Maria Korneeva/iStock via Getty Images

Investment Thesis

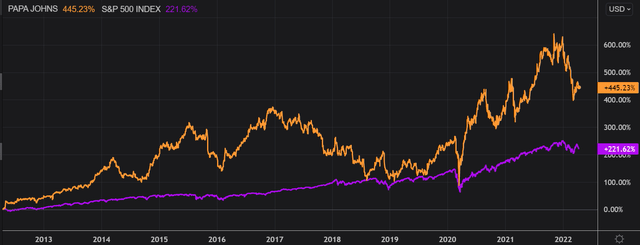

Papa John’s International, Inc. (NASDAQ:PZZA) is one of the winners of the past decade, outperforming the S&P 500 by a whopping ~224 percentage points margin. This company has many of the characteristics of an excellent business, such as a moat, good margins, and an asset-light business model. In terms of valuation, PZZA is currently trading at approximately 32x LTM free cash flow, which makes it expensive for a company likely to grow at a high single-digit rate going forward. I will add this stock to my watchlist and I will be looking to accumulate below $80 per share.

Company Overview

Papa John’s International, Inc. is an American pizza restaurant chain. It is the fourth largest pizza delivery restaurant chain in the United States. As of December 2021, there were 5,650 Papa John’s restaurants in operation, consisting of 600 Company-owned and 5,050 franchised restaurants.

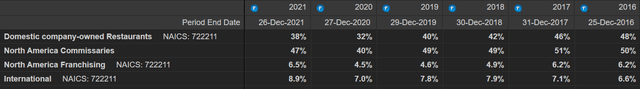

The business is divided into 4 segments:

- Domestic company-owned restaurants: this segment consists of the operations of all domestic company-owned restaurants.

- North America commissaries: it comprises 11 full-service regional dough production and distribution centers in the US which are in charge of supplying the basic ingredients to make pizza, as well as other food products and cleaning supplies.

- North America franchising: this segment is responsible for franchise sales and support operations in the US and Canada.

- International: it principally consists of distribution services provided to franchised Papa John’s restaurants located in the UK, and the collection of royalties, franchise fees, and development rights from PZZA’s international franchisees (outside of the US and Canada).

The company derives 47% of its revenue from the North America Commissaries segment, followed by Domestic company-owned restaurants, International and North America franchising. The company’s true cash cow is the North America franchising segment which achieved a ~91% operating margin in FY21.

The Market Opportunity

A quick-service restaurant is a restaurant that offers certain food items that require minimal preparation time and are delivered through quick services. Typically, quick-service restaurants have a limited menu that can be cooked in lesser time with a minimum possible variation.

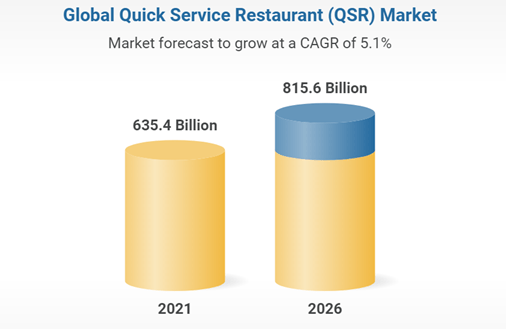

The Global QSR Market was valued at $610.23 billion in 2020 and is expected to increase at a CAGR of 5.1% to $815.6 billion by 2026.

Azoth Analytics If we turn to the US, there are over 197,000 fast-food restaurant businesses. The fast-food industry market size by revenue is estimated to be $296.6 billion, which is ~49% of the global fast-food market. According to Statista, this market is expected to grow at a compound annual growth rate of 5.1% from 2020 to 2027. Moreover, burger-focused restaurants have a leading market position in the US, representing 31% of the fast-food market, followed by pizza parlors (15%) and sandwich shops (12%). The US pizza market is expected to exceed $53 billion in 2022 and has grown at ~2% annually since 2017. It is therefore a mature market, where the main growth opportunities are likely to come from innovation.

Business Strategy

The vast majority of PZZA’s locations are franchised. A franchised business provides earnings stability and has the benefit of requiring little capital to run. Moreover, PZZA’s business model has the advantage of growing fast given the fact that the franchisee needs to secure the location and pay for the upfront costs. I personally think this business model will be even more valuable in the context of an international expansion since locals will have an edge in finding the best locations.

Speaking of expansion, the company has solid unit growth opportunities both in the US and internationally. PZZA announced a new partnership with Drake Food Service International in August 2021, with the goal of opening over 220 restaurants in Spain, Latin America, Portugal, and the United Kingdom by 2025. On top of that, PZZA signed a development contract for 100 additional sites in September 2021 in high-growth cities in Texas and the South. More recently, PZZA announced a collaboration with FountainVest Partners, to establish more than 1,350 additional restaurants across South China by 2040. The current pipeline of projects accounts for more than 29% of the company’s total stores In FY21 alone, the company added 250 net new restaurants, which represents a 4.5% unit growth. PZZA’s management anticipates 260 to 300 net new restaurants in 2022.

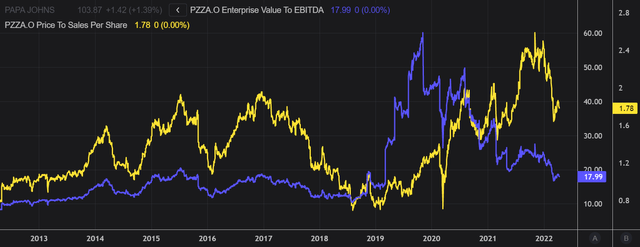

Despite the strong pipeline, growth was sluggish in the past. Revenue grew at a 5% CAGR from FY12 to FY21, which translates into a real growth rate of approximately 3%, assuming 2% annual inflation. The stock price did very well, however, more than quadrupling since mid-2012. Part of the performance can be explained by improvements and the growth of the business. That said, the willingness of the market to pay a higher multiple for PZZA played a key role in the spectacular performance. For instance, the EV/EBITDA multiple doubled since FY12. That is also true for the P/S ratio.

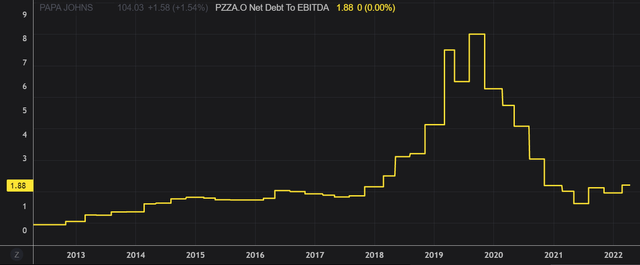

At the same time, net debt skyrocketed from less than $60 million in FY12 to over $430 million as of Q4 FY21. Most of the borrowed funds were used to expand the business, but also to buy back stock. This definitely adds some risk to the bullish thesis but I’m pretty confident PZZA will be capable of servicing its debt obligations. Over 75% of total debt is issued at a fixed interest and a large part of the remaining portion is hedged through swaps.

Net debt/EBITDA also shows that the company isn’t overleveraged. However, I think it’s interesting to highlight how this trend has evolved over time. The net debt/EBITDA ratio is now 9x higher than it used to be back in FY12.

Valuation

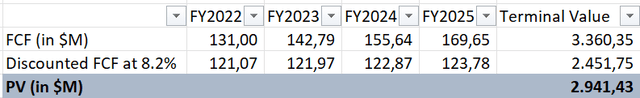

Based on 35 million shares outstanding, and a price of $103.4 per share, the company has a market cap of approximately $3.62 billion. In this part, I have used a discounted free cash flow model to value the business. The following assumptions have been made in the model:

- Estimated free cash flow for FY22 of $131 million, in line with Wall Street estimates.

- A 9% growth rate over the next 4 years, slightly higher than the historical average to account for PZZA’s robust pipeline of projects.

- A 3% terminal growth rate, slightly higher than the long-term GDP growth rate of 2% reflecting the quality of the business and brand.

- A discount rate of 8.2%.

Based on my model, the fair value of the stock is around $84 per share. Given the current price, PZZA is overvalued in my opinion. Moreover, I think the current stock price doesn’t leave any margin of safety. PZZA would have to achieve an annual growth rate north of 15% over the next 4 years to justify the current valuation, which is not impossible. I personally consider the current risk-reward balance to be tilted towards more risk than reward, which is the main reason why I would wait for a cheaper entry point.

Key Takeaways

PZZA has outperformed the S&P 500 by a remarkable 224 percentage points margin over the last decade. I think the company has a quality business model which requires little capital and is easily scalable. As a result, the company has a solid pipeline at the moment, which should stimulate future growth. That said, PZZA is now selling at about 32x LTM free cash flow, which is pricey for a firm that I believe will grow at a high single-digit rate going forward.

Be the first to comment