SHansche/iStock via Getty Images British Land plc logo (British Land homepage)

Introduction and Investment thesis

I have often explained to my readers the importance of having some cash on the sideline. Apart from the obvious benefit that this has in case of any emergency expense you may encounter, it also is vital if and when any investment opportunity arises. Whenever there are some liquidity crises, people in need of cash often call Warren Buffett. He may, or may not, offer a “helping hand.” Usually, these work out to be very profitable for the Oracle of Omaha.

I am not sitting around waiting for my phone to ring, but I have experienced in earlier financial crises that I have been able to do deals that require quick action.

To sit on cash has been costly over the last 10 years as it hurts the overall return. This is changing now.

During the beginning of the pandemic, when I and my wife were confined to stay at home, the share prices of many companies took a big dive. Great valuations occurred for some time.

That is when I bought into British Land Company Plc (OTCPK:BTLCY). For your information, I bought it on the London Stock Exchange.

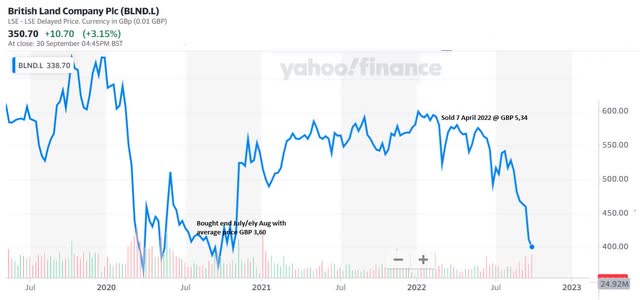

Timing of purchase and sale of BTLCY (Yahoo Finance)

Between 28th July and 7th August, I made my main purchases at an average price of GBP 3.60.

I have covered the company here on Seeking Alpha over a long period, and my last article was published on 25th June 2021.

On the 7th of April this year, I sold my entire stake at GBP 5.34

British Land FY 2022 Financial Results

BTLCY did deliver solid results for the fiscal year 2022, which came out in May this year.

The underlying net profit was GBP 251 million, which was an improvement of 24.9% from the previous year. They managed to eke out a positive rental growth of 2.5% in their office campus portfolio and 6% from their retail parks. The negative rental growth is still in the shopping centers, which recorded minus 6%.

Their balance sheet is still solid with a leverage of just 28.4% based on loan-to-property valuation. This was an improvement from a leverage of 32% last year.

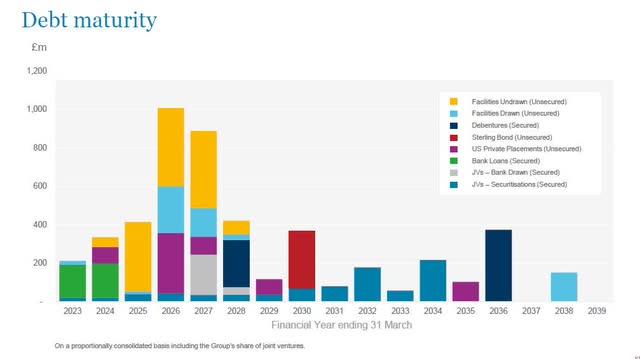

The weighted average interest rate was 2.9% for the year. They are fully hedged for 2023 and have 79% of their financing hedged for the next 5 years. There is no need for refinancing until the end of 2025.

British Land – debt maturity. (British Land – 2022 FY Result presentation)

The net asset value, based on EPRA valuation methodology, was GBP 7.27

With a share price of GBP 3.50, we do get a very attractive price to the net asset value of 0.48

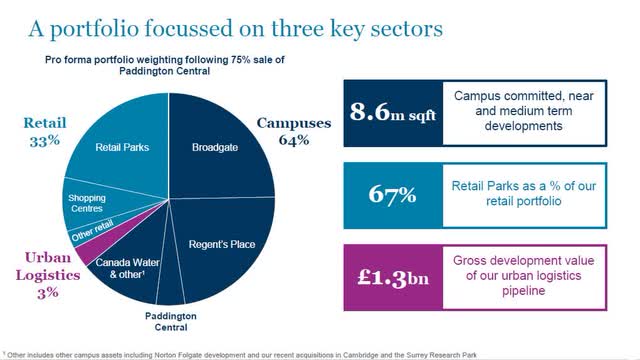

They started to diversify their real estate segments about two years ago when they invested in some urban logistic properties.

Although this only constitutes 3% of their present real estate portfolio, there is a plan to grow this segment.

Property segments (British Land – 2022 FY Financial result presentation)

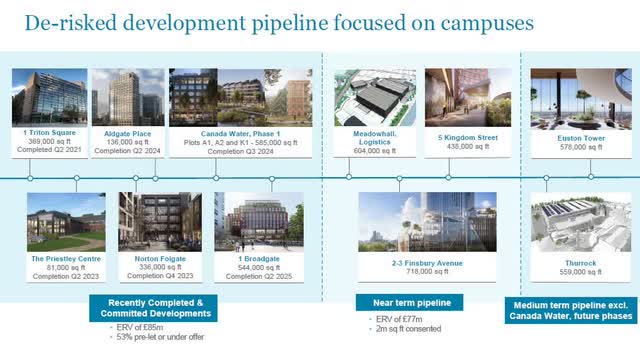

Contrary to many real estate investment trusts (“REITs”), BTLCY does have a good pipeline of ongoing property developments. I like this, as we can see there is a clear path for further growth for the company.

British Land pipeline of property developments (British Land – 2022 FY Results presentation)

Their dividend for the year was GBP 0.2192 per share. This gives us a yield of 6.26% on a 12-month trailing basis. This is gross before a withholding tax of 20% on foreign shareholders, in effect reducing it to a net yield of 5%.

The payments you receive from British Land are generally not an ordinary dividend, as received from other non-REIT UK companies, but a Property Income Distribution. UK REITs are exempt from tax on the property income they receive but have to distribute at least 90% as PIDs. The REIT must withhold tax on PID payments as such payments are UK property income subject to UK tax even if received by overseas residents; the withholding is at the standard UK income tax rate of 20%.

Although I had a low entry price, the effective net yield I received in 2021 was only 3.4%

Herein, lies some of the problems I have with BTLCY.

Under the present environment, with many REITs in Singapore and Hong Kong, some even holding large UK property portfolios, trading with a higher yield and attractive fundamentals, it makes BTLCY less attractive for me.

Conclusion

The reason I sold my shares in April this year was neither that I thought the company was not doing well, nor was it because I could foresee its decline in the share price.

I own several REITs in my portfolio.

Just like these companies that recycle their capital, so do I as an investor. I look at where I have a profit if I sell, and where else I can deploy the capital with potentially better prospects of yield and capital gain. This was the reason I sold.

I simply found a better place for the money.

Would I buy British Land again?

Perhaps. But the withholding tax on the distribution is a negative, as I do not have this on any other REIT I own, except for Simon Property Group (SPG).

Apart from a further appreciation of share price, which I think SPG has in it, I would have to see a more attractive yield after taxes and a potential return to a higher share price.

As such, it is a hold stance for me at this moment.

Be the first to comment