Ronald Martinez/Getty Images News

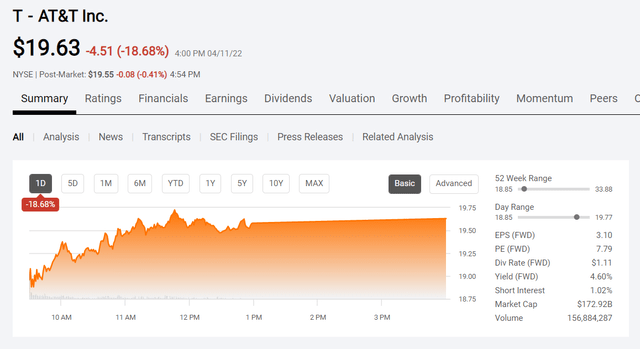

AT&T (NYSE:T) confounded a whole lot of opinions when the roof failed to fall in on the stock price today (which was the first day of the post spinoff trading). In fact, the first day of trading of Warner Brothers Discovery (WBD) and AT&T holdings was worth about 10% to 15% more than was the case on Friday. The AT&T stock not only began by trading higher than many expected, but it also actually held those gains and added some. That is actually fairly typical for this type of situation where the main company (in this case AT&T) is rationalizing its structure after a few years of venturing into the unknown.

AT&T Common Stock Price History And Key Valuation Metrics (Seeking Alpha Website April 11, 2022)

What this first day of trading demonstrates is that the market frequently goes to extremes that nearly any trader can take advantage of. In this case, the extreme was one of completely undervaluing the future prospects of the (NOW) two parts of the company.

Today, as I am submitting this article, the stock price is still holding on (with a small loss so far) to the unexpectedly strong pricing. So many estimates that I had guessed a beginning price closer to $14 (give or take). As usual, the market went way overboard on this.

Even more important is that the stock had lost about 50% of its value before the spinoff. Evidently, prospects were so poor in the eyes of the market that a downward trend was inevitable all the way up to the day of the spinoff.

Now, all of a sudden, prospects are much better than was the case last week. In the eyes of economists, the market is an efficient mechanism. But it does not work so well that traders cannot take advantage of material temporary mispricing caused by a lot of human emotions (by a lot of humans).

Market efficiency depends upon perfect information and rationality. Books such as the “Contrarian Invest Strategy: The Psychological Edge” by David Dreman have covered this for decades. Yet the market still behaves as it did before the coverage began. The temptation to overboard is evidently irresistible.

But the future changes rapidly. As it changes, so does the requirement of perfect information. The second part about humans being rational has been a discussion point among economists for some time. Rather than rational behavior dominating market action, groupthink is far more likely to prevail in the short term. Contrarian investors who know when to invest contrary to a groupthink conclusion can make a lot of money.

So, the question really becomes if the company, now in two parts, is still worth the value of just a few years back. Oftentimes, research indicates that the parts are worth more than they were as one company. That bodes well for investors wanting to hang on for long-term appreciation potential.

Many times, both parts of the company can focus and execute far more efficiently than was the case with the prior combined company. Ironically, spinoffs usually outperform their former parents (but not always, of course). This case is a little more complicated as the spinoff was combined with another entity. But the research results (and the books) still appear to be accurate predictions.

That does not mean that the stock prices will just “hop up” to far better valuations, though that certainly could happen. There may be a runup fueled by optimism in the beginning that exceeds the initial results to the point that some investors decide to sell. But the long-term investing results of a spinoff of this type have been beyond dispute for some time, and those results benefit buy and hold investors.

Of course, there are no guarantees this one will work. Furthermore, the results may not satisfy income investors that depended upon the dividend for income. But I like the odds and think that for many investors, at least initially, both pieces are worth holding until a few quarters have been reported before a sell decision needs to be made.

When it comes to valuation, AT&T stock should likely be held until the price is no longer justified by potential dividend increases when compared to whatever else is available at the time. Right now, the market is set upon inflationary expectations. Just about any income stock will do well as those inflationary expectations inevitably decline. As a result, this is likely the time to buy income stocks (not sell) unless you expect inflation to get worse over the next several years.

Despite the fact that we live in a free-market economy and every single sector can make its own decisions regarding supply of product to sell, there has been a lot of misinformation to the contrary. No one saw the recovery happening as fast as it did. Bottlenecks were inevitable because “no one” planned for that fast recovery. The same goes for supply shortages. All of this and more is likely to ease as expectations adjust to far more robust economic circumstances than anyone thought possible.

Similarly, the inflation caused by supply shortages is likely to ease. It is also likely that we need higher rates to stop some of the inflation from becoming a permanent part of our expectations. But as supply and demand come into balance, the inflation caused by supply shortages should ease considerably to a better 2023 than the market expects. This bodes very well for a stock such as AT&T.

Warner Brothers Discovery is likely to prove to be a completely different valuation analysis. That new company is likely to embark upon a growth path that may not end for the foreseeable future. The company is likely to be a formidable entry into the streaming market. That entry is very likely to help the profits of several other divisions regardless of the results posted by the streaming division itself.

The initial news was not the greatest. But those things happen with new entries. The new management will likely straighten out the problems over time to get things going as they should. After all, there is a reason for that spinoff, and this is likely a symptom of the problems.

For me, I am likely to follow the Warner Brothers Discovery growth story to its logical end. Even though I plan to retire soon, I don’t need dividend income from every single holding and would like to see the portfolio grow somewhat at least during my early retirement years.

There appear to be a lot of initial synergies that Warner Brothers Discovery can take advantage of. The opportunities available to the combined company to grow appear to exceed the growth opportunities of the parts. That type of future synergy does not appear to be priced into the stock at all. But it will likely become apparent to the market soon enough.

The Discovery division itself brings a unique perspective into the marketplace that few others have really bothered with. As a result, there is likely to be slightly less competition for the Discovery material than there is for other parts of the streaming sector. That “slightly less” may prove to be a competitive advantage for as long as it lasts.

The whole future of both parts of what was formerly AT&T in one piece appears to be quite bright. An additional advantage is that one part could partially or totally fail to reach market objectives, yet the investors would still benefit from the other piece appreciating as planned. Spinoffs tend to beat the market in the initial period they are public. That initial period usually lasts a few years (but it can last a decade or more). Both of the new companies have solid reputations and know their businesses. I like the chances that both succeed and intend for the time being to hold both.

Be the first to comment