Kenishirotie/iStock via Getty Images

Performance Review

A Strong Finish Following A Slow Start

As stated in my 3Q 2022 update, Vailshire Partners LP fully transitioned from its longstanding “buy and hold” tradition to a proprietary “long-term trading” strategy.

Given the ferocious rally in risk assets from mid-June to mid-August 2022, my timing on implementing this system truly could not have been worse, I hate to admit. And this “poor timing” was reflected in our July 2022 return of -17.94% (note: all stated returns are unaudited).

However, since that first dismal month, our new system has started to shine.

As my macroeconomic research suggested and Vailshire’s trading system confirmed, the summertime bear market relief rally faltered and gave way to significant underlying weakness.

In August 2022, Vailshire squeaked out a respectable gain of 0.38% while the S&P 500 turned over.

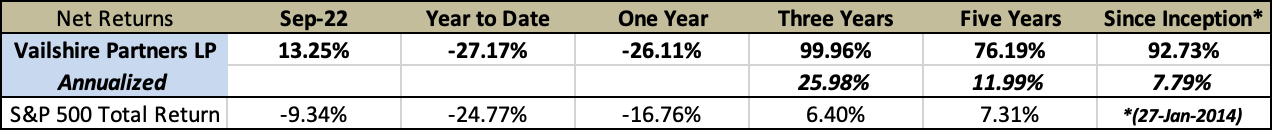

September 2022 was much more encouraging. While the total S&P 500 return (including dividends) was -9.34%, our fund returned an impressive 13.25% (see table below for complete results).

Despite the underperformance over the past 12 months, the annualized returns of Vailshire Partners LP over the past three- and five-years–measuring +25.98% and +11.99%, respectively–continue to outperform the S&P 500 (+6.40% and +7.31%, respectively) by an impressive margin. And it should be noted that the majority of this long-term outperformance occurred using a simple buy and hold strategy.

While I cannot make promises on any future investment returns, I am confident that Vailshire’s proprietary trading system will continue riding profitable long-term market trends for many years and decades to come.

Current Market Conditions

As we look around us, we can see that conditions are going from bad to worse. And, unfortunately, even “good” economic data is interpreted as bad news for risk assets these days.

Inflation remains sticky high, and the Federal Reserve remains laser-focused on squelching it. To achieve their goal, the Fed has maintained their hawkish stance–raising the federal funds rate and decreasing their sizable balance sheet of US Treasuries and mortgage-backed securities.

This hawkishness serves to destroy economic demand, bringing the supply/demand curves back into alignment and (ideally) lowering price inflation.

Higher interest rates raise costs for individuals, corporations, and governments. Higher costs mean that life is getting more difficult for the above-mentioned groups. Consumption dramatically slows and corporate margins and earnings are materially reduced.

We are seeing the effects of these higher interest rates throughout the (still somewhat resilient) economy… and they are getting worse by the week.

Home prices have rolled over and the supply of houses for sale is increasing at a rapid rate. Stocks indices peaked between November 2021 and January 2022 and have been in a strong downtrend for the majority of the year. Bonds continue having their worst year ever and don’t look to recover any time soon.

It’s ugly out there… and it will get worse before it gets better. Sorry.

As the Fed doubles down on its hawkish stance to fight price inflation into an inevitable worldwide recession; and as the cost of capital rises precipitously; and as equities, real estate, and bonds roll over from historically high valuations… these factors portend to a miserable outlook for risk assets, in general, for the remainder of 2022… with likely continuation well into 2023.

The traditional 60/40 stock and bond portfolio is dead. Sorry (again). So, in order to preserve and grow our hard-earned purchasing power over the coming decade we need to utilize a nimble, yet shrewd trading and investment strategy for such a time as this.

4Q 2022 Investment Strategy

The Goal: Generating Alpha in Any Direction

I am a very happy trader/investor when my macroeconomic views perfectly align with our momentum and volatility-based strategies.

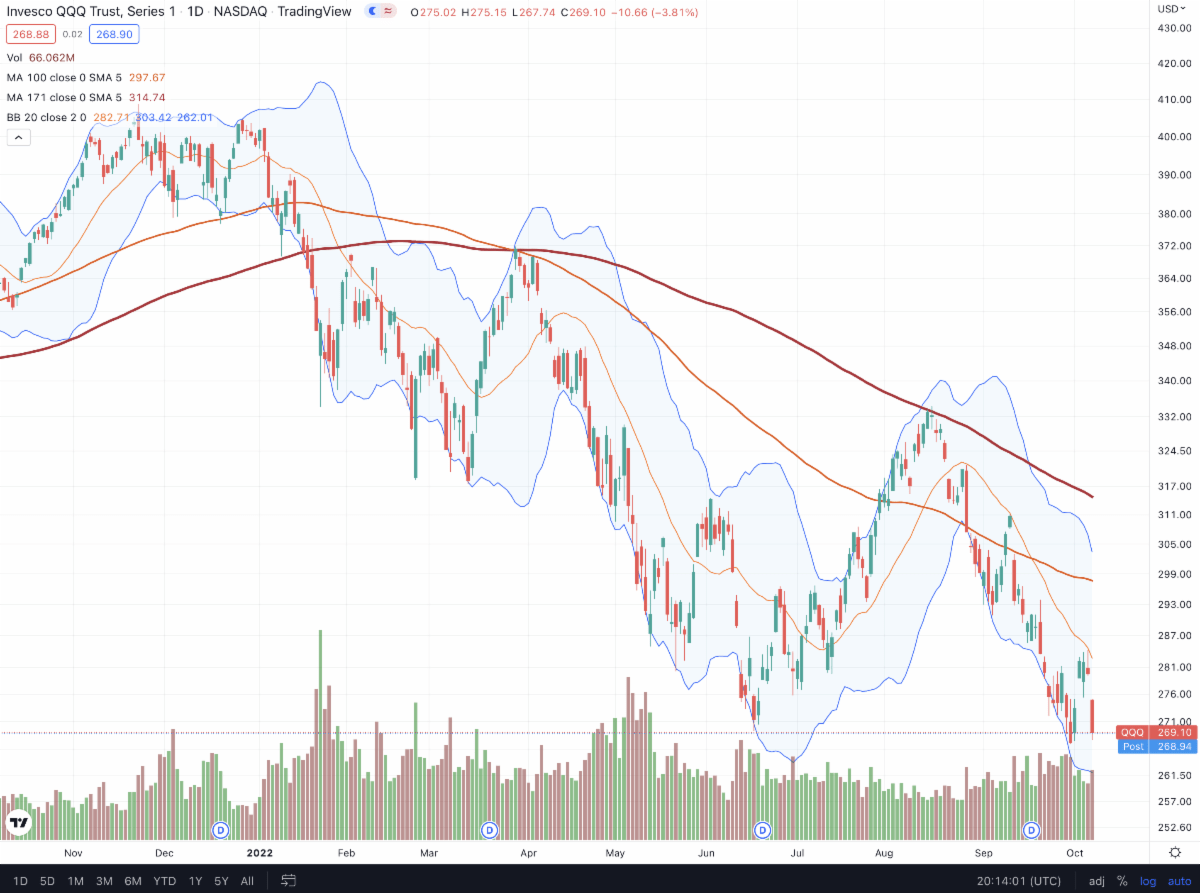

Today, we are in such a time. As the accompanying graph shows, NASDAQ equities have been in a strong, clear downtrend since 4Q 2021.

As you know, I remain exceedingly bearish on risk assets while the Federal Reserve gets increasingly hawkish into the throes of a worldwide recession. And, based on the comments of every Fed official I have watched or read in the past few weeks, they will continue with their “demand destruction” policies until price inflation has materially and convincingly declined.

Outside of a massive, capitulatory, deflationary bust–similar to late 2008/early 2009–I don’t see significantly disinflation happening anytime soon. This means that the Fed will likely remain hawkish for longer.

Given our current macroeconomic, fiscal, and monetary scenario, Vailshire Partners LP remains sizably net short in its positioning. And we will continue this policy until our trailing stop losses have been triggered. Based on current price points, this may not happen for quite some time.

By far, our largest position continues to be our NASDAQ short. This means that as these growth and innovation stocks continue to decline–as I expect for the foreseeable future–then we should profit along the way.

Bitcoin persists in an undeniably strong downtrend, which means that we are holding fast to our short BTC futures ETF. As a huge fan of Bitcoin and its long-term potential as better money for a better world, I am closely watching for a possible bottom in price action. I believe the next bitcoin bull market will produce life-changing gains for those who are wise enough and brave enough to endure its infamous volatility, while it expands through its mandatory price discovery phase.

Our sizable cash position is currently earning 2.58% (annualized) interest, compliments of Interactive Brokers. Hopefully, this rate will continue to increase over the coming months, in order to offset sustained price inflation.

Finally, we added two oil and gas companies at the beginning of October to take advantage of oil’s resilient price action since crossing $80/barrel recently. While anything can happen in these tumultuous times, these two portfolio holdings are already off to a nice start… up 8-9%.

In conclusion, the market outlook remains as bleak as ever, but Vailshire’s proprietary long-term trading strategy is designed to maximize profits during major market moves… in any direction.

I am constantly humbled and honored by the trust my LPs have placed in me to make wise investment decisions throughout this tumultuous decade… and I take this responsibility very seriously. If you are reading this and you are already a part of the Vailshire family: thank you.

For current non-clients: If you would like to discuss what Vailshire’s innovative investment strategies can do for you and your family, please do not hesitate to reach out to me personally. This is not a solicitation to invest but, rather, an invitation to inquire more.

Living well and investing wisely with you,

Jeff Ross

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment