wildpixel

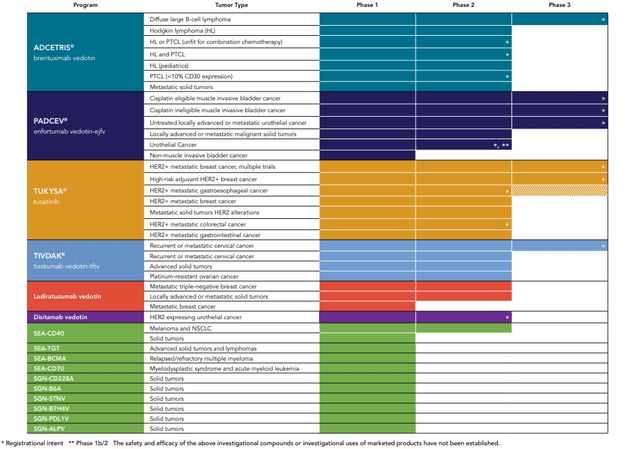

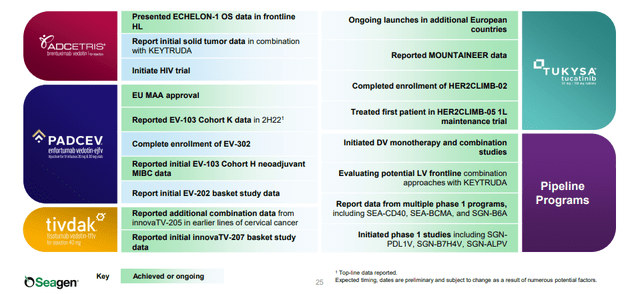

Seagen (NASDAQ:SGEN), formerly Seattle Genetics, is a pioneer in antibody-drug conjugates (or ADCs) and now a large ($25 billion market cap) global biotechnology company. It commercializes the ADCs ADCETRIS for several types of CD30-expressing lymphomas, PADCEV for locally advanced or metastatic urothelial cancer, and TIVDAK for recurrent or metastatic cervical cancer, as well as the small molecule TUKYSA for certain HER2-positive metastatic breast cancers. In addition to these four approved brands that are continuously being evaluated for future label expansions, there are 12 other novel therapies in its clinical pipeline (Figure 1). Several milestones are anticipated in 2022 (Figure 2), but for the most part, timelines are unclear. The current article will attempt to provide more specific periods.

Figure 1. Seagen Clinical Development Pipeline

Figure 2. Seagen 2022 Achievements and Upcoming Milestones

ClinicalTrials.gov lists each study’s “estimated” primary completion date, which is the date the researchers think that the final data for the primary outcome measure will be collected. For example, in September 2021, Seagen completed enrollment in the MOUNTAINEER trial. The study would be completed approximately 8 months after data was collected from the last of these patients (or disease progression, initiation of new therapy, study withdrawal, or death, whichever came first). Per Table 1, the actual primary completion date was March 28 (6 months), then statistical analysis began. The company reported topline results on May 23.

Table 1. Seagen Clinical Trials and Estimated Primary Completion Dates

|

Program |

Setting/Tumor Type |

Trial Name/Description |

Completion Date |

|

Brentuximab vedotin (ADCETRIS®) |

R/R Diffuse large B-Cell lymphoma |

ECHELON-3: + lenalidomide, rituximab |

|

|

1L Hodgkin lymphoma (or HL) |

+ nivolumab, doxorubicin and dacarbazine |

||

|

1L HL or PTCL (unfit for combination chemotherapy) |

Monotherapy |

||

|

R/R HL and PTCL |

Retreatment |

||

|

R/R HL (pediatrics) |

CheckMate 744: + nivolumab |

||

|

1L PTCL (< 10% CD30 expression) |

+ cyclophosphamide, doxorubicin and prednisone |

||

|

R/R Metastatic solid tumors |

+ pembrolizumab post PD-1 |

||

|

Enfortumab vedotin-ejfv (PADCEV®) |

1L untreated locally advanced or metastatic urothelial CA |

EV-302/KEYNOTE-A39: + pembrolizumab vs chemotherapy alone |

|

|

Perioperative muscle invasive bladder CA |

KEYNOTE-905/ EV-303: + pembrolizumab, cisplatin ineligible |

||

|

Perioperative muscle invasive bladder CA |

KEYNOTE-B15/ EV-304: + pembrolizumab, cisplatin eligible |

||

|

Locally advanced or malignant metastatic solid tumors |

EV-202: Monotherapy |

||

|

Locally advanced or metastatic urothelial CA* |

EV-103/KEYNOTE-869: +/- pembrolizumab [Cohort K] |

||

|

Perioperative muscle invasive bladder CA |

EV-103/KEYNOTE-869: +/- pembrolizumab |

||

|

BCG unresponsive non-muscle invasive bladder CA |

EV-104: intravesical EV |

||

|

Tucatinib (TUKYSA®) |

1L/2L metastatic HER2+ breast CA |

HER2CLIMB-02: + T-DM1 |

|

|

Adjuvant high risk HER2+ breast CA |

COMPASSHER2 RD: +T-DM1 |

||

|

1L maintenance HER2+ metastatic breast CA |

HER2CLIMB-05: + trastuzumab and pertuzumab |

||

|

1L HER2+ metastatic colorectal CA |

MOUNTAINEER-03: + trastuzumab and mFOLFOX6 |

||

|

2L HER2+ metastatic breast CA |

HER2CLIMB-04: + trastuzumab deruxtecan |

||

|

R/R HER2+ metastatic colorectal CA†‡* |

MOUNTAINEER: + trastuzumab |

||

|

2L HER2+ gastroesophageal CA |

MOUNTAINEER-02: + trastuzumab, ramucirumab and chemotherapy |

||

|

Metastatic solid tumors HER2 alterations |

+ trastuzumab |

||

|

1L HER2+ metastatic gastrointestinal CAs |

+ trastuzumab +/- pembrolizumab +/- FOLFOX or CAPOX |

||

|

Tisotumab vedotin-tftv (TIVDAK®) |

2L/3L Metastatic/recurrent cervical CA |

innovaTV 301: Monotherapy vs. chemotherapy |

|

|

1L/2L Recurrent or metastatic cervical CA |

innovaTV 205: + other anti-cancer agents |

||

|

R/R Metastatic solid tumors |

innovaTV 207: Monotherapy or + other anti-cancer agents |

||

|

2L Platinum-resistant ovarian CA |

innovaTV 208: Monotherapy |

||

|

Disitamab Vedotin |

2L HER2 expressing metastatic urothelial carcinoma |

RC48 G001: Monotherapy |

|

|

Ladiratuzumab vedotin |

1L Metastatic triple-negative breast CA |

+ pembrolizumab |

|

|

R/R Metastatic solid tumors |

Monotherapy |

||

|

R/R Metastatic breast CA |

Monotherapy |

||

|

SEA-CD40 |

Melanoma and Non-Small Cell Lung Cancer |

+/- other agents |

|

|

R/R Solid tumors and lymphomas |

+/- other agents |

||

|

SEA-BCMA |

R/R Multiple myeloma |

+/- other agents |

|

|

SGN-CD228A |

R/R Solid tumors |

Monotherapy |

|

|

SEA-CD70 |

R/R Myelodysplastic syndrome/acute myeloid leukemia |

Monotherapy |

|

|

SEA-TGT |

R/R Solid tumors and lymphoma |

+/- sasanlimab |

|

|

SGN-B6A |

R/R Solid tumors |

Monotherapy |

|

|

SGN-STNV |

R/R Solid tumors |

Monotherapy |

|

|

SGN-B7H4V |

Advanced solid tumors |

Monotherapy |

|

|

SGN-PDL1V |

Advanced solid tumors |

Monotherapy |

|

|

SGN-ALPV |

Advanced solid tumors |

Monotherapy |

Legend: 1L=frontline/first-line, 2L=second-line, R/R=relapsed/refractory, PTCL=peripheral T-cell lymphoma, CA=cancer.

*Enrollment Complete. †Pivotal Trial. ‡Top-line Data Reported

According to Table 1, HER2CLIMB-04 is the next study expected to complete, by the end of next month. This would be followed around year end by SEA-CD40’s PN 863, and the first-in-human trials of ladiratuzumab vedotin (SGNLVA-001), SGN-STNV, and SGN-TGT. Of these, the Phase 2 is most important. It wouldn’t be too much of a big deal if any of the latter 4 Phase 1’s failed.

In HER2CLIMB-04, TUKYSA is being evaluated as a second-line treatment in combination with Enhertu (trastuzumab deruxtecan) for HER2+ metastatic breast cancer. TUKYSA is an oral tyrosine kinase inhibitor of the HER2 protein, a protein that contributes to cancer cell growth. Enhertu is a collaboration of AstraZeneca (AZN) and Daiichi Sankyo (OTCPK:DSKYF) and the lead product of their respective ADC platforms; the ADC consists of the humanized monoclonal antibody trastuzumab (Herceptin), which is covalently linked to the topoisomerase I inhibitor deruxtecan (the payload). On August 6, Enhertu was approved in the US as monotherapy in adult patients with metastatic HER2-low breast cancer who have received prior chemotherapy. Meanwhile, TUKYSA is indicated in combination with trastuzumab and capecitabine (Xeloda) for treatment of adult patients with advanced unresectable or metastatic HER2-positive breast cancer, including patients with brain metastases, who have received one or more prior anti-HER2-based regimens in the metastatic setting. Therefore, studying if the TUKYSA- Herceptin combination works as well without Xeloda makes sense. A positive HER2CLIMB-04 may eventually raise TUKYSA sales because oncologists would prefer a 1- or 2-product over a 3-product regimen. If it compares favorably with Enhertu monotherapy results, it may compel oncology groups to list the combo as a preferred treatment option; and if impressive enough, it might inspire a head-to-head trial vs Enhertu.

Further out, the last with a possible readout within 6 months, but certainly not the least, SGNTUC-019 will see if TUKYSA works for solid tumors that make either more HER2 or unusual kinds (HER2 alterations). This Phase 2 is slated to complete at the end of January, 2023. Success in one or more tumor types could be a catalyst for confirmatory Phase 3 studies to secure label expansions. None of these soon upcoming trials were significant enough to mention in any of this year’s earnings calls, but the Phase 2 studies can increase the value of TUKYSA.

To cap this section, the Barclays analyst mentioned that KEYNOTE-B81 data was coming later this year, although the estimated date is listed as June 30, 2023 at ClinicalTrials.gov. This study looks at ADCETRIS combo with pembrolizumab (Keytruda) in metastatic solid tumors. Because this is a major exploratory trial, it’s likely that the analyst was fishing and was rebuffed.

Moving on to the obligatory financials: with $1.9 billion cash and investments and a quarterly burn of $133 million, Seagen has enough resources to fund all the ongoing trials up to at least 2026. However, the company may seem overvalued relative to their peers. Price/sales (14.2) and price/book (8.66) are much higher than the Healthcare Sector (4.22, 2.0) and Biomedical and Genetics Industry medians (9.54, 1.76). Q2 revenue of $500 million represented 28% year-over-year growth, and Seagen raised their 2022 revenue outlook to $1.71-$1.795 billion, but this was still below Street expectations of $1.84 billion.

Part of this caution is competition (Table 2). Rivals include blockbusters Opdivo from Bristol Myers Squibb (BMY) and Keytruda (pembrolizumab) from Merck (MRK). On August 6, Enhertu was approved by the US Food & Drug Administration (FDA) as monotherapy in adult patients with metastatic HER2-low breast cancer who have received prior chemotherapy. More are on the way: the FDA gave Byondis a Prescription Drug User Fee Act (PDUFA) action date of May 12, 2023 for SYD985 to treat HER2-positive unresectable locally advanced or metastatic breast cancer.

Table 2. Seagen’s Competitive Landscape

|

Product |

Therapeutic Area |

Competitive Product |

Manufacturer |

Total addressable market, US |

TAM, Global |

|

Brentuximab vedotin (ADCETRIS®) |

Hodgkin Lymphoma |

Opdivo (nivolumab) |

Bristol Myers Squibb |

||

|

Keytruda (pembrolizumab) |

Merck |

||||

|

T-cell Lymphoma |

Folotyn (pralatrexate) |

Acrotech Biopharma |

|||

|

Istodax (romidepsin) |

Bristol Myers Squibb |

||||

|

Enfortumab vedotin-ejfv (PADCEV®) |

Urothelial Cancer |

Trodelvy (sacituzumab govitecan) |

Gilead Sciences (GILD) |

515,700 |

|

|

Bavencio (avelumab) |

Merck/Pfizer (PFE) |

||||

|

Keytruda |

|||||

|

Balversa (erdafitinib) |

Johnson & Johnson (JNJ) |

||||

|

Tucatinib (TUKYSA®) |

Breast Cancer |

Perjeta (pertuzumab) + trastuzumab |

Roche (OTCQX:RHHBY) |

||

|

Kadcyla (ado-trastuzumab emtansine) |

Roche |

||||

|

Tykerb (lapatinib) |

Novartis (NVS) |

||||

|

Enhertu |

Daiichi Sankyo/AstraZeneca |

||||

|

Margenza (margetuximab) |

MacroGenics (MGNX) |

||||

|

Tisotumab vedotin-tftv (TIVDAK®) |

Cervical Cancer |

Keytruda ± bevacizumab biosimilars |

Risks and Takeaways

Traders should probably sell if they want stocks with better valuation and growth prospects, or if they went in for the mergers and acquisitions (M&A) type of speculation involving Merck. Seagen decided to do their own M&A thing and snagging an exclusive license for a pre-clinical agent from LAVA Therapeutics (LVTX); but only LVTX shares doubled while SGEN prices didn’t budge. This also why any in-house candidates that whiff in Phase 1 will not be missed; they cost much less to develop than the $50 million paid for LAVA-1223, are usually immaterial to a company that has grown to Seagen’s size.

Investors with a longer-term outlook could buy SGEN because, after all, healthcare is still a reliable defensive sector during bear markets. It is also prudent to hold until more of the pipeline matures. Seagen does have a track record of being judicious with their drug candidates, although some that have been discontinued over the years are illustrative of the risks with any biotech. The company hasn’t had an official failure since Lintuzumab in 2010. Their biggest setback was a pivotal Phase 3 for vadastuximab talirine in 2017, which proved to be unsafe. Seagen dropped denintuzumab mafodotin in 2018; 1 of the 2 Phase 2’s showed potential, but the company had to prioritize its limited funds. And some, like SGN-CD123A in 2018, were just quietly terminated. That said, it’s very unlikely that the more than 2 of the 6 upcoming readouts will disappoint.

Be the first to comment