Dilok Klaisataporn/iStock via Getty Images

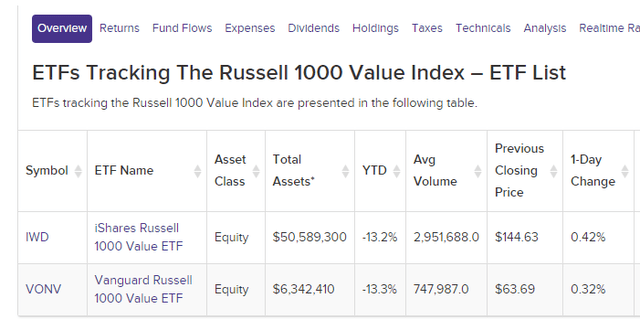

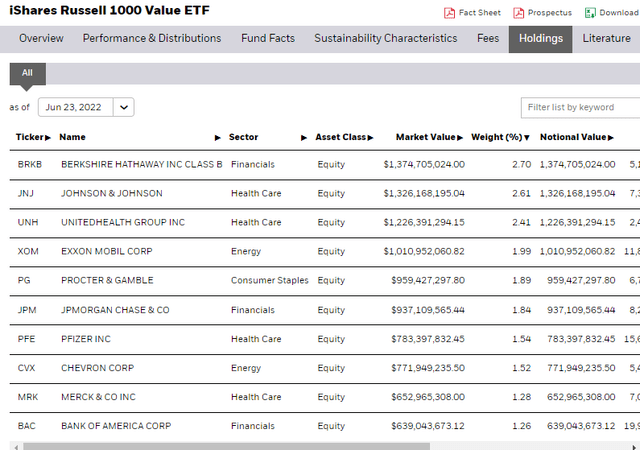

Friday’s Russell reconstitution made for a lot of headlines. Stocks rallied big, maybe due in part to the massive reshuffling of stocks. Among the most significant changes were those made in the Russell 1000 Value index. The primary ETF tracking that part of the style box is the iShares Russell 1000 Value ETF (NYSEARCA:IWD). According to iShares, the ETF seeks to track the investment results of an index composed of large- and mid-capitalization U.S. equities that exhibit value characteristics.

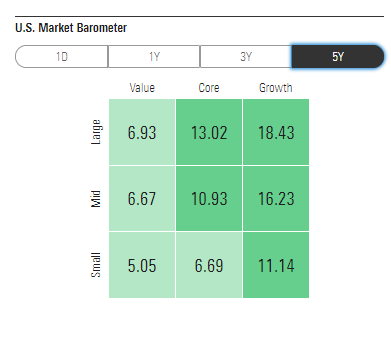

Large-cap value has drastically underperformed large-cap growth over the past five years, according to Morningstar. Of course, that doesn’t make it a relative buy on its own.

Large-Cap Value’s Major Underperformance Vs. Large-Cap Growth

Morningstar

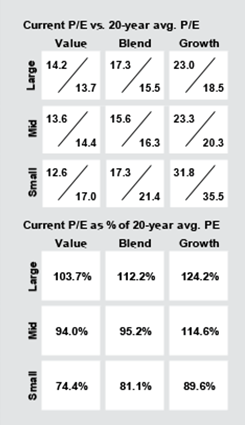

Large-cap value is about on par with its historical P/E ratio, but large-cap growth has a relatively high P/E ratio, according to J.P. Morgan Asset Management. So neither is a screaming buy here based on that metric.

Large-Cap Value Priced In Line With Its Long-Term Average

J.P. Morgan Asset Management

The iShares play on blue-chip domestic stocks has about nine times the AUM of the Vanguard Russell 1000 Value ETF (VONV).

IWD: Major Large-Cap Value Fund

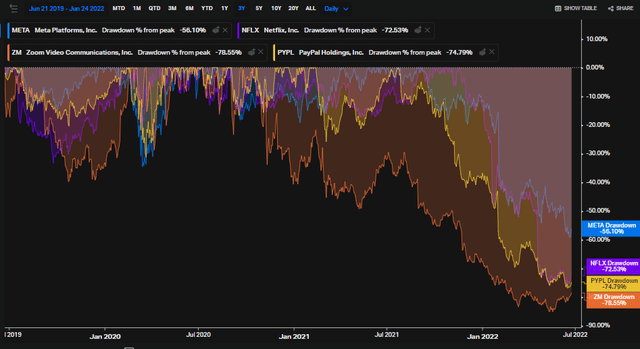

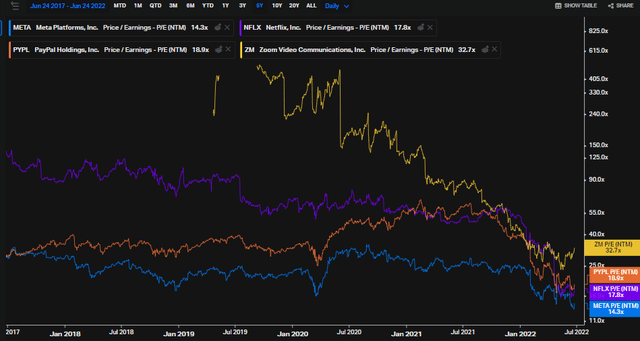

Going forward, according to the Wall Street Journal, Meta (META), Netflix (NFLX), PayPal (PYPL), and Zoom (ZM) are just some of the high-profile and once-high-flying stocks to be added to the IWD portfolio. This might cause some hand wringing among true value investors as they might scoff, saying these kinds of companies do not exhibit classic value characteristics. But consider that Meta’s free cash flow yield is above 8% right now according to Koyfin Charts.

Meta, Netflix, PayPal, Zoom Stock Drawdowns

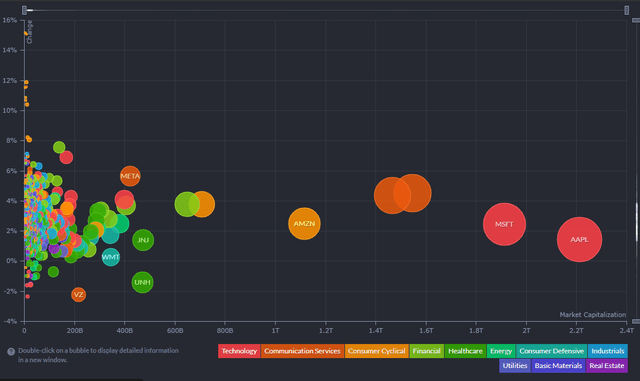

Another take is that this could be a contrarian indicator. Perhaps sentiment has turned too bearish on many once-growthy companies. Importantly, though, the large market caps of, say, Meta and PayPal, will pose a significant weight in IWD. Meta should rank in the top five biggest holdings based on current market caps.

IWD Portfolio Prior To The Russell Value Index Reconstitution

S&P 500 Market Caps: Meta About The Same Value As JNJ, UNH

Four Horsemen P/E Ratios Have Cratered. Meta Trades At A Discount To The S&P 500’s P/E

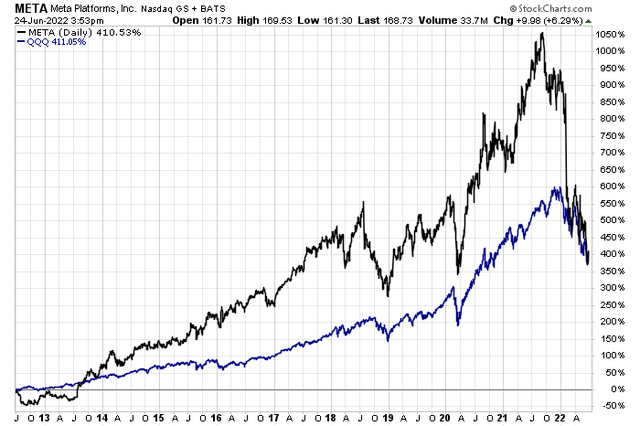

Remarkably, Meta is now underperforming the Nasdaq 100 ETF (QQQ) over the last decade. Recall that its shares went public in May 2012. The stock had revenue of around $5 billion back then, but now sports annual sales that top $110 billion, according to company data.

META Has Given Back All Of Its Outperformance Vs QQQ

The Technical Take: IWD

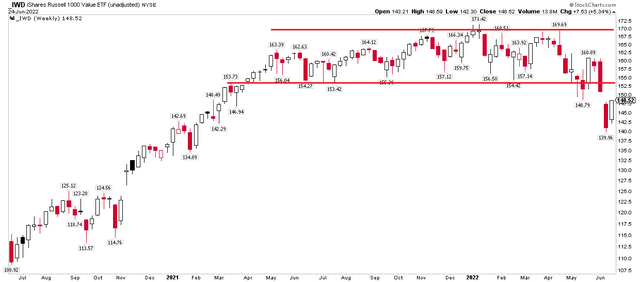

I think these are contrarian buy signals for the four aforementioned stocks. That means IWD might continue to work, but the charts suggest caution is warranted. The weekly chart of IWD shows that there’s a tremendous amount of bearish overhead supply in the $153 to $170 range.

IWD: Bearish Overhead Supply $153-$170

The Bottom Line

When it comes to the new-school large-cap value, I would rather own the new kids on the block: Meta, Netflix, PayPal, and Zoom rather than IWD right now. Weighing all the pieces of evidence and risks, a bullish contrarian buy on those four horsemen looks better to me than the bearish overhead-supply-laden IWD chart.

Be the first to comment