Jay Yuno/E+ via Getty Images

As we continue to look ahead to a near-term rebound in the stock markets, the key task for investors will be to find declining stocks whose YTD losses have dislocated them from their fundamentals. Pegasystems (NASDAQ:PEGA), in my view, fits the bill perfectly. This little-known software stock is actually a hidden giant in the CRM and platform software markets, which is capitalizing on its legacy customer base to build a more enduring subscription-software business.

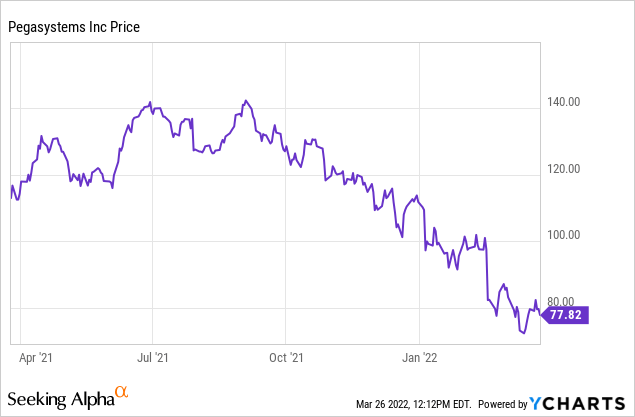

Year to date, shares of Pegasystems have shed 30% of their value, and it’s down roughly ~50% from all-time highs. The most recent catalyst for Pegasystems was its mid-February release of Q4 earnings, where the company missed growth expectations. However, this needs to be read with some context: for a company that is in the midst of a subscription transition, a revenue miss is actually a side symptom of really strong subscription deals.

I remain solidly bullish on Pegasystems. I think this is a company that has become a known quantity in very attractive end-markets, while building up a foundation for a highly profitable business.

For investors who are newer to this stock, here is a refresher on the key bullish drivers for Pegasystems:

- Substantial $110 billion TAM by 2025. There’s a saying that you should never back a tech stock with a small market to play in. This isn’t an issue at all for Pegasystems, which touts a massive $110 billion market opportunity. Supported by a continued drive for business transformation, Pegasystems addresses major markets in CRM and BPM, and its history of execution plus its base of blue-chip customers are strong tailwinds.

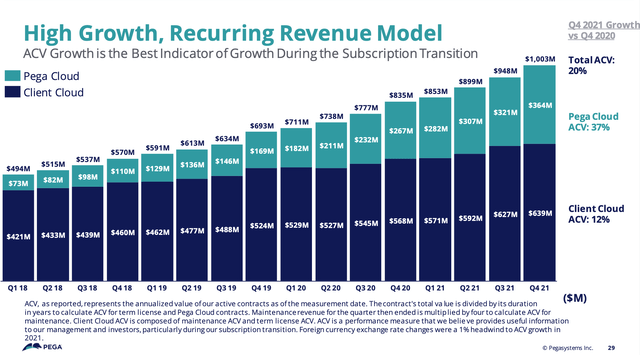

- Continued cloud conversion. Pegasystems is now three years into a cloud transition that began in 2017, a move that the company says typically takes around 4-5 years. The company expects to be fully transitioned by early 2023. Continued buildup of ACV, especially on the Pega Cloud product, can help to shift sentiment in this stock.

- Buildup of cloud gross margins. As Pegasystems’ scale in the cloud has increased, so have its gross margins. Improved profitability and cash flow can help to drive a re-rating in the stock.

- Becoming much more predictable thanks to recurring revenue. Pegasystems has reached >$1 billion in revenue, but it’s also close to reaching $1 billion in ACV (at $948 million in the most recent quarter). The high degree of its contractually locked-in revenue makes the company’s business much more predictable going forward.

- Continued consolidation in the software sector. Many older and slower-growing software companies have found themselves the target of private equity firms, especially if they have built up large recurring revenue bases. Among recent private-equity buyouts of declining software stocks is Anaplan (PLAN), which got acquired by Thoma Bravo for a whopping ~12x revenue.

From a valuation perspective: at current share prices near $78, Pegasystems has a market cap of $6.35 billion. After we net off the $362.8 million of cash and $590.7 million of debt on Pegasystems’ most recent balance sheet, the company’s resulting enterprise value is $6.58 billion.

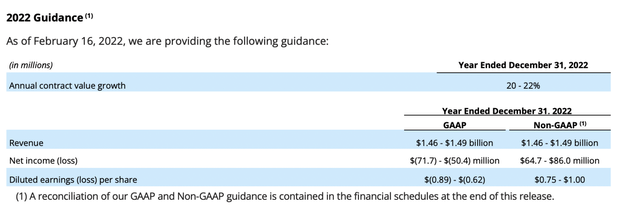

Meanwhile, for the upcoming fiscal year FY22, Pegasystems has guided to $1.46-$1.49 billion in revenue, representing 21-23% y/y revenue growth. This is roughly in line with ACV growth of 20-22% y/y. Note that Pegasystems seems to be hinting that it’s reaching the “maturity” point of its cloud transition, where its ACV growth and revenue growth will be more at par; whereas currently, ACV growth is far outstripping revenue growth as Pegasystems hews off its term license contracts which were a far bigger revenue contributor in FY20.

Pegasystems guidance (Pegasystems Q4 earnings deck)

At the midpoint of this guidance range, Pegasystems trades at just 4.5 EV/FY22 revenue – which is quite a bargain for a company that is projected to achieve ~20% y/y baseline growth while also generating positive pro forma EPS, which is a rarity in the software sector.

The bottom line here: don’t let this stock’s relative obscurity, and the fact that its growth rates are a little depressed right now due to its cloud transition, prevent you from seeing this stock’s merits, especially at a very modest multiple of revenue.

Q4 download

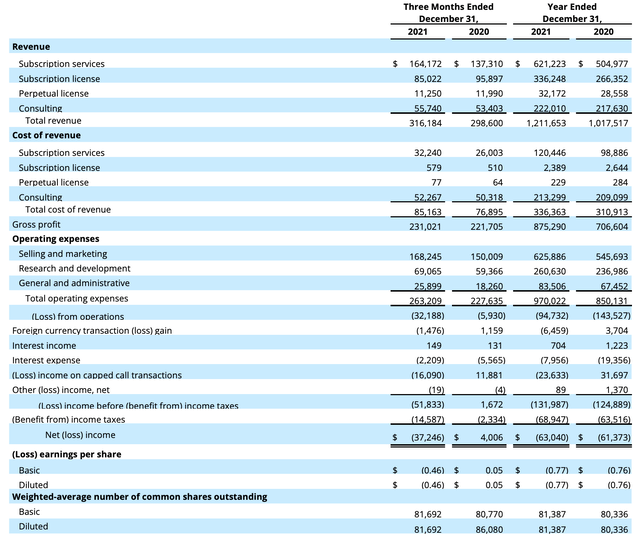

Let’s now go through Pegasystems’ latest Q4 results in greater detail. The Q4 earnings summary is shown below:

Pegasystems Q4 results (Pegasystems Q4 earnings deck)

Pegasystems’ total revenue grew 6% y/y to $316.2 million, missing Wall Street’s total expectations of $342.9 million (+15% y/y) by a nine-point margin. While this sounds rather severe, note that revenue is hard to call for a company in the midst of a subscription transition – where a license customer renewing into a subscription contract can represent a huge headwind to current-quarter revenue growth, even though it’s a positive factor for the business in the long run.

Pegasystems’ CFO Kenneth Stillwell also cautioned against reading only into revenue growth during the Q4 earnings call:

Revenue would have been even higher if not for significant growth of 45% in our term license backlog. As many of you know, the timing of the revenue under our client cloud model is not — it can have some lumpiness between quarters and it’s not as predictable as our Pega Cloud revenue recognition. So it’s important to look at revenue and backlog because it tells a complete story.”

More representative of Pegasystems’ underlying growth, meanwhile, is its progress in ACV. Pegasystems’ total ACV grew 20% y/y to $1.00 billion in Q4, the first time the company’s ACV has ever crossed the >$1 billion mark. Note as well that the $1 billion in ACV it has “locked down” already covers 67% of the company’s high end guidance for next year. As previously mentioned, the company is expecting revenue growth and ACV growth to track more closely in line in FY22.

Pegasystems ACV trends (Pegasystems Q4 earnings deck)

Here’s some further commentary from Stillwell on how the subscription transition has played out since it began in 2017:

The first step was to change the way we sold software moving away from selling perpetual licenses. Before we started the transition back in late 2017, over 50% of our new client commitments were perpetual arrangements.

And for the last couple of years, almost 100% of our new client commitments are now subscription arrangements. Our sales team and our clients have clearly moved from a perpetual to a subscription buying and selling model, which is a very dramatic change in just a few years. It’s also great to see that our revenue growth rate and our ACV growth rate have really converged closely.

When we started the subscription transition, I talked about our revenue growth rate declining in the early years of the transition, which is exactly what happened. And as we moved away from selling perpetual licenses where the license is largely recognized upfront, and as you move to a ratable subscription model, the revenue begins to reverse and normalize as you get closer to the exit of the transition.

Pega’s annual growth — annual revenue growth was flat in 2018, for example, and only grew 2% in 2019, but ACV was growing by over 20% in both of those years. Now when you fast forward to 2021, Pega’s revenue grew 19% in 2021. Our subscription revenue grew 24% in 2021, and ACV grew just over 20%. So largely as we envision this playing out.”

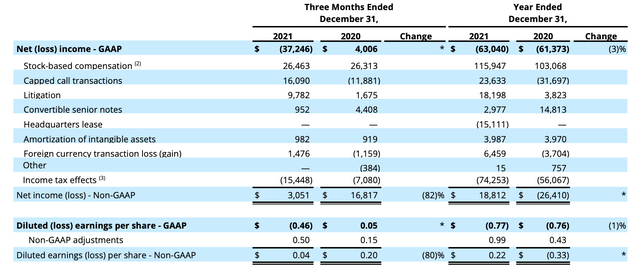

From a profitability perspective, note that Pegasystems is starting to come out of the hole here as well. The company generated $18.8 million in positive pro forma net income in FY21 ($0.22 in pro forma EPS), versus a larger magnitude loss in the prior year.

Pegasystems earnings (Pegasystems Q4 earnings deck)

Profitability will continue scaling next year, with the company projecting 3-4x pro forma net income growth to $65-$86 million in pro forma net income ($0.75-$1.00 in pro forma EPS) in FY22.

Key takeaways

Pegasystems may not be the most exciting stock in the software sector, but this is a solid company building substantial recurring revenue bases in two large markets, CRM and BPM. With the stock down ~30% YTD, and with Pegasystems projecting revenue acceleration as well as earnings expansion in FY22, it’s a good time to buy in.

Be the first to comment