Leonid Ikan

On Friday, November 4, 2022, Canadian midstream giant Enbridge Inc. (NYSE:ENB) announced its third-quarter 2022 earnings results. The initial headline numbers are mixed here as the company failed to meet analysts’ revenue expectations but did beat the bottom-line net income estimate. As has been the case with most midstream companies that have published their results so far though, Enbridge did show some year-over-year growth in pretty much all measures of financial performance. We will likely see this trend continue over the rest of the decade too as the demand for liquefied natural gas grows and Enbridge attempts to take advantage of the trend. The company certainly has other opportunities available to it as well, which we will naturally discuss throughout this article. Overall though, Enbridge’s latest results show that the company continues to earn its place as a core holding in anyone’s portfolio.

As my regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its earnings results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Enbridge’s third-quarter 2022 earnings results:

- Enbridge reported total operating revenue of C$11.573 billion in the third quarter of 2022. This represents a 0.93% increase over the C$11.466 billion that the company reported in the prior-year quarter.

- The company reported an operating income of C$1.778 billion in the reporting period. This compares very favorably to the C$1.388 billion that the company reported in the year-ago quarter.

- Enbridge transported an average of 2.966 million barrels of crude oil per day through its mainline system during the current quarter. This represents a 10.96% increase over the 2.673 million barrels of crude oil per day that the company’s mainline system transported per day on average during the same period of last year.

- The company reported a distributable cash flow of C$2.501 billion in the most recent period. This represents a 9.21% increase over the C$2.290 billion that the company reported during the equivalent period of last year.

- Enbridge reported a net income of C$1.279 billion in the third quarter of 2022. This represents a substantial 87.54% increase over the C$682 million that the company reported in the third quarter of 2021.

It seems likely that the first thing that anyone reading these highlights will notice is that the company’s financial performance improved in every possible way. This has been the case with every midstream company that has reported its earnings so far so this is not exactly unexpected. One of the big reasons for this is that the company’s transported volumes of liquids and gas increased compared to the prior-year quarter. As we saw in the highlights, Enbridge’s liquids pipeline systems generally saw higher volumes during the most recent quarter than they did in the prior-year quarter. The same is true of its natural gas systems. The reason why this resulted in increased cash flows is because of the business model that the company uses. In short, Enbridge enters into long-term (usually five to ten years in length) contracts with its customers. The customer uses Enbridge’s infrastructure to transport or store its crude oil and natural gas. In exchange, the customer compensates Enbridge based on the volumes of resources that are handled, not on the value of the resources. Thus, when resource volumes increase so do the company’s revenues and cash flows. In addition, this business model provides Enbridge with a great deal of protection against fluctuations in energy prices. This is why the company was not really affected by the energy price crash back in 2020, although its stock price certainly was. However, the company also does not significantly benefit from increases in energy prices. We can see this in Enbridge’s financial results as it generally did not display the same year-over-year revenue or cash flow growth that many of the shale companies saw in their most recent quarters. Nonetheless, this model works quite well for more risk-averse investors that want income more than capital gains.

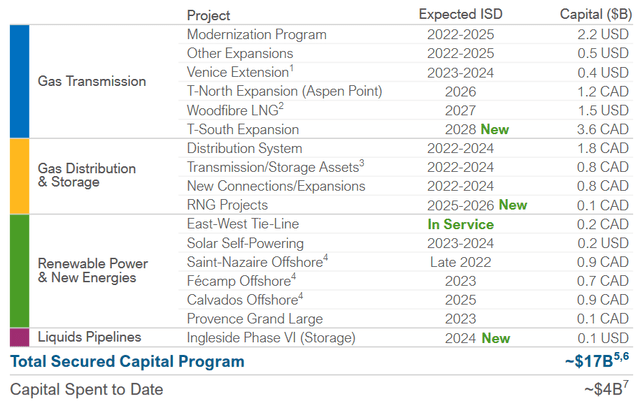

This does not mean that Enbridge is without growth prospects. In fact, the company is quite likely to deliver fairly strong growth over the coming years. This is because its volumes are very likely to increase. As pipeline and storage infrastructure is only capable of handling a limited quantity of resources, Enbridge needs to construct new infrastructure in order to significantly increase its capacity and ability to handle higher volumes. The company is doing exactly this as it currently has C$17 billion worth of growth projects in various stages of development:

As we can see, Enbridge is planning to bring these projects online between now and 2028 so this is certainly a fairly long-term plan. The nice thing about all of these projects is that Enbridge has already secured contracts with its customers for the use of the infrastructure as it comes online. This serves two purposes, both of which are beneficial. The first reason that the already-contracted status is nice is that it ensures that Enbridge is not constructing a great deal of money to construct infrastructure that nobody wants to use. The second reason that this situation is advantageous is that Enbridge knows in advance how profitable each project will be before construction begins so it knows that it is receiving a sufficient return to justify the investment. The company has not specifically stated what this return will be but midstream projects usually pay for themselves after four to six years so that would be a reasonable expectation for the company’s current projects. We can expect each project to begin generating revenue as soon as it begins operating, so this capital investment program provides Enbridge with a strong pathway for growth over the next several years.

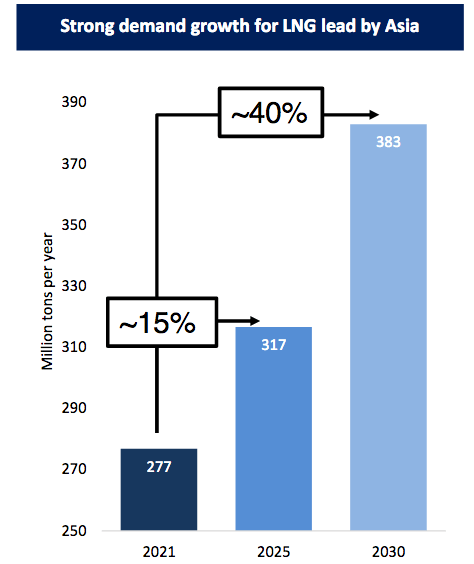

In January 2023, Greg Ebel will replace Al Monaco as CEO of Enbridge. Mr. Ebel has stated that he sees some significant growth potential for Enbridge in the emerging liquefied natural gas sub-sector of the energy industry. This is certainly the case as this is one of the fastest-growing markets in the world. In fact, Asia alone is expected to increase its imports of liquefied natural gas by 40% between now and 2030:

Golar LNG

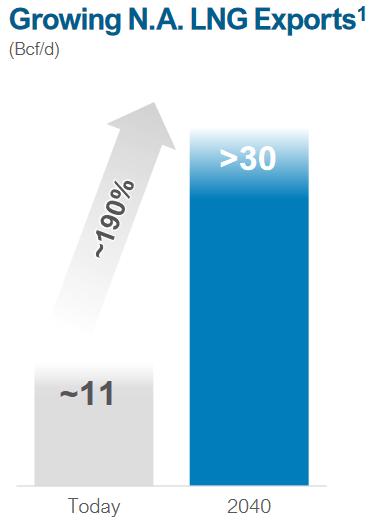

In addition, Europe is increasingly looking to increase its own imports of the substance in order to reduce its dependence on Russia as an energy provider in light of the situation in Ukraine. The United States and Canada are among the only countries in the world that can significantly increase their production of natural gas to meet this demand and energy producers have been constructing numerous liquefaction plants, primarily along America’s Gulf Coast. There are some other areas in which we have seen these plants get sited though, including America’s East Coast and Prince Edward Island in British Columbia. The consumption of natural gas by these plants in order to make liquefied natural gas is expected to increase by an enormous 190% between now and 2040:

Enbridge

One of the major reasons for this is the global concerns about climate change. As everyone reading this certainly knows, many nations around the world have imposed a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. Among the most common of these mandates is the reduction of the use of coal for the generation of electricity. In most cases, old coal-fired power plants are being replaced with renewables but solar and wind power are not nearly reliable enough to provide the “always on” performance that modern society requires from the electric grid. After all, wind power does not work when the air is still and solar power does not work particularly well at night or when the sun is not shining. The usual solution is to use natural gas turbines to supplement renewables since natural gas burns cleaner than any other fossil fuel and does have the reliability to ensure the performance that we expect from a modern electric grid.

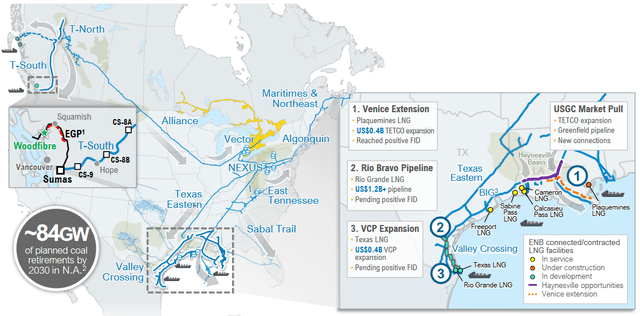

Enbridge’s incoming CEO recognizes that the company may have the ability to profit from this trend even though Enbridge does not actually produce any natural gas itself. This is because Enbridge has one of the largest natural gas transportation networks in North America, accounting for about 20% of the continent’s capacity. Thus, it seems likely that it will be transporting a substantial portion of the incremental natural gas needed to feed the new liquefaction plants that are being constructed. This is especially true because its network already stretches to the areas where many of the new plants are being constructed:

Enbridge has already begun some projects meant to take advantage of this. We can see a few of them in the map above such as the Venice Extension, the Rio Bravo Pipeline, and the VCP Expansion projects. Admittedly, Enbridge has not committed itself to undertake these projects as the company is attempting to secure contracts for their use. However, it seems likely that the company will eventually receive such contracts considering the proximity of its pipelines and the enormous amount of natural gas that the liquefaction plants in the area will require when they ultimately come online. As we already discussed, Enbridge’s cash flows are directly correlated to the resources that it carries. Thus, it would see both its volumes and cash flows increase as it carries the growing quantities of natural gas needed by these liquefaction plants.

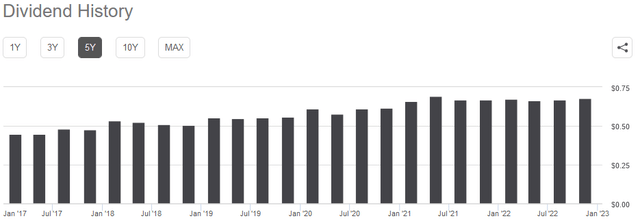

One of the biggest reasons that investors purchase companies like Enbridge is because of the high dividend yields that the company typically pays out. Enbridge yields 6.85% at the current price, which is quite attractive considering that the S&P 500 index (SPY) only yields 1.66% as of the time of writing. Enbridge also has a long track record of raising its dividend over time:

There might be some readers that point out that this chart shows the dividend varying somewhat from quarter to quarter, although the overall trend is still positive. This is because of the exchange rates between the U.S. dollar and the Canadian dollar. Anyone purchasing the stock on the New York Stock Exchange will see the dividend vary a bit because Enbridge pays its dividend in Canadian dollars but American investors receive the U.S. dollar equivalent. The company’s track record in Canadian dollars shows a steady line of increases. As is always the case though, it is critical that we analyze the company’s ability to pay its dividend. After all, we don’t want it to be forced to reverse course and implement a cut since that would reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we analyze a midstream company’s ability to finance its dividend is by looking at the distributable cash flow. Distributable cash flow is a non-GAAP metric that theoretically tells us the amount of money that was generated by a company’s ordinary operations and is available to be distributed to the shareholders. As mentioned in the highlights, Enbridge reported a distributable cash flow of C$2.501 billion in the third quarter of 2022. This works out to C$1.23 per outstanding common share. However, the company only declared a dividend of C$0.86 per common share. Thus, the company had sufficient distributable cash flow to cover its dividend 1.43 times over. Analysts generally consider anything over 1.20x to be reasonable and sustainable so Enbridge clearly meets that requirement. Its coverage ratio is nowhere near as good as many of its American peers possess, however. Overall though, the dividend is probably pretty safe.

In conclusion, Enbridge has long been considered to be a core holding of many dividend investors for a very good reason. The company boasts a reasonably attractive balance sheet, pays out a high dividend yield, and enjoys remarkable financial stability regardless of conditions in the broader economy. The fact that the company has significant growth prospects only adds to its appeal. Overall, this company continues to earn its place in any income-focused portfolio.

Be the first to comment