Ольга Симонова/iStock via Getty Images

Amazingly, Verano Holdings (OTCQX:VRNOF) has only gotten cheaper in the last quarter as the cannabis business continues to develop. The launch of recreational cannabis in New Jersey was just the first step in the next move higher. My investment thesis remains ultra Bullish on the multi-state operator (MSO).

Back On The Rebound

As with most MSOs, the winter months were rough for the cannabis company. High inflation pressured consumer wallets and new state markets failed to open.

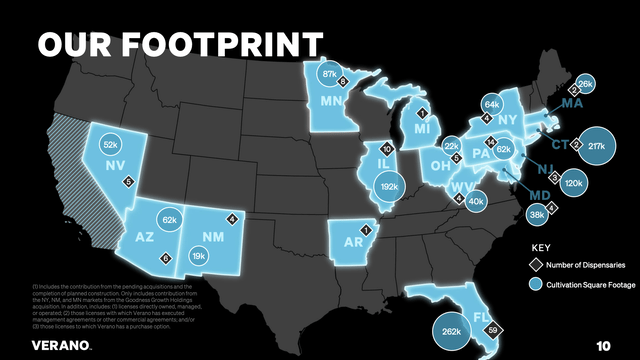

Finally, the U.S. cannabis market returned to growth in April with the official launch of recreational cannabis in New Jersey. Verano is one of the best positioned MSOs with licenses in key Northeast markets opening up recreational cannabis in New Jersey, New York and Connecticut.

For Q2’22, Verano reported revenue grew 12% to $224 million. The MSO had seen revenues peak at $211 million back in Q4’21 after reaching $207 million in Q3’21.

Verano reported Q2’22 adjusted EBITDA of $76 million and $163 million for the 1H of the year. Adjusted EBITDA was down sequentially as the company ramps up operations for the launch of the New Jersey market and future launches in New York and Connecticut.

Source: Verano Q2’22 presentation

My warning from a while back highlighted how the MSO would face this normalized pain after having a relatively low cost structure and needing to spend to move into these large markets in the Northeast. According to CEO George Archos on the Q2’22 earnings call, the company spent on far more than just improving operations:

In addition to operations, and I will touch on this in more detail later on, we continue to beef up our back office capabilities. This includes significant investments in accounting, financial planning and analysis, as well as in our securities legal practice. In light of all these investments, we still produce a strong adjusted EBITDA margin of 34%, which I believe is not only impressive given through industry headwinds, but also given the challenging macroeconomic environment as a whole.

In fact, Verano spent $11 million on additional SG&A expenses in the quarter to cover the higher costs in the corporate office described above along with beefing up staff in New Jersey with the recreational cannabis launch. The company is now spending more normalized levels causing adjusted EBITDA margins to dip back to more sustainable levels.

$1 Billion Business

The market can now more fully value Verano for the next growth phase with 2 of the New Jersey stores opening up in late April followed by a likely launch in New York in early 2023. The MSO is already running at a nearly $1 billion annual sales rate based on Q2 numbers and the additional stores opened in Q3 so far.

Since the end of Q2, Verano has launched the Zen Leaf Neptune store in New Jersey in late July and the company has now expanded Florida by another 11 stores to reach 59 open dispensaries in the state. In addition, the MSO has opened stores in West Virginia and Maryland to bring the total store count to 114 after only crossing the 100-store milestone during Q2.

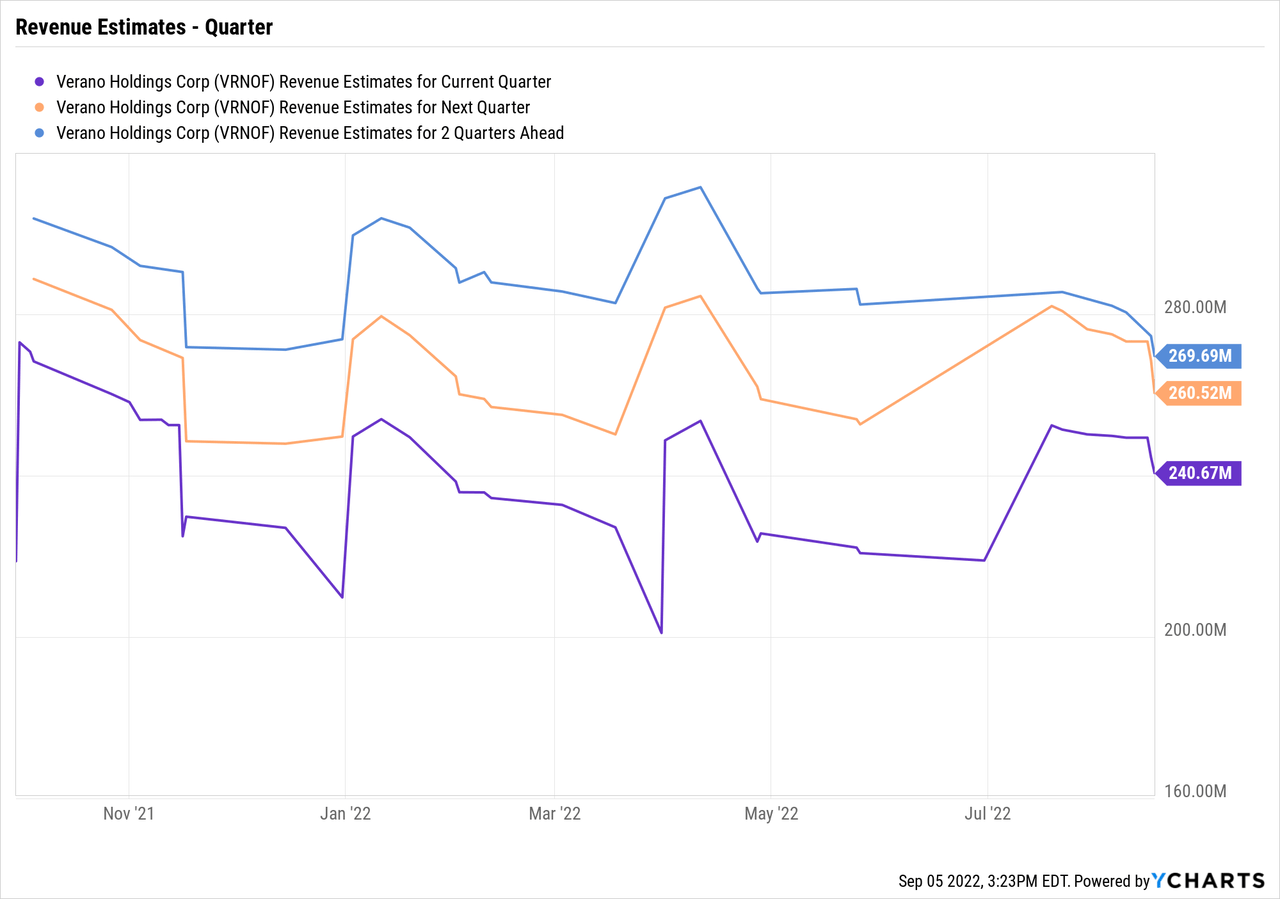

These additional store openings set up Verano for solid growth before the benefit of any other recreational cannabis state launches. Analysts currently have Q3 revenues jumping to $241 million followed by another $20 million boost in Q4 to end the year at $261 million in quarterly sales.

These estimates appear very conservative considering revenues were up $21 million sequentially on just having the 2 New Jersey stores open for just over 2 months each. The New Jersey stores were open a combined 4 months during Q2 and the stores will be open 8 months during Q3.

The stock has a market cap of $2.2 billion based on 331 million shares outstanding. Again, the Verano is exceptionally cheap at 2x sales for the current year and far below such multiple with a 2023 revenue target of $1.2 billion.

The company had 34% adjusted EBITDA margins in Q2 and the MSO would generate over $400 million in 2023 EBITDA based on maintaining those margins next year. The stock only trades at 4x 2023 EBITDA targets which remains an incredibly low target with 27% revenue growth forecast for next year.

Verano does have $403 million in total debt and a net debt position of $310 million leading to $12 million of quarterly interest expenses. While adjusted EBITDA is an attractive measure for valuing MSOs due to irrational taxes, SBC and amortization charges, interest expenses are real costs.

The company would only produce ~$350 million in adjusted profits when including interest expenses on the large debt, though these debt costs would normalize at far lower levels when cannabis is legalized and Verano has access to the banking system where loans for a high EBITDA producing company are far below the current 12% average rate of Verano.

Takeaway

The key investor takeaway is that Verano is crazy cheap here and investors are stealing shares buying the stock at $6.50. The U.S. cannabis sector still has a large catalyst via federal legalization providing access to stock exchanges and the banking system, but the stock is far too cheap here. Verano could double and triple from here and still trade at a low multiple of EBITDA for the growth rates.

Be the first to comment