Editor’s note: Seeking Alpha is proud to welcome Yiping Wang as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Nisian Hughes/DigitalVision via Getty Images

Investment Thesis

I rate Willis Lease Finance Corporation (NASDAQ:WLFC) as a Strong Buy with a base case target price of $69.7 (80% potential upside). WLFC’s price plunged two years ago due to the earnings decline caused by COVID-19, and the current price is still 40% lower than the 2019 level. WLFC is the largest player in a niche market (aircraft engine leasing) with a superior business model, and will very likely recover as the pandemic fades away. I also believe that WLFC can benefit greatly from current interest rate hike since its revenue will increase with interest rate but the majority of its debt carry fixed interest rate and will not mature in a long time. WLFC’s margin should improve as well because they borrowed lots of money at very low fixed rates during the pandemic and purchased equipment in a distressed market, which effectively lowered their cost base. Further more, WLFC operates internationally, which allows it to capture future organic growth from emerging markets. I believe the factors mentioned above can drive WLFC’s EBITDA up to ~$277 million in 1-2 years. WLFC then should be trading at ~ $428 million ($69.7/share) at 8x EBITDA (pro forma 2019 multiple).

Why this Opportunity Exists

- The company is virtually undiscovered.

- Bias against the aviation industry and highly leveraged leasing business, ignoring the fact that the debt won’t come due in tens of years.

- I believe the market doesn’t truly understand WLFC’s competitive advantages.

Willis Finance Lease Business Overview

WLFC’s principal business objective is to build value for shareholders by acquiring commercial aircraft and engines (mostly engines) and managing those assets in order to provide a return on investment, primarily through lease rent and maintenance reserve revenues, as well as through gains on sale of spare part and management fees earned for managing assets owned by other parties.

Engine is a necessary, independent and vulnerable part of an aircraft. Commercial aircraft operators need engines in addition to those installed on the aircraft that they operate. These spare engines are required for various reasons, including requirements that engines be inspected and repaired at regular intervals based on equipment utilization.

The advantages of leasing engines for aviation businesses includes repair cost savings, logistics simplification (centralized maintenance by lessor improves efficiency), and capex & residual risk reductions.

Integrated Business Model

Through two of its wholly owned subsidiaries, Willis Engine Management and Willis Aero, WLFC can provide an integrated end-to-life engine solution. Willis Engine Management engages in providing engine management/maintenance service. The number of engines under its management grew from 40 in 2015 to 400 in 2020. Willis Aero engages in sale of spare parts and technical support. It was launched in 2013 to augment WLFC’s business model, which is proven effective: WLFC’s net income from the sale of spare parts grew from almost $0 in 2013 to $12 million in 2019, accounting for 18% of the total.

The Leasing–Managing–Selling model has the following advantages:

- The synergies between engine management business and leasing business can reduce operating costs.

- WLFC’s history shows management’s effort to keep augmenting the business model, a quality that virtually all competitors lack.

- The Leasing–Managing–Selling model creates lots of cross-selling opportunities such as offering management/repair service to engine lessees, attractive equipment acquisition opportunities provided by management service customers, etc. This also provides convenience to customers.

From the past performance, we can tell this model worked out pretty well. Before the pandemic (2010-2019), WLFC’s annual pre-tax income grew from $20 million to $89 million, a CAGR of 20%, backed with a solid revenue CAGR of 11% (from $148 million to $409 million). ROE ranged 15%-20% from 2016 to 2019. WLFC does not have access to the cheapest fund, (lots of leasing companies use short-term debt to finance equipment with long lifespan, which is really risky, especially during unusual events like COVID-19) but it is one of the fastest growers in the market. The management doesn’t explain the reason of this growth, but I think it attributes to its superior business model.

Diversified Operations

WLFC has established solid revenue and sales channels evenly around the world, with focus in areas with high aviation growth rate and profitability. As one of the few players that operate internationally, WLFC can do business with larger airlines while small competitors can’t. It’s a self-reinforcing process that can lead to WLFC’s further growth.

One major difference in asset allocation between pre-pandemic period and today is that the equipment held and revenue generated in Asia dropped to ~17% (per 2019 & 2021 10k). It is primarily due to slower recovery rate and greater negative effect the Asian market suffered from COVID. I believe this is temporary and WLFC is well positioned in this fast-growing market.

Financials & Balance Sheet

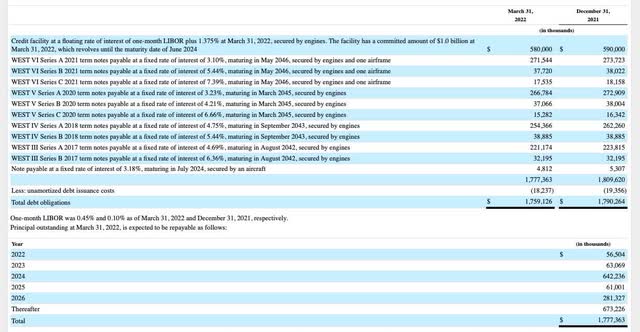

We have illustrated the competitive advantages of WLFC above, now let’s analyze its balance sheet to make sure it won’t go bankrupt. As of March 31 2022, WLFC had $1,951.4 million equipment held for operating lease and $114.3 million notes receivable which represented 298 engines, 12 aircraft, one marine vessel and other leased parts and equipment. WLFC has a total debt obligation of $1,759 million according to the last 10Q (Mar 31, 2022), which comes from two sources:

- Willis Engine Securitization Trust III, IV, and V (WEST III, IV, V) are three asset backed trusts. The structure of the WESTs gives special advantage to WLFC compared to other leasing companies, and the management has been improving it for a long time. The WESTs have the following features:

- Bankruptcy remote: As bankruptcy remote entities, WESTs can only use their proceeds to repay notes or acquire new equipment. WLFC seems to be highly leveraged because the WESTs are consolidated into the company’s financial statements, but even if the WESTs default, WLFC itself wouldn’t face creditor claim or bankruptcy.

- Long-term: Notes issued by WEST III,IV,V account for 57.4% of WLFC’s total debt obligation, and carry an average interest rate of 4.1%. None of those notes mature in at least 20 years (maturity dates vary from 2042 to 2046). WLFC constantly had 3x EBITDA ($195 million)/Total interest expense ($65 million) ratio during pandemic. This ratio was even higher before the pandemic (4-5x).

- Cash generation: WLFC receives monthly fees of 11.5% as servicer and 2.0% as administrative agent of the aggregate net rents received by the WESTs.

In conclusion, the WESTs successfully reduce WLFC’s leverage exposure, contribute to WLFC’s income, and are able to provide cash flow. In his 2014 letter to shareholders, the CEO predicted that the effort WLFC put in developing the WESTs would pay out in the future. He is now proven right.

2. Revolving credit facility – The credit facility carries a floating interest rate of one-month LIBOR plus 1.75%, which revolves until the maturity date of June 2024. WLFC has been consistently upgrading the facility to increase borrowing capacity. Per the last 10Q, WLFC has borrowed $580 million from it, accounting for 33% of the company’s total debt. Even if WLFC’s EBITDA remains at the pandemic level, it would earn around $400 million operating cash flow by 2024 (I didn’t use FCF because more than 90% of WLFC’s capex is used to purchase new equipment), representing ~70% of its debt. Don’t forget we are talking about 3 years of worst performance, and that WLFC can always liquidate some engines if needed.

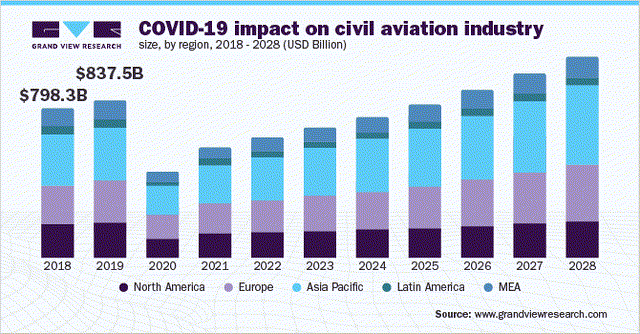

Based on the outlook of current environment, it is reasonable to assume the aviation industry is going to recover as more and more people are getting vaccinated, and that flying is still the only choice for convenient long-distance trips.

Aviation market interruption (Grand View Research)

Opportunities from hike in interest rates

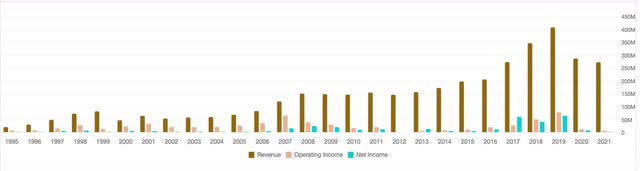

Unlike most lessors that finance their book with short-term debts for higher margins, a rise in interest rate is beneficial to WLFC. It is because potential customers would rather lease than finance their engines if it costs more to borrow from financial institutions, and that the majority of WLFC’s debt won’t mature in over 20 years and carries fixed interest rates. This plays out extremely well for WLFC based on past records. Let’s roll out WLFC’s revenue and pre-tax earnings all the way back to 1995:

Rev/Pre-tax earnings($ million):

WLFC revenue and Pre tax earning history (ROIC.ai)

From the data and chart above, it’s easy to spot 4 earnings boosts (pre-tax earnings deviates from run-rate):1996-1998, 1999-2001, 2005-2008, 2015-2019. (If the chart is not clear for you, the numbers can be found here)

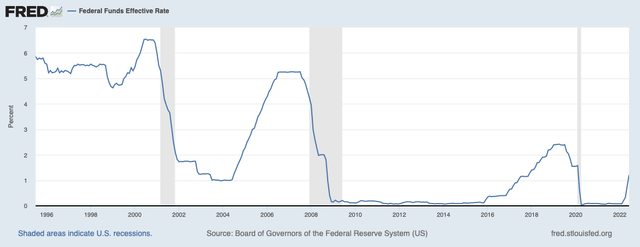

Now the FED funds rate:

FED Funds Rate (FRED)

If you compare the earnings boosts to the FED funds rate chart, it’s super clear that all of these four earnings boosts perfectly align with FED funds rate hikes. They start and end in the exact same year. For example, FED funds rate remained flat since GFC until 2015-2016, and kept rising until 2020. During this time period, WLFC’s pre-tax income grew at a CAGR of 55% without one single setback.

Similar stories happened during all four earnings boosts, which means WLFC’s top/bottom lines have a positive correlation with interest rates. It’s definitely a strong tailwind, in both short and long term, given the current depressed earnings are already priced in the stock.

Low-cost funds borrowed during pandemic supports margins post recovery

One would assume that WLFC would remain prudent with their borrowing during the pandemic, but the company chose to take advantage of the low interest rates: in 2020 and 2021, it issued $552 million long-term notes through the WESTs at a rate of 3.1%-3.3%, the lowest among almost all of its long-term debts (the 2018 and 2017 ones are 4.8% in average). Almost all of the funds were used to acquire new engines and equipment. I am optimistic about this, because the interest rate is locked in for tens of years, but the potential earnings power of the engines can increase significantly as the pandemic fades away. It’s also reasonable to assume WLFC bought cheaper engines during the pandemic which wouldn’t affect the bottom line until they start generating revenue or are sold with a net gain. This aggressive action combined with insider buying activity indicates management’s confidence in the company.

WLFC debt (WLFC 10k)

Post-pandemic environment is in favor of leasing business

During the post-pandemic recovery, it’s reasonable to assume airlines would prefer to lease than purchase engines and equipment since they really want to repay the government aid and all the debts first before spending large capex for acquisitions of equipment. The CEO of Aercap said: “aircraft lessors will become more important as cash-strapped U.S. airlines save cash to pay down debt”. WLFC is already in a comfortable inventory position to meet the increasing demand.

WLFC Stock Valuation

Before getting into valuation, I do want to address that no one can accurately predict near-term earnings and market movements. All I know is I am buying a growing market leader with solid assets and moat at a low price with significant catalysts that can drive earnings back to normal, which is enough for me.

After the pandemic hit, WLFC’s EBITDA margin didn’t drop but slightly increased (from 59% to 60%), from which we know that most earnings drop attributes to depressed utilization rate and non-leasing operations. WLFC’s utilization rate varied from low 90s% to high 80s% before the pandemic and dropped to 80% in 2021, before recovered to 84% in 1Q22. It’s an all-time-low rate when no fundamentals of the company have changed.

Current TEV=$236 million market cap + $1.75 billion net debt – $113 million notes receivable carrying 6.3%-12.2% interest caused by several failed sale- leasebacks = $1.87 billion

EBITDA margin: 60% (it’s been steady in the past 10 years and never fell below high 50s%).

Book value of equipment held for lease: $1.95 billion.

Pro forma rent revenue + maintenance reserve revenue ~18% of utilized equipment. ((2019 rent revenue + maintenance reserve revenue) / utilized equipment book value=18%).

Base case

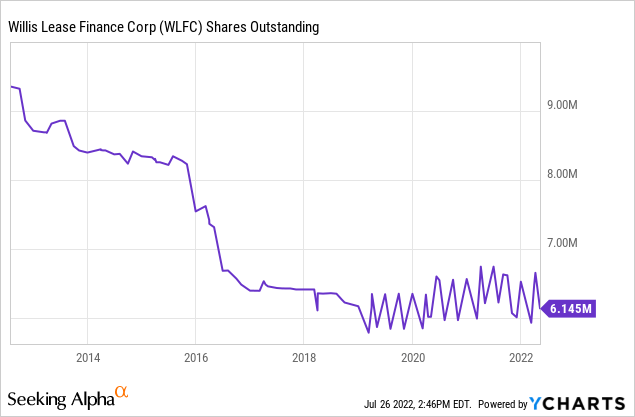

Utilization rate goes back to run-rate (90%), non-leasing operation recover to the 2019 level ($110 million), with no organic growth or price increase, at 8x TEV/EBITDA (pro forma 2019 multiple): revenue = 90% * $1.95 billion * 18% ~ $426 million, EBITDA = $426 million * 60% = $255.6 million, TEV=8 * $255.6 million=$2,045 million, market cap=$2,045 million (TEV)-$1,617 million (net debt)=$428 million, share price=$428 million/6.14 million shares outstanding=$69.7, ~81% implied gain.

Bear case

Utilization rate stays at 85%, non-leasing operation stays at the 2021 level($62 million): revenue=$1.95 billion*85%*18%=$360 million, EBITDA =$360 million*60%=$216 million, TEV=8*$216 million=1,728 million, market cap =$1,728 million-$1,617 million=$111 million, share price=$111 million/6.14 million shares outstanding=$18, ~50% potential loss.

The bear case is very unlikely to happen: the pandemic wouldn’t last forever, WLFC has significant competitive advantages, and the saleable assets in general are worth approximately $2.1 billion against $1.75 billion net debt. We get ~$350 million equity buffer (~148% of market cap) excluding debt.

Insider Ownership & Recent Activities

WLFC is a family business. Mr. Charles F. Willis is the founder of WLFC, and has been in aviation for almost 40 years. He is also the largest shareholder of WLFC, owning 44.4% of the company. Another family member Austin Willis owns 11.49%. The third largest shareholder is CFW Partners, owning 31.62% of the company. Mr. Charles Willis is a general partner of CFW Partners. According to the Acquisition statement published on 25 June 2021, the Willis family proposed to acquire all outstanding shares for $42 per share. The deal was later mutually terminated in August.

On 23 August 2021, right after the proposal was terminated, the CEO Charles F Willis purchased $500K worth of WLFC stock at $37.43. Recently the insiders have generally purchased more stocks than they have sold (net purchase of 89k shares in last 12 months).

Combined with the current market situation mentioned above, I think this indicates that the management/largest shareholders of the company have a great faith in this company.

WFLC vs. Peers

The aircraft engine leasing market is highly fragmented. Most players are either small private companies or subsidiaries of large manufacturers. Compared to the competitors that belong to large aircraft manufacturers that have to lease their own brand of equipment, WLFC’s engine portfolio is more diversified. Compared to small private companies, WLFC has larger scale and more access to funds.

Willis Lease Finance Corporation: Public company. It owns 291 engines, manages and maintains 450+ engines, provides intensive engine related service such as AOG urgent request, inspections, serviceable material supply, engine removal forecast, engine/mod exchange programs, equipment broker, ConstantThrust, and Willis Lease Pooling Program. According to its website, Willis Lease has successfully purchased, leased and sold more engines in more countries over a longer period of time than any independent competitor.

Engine Leasing Finance Corporation: Private company. WLFC’s largest competitor. According to its website, ELFC “owns/manages” ~300 engines. WLFC is almost as big as ELFC if we assume ELFC owns all of the 300 engines. WLFC is almost twice as big as ELFC if we count in its “managed” engines. ELFC doesn’t provide engine related service.

MTU Aero Engines (OTCPK:MTUAY): A German public engine manufacturer. Although MTU does offer engines of other brands, its leasing business is way smaller than WLFC. It’s clear that MTU isn’t attaching importance on leasing business since it’s barely mentioned in MTU’s annual report, and the inventory page hasn’t been updated since 2021.

Beautech Engine Asset Management: Private company that only operates in the US. There are only 10 jet engines are currently available for lease, with no engine related service.

SMBC Aero Engine Lease: Private company. No inventory info on the website. Doesn’t provide engine related service. Poor engine collection (only 7 types of engines). No reply to the inquiry email I sent.

Hale Aircraft: Small Private company. Offers engine services but has virtually no leasing business.

Rolls-Royce & Partners Finance: A joint-venture created by GATX Corporation (GATX), a railcar lessor and Rolls-Royce Holding (OTCPK:RYCEY), a motor manufacturer. RRPF only leases engines manufactured by Rolls-Royce, and offers no engine-related service.

From the analysis above, we can get a few conclusions:

- WLFC is the largest independent player in the aircraft engine leasing market.

- WLFC is the only leasing company that offers intensive engine services.

- WLFC focuses on integrated service only for aircraft engine as its competitors provide shallow services in multiple areas.

Risks

- Aviation recovery is slower than expected.

-

Fairly high executive compensation. The CEO Mr. Charles Willis got paid approximately $10 million in 2021 (per proxy), which in my opinion is a little high.

- WLFC is an inherently capital-intensive business, which has built in risks. But this risk can be mitigated by the long debt maturity and the good value the current share price offers.

Conclusion

2020-2021 were the worst two years for WLFC in the last 10 years, and the stock price dropped with depressed earnings. Buying WLFC at $38 is buying a rapidly growing market leader with moat in an unusual event that temporarily distressed its earnings, with a free call option on interest rate increase, post-pandemic economy/aviation industry recovery, and aviation industry growth in emerging market. I recommend holding on to the WLFC stock as long as the company is still recovering (increasing utilization rate) or growing (larger portfolio, higher revenue in a high interest rate environment).

Be the first to comment