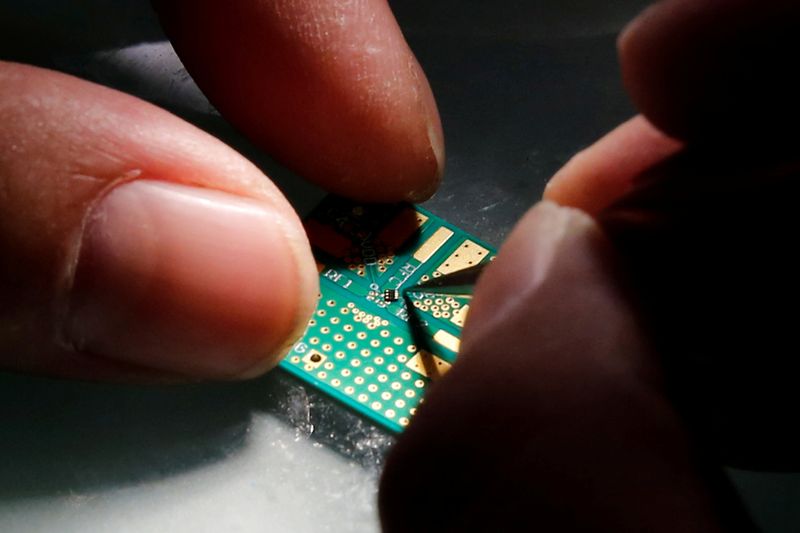

© Reuters BofA bullish longer-term on semiconductors

By Sam Boughedda

BofA analysts said in a research note to clients on Tuesday that the firm is bullish longer-term on semiconductors.

The analysts explained that following a “tough CY22 when index plunged -36%, 16pts lower than (worst delta since 2004), there has been a nascent recovery, with SOX up 11%/10% YTD/Q4’22, 600bps/270bps ahead of SPX.”

“Bulls say SOX outperformance signals a ‘soft-landing’ as all/most cycle cuts priced in and better times are around the corner in 2HCY23. Bears say this is merely a beta rally, spurred by undue excitement around peaking US rates and uncertain China reopening benefits, with SOX now trading 19.4x NTM PE, 1.8x turn ahead of the SPX, a premium to historical inline multiples,” wrote BofA.

The analysts confirmed that BofA assumes a soft landing as the consumer chip inventory correction is completed by H1 and as industrial/auto chip pricing remains resilient.

“Importantly, we are bullish longer-term, noting the secular shift towards Capex (fabs, green energy, AI) from Consumption and Consumer (PC, phones) that helps inform our top 3 themes: 1) Reshoring (AMAT, KLAC), 2) Generative AI/cloud computing (NVDA), and 3) Automation/EV (ADI, ON, NXPI, COHR),” they added.

Be the first to comment