sarawuth702

Investment Thesis

Ideanomics (NASDAQ:IDEX) is trading at a low price and isn’t looking too ideal for short-term growth potential. Instead, the company’s recent acquisitions and as-a-service business model position itself in value territory. It’s going to be a long-term waiting game. It can potentially be profitable through the company’s EV business moves through its recently acquired companies like Solectrac – manufacturer and distributor of electric agriculture equipment; US Hybrid – which designs and manufactures zero-emission electric powertrain components; Energica – the world’s leading manufacturer of high-performance electric motorcycles, and many other potential avenues for growth for Ideanomics. The company has negative cash flow, but it is reasonable as it has been making significant acquisitions for the past year. I rate the stock as a Hold for now. The company is profitable if all ideal conditions are met. However, there is still uncertainty, especially regarding how things are going at the macro level and if trends will change in the coming years, especially in the EV market, where companies heavily rely on consumer power.

Potential Growth In EVs

There are numerous reasons why I think that Ideanomics could be an outstanding stock if we took everything from an idealistic perspective. According to CompaniesMarketCap, the top 5 EV companies are Tesla (TSLA), Rivian (RIVN), Lucid Motors (LCID), NIO (NIO), and Li Auto (LI).

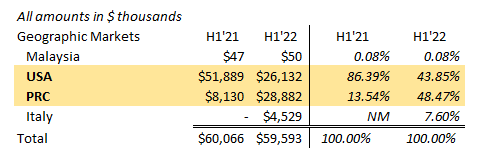

Geographical Markets

In the details mentioned above, three are in the US, and the other two are in the PRC, similar to the majority of IDEX’s revenue. The US and PRC market accounts for 44% and 49%, respectively, of the company’s revenues in the company’s performance of the first half of 2022. This tells us 1) If these countries adapt to using electric vehicles, EV-related services would be beneficial (assuming customers would buy your products), and 2) The US and PRC are highly developed countries with a large consumer base that could potentially afford these high-tech EV products/services. However, even if its revenues mainly come from these locations, I also think the EV business is subject to a high risk of threat of new entry (which I will discuss later). Essentially, many companies are looking to pursue the EV business, with its strength being that you don’t have to pay for gas fees, it’s good for the environment, and it’s the new trend of technology. However, I think that Ideanomics is in the prime location to deploy its EV products, and if they find massive success in specialty EV segments, it can potentially solidify itself as a well-known EV brand through innovative products such as two-wheelers, rickshaws, tractors, charging stations, and many more potential EV outlets.

Ideanomics Quarterly Results – Geographic Markets

In the auto EV industry, Tesla is the most recognized EV brand, and with a $682 billion market cap, the company and its shareholders have high trust in that brand to produce high-quality EV cars. However, with IDEX, the company aims to market its products through three primary channels: Ideanomics Mobility, Capital, and Energy, with Ideanomics Mobility as its primary source of revenue, in terms of EV products. So if Tesla specializes in making EV cars, what does IDEX has to offer? The core market segments that Ideanomics is targetting are off-highway, on-highway, and two-wheelers. This leads us to our next section, the company’s EV-related acquisitions, which I think can hugely contribute to its growth potential once it has positive signs of progress after the company’s investing activities.

EV-Related Acquisitions

Ideanomics have acquired several companies over the past year. Since their business model mainly involves EV products and services, I think that it’s a significant step that they’re acquiring EV products, not specifically car products, but specialty products such as tractors and two-wheelers, which I don’t think have a well-known brand, similar to the likes of Tesla. Many potential EV products don’t have brands that are recognized worldwide. If you think of phones, you think of iPhones by Apple (AAPL). Tesla will come into mind if you think of EV cars. How about EV motorcycles? EV tractors? Reputable EV charging stations? Some companies may have customized charging stations specific to their products, but it can be a potential revenue source, assuming that there’s a centralized way of charging these EVs and that most people will need them for their EVs. Additionally, here are IDEX’s recent acquisitions that are related to EV and why I think they’re good (or bad) for the company:

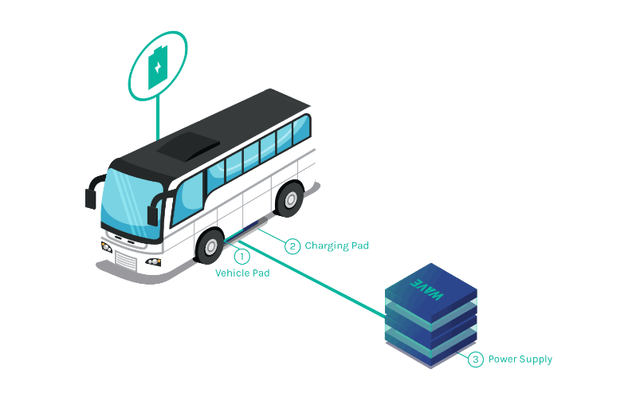

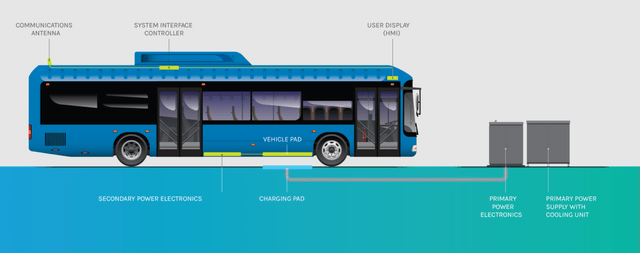

WAVE

WAVE is a leading provider of high-power inductive (wireless) charging solutions for EVs. They charge vehicles in scheduled stops and create hands-free charging solutions for EV owners. They have demonstrated their capability in EV by providing custom fleet solutions for EV manufacturers that can power mass transit, logistics, airport and campus shuttles, drayage fleets, and off-road vehicles at ports and industrial sites.

All user interfaces and communication antennas are located at the vehicle’s top. During a scheduled stop, the EV is charged through a charging pad located under the vehicle, charging the vehicle pad and its secondary power electronics. Power is drawn from the primary power electronics from the primary power supply. In places where scheduled stops are frequent such as buses, airports, and campus shuttles where vehicles tend to be idle for quite some time before traveling, these charging solutions can be a great wireless alternative compared to visiting a gas station every once in a while to refuel.

The company found success in its WAVE 500kW ultra-fast charger on September 2022 at the port of Los Angeles. This further improves my belief in the company being profitable if they continue their charging stations to be an “as a service” type of business. Read more about it in Seeking Alpha news here.

Solectrac

Solectrac is a company that sells electric-powered tractors and could be the future of agriculture, and likewise is beneficial for the climate. They aim to have zero emissions in regenerative agriculture and utility operations. In October 2022, Solectrac secured new business contracts to supply electric tractors to major fleet operators. The company has 17 zero-emission e25 tractors for the University of California Agriculture and Natural Resources. Read more about it in Seeking Alpha News by clicking here.

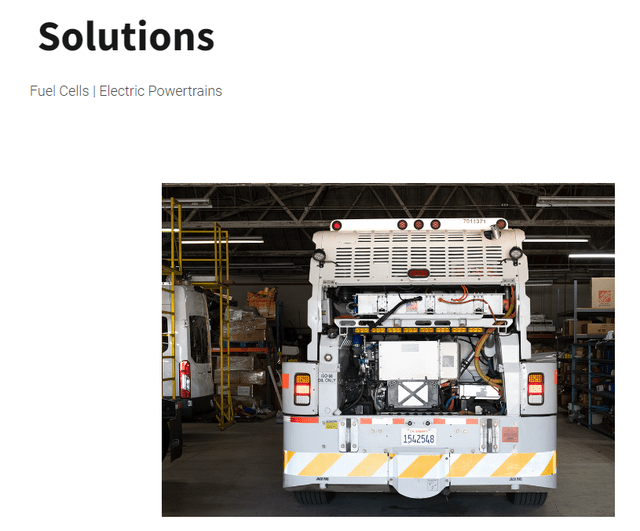

US Hybrid

US Hybrid is essential to OEM EV manufacturers as they create hydrogen fuel cells and power electronics for electric, hydrogen, and hybrid-powered vehicles. The company will continue to serve external and internal customers within Ideanomics, and if IDEX wants to make great EV products, they need to have great fuel cells; US Hybrid is good at that.

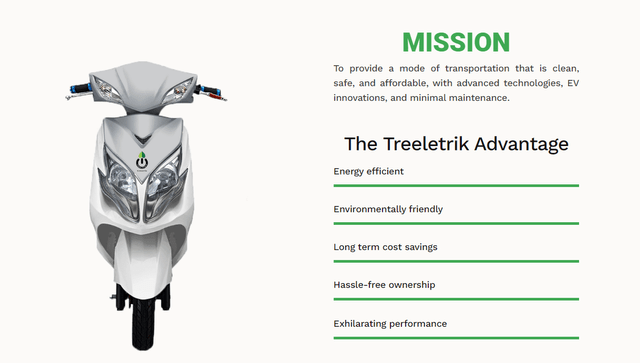

Tree Technologies

Like Solectrac, Treeletrik makes EVs, but instead of tractors, they make two-wheel vehicles such as motorcycles, rickshaws, and scooters. The company can potentially be one of the leading EV motorcycle providers in Asia, specifically in countries such as Indonesia, the Philippines, and Thailand. The company is in collaboration with Energica to make these EVs.

Status Of Previously Announced Acquisitions:

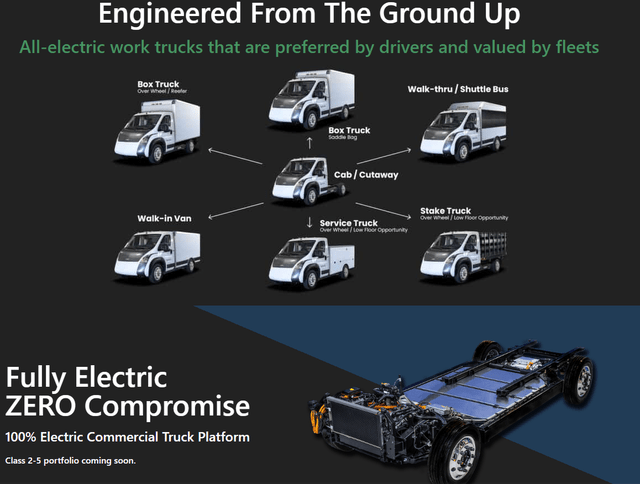

Via Motors – 100% $630 million

VIA Motors is a commercial EV truck manufacturer creating different types of trucks with zero emissions. The considerable payment for the transaction is $630 million, with an upfront payment of $450 million for both stock and cash consideration, with $180 million as an earnout payment in IDEX’s common stock, and is anticipated to close the deal in the fourth quarter of 2022.

Energica – 90% – $60 million

Similar to Treeletrik, Energica creates motorcycles in the field of motorsports. Leveraging Energica’s technology to improve Treeletrik’s current technology will bring much more efficient two-wheel vehicles. On February 2022, IDEX wired $60.3 million to an escrow account to facilitate and fund the conditional tender offer, and on March 2022, the company announced that it had achieved the 90% threshold for the conditional tender offer, and the transaction closed in the same month.

Overall, with all the company’s acquisitions in the past year, I am confident there is excellent potential in the stock. Instead of competing with the big companies with billions of market cap, Ideanomics are finding new ways to disrupt the EV market through different EV car alternatives such as two-wheel vehicles, buses, wireless charging stations, and EV motorsports vehicles. I also think it’s brilliant that they’re keeping up with the new trends, especially related to creating a sustainable environment at a low cost. With a growing addressable market, the company has great potential:

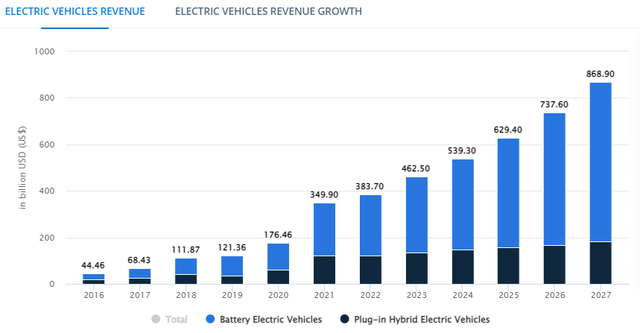

Total Addressable EV Market

Statista – Projected EV Revenue

If the trend of electric vehicles continues, there’s a space for Ideanomics to ride the trend. According to Statista, revenue in the EV market is projected to reach $384 billion in 2022 and is expected to show a CAGR [Compound Annual Growth Rate] of 17.75%, resulting in a projected market volume of $869.30 billion by 2027. 5 years from now, it is also estimated that there will be 16.2 million EV market sales.

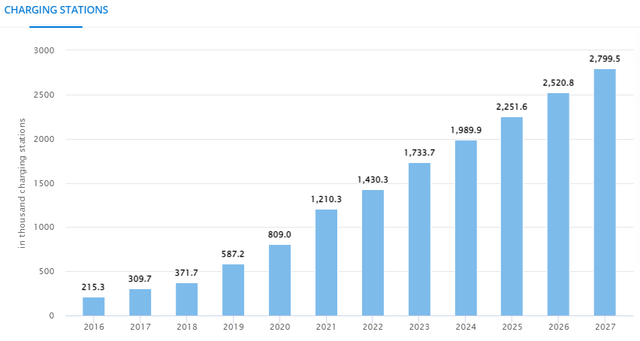

Statista – EV Charging Stations

Since Ideanomics is not only creating EV charging stations but also creating EV trucks, two-wheel EVs, and EV motorsports. This can be an excellent way to enter the EV industry, as IDEX is not purely focused on making cars but on various EV products and services. Their charging stations can also be a considerable source of revenue if they pursue this line of business.

Risks

There are three primary risks that I’m concerned with Ideanomics. These risks can be a significant factor that determines the company’s performance. Even if the company seems to be on a great path to profitability, the short-term uncertainties can rob its “great” future:

The Threat of New Entry

While it’s true that the EV industry is trending and people like the idea of owning a vehicle that doesn’t rely on gas but electricity, since the EV market has been prevalent only in the past decade, there are still undiscovered products/services (that aren’t highly marketed yet, since there are a few electric vehicles) that companies can capitalize on due to their profitable nature. A great example of this is Tesla (TSLA). They may not be the first innovators of electric vehicles, but due to the industry’s early exposure to this technology in public and being actually great at making electric vehicles, they’re the largest EV company in the world. Since there are different avenues to get revenue in the EV market, there’s always a constant threat of new entry. Starting an EV business is expensive, but due to its profitability, I can confidently say that the difficulty level in this market for emerging companies gets more challenging by the day as technology advances.

Consumer Purchasing Power

The world is experiencing a recession, which means that if the situation worsens, the middle class would most likely set its priorities on daily needs instead of purchasing electric vehicles. A weakening consumer purchasing power means that there would be fewer sales for an EV company such as Ideanomics.

Acquisition Uncertainty

Other than the company’s previous performance, there is still uncertainty left with the recent acquisitions that Ideanomics has made. It’s great that they are acquiring some great companies with EV experience. It’s just that with the current economic situation of the world and the supply chain disruptions across different industries (such as the most recent chip shortage in the semiconductor industry – it’s needed to make smart electric vehicles), the company is in a tough spot. It’s been at a loss for quite some time and isn’t generating cash (which is understandable since the company has been making acquisitions, but there is still much uncertainty with these investing activities), and investors should be aware of this.

Financials and Valuation

Ideanomics Price Return – Seeking Alpha Charts

As for the company’s financials and valuations, the stock has been on a downtrend ever since the stock reached its 1-year high of $2.11 a share to where it’s currently at today, which is $0.23 a share.

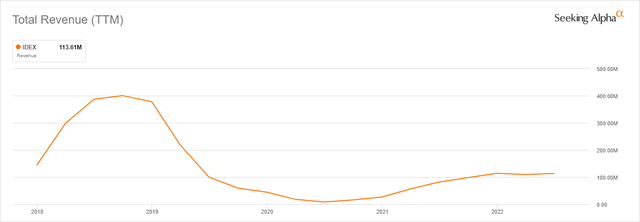

Ideanomics Total Revenue – Seeking Alpha Charts

The company’s revenue grew from $26 million in 2020 to $114 million in 2021, or a 326% revenue growth driven by title and escrow services with a revenue of $73 million and electric vehicle products of $31 million. This generated cash for the company that would later be used for investing activities and acquiring more companies to solidify Ideanomics’ destiny in the EV business and hopefully make it more profitable for the business and its shareholders.

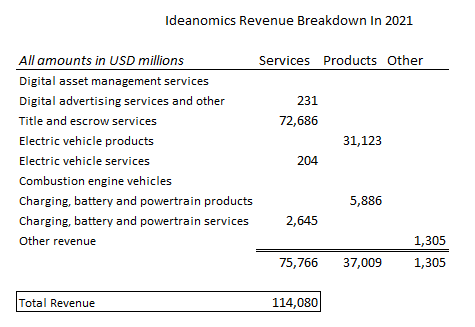

Ideanomics – Revenue Breakdown Made by Author

Overall, Ideanomics had $75.7 million in revenue in services, $37 million in products, and $1.3 million in other revenue, totaling $114 million in revenue for the fiscal year 2021.

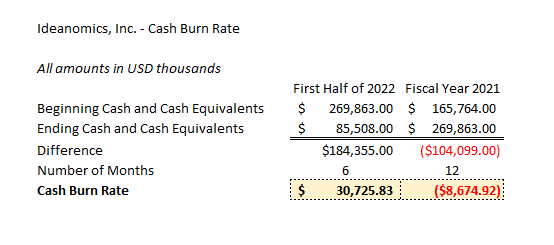

Ideanomics Cash Burn Rate – Author

Ideanomics had a cash burn rate of $31 million per month in the first half of 2022, while the company had a negative cash burn rate of $8.7 million in the fiscal year 2021, which the company’s revenue increase may drive. An ideal situation to insulate this problem is to increase revenues and decrease costs, but since the company has been making acquisitions, growing revenues in the short term may be challenging to pull off, and because of the current macro situation, costs will increase. However, since they’re venturing forward into the EV business, I think that the cash burn rate is meaningful because:

- The reward outweighs the risk taken by the company if the investments live up to their potential.

- The economy and industry are directed to zero-emissions and affordable transportation, which the EV business possesses.

- There’s the future availability of capital if most of the company’s source of financing remains in equity.

However, the company doesn’t have a quick path to profitability unless they release affordable, low-cost Treeletrik EVs in the next year. I say affordable since the target market for these EVs is the Asian middle class in Indonesia, the Philippines, and Thailand, the countries where Treeletrik primarily sells its EVs.

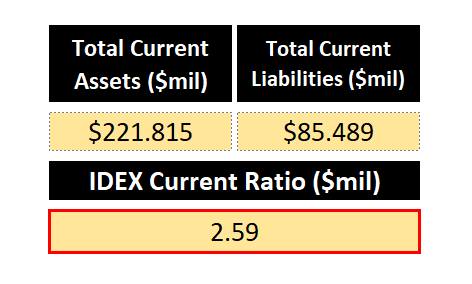

Ideanomics Current Ratio – Author

The company has $222 million in current assets and $85 million in current liabilities, which means that the company has a 2.60 current ratio, which indicates that the company has no solvency issues as sufficient existing assets cover the current liabilities.

Ideanomics also has a relatively low debt-to-equity ratio of 0.19, meaning that most of the company’s financing is sourced from equity, not debt. Although 0.19 is a healthy debt-to-equity ratio, it can still source some of its debt. According to Alf Poor, IDEX’s CEO, the company’s Q4’21, and Q1 & Q2’222 earnings call:

“We have a mature approach to doing so, and we use a mixture of debt and equity to minimize the dilution to our shareholders.”

This means that if Ideanomics wants to have more funding, it can still source some of its funding through debt, which is achieved by a relatively low debt-to-equity ratio, especially in the EV market, where it requires a significant upfront investment.

However, I will monitor the company announcements and the technology they will bring to the EV market. My rating is consistent, and it’s still a Hold due to the previously mentioned risks.

Final Thoughts On Ideanomics

Overall, I genuinely think that Ideanomics potentially has a great future ahead of it if it weren’t for the macro factors and uncertainties the company possesses. I firmly believe they could be one of the industry leaders in the electric vehicles industry. The recent acquisitions can be great revenue sources throughout various geographical markets. However, without solid results that signal a stable long-term performance (profitability & efficiency-wise), there’s no excellent reason to rate it as a Buy, at least for now. I rate the stock as a Hold. However, I’ll be glad to monitor the stock and wait for Ideanomics’ future guidance for the company.

I hope you’ve enjoyed reading, have a great day.

Be the first to comment