Martina Birnbaum/iStock via Getty Images

Leslie’s Inc. (NASDAQ:LESL) has gone through several market disruptions in the last two years. But, it remained unperturbed, given its impressive revenue growth. Its increased share capitalization in 2020 allowed it to expand its operations. It proved fruitful as a larger operating capacity led to higher efficiency and sustainability. Meanwhile, the stock price appears to be fairly valued, but the trend remains stagnant. It may not change its direction for the next few weeks.

Company Performance

In my previous article, I discussed that Leslie’s, Inc. has been through massive changes since its incorporation. But in recent years, its growth has become more evident, allowing it to expand and go public. From 100 to 750 stores in 1989-2014, it rose to 932 with about 5,000 regular and seasonal employees in the US. It is no surprise that it remains one of the key retailers of swimming pool supplies and other related products.

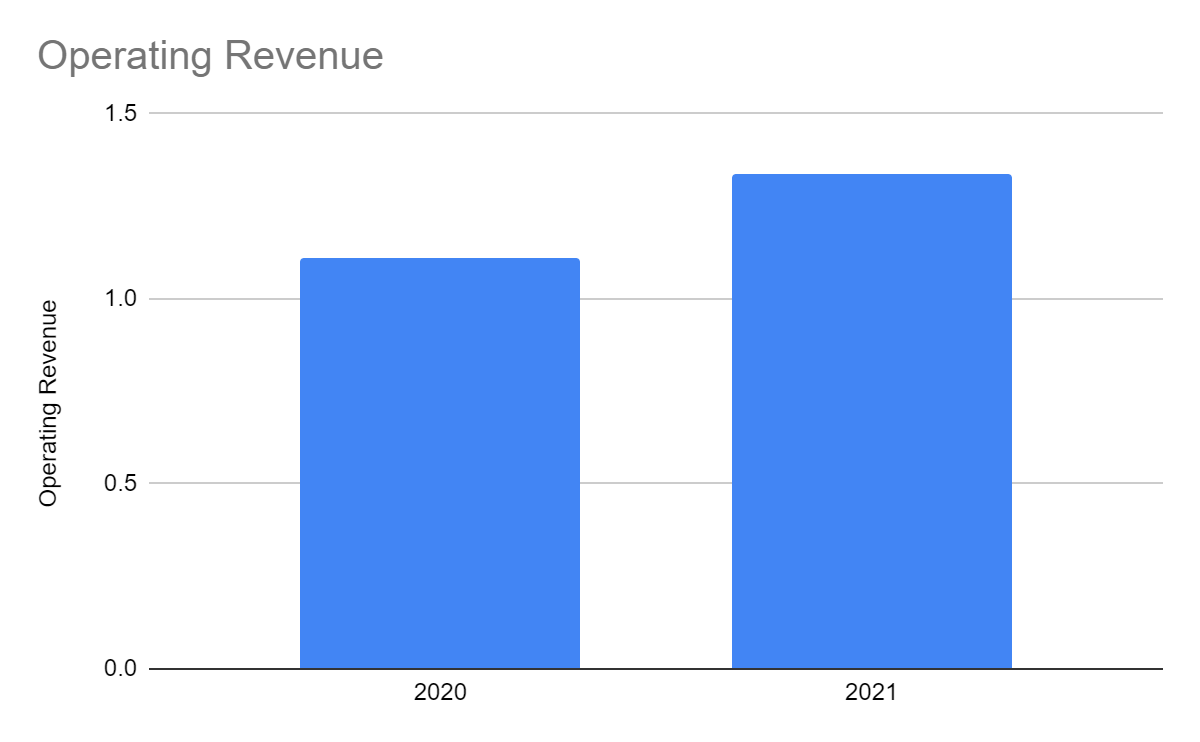

From 2018 to 2020, its operating revenue has increased from $890 million to $1.1 billion. The pandemic could have hampered growth due to disruptions in the supply chain and decreased purchasing power. But, the company continued to see an influx of customers. It appears logical as most people had to avoid beaches, campsites, public pools, and spas. Instead, they switched to swimming pools at home. In the first half of 2020, backyard pool sales boomed as more spent their Spring and Summer at home. In turn, swimming pool supply retailers like Leslie’s reaped its benefits.

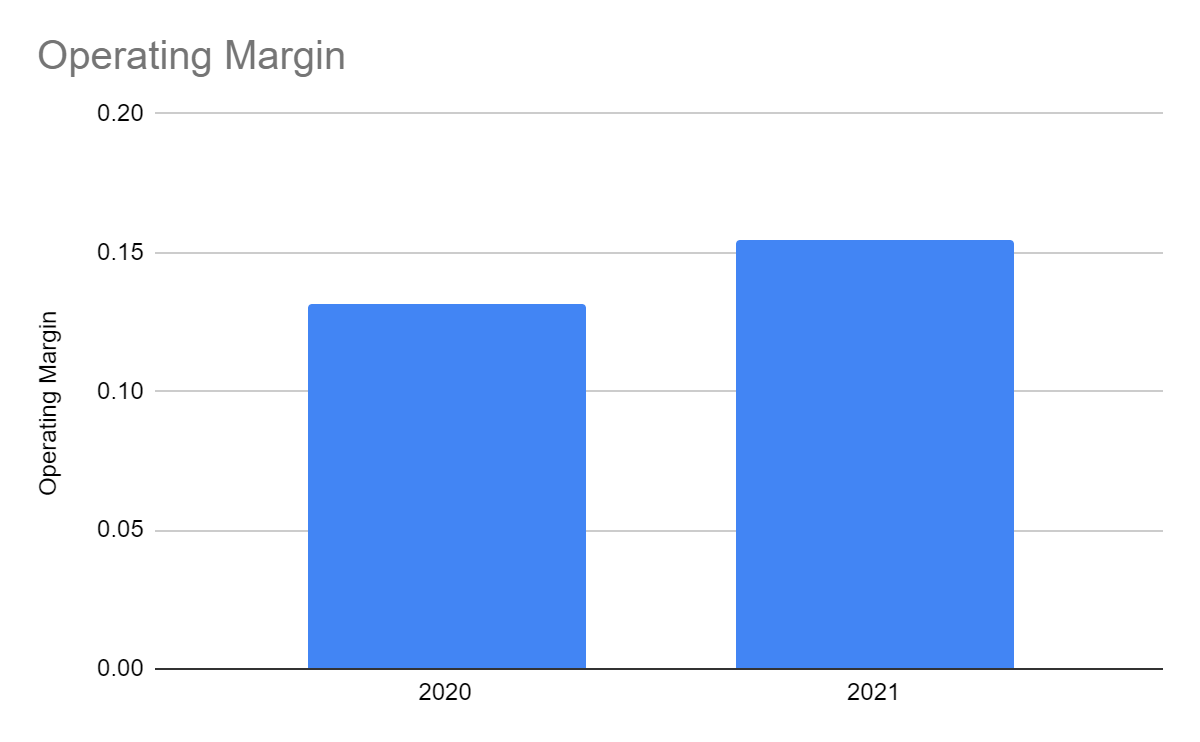

Before its FY 2020 ended, the chlorine industry faced a big challenge when a fire broke out in a chlorine plant in Louisiana. The unfortunate event cut the pool chlorine supply by 40%, leading to an upsurge in prices. Fortunately, Leslie’s supplier was unfazed. The company took advantage of it and captured more market demand. As such, revenues rose while the operating margin reached 13%.

In 2021, it filed another IPO, which closed with 46 million common shares. This capitalization enabled the company to enlarge its operating capacity, which proved fruitful. The easing of restrictions amidst increased vaccination allowed many businesses to operate further. Beaches, pools, and spas saw pent-up demand, which helped product suppliers and retailers. But what was more apparent was that as the company expanded, it kept its costs and expenses low. It closed the year with operating revenue of $1.34 billion, the highest value and revenue growth history. Its operating margin reached 15%, showing enhanced efficiency in the core business. Meanwhile, net income more than doubled, amounting to $126 million.

Operating Revenue (MarketWatch)

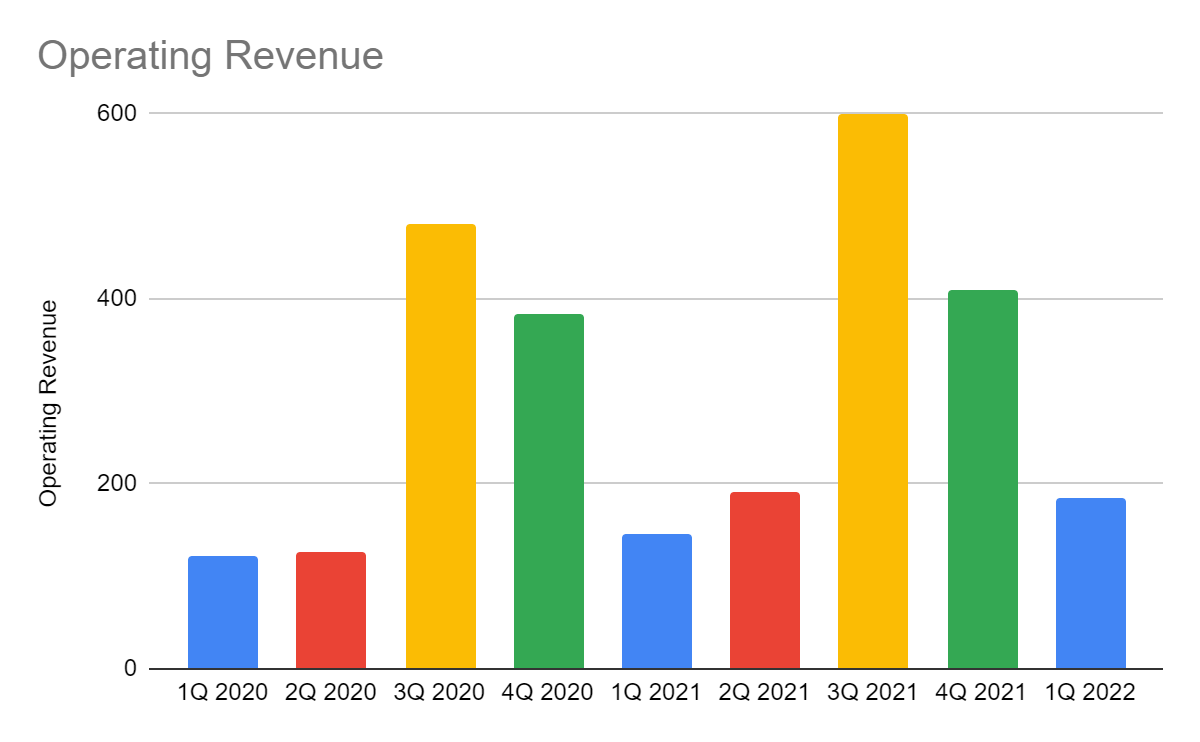

Operating Revenue (MarketWatch)

Operating Margin (MarketWatch)

Today, Leslie’s, Inc. remains a formidable figure in the industry. It continues to succeed at lightning bolt speed. This year may demonstrate its enhanced strength, given the 1Q results. For instance, its operating revenue amounted to $184 million, a 26% increase. It is way higher than the 17% year-over-year growth in 1Q 2021. Its strong and impressive start led the management to raise its 2022 guidance. For instance, its operating revenue guidance increased from $1.475-$1.5 billion to $1.495-$1.52 billion. My estimation using the average growth in recent years is a bit higher at $1.53 billion. Check out this link for the complete guidance.

How the Business Can Sustain Growth

Leslie’s is growing, and its 2022 guidance shows more promising growth prospects. Here are some possible growth drivers.

Sound Fundamentals

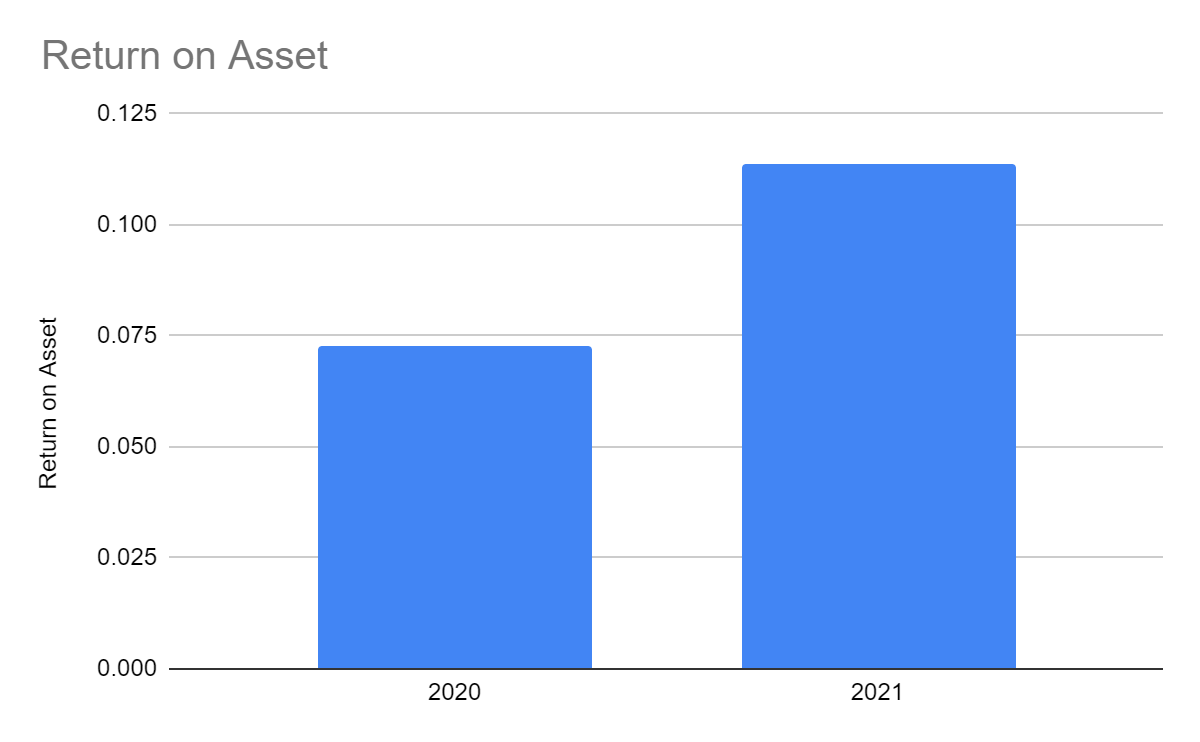

We have already seen impressive growth in Leslie’s revenue and earnings. Aside from its demand, it shows efficient asset management, given the increase in its Return on Asset (ROA) from 7% to 11%. This proved that its increased capacity led to increased efficiency and profitability.

Return on Asset (MarketWatch)

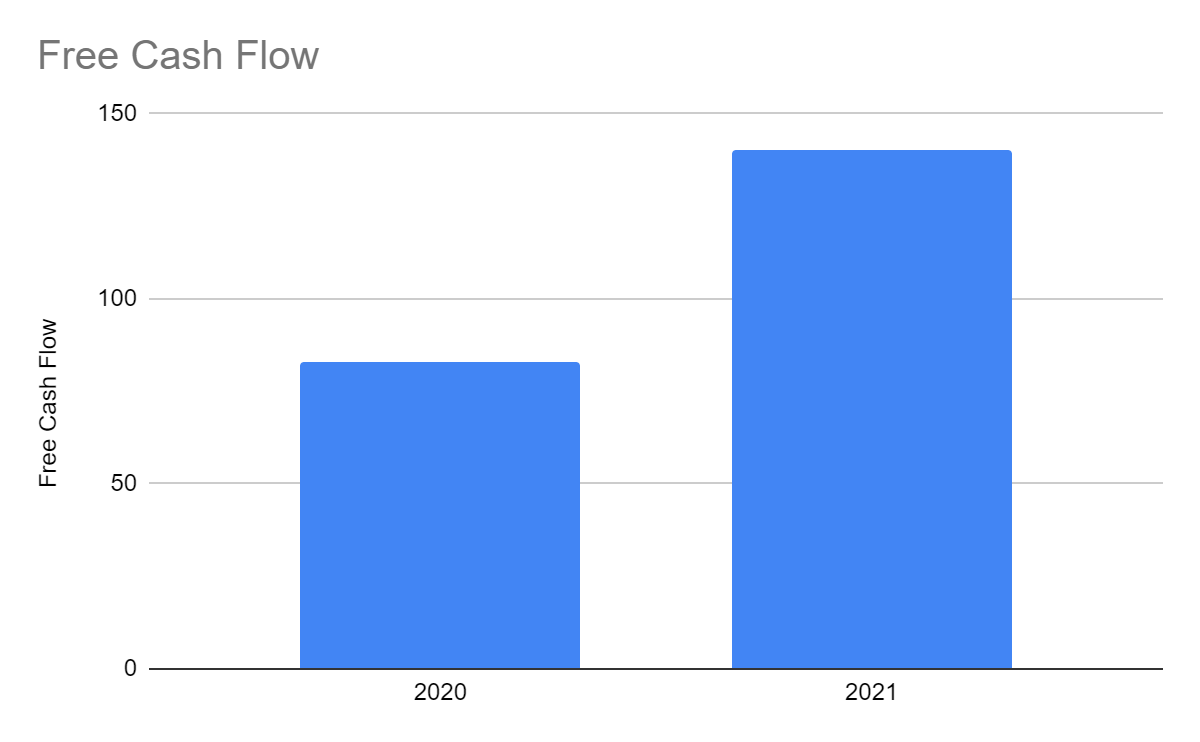

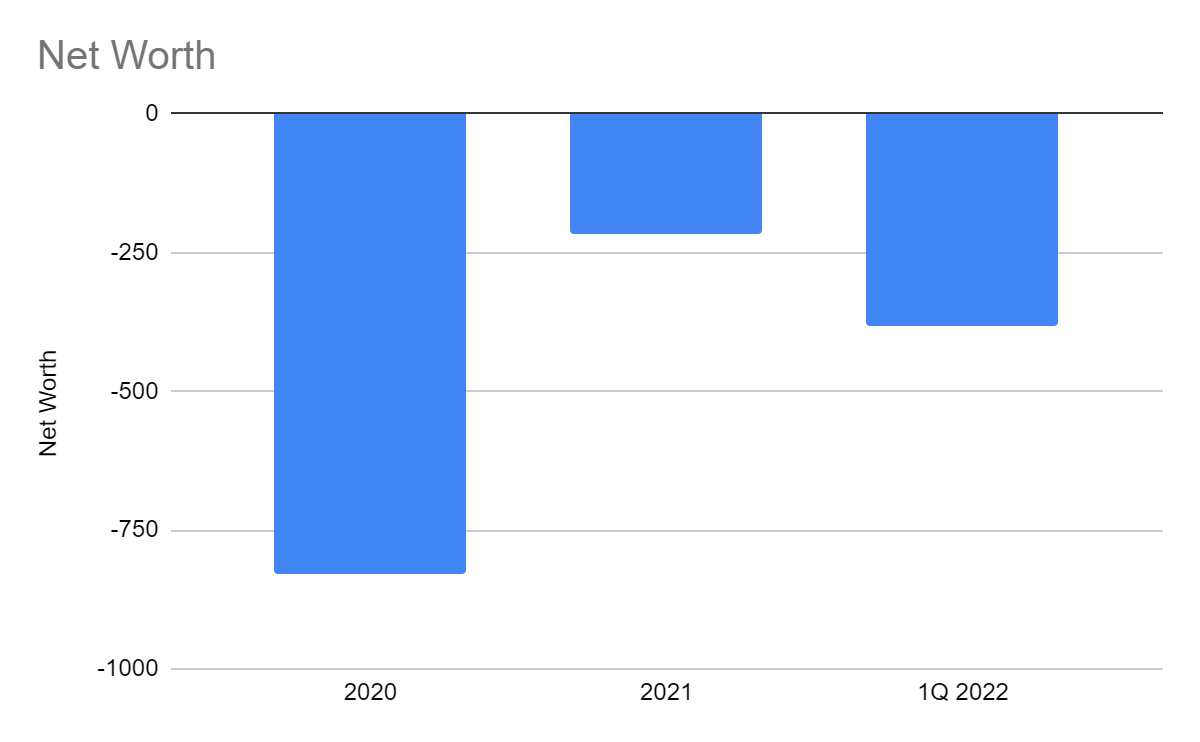

Moreover, there is consistency in its financial statements, showing that it can sustain its growth. For example, its Free Cash Flow remained positive and increased from $83 million to $140 million. So, its pure cash transactions are profitable enough to cover its expenses and expand. In the same, its cash more than doubled while its financial leverage through borrowings decreased. As such, its Net Worth had substantial improvement.

Free Cash Flow (MarketWatch)

Net Worth (MarketWatch)

This year started with lower cash, which plunged by almost 50%. But, inventories and CapEx increased by $70 million and $2.8 million, respectively. This shows the continued growth in its operations. Higher levels of production may lead to more income as Spring approaches. The other portion of cash outflows was used for debt repayment and share repurchase. So, Leslie’s is still capable of sustaining its growth and expansion.

Swimming Pool Demand

In the latter part of 2021, a survey showed a better future ahead of the swimming pool and supplies industry. Among the respondents, 64% of pool owners plan to update their swimming pools in the next two years. Among those who do not have swimming pools, 57% said they were interested in having one. Most pool consumers, owners or not, said they plan to maintain or increase pool usage this year.

Pent-Up Travel Demand

The hype in travel and leisure has not subsided yet. In fact, many surveys are seeing more travelers this Spring. More recent surveys show that 56% of Americans plan to travel this Spring. There is also a substantial increase in those who plan to travel during the Spring break. Hotel and vacation rentals may have more demand, which may also help swimming pools and spa supplies retailers.

Price Valuation

The price of LESL has been declining since the second half of 2021. At $19.03, the price remains stagnant and may not increase soon. Meanwhile, its PE Ratio of 25.79 appears to be fairly valued and is still within the market average. Also, it is cheaper than one of its peers Pool Corporation (POOL), with a PE Ratio of 27. To better value the price, we can compute its forward PE Ratio. Given the guidance of the company, the forward PE Ratio may range from 18.4 to 19.7. The estimated earnings show that there should be an upside of 24-28%. My estimation shows a lower but more conservative ratio of 24.08. This may be achieved, given the solid and intact fundamentals of the company and demand for swimming pool and spa supplies. But given the recent trend, an increase in the next few weeks must not be expected.

Bottomline

Leslie’s shows solid and intact fundamentals, given the consistency in all its financial statements. The increased profitability, net worth, and FCF show that it can sustain its growth and expansion. But, its price does not seem to follow its fundamentals. I am not closing doors since the Spring and Summer may become a primary growth driver in its revenues and earnings. The hype for swimming pools and spas may influence the price. The trend in the previous year may verify it. But, I still suggest to hold it for now. Its slow-moving trend does not show instant price increases.

Be the first to comment