WangAnQi

Introduction

As a dividend growth investor, I am constantly working on increasing my dividend income stream. I may buy shares in companies I do not own to increase my exposure to different segments. Occasionally, I will add to my existing positions whenever I believe the shares are attractively valued. Higher volatility in the markets may be a long-term opportunity for investors.

In this article, I will look at a company from the utility sector. Duke Energy (NYSE:DUK) is a large cap firm that enjoyed long-term stability. Utilities outperform during times of uncertainty as they are often a local monopoly. As investors are looking for a haven, I will examine if I should add more shares to my existing position as I look for stability.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows Duke Energy operates as an energy company. It operates through three segments: Electric Utilities and Infrastructure, Gas Utilities and Infrastructure, and Commercial Renewables. The Electric Utilities and Infrastructure segment sells electricity in the Carolinas, Florida, and the Midwest. The Gas Utilities and Infrastructure segment distributes natural gas to natural gas customers and owns, operates, and invests in pipeline transmission and natural gas storage facilities. The Commercial Renewables segment acquires, owns, develops, builds, and operates wind and solar renewable generation projects.

Fundamentals

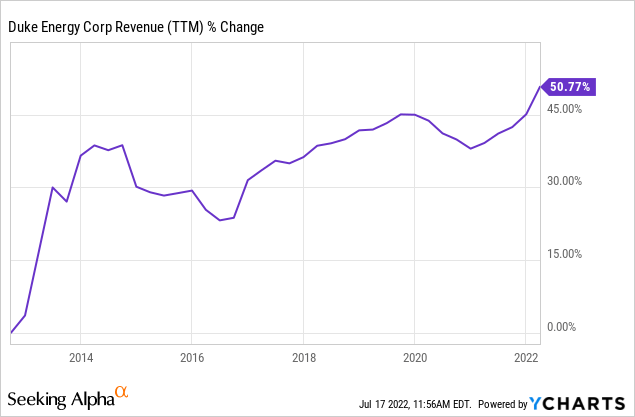

Revenues of Duke Energy have increased by 50% over the last decade. Duke Energy increases its sales using price increases (regulatory approval is sometimes needed), demographic trends (the company operates in growing states) that increase energy demand, and acquisitions to expand the scope and enjoy economies of scale. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Duke Energy to keep growing sales at an annual rate of ~4% in the medium term.

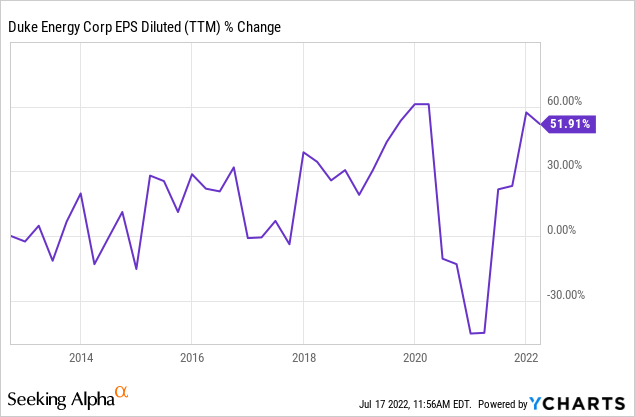

The EPS (earnings per share) has been growing similarly to the revenues. Over the last decade, the company’s EPS grew by 52%. The EPS growth is attributed mainly to sales growth. It outpaced sales growth despite the higher number of shares as the company became more efficient and improved its margins. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Duke Energy to keep growing sales at an annual rate of ~6% in the medium term.

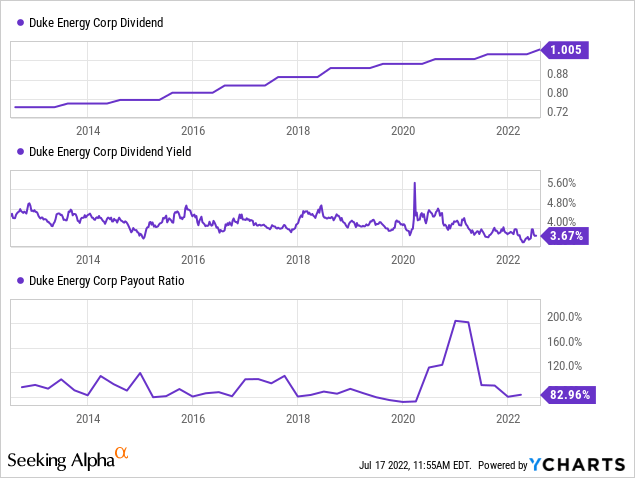

The dividend is usually an essential feature of a utility company. These companies are limited in their growth, and their most prominent way to reward shareholders is their dividends. Duke Energy is paying 83% of its GAAP earnings and 75% of its non-GAAP earnings in dividends. The figure may seem high, but the defensive nature of the business allows it to be sustainable. The company pays a 3.75% dividend following the latest increase. It has been increasing the payout annually for more than a decade.

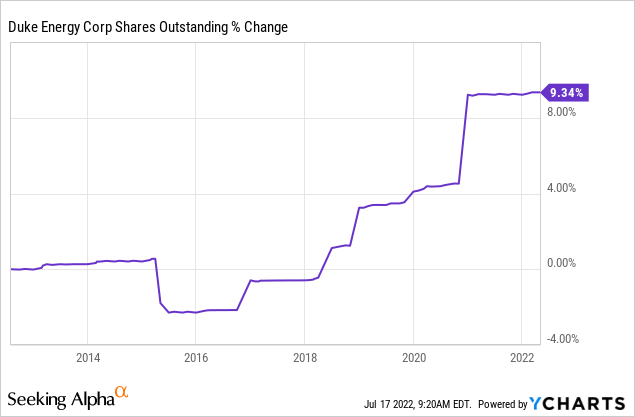

In addition to dividends, dividend growth companies use buybacks to return capital to shareholders. Buybacks are beneficial for growing companies as they support EPS growth. Duke Energy has been buying back shares in the last several years. The company, though, didn’t dilute the shareholders significantly. The shares are used to compensate employees and for acquisitions. Buybacks can be a plus, but the high payout ratio leaves little room for them.

Valuation

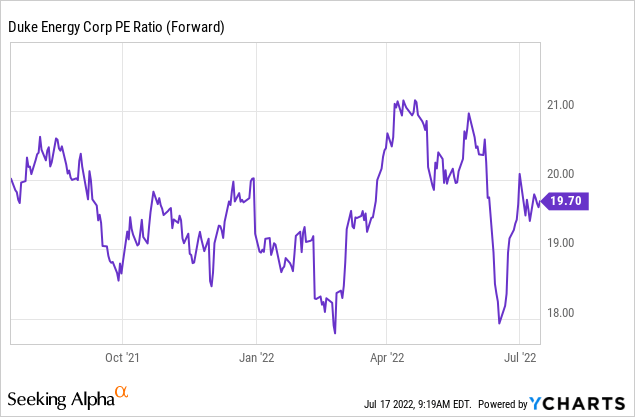

The P/E (price to earnings) ratio of Duke Energy is 19.7 when considering the forecasted earnings for 2022. It is roughly the same valuation we saw a year ago and in line with the average valuation of Duke Energy in the past year. Paying almost 20 times earnings from a company that grows at roughly 6% annually seems a bit rich. The market is granting premium valuation to shares of Duke for their stability and consistency in volatile times.

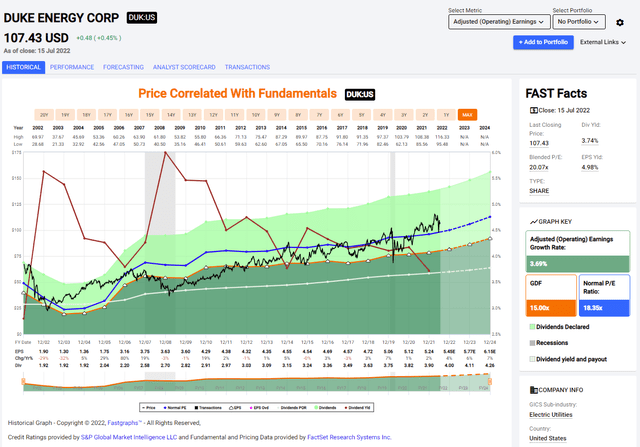

The graph below from Fastgraphs emphasizes that Duke Energy is trading for a light premium. Over the last two decades, the average P/E ratio was 18.35. The current P/E ratio is slightly higher than that average. The analysts expect the company to grow faster than the average. Therefore, while there is a small premium, I believe it is justified, and shares are reasonably valued.

To conclude, Duke Energy is a highly stable company. Its sales and EPS are growing steadily, and the company uses its earnings to reward patient shareholders with dividends. The safety and stability of Duke Energy are appealing to investors. Therefore, despite the higher volatility, the company is trading slightly above its average valuation, making it reasonably valued yet not unusually attractive.

Opportunities

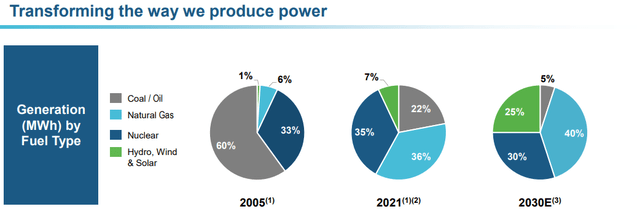

The world has started recognizing nuclear energy as a green way to produce electricity. The European Union voted to treat atomic energy as green energy. It is excellent news for Duke Energy which generates 35% of its energy using nuclear power. Their transition towards renewables can now focus solely on polluting coal. The company’s expertise when it comes to nuclear energy can also be used both domestically and abroad.

The second growth opportunity is the completion of the transition away from coal. The company focuses on renewable energy and plans to transition its entire coal power plants to renewable energy facilities. This change will prepare Duke Energy for the future. It will allow it to increase prices to justify the investment. It will make the company favorable to investors who distance themselves from highly polluting fossil fuels such as oil and coal.

Another opportunity is the company’s stability for the long term. The company needs a very narrow margin of safety. The company derives most of its revenues from the regulated segments- electricity and natural gas. Therefore, there is a minimal risk. Investors may keep flocking to havens like Duke if we enter a recession, and it may be a short-term catalyst for share price appreciation.

Risks

The limited upside is the most significant long-term risk for investors in Duke Energy. There is not much room for long-term multiple expansion at the current valuation. Investors will have to rely solely on future growth. While 6% is decent, the growth is limited and capped as any price increases rely on the regulators’ approval in the states where Duke operates.

Inflation is another risk for the company in the short and medium term. The increase in prices of basic materials used to produce energy and the rise in labor costs will pressure expenses upward. The company must get regulatory approval to increase prices, and as regulators are concerned with the public’s reaction, they may attempt to delay price increases or limit them.

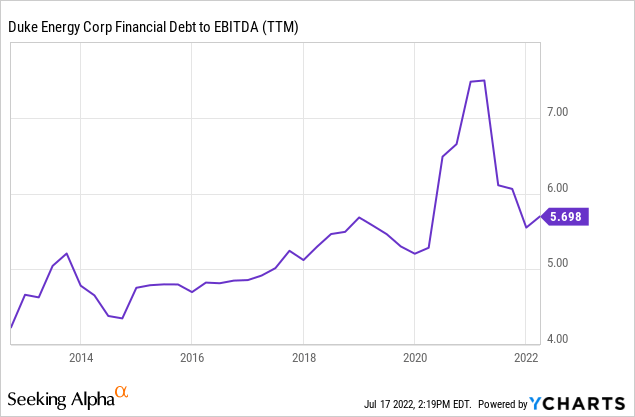

Interest rates are another risk in the medium and long term. Utility companies rely heavily on debt; over the last decade, the leverage of Duke Energy has increased significantly. Higher rates will mean new projects will be more expensive, and the current debt will bear higher interest expenses when new debt is taken to pay older debts. It, too, will pressure the EPS as the company attempts to grow.

Conclusions

Duke Energy is a great company. The company has been a remarkably stable investment over the last two decades. Investors saw sales and EPS increasing steadily, and the company has rewarded its investors with dividends. The company has several growth prospects revolving around greener energy and renewable projects.

However, there are also several risks to the investment thesis. The higher rates and the inflation may hurt the EPS, and regulators cap the long-term growth. Still, the current valuation doesn’t leave much room for multiple expansions in the future, and while the company is fairly valued, the upside is somewhat limited. Thus, I believe that investors should follow Duke Energy and add if the price dips, but at the moment, it is a HOLD for me.

Be the first to comment