Just_Super/E+ via Getty Images

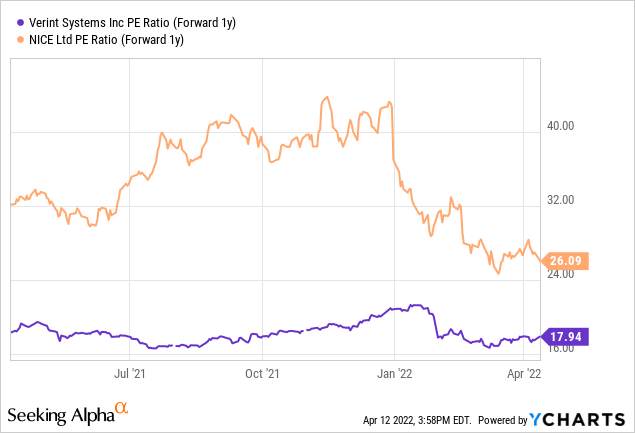

Verint (NASDAQ:VRNT) could prove to be a great play on the multi-year upgrade cycle within the contact center vertical. As the latest quarterly results (VRNT’s first as a standalone cloud-focused entity post-spinoff) showed, the cloud transition is playing out very nicely for the company. Plus, the cloud expansion playbook has played out successfully in other industries before, and as the company continues to execute according to plan, higher adoption within contact centers should lead to a step-up in earnings growth. Beyond contact center growth, the VRNT investment case could benefit from a massively expanded TAM via a broader ecosystem of partners and investments in new AI capabilities (e.g., Verint Da Vinci). At ~18x fwd P/E for a growing tech name, VRNT stock is priced very attractively.

Verint’s P&L Inflects Higher Amid the Accelerating Cloud Transition

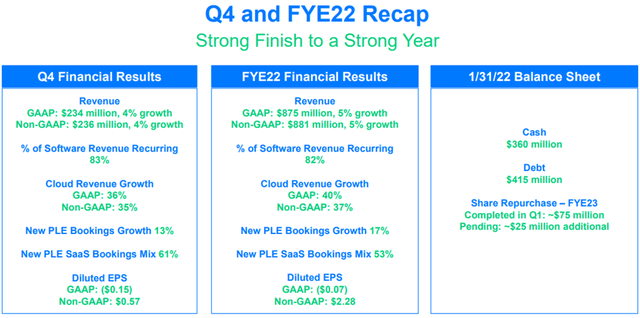

It was a good Q4 for VRNT, as it closed out a strong year tracking ahead of the three-year plan. The key highlight was the >30% cloud growth, setting a solid base for the company to accelerate revenue growth in the years ahead. Cloud revenue growth at +35% for the quarter (vs. 30% previously) was led by greater-than-expected automation demand and the closing of the engagement capacity gap. Plus, the 100 net new logos signed in Q4 included some notable brand wins, highlighting the growing role of its partner ecosystem in new customer generation and extending the offerings down market. All in all, new SaaS annual contract value (or ACV) was up 38.8% YoY. As impressive as these numbers are, however, I think the cloud numbers have ample room to run, given some of VRNT’s largest legacy on-prem holdouts are returning to the table for negotiations as they also look to transition to the cloud. The balance sheet is healthy – VRNT closed the year with a ~$360m cash balance and ~$415m of debt, allowing a $75m share buyback YTD. Given that ~$25m remains available for buyback deployment and VRNT continues to generate FCF, I wouldn’t be surprised to see an upsized buyback authorization down the line.

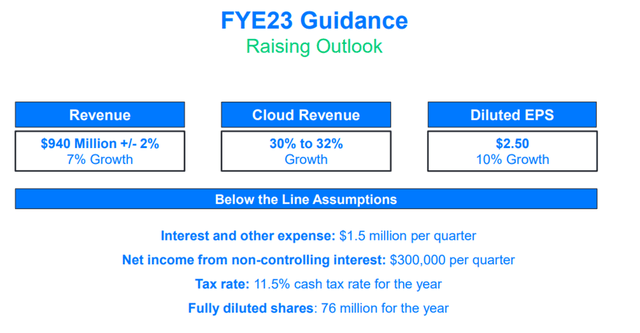

Forward Guidance Moves Higher but Could Still Prove Conservative

Verint’s guidance for the upcoming year is as follows – revenue of $940m (+/- 2%) and 7% YoY growth, with cloud revenue growth of 30% to 32% YoY (vs. 30% previously). The stronger cloud outlook entails a higher pro forma EPS of $2.50, just above the prior $2.49/share. Flowing through these numbers through fiscal year 2024, a 30% YoY cloud revenue growth trajectory equates to $672m and a 10% YoY overall growth to $1.0bn. The higher guidance makes sense in light of the accelerating pace of cloud transition seen in recent quarters and should prove sustainable, in my view, given the building cloud adoption across industries. While perpetual revenue is guided to be a drag on growth at ~$120m, the revenue mix is shifting – from a 45% cloud non-GAAP revenue contribution in the latest fiscal year, VRNT is on track to hit a ~65% cloud mix in 2024. This means modest improvements in gross and operating margins, as well as stronger FCF generation. That said, I think management could be leaving a fair bit on the table -the record number of $1m cloud deals (+25% YoY) highlights momentum around cloud adoption is picking up, while the broader recurring revenue base is another key positive. As a long-term investor, though, I think the bigger picture is key – the positive results and optimistic outlook underline the strength of Verint’s cloud platform, while management’s solid execution (post-spin-off of its security business last year) indicates the company is in good hands.

A Secular Beneficiary of the Enterprise Cloud Transition

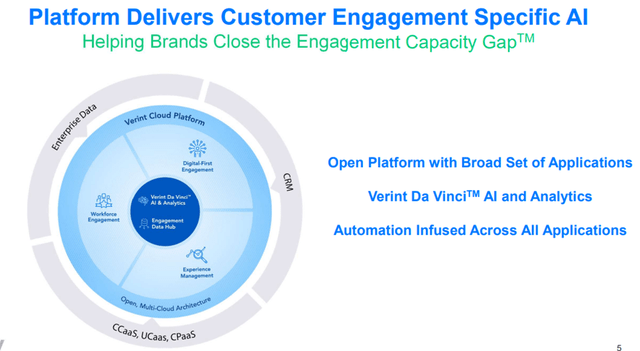

As big tech pushes to become the future operating systems for cloud communications offerings, VRNT is well-positioned to capitalize. VRNT’s application niche focus areas and ability to compliment/partner vendors across the spectrum (UCaaS, CCaaS, and CPaaS) have already begun to pay off – VRNT now lists Microsoft (MSFT) and Google (GOOGL) as partners/customers while Amazon (AMZN) is a “partner, but not yet a customer.” Going forward, the VRNT open platform could see adoption accelerate amid demand tailwinds from infrastructure platforms focused on data management, workforce efficiency, and customer experience. The runway is massive – digital transformation for customer engagement remains in the early stages, with voice accounting for ~80% of customer experiences and ~20% digital.

Given the market is spending ~$2tn on labor when it could expend ~$65bn by leveraging technology, the value proposition is very appealing. Thus, VRNT continues to push the high ROI narrative – per management, every dollar of tech spend saves five dollars of labor costs and helps close the COVID-accelerated customer engagement gap. Coupled with the tight labor markets today, I see a clear catalyst for a rise in demand for AI solutions to enable greater productivity. By deploying VRNT’s AI solution, Da Vinci, for predictable and routine problems, companies can more efficiently utilize their labor for more complex issues. Plus, VRNT also allows partners to develop on the Da Vinci platform (now offered separately as a service), so there is an optionality for even more revenue generation down the line.

An Attractively Priced Cloud Transition Play

Cloud adoption remains key to the VRNT investment case, as robust growth in the SMB channel, as well as an accelerating enterprise transition, has driven the cloud mix of new bookings to >60%. This trend should continue, and as cloud becomes a larger contributor to sales over time, VRNT’s overall revenue growth should inflect higher. Plus, VRNT deserves credit for the visibility provided by its recurring revenue base, with margins also set for upside as mix benefits accelerate. That said, investors don’t seem to be giving VRNT enough credit for its cloud transition at the current ~18x fwd P/E multiple. An eventual acceleration in the cloud mix past the 50% mark, though, to ~55% of total revenue in 2023 and ~65% in 2024, should support the case for a multiple re-rating relative to more richly-valued peers like NICE Ltd (NICE).

Be the first to comment