Marina_Skoropadskaya

Summary

I recommend a buy rating on Velod3D (NYSE:VLD). With the transition from subtractive manufacturing [SM] to additive manufacturing [AM] in the industrial manufacturing industry, companies in the AM industry have a huge business opportunity.

By focusing on the production of very specific parts that are hard to make and can’t be made cheaply, VLD stands to gain by being a monopoly and grabbing a huge market base before any competition shows up.

Company overview

VLD is a digital manufacturing company that uses AM to produce complex, mission-critical parts. VLD’s full-stack hardware and software solutions, which are based on their patented power bed fusion [PBF] technology, are so advanced that their competitors that use legacy solutions can only copy them by re-designing their production lines or adding to their assembly setup.

VLD’s products have the capability to design and produce metal parts that had previously been considered impossible to produce with AM. VLD’s products provide for ease of design and production. They are used by customers in the defense, aviation, space, energy, and industrial markets.

VLD’s all-rounded hardware and software AM solutions are sold via two models:

- 3D printer sale transaction: structured as a fixed price for the whole system.

- Recurring payment transaction: split into two, a leased 3D printer transaction and a sale & utilisation fee transaction.

For more information about the industry, refer to VLD S-1.

Several benefits to manufactures from additive manufacturing

Utilizing AM in direct product manufacturing grants businesses a number of benefits. The benefits are directly caused by:

- Supply chain efficiencies,

- End-to-end sourcing control of inputs, and

- Acceleration of the conceptualization-to-production cycle.

VLD claims that their technology can deliver the following unique features that can’t be delivered by other AM solutions:

- VLD’s solutions allow for the design of high-value metal parts aiming at performance and optimal functional efficiency. This has not been possible in previous technologies, where the complexity of a part’s design would result in a higher production cost.

- VLD’s solutions provide a shortcut to qualify, validate, and produce parts that otherwise could take a long time to produce. By doing so, making parts on demand is made easy and possible. This in turn reduces the need to have stock of the parts in different locations, thereby reducing the need for stock. This lowers inventory management costs and presents a higher potential cash flow.

- Consolidation of thousands of metal parts into a simple, complex printing assembly reduces labor costs, saves time that would have been used for final part production, and also eliminates post-processing costs.

- Subtractive manufacturing methods produce more waste material than additive manufacturing. This means that only the required amount of raw materials is transported, resulting in reduced transport costs. Additive manufacturing allows for complex designs with reduced part weights. Both of these features combined are of great value to VLD’s customers in the space, defense, aviation, energy, and industrial markets.

VLD targets markets that has less competition

VLD does not compete in markets whose solutions can be provided by existing competitors. They focus on markets where only the strongest solutions are required. This ensures they only deal with high-end, long-term clients with little to no competition.

VLD has targeted customers who need highly specific and complex parts. These parts can only be produced by VLD’s PBF technology, not the competitors’. The production processes of VLD’s competitors require support for the complex internal geometries of these highly specific parts. Likewise, resorting to traditional manufacturers will result in low performance parts produced at a high cost and a longer waiting time.

Land and expand strategy to extend growth runway

VLD adopts a two-step process to onboard clients and boost customer relationships:

- VLD validates their technology with the customer before integrating it into their designs and production processes.

- After successful validation, VLD’s sales and engineering personnel collaborate with their customer’s equivalent to identify how VLD’s technology can add maximum value to the customer’s process and product.

Combined, both steps help the customer better understand the potential and freedom that VLD’s product has to offer. Customers often fully integrate VLD’s technology into their processes, which gives VLD a chance to sell them something else.

In addition, small groups of sales and engineering personnel can serve a large number of machines through collaborative efforts. By integrating their technology into their customers’ processes, VLD is able to serve a huge, uncontested market.

Proprietary PBF technology

VLD’s technology lives up to the promise of AM. Their technology gives customers freedom to design complex products with high performance. This technology also enables Assembling multiple metal parts into a stronger, lighter, better-performing, single part at a relatively lower cost than the traditional metal manufacturing techniques.

Other AM solutions are limited compared to VLD’s. This is because they use internal support to enable production of metal parts with complex internal geometries. VLD’s proprietary PBF can produce these metal parts without using internal support. Manufacturers resort to AM for high performance products because products made by AM have a better performance, are produced at a lower cost, and can be produced within a short time.

VLD’s solutions allow for the production of high-value, low-volume spare parts on demand. This directly translates to lower need for inventory. With all these factors, VLD controls an uncontested market in which they are well positioned to serve.

One-stop shop

VLD’s solutions are easy to integrate with customers’ operations. This makes it easy to adopt new customers or install additional systems for existing customers. The ready-to-use nature of their products also allows for a land-and-expand strategy. A fully dedicated engineer is available for several weeks around the time of installation to inform customers on how to use VLD’s products and find out how these products can best serve the customer.

After installation, the customer receives occasional support from VLD’s sales and engineering staff. This allows for the staff to be allocated to new customers, therefore allowing VLD to scale their operations faster.

3Q earnings

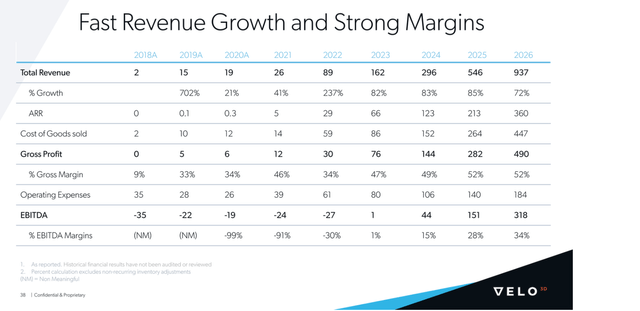

Overall, I think VLD is still on the right track. While not as meaningful in the overall scheme of things, 3Q revenue continued to grow >100% to $19 million, and this was supported by a strong backlog of demand (cumulatively $66 million with 3Q bookings of $27 million). All of this points to increased momentum in acquiring new customers and market opportunities, particularly for the two leading European aerospace OEMs.

What I would need to point out is that the focus is really on the long-term, and whatever happens in the short term is high volatility that investors need to bear. For instance, the supply chain disruption issue is a big thing, and it has impacted the progress of VLD production. While management mentioned that they have secured all the required parts for 4Q, the challenge remains for next year. The direct impact of this is the delay of first commercial production (which is what a lot of investors are focusing on, in my opinion, as this would delay the timing of all future cash flow).

In terms of guidance, VLD continues to expect revenue in the range of $75 million to $80 million.

Valuation

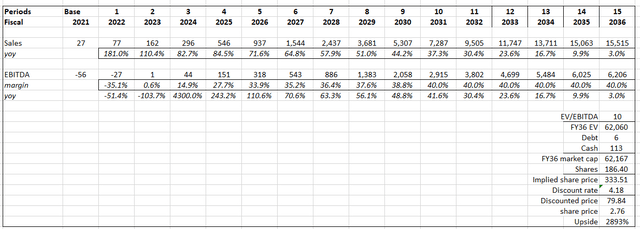

I believe the current valuation does not reflect VLD’s long-term potential value. I expect VLD to make $15.5 billion in sales in FY36, giving it a market cap of $62 billion and a stock price of $335 in FY36 or $80 after discounting by 10%.

Assumptions:

- Until FY26, sales will trend as predicted by management, but thereafter they will slow to keep pace with inflation over the next decade. Once VLD reaches maturity and the easy wins have been taken, growth should decelerate, according to this theory.

- Similar to revenue, I used management’s EBITDA estimates for the first few years, and assumed that the margin would slowly move up to 40% over the years due to further cost rationalization.

The most important point to emphasize is that I believe management would be able to meet their targets. According to my analysis, investors have a window of opportunity because the market is not yet reflecting any of these potential benefits.

Risks

Adoption for 3D printing may not materialize

Even though the industrial manufacturing market is shifting toward AM, it is still saturated with conventional manufacturing processes. VLD may not be able to properly convince potential customers of the benefits of AM, thereby lowering AM’s market acceptance. With low acceptance, VLD’s level of sales will dip, directly affecting their operating results.

Potential for more competition

VLD’s competitors are continually researching, designing, and developing other products and services that may render VLD’s products obsolete or uneconomical. The AM industry is highly fragmented and competitive.

Conclusion

The current valuation presents an amazing opportunity for investors to take advantage of a huge mispricing. In spite of the high level of competition in the AM industry, VLD has positioned itself as unbeatable by offering an all-round service to its customers. By involving a sales team and finding out how best its solutions can be of value to customers, VLD positions itself as a unique product and service provider in the AM industry. Incorporating their technologies with those of the customers also guarantees a long-term business relationship.

Be the first to comment