Roman Barkov

The natural gas market has had an extremely volatile year as production slowly recovers from lockdown-era decline while the E.U. loses access to Russian gas. U.S. natural gas prices are near the highest levels they’ve been since the 2000s. However, E.U. natural gas prices are nearly a magnitude higher at an equivalent price of around $87 per MMBTU compared to $8.4 per MMBTU in the U.S. European gas prices surged 30% in recent days as Russia admitted it planned to halt all Nord Stream 1 gas flows until Western sanctions are lifted. The E.U. has enacted a 15% gas-for-power cut plan but has only managed a 2.2% reduction thus far and has seen growing protests and discontent as electricity bills surge.

E.U. gas prices are currently over 15X higher than they were in mid-2020 and are far above U.S. prices. To many traders, this has made the U.S. natural gas futures ETF (NYSEARCA:UNG) an interesting choice as it would seem U.S. prices should eventually re-converge with E.U. prices. Of course, natural gas can only be exported through liquefication, and the U.S. has nearly maximized its LNG production capacity. U.S. gas exports to Europe are stalling, and, for this reason, I was slightly bearish on natural gas months ago. However, my negative outlook on natural gas has been offset by larger-than-expected supply cuts from Russia, lifting both E.U. and U.S. natural gas prices.

The demand for U.S. natural gas exports is likely to remain strong, but LNG capacity won’t rise until late 2023, so the export level should not rise much higher. That said, exports should increase slightly around November as the Freeport LNG plant is finally restarted after its June explosion. U.S. natural gas storage levels are historically low based on the current season, and domestic production is no longer rising. U.S. natural gas consumption is near record levels and has grown to extremes on the west coast as its power grid falters on record A.C. demand. These factors are undoubtedly supportive of high natural gas prices, but in my view, there will need to be further bullish catalysts to support an even higher move in natural gas. As such, evidence suggests the popular natural gas ETF may decline in value over the coming weeks.

Natural Gas Production and Consumption Peak

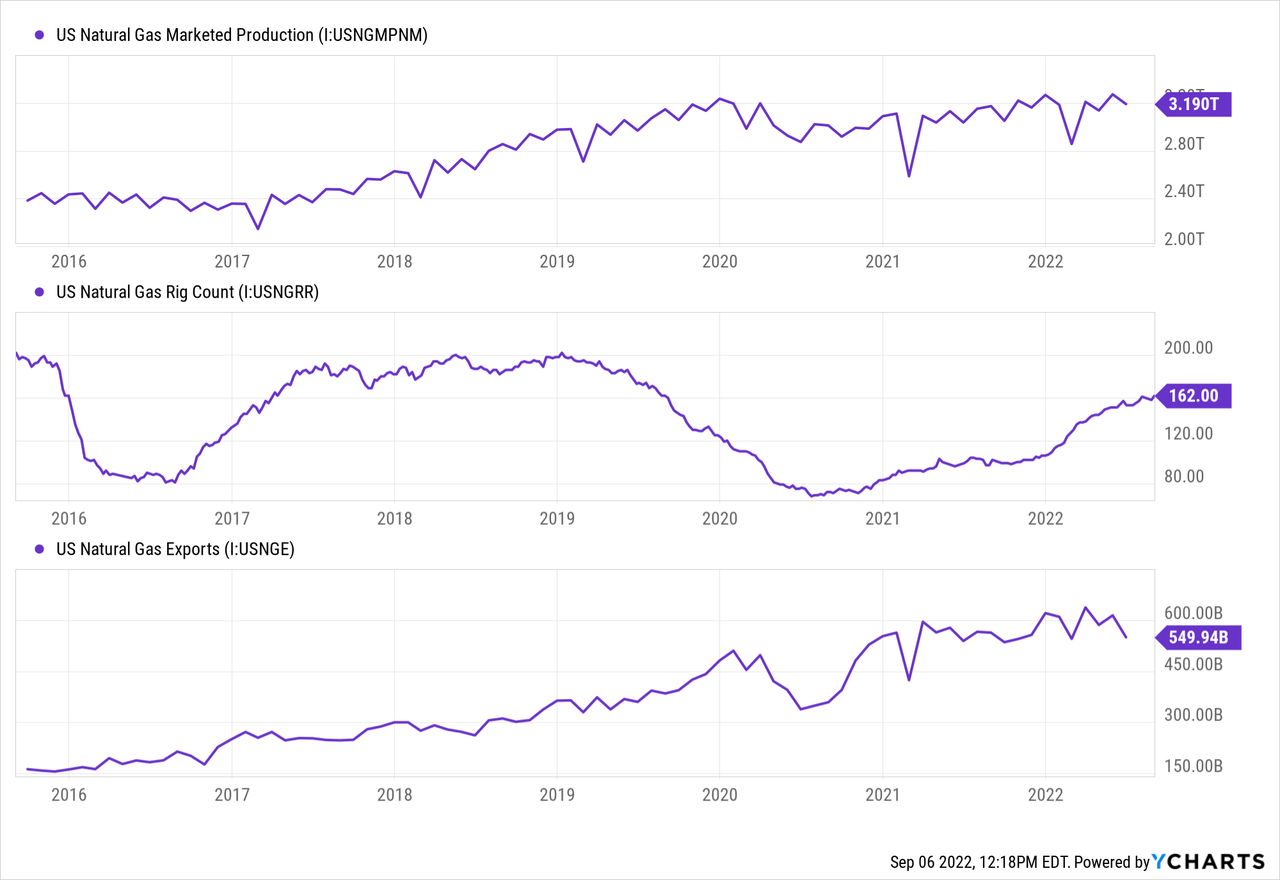

Natural gas prices rose over the past two years primarily due to significant rig shutdowns in 2020, leading to supply being chronically below demand. Over the past year, U.S. natural gas production (though not crude oil) has returned to pre-pandemic levels, but the market has still been strained by growing export demand. The U.S. natural gas rig count has slowed but is still slowly trending higher, indicating natural gas production may rise slightly. See below:

Natural gas wells typically face significant production declines during the first two years after drilling, so the drilling rate must be relatively high for production to be constant. Notably, much of the 2021-2022 production recovery has not come from newly drilled wells but from competing wells drilled before 2020. With this in mind, I estimate that the natural gas rig count must be over 150 for production to grow.

Looking forward, the current natural gas rig count suggests production may rise and is more likely to remain flat. At the same time, U.S. natural gas exports appear unlikely to grow and have reversed much of 2022’s gains due to the Freeport LNG plant shut-off. Even after that plant returns online, I doubt it will cause U.S. natural gas exports to rise too dramatically as capacity is limited.

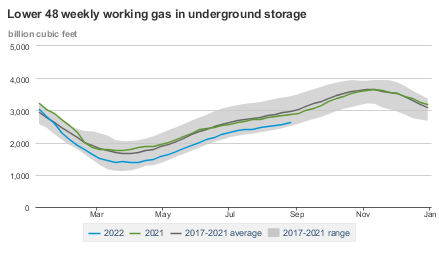

While there are signs of strengthening natural gas production, inventory levels are low by historical standards. U.S. natural gas inventories in underground storage are near the lowest seasonal levels within the past five years. See below:

E.I.A Natural gas in underground storage (Energy Information Administration )

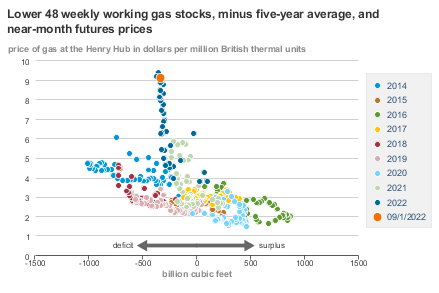

The current storage deficit is notable and implies that inventory levels may decline significantly this winter. That said, prices are still abnormally high compared to the deficit level. In 2017, the shortage was slightly more significant than today’s, and natural gas was only $2-$3 per MMBTU. The shortfall was over twice as large in 2014, and gas was below $5 per MMBTU. See below:

Natural Gas Price vs. Storage Deficit (Energy Information Administration)

There was a solid linear inverse trend between natural gas prices and seasonally-adjusted storage levels between 2014 and 2021. This year, natural gas prices have risen to exceptional highs of $9-$10+ while the deficit, though notable, is not as extreme as it has been. Using the normal relationship, we expect natural gas prices to range from $2-$5 per MMBTU based on today’s ~400 BCF deficit.

Can Natural Gas Sustain Highs?

The typical factors that drive the price of natural gas do not necessarily support today’s price level. Demand is high and is supported by exports, but neither is expected to rise higher until 2023-2025 when more LNG capacity is developed. Production has stagnated, but the rising rig count and large profit margins generated on natural gas support some moderate production growth. Natural gas inventories are low by historical standards but not low enough to justify a $9 per MMBTU gas price.

Undoubtedly, the U.S. natural gas price is supported by the extreme rise in prices in Europe, which will drive long-term export growth if Russia continues to withhold exports. In my view, it is highly unlikely Russia will withhold exports well into 2023 since Europe’s energy crisis is becoming large enough that many people in Europe may not be able to heat homes this winter without Nord Stream 1 gas. Given there are already large protests in Europe due to electricity prices, I have doubts regarding the E.U.’s ability to maintain its stance on Russia without risking a humanitarian crisis. While this situation is temporarily bullish for Europe’s natural gas price, the U.S. market is isolated by stalled LNG exports.

Based on today’s situation, I do not believe U.S. natural gas prices are justified above $7 per MMBTU. In my view, natural gas may decline as the market realizes the relatively low likelihood of the natural gas crisis spreading to the United States. However, even at $8-$9 per MMBTU, natural gas is far cheaper than it was in the 2000s when it was closer to $15 from an inflation-adjusted standpoint. In the long run, I believe natural gas prices will remain higher than they have been over most of the past decade as the shale patch’s growth slows and reverses, but for now, there are few solid bullish catalysts.

What This Means for UNG

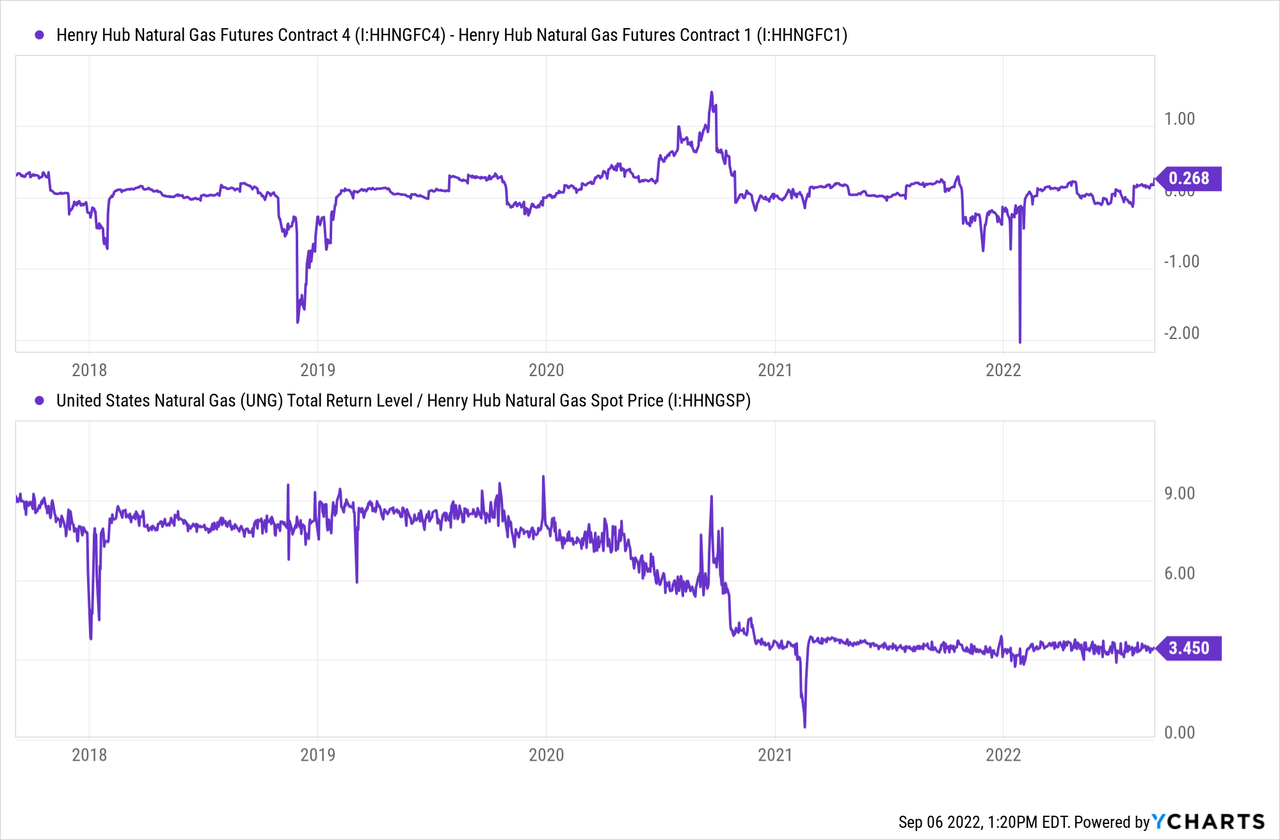

The United States Natural Gas Fund is a popular way to trade natural gas futures without using a derivatives account. The fund closely tracks the price of natural gas futures but usually decays in value over the long run due to “contango” in the natural gas curve. The decay rate of UNG rises as the longer-dated natural gas futures exceed spot prices. This relationship can be seen in the difference in returns between UNG and the natural gas spot price:

From 2020 to 2022, the natural gas market was generally in an acute shortage that limited contango in the futures curve, keeping UNG from experiencing significant decay. However, in recent months as the export level has slowed and production has improved, the natural gas market has returned to a more apparent state of contango. As such, UNG’s decay pace may accelerate, exacerbating potential losses.

Overall, I remain moderately bearish on UNG and believe it will decline in value from its current price. Natural gas may rise much higher if U.S. export capacity improves without renewed Russian flows, but that would likely not occur until late 2023, and UNG will face significant decay by then. One way for UNG to rise higher in the short-run would be for a surprise shutdown or decline in U.S. production, which, at this time, seems unlikely. It is also possible this winter is frigid and, combined with lower storage levels, could result in a severe, temporary shortage. That said, unless the situation changes, UNG’s bearish catalysts appear to outweigh these bullish potentials.

Be the first to comment