jetcityimage/iStock Editorial via Getty Images

Introduction

As a dividend growth investor, I am constantly looking for opportunities to increase my income stream. Sometimes I add to my existing positions in my dividend growth portfolio, while other times, I am adding new positions to my portfolio. The current volatility in the market, and the S&P 500 in a bear market, leave room for some more opportunities.

The consumer discretionary sector is an interesting sector at the moment. Investors are concerned that the economy will slow down, resulting in less spending. The discretionary spending will be the first to suffer, thus some major names such as Lowe’s (LOW) have suffered. In this article, I will look into another player in this sector: Domino’s Pizza, Inc. (NYSE:DPZ).

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, Domino’s Pizza operates as a pizza company in the United States and internationally. It operates through three segments: U.S. Stores, International Franchise, and Supply Chain. The company offers pizzas under the Domino’s brand name through company-owned and franchised stores. It also provides oven-baked sandwiches, pasta, boneless chicken and chicken wings, bread and dips side items, desserts, and soft drink products.

Wikipedia

Fundamentals

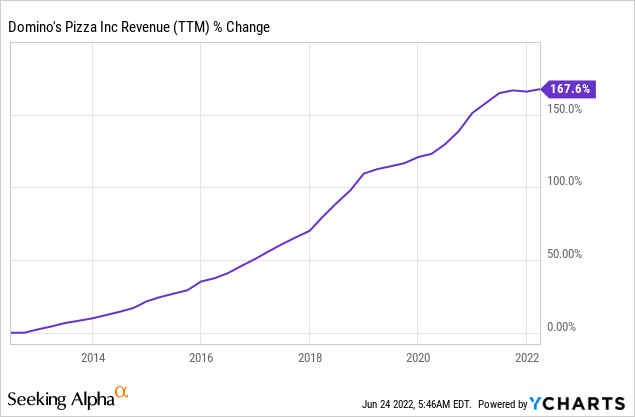

Over the last decade, Domino’s Pizza has shown significant growth when it comes to sales. Sales are up 167% in the past 10 years as the company opened new stores and improved same-store sales. The growth has been mostly organically. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Domino’s Pizza to keep growing sales at an annual rate of ~6% in the medium term.

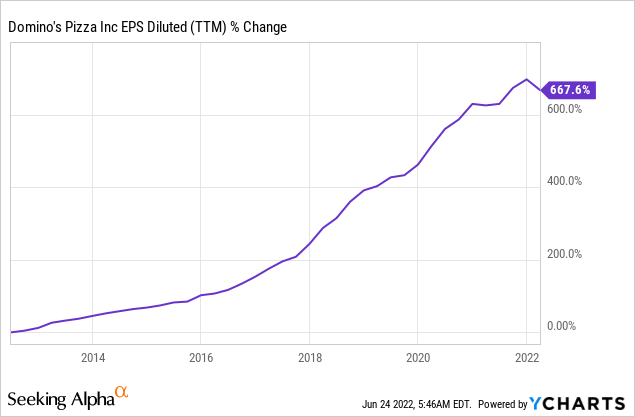

The EPS (earnings per share) has grown at a much faster pace compared to the revenues. EPS growth was fueled by top-line growth, together with significant buybacks as well as margin improvement as the company improved its digital offering. All three together have led to the EPS growing almost 700% in the last 10 years. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Domino’s Pizza to keep growing EPS at an annual rate of ~8% in the medium term.

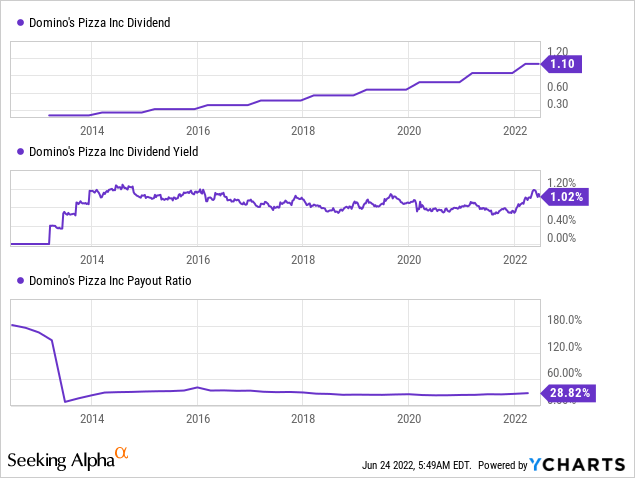

As sales and EPS grew significantly, the company has found itself with a lot of excess cash. Therefore, it started paying a dividend 8 years ago. The current dividend is $4.4 a share, and that equates to a dividend yield of 1%. This is not an impressive figure in the restaurant business, but the dividend increases are very impressive. Investors should expect Domino’s to keep raising the dividend at a double-digits rate as the dividend payout ratio is below 30%, making it relatively safe.

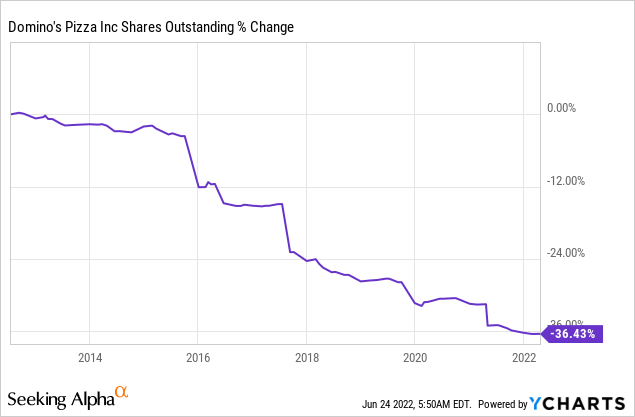

In addition to the growing dividend, the company is also aggressively buying its own shares. Over the last decade, the company has bought back more than a third of its shares outstanding. Buybacks support EPS growth and are generally a positive move by the management as it accelerates EPS and later dividend growth. At the current valuation, the buybacks are less effective.

Valuation

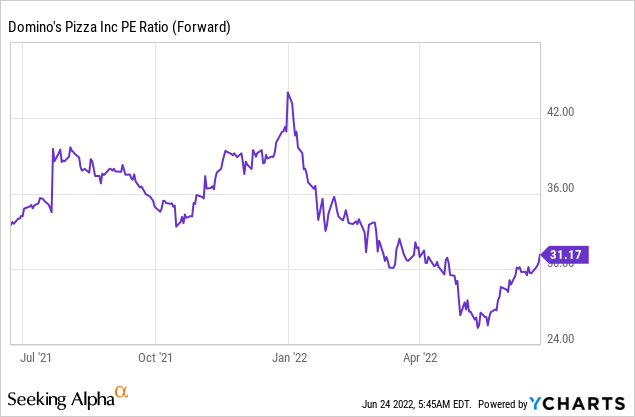

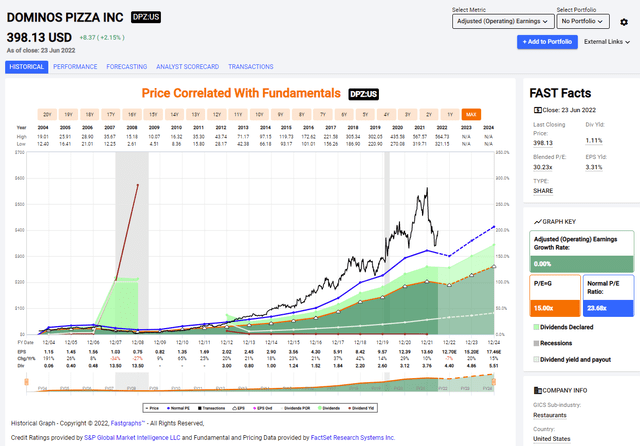

The current P/E (price to earnings) ratio when taking into account the 2022 earnings forecast sits slightly above 31. This is a high P/E ratio despite the fact that the company has been trading for a higher P/E over the last twelve months. This is a P/E that is higher than the P/E of leading tech companies such as Microsoft (MSFT), Apple (AAPL), and Google (GOOG, GOOGL). Therefore, I believe that the company seems overvalued based on that metric.

The graph below from Fastgraphs emphasizes how Domino’s Pizza has detached from its fundamentals. The shares are trading for a P/E ratio that is significantly higher than the company’s average P/E. Moreover, the current forecasted EPS growth rate doesn’t justify a higher than 30 P/E. Therefore, I do believe that the shares of Domino’s Pizza are currently overvalued.

To conclude, Domino’s Pizza has some great fundamentals. It showed significant sales increase together with an EPS increase. The top and bottom lines increasing allowed the company to increase the dividends and retire many shares. This great package comes at what I believe to be an expensive price, and the company will have to show significant growth opportunities to justify it.

Opportunities

The first growth opportunity for Domino’s Pizza is extending its digital value proposition. The company has created an extremely convenient order and tracking system. Right now, over 75% of the orders in the United States are done in digital channels. It allows the company to lower labor cost on the one hand, and offers a seamless and frictionless experience to the clients. Continuing to improve the experience and shifting more clients will support future growth and improved margins.

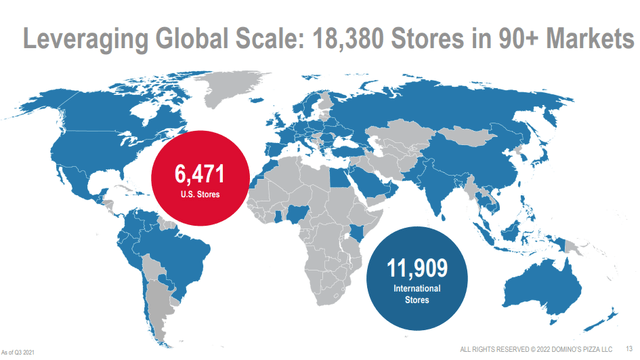

Domino’s Pizza has leadership both in the United States and internationally. It allows the company to grow solidly and understand its clients. Domino’s has data and input from different states and counties, and it allows it to amend its proposition according to the tastes of clients. The leading position also gives the company a significant scale, which supports cost-saving.

Worldwide expansion is another growth opportunity for Domino’s Pizza. The company can bring trends and technologies between markets. It also lowers its reliance on one specific market. The company wishes to focus on Europe and emerging markets, and it believes that there is room for 10,000 more restaurants in these markets. Using the company’s own scale, it can open more restaurants and expand its reach.

Risks

Inflation is a major risk for restaurants. The company has to deal with higher labor costs and higher food costs. Restaurants don’t have very high margins, to begin with, and it may be a challenge for the franchises. Moreover, if the economy falls into a recession, we may see lower spending on discretionary spending such as eating out and pizza in particular.

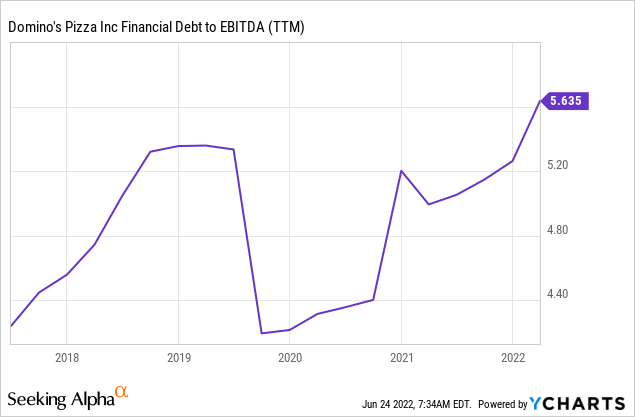

Another risk for Domino’s Pizza is the debt level. The company is operating with a very leveraged balance sheet. So far it has been a blessing as the management proved to be a great capital allocator. However, higher interest rates will increase interest payments by the company and will increase the overall risk in the current leveraged business model.

For dividend growth investors, there is also the risk that the company may not maintain the dividend if the economic situation deteriorates. In the past, the company attempted to start paying a progressive dividend. This dividend was eliminated during the financial crisis of 2008. If the economy enters a recession, Domino’s may do it again.

Conclusions

Domino’s Pizza is really an inspiring company. It is operating in a segment where you don’t expect much innovation and exceptional returns. However, the company has innovated with its digital offering, and the clients loved it. The fundamentals are strong and there are plenty of growth opportunities in the future both in the U.S., as the company improves its value proposition, and abroad.

However, there are also risks to the bullish thesis. These risks hover around the high debt level and the risks of recession and inflation. I believe that the company proved that it can overcome these challenges. Yet in the current environment, with higher rates and alternatives, the valuation is too high, thus I believe that Domino’s Pizza is a HOLD.

Be the first to comment