |

$66.7 |

$59.6 |

$50.1 |

$47.1 |

|

Net debt ($ billion) |

$-57.6 |

$-61.6 |

$-73.2 |

$-72.1 |

$-54.9 |

|

EBIDTA ($ billion) |

$45.0 |

54.6 |

$65.3 |

$80.8 |

$98.0 |

|

Net leverage |

-1.3x |

-1.1x |

-1.1x |

-0.9x |

-0.6x |

Capital return history

Speaking of dividends and buybacks, Microsoft does a great job in returning capital to its shareholders. With this year’s September increase, Microsoft has increased its dividend for 18 consecutive years. This company is a new dividend aristocrat in the making. Looking at the dividend growth, it can be observed that the dividend has been increasing at a much lower rate compared to earnings per share (10.2% versus 25.6% annually since 2018), resulting in a decreasing pay-out ratio. In my view, this is a positive sign. It seems Microsoft recognizes that it has entered a growth phase again. I think this is the main reason why companies like Amazon and Google have not yet started to pay out dividends. But in the case of Microsoft, it makes sense to keep increasing the dividend at a steady pace.

|

2018 |

2019 |

2020 |

2021 |

2022 |

4Y CAGR |

|

|

Dividend per share ($) |

$1.68 |

$1.84 |

$2.04 |

$2.24 |

$2.48 |

10.2% |

|

Pay-out ratio (%) |

43.3% |

36.4% |

35.4% |

27.8% |

25.7% |

On top of the dividends, Microsoft buys back shares yearly. If there is excess capital, I like such buybacks as my own share in the company will increase. On average, Microsoft has decreased its outstanding shares at 0.8% annually. This will likely continue in the foreseeable future.

|

2018 |

2019 |

2020 |

2021 |

2022 |

4Y CAGR |

|

|

Shares outstanding (# million) |

7,700 |

7,673 |

7,610 |

7,547 |

7,458 |

-0,8% |

MSFT Stock Valuation

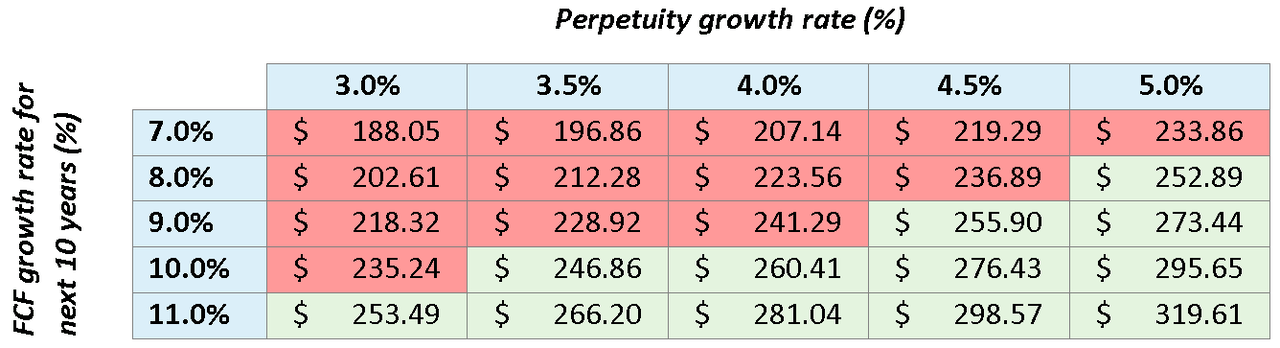

It is clear that Microsoft is a great business with some wide moats and splendid financials. But, as mentioned in my investment strategy, I aim to buy such companies at reasonable prices. To calculate the intrinsic valuation of a company, I often use a Discounted Cash Flow Analysis. This calculates the value of a business given its future cash flows. Because it is very hard to predict the exact growth rates, I use different growth rates in a sensitivity analysis. A sensitivity analysis helps to understand how the intrinsic value differs with various inputs for the growth rates. The table below shows my inputs.

|

Input |

Value |

|

First year of projections |

2023 |

|

Personal Required rate of Return |

10.0% |

|

Number of shares outstanding |

7.458 billion |

|

Net borrowings |

$-55.0 billion (net cash position) |

|

Base free cash flow (fiscal year 2022) |

$65.15 billion |

|

Free cash flow growth rate for next 10 years |

7.0% / 8.0% / 9.0% / 10.0% / 11.0% |

|

Growth rate in perpetuity |

3.0% / 3.5% / 4.0% / 4.5% / 5.0% |

Looking at the historical financial figures, I think it is very probable that Microsoft will post double-digit free cash flow growth. Analysts currently assume mid-teens growth in the mid-term, but I think that the growth rate will decrease over the years. The perpetuity growth rate is typically between historical inflation (2-3%) and historical GDP growth rate (4-5%). Given the dominance of subscription and cloud offerings, I think the 3.0%-4.0% range is a good assumption for the perpetuity growth rate. If you want a 10.0% return on your investment and think these are reasonable assumptions, the stock could be a reasonable buy at the current price ($244.52 at the time of writing). Note that if cash flow growth quickly falls below 10.0% due to unforeseen circumstances, the stock price might still be a bit expensive.

Sensitivity analysis valuation Microsoft Corporation (Author)

Final Thoughts

I think that currently Microsoft Corporation is a great business at a great price. There is simply a lot to like about this company and it fits my investing strategy very well. The company has some interesting growth levers across its three business segments, it has multiple moats, it has great profitability, an impressive growth track record, and pristine balance sheet. Given my assumptions the current valuation seems fair, which makes Microsoft a great buy for any long-term investor who believes the company’s growth path will continue into the future.

Be the first to comment