vvvita/iStock via Getty Images

PIMCO Municipal Income Fund III: Main Thesis & Background

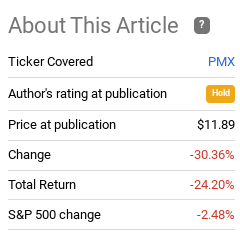

The purpose of this article is to evaluate the PIMCO Municipal Income Fund III (NYSE:PMX) as an investment option at its current market price. This is a fund I keep on my radar screen because I see value in PIMCO’s CEF offerings across the board on many occasions. I am an avid investor in the muni space, and I have held muni CEFs from PIMCO in the past. However, it has been a while since I have seen a buy point for PMX in particular. As a result, it has been almost two years since my last article on it, when I suggested investors look elsewhere. In hindsight, that turned out to be the right advice:

Fund Performance (Seeking Alpha)

Given the time that has passed, combined with this massive drop in price, I thought it was time to take another look at PMX. After review, I see a buy opportunity here that has been lacking for a while, and will explain why below.

Deep In Bear Market Territory

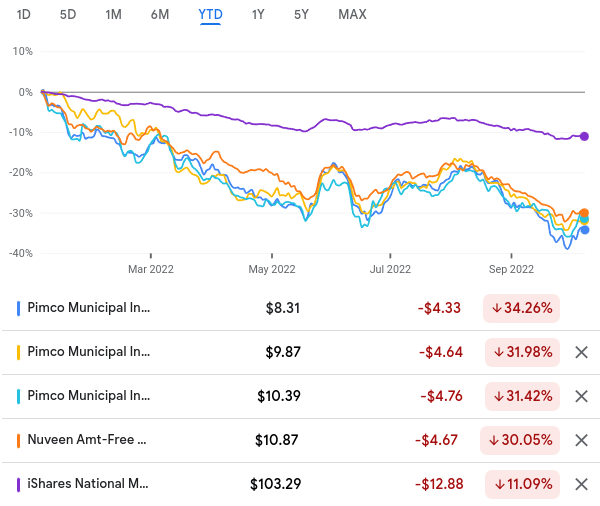

To begin, let us reflect on the state of the broader muni market and of PMX in particular. As followers of this fund are almost certainly aware, 2022 has not been kind to this investment idea. Munis have been punished mostly by rising interest rates, but also the fear of a recession and the impact that could have on state and local government revenues. The end result has been sharp losses for muni bonds, with leveraged products like PMX feeling an oversized amount of pain (leverage will amplify losses when the market’s direction turns against the underlying holdings). For perspective, here is a breakdown of the calendar year returns for the three PIMCO national muni CEFs, as well as the Nuveen AMT-Free Quality Municipal Income Fund (NEA) and the iShares National Muni Bond ETF (MUB) – which is a good benchmark for this sector’s performance as a non-leveraged, passive ETF:

YTD Performance (Various Muni Funds) (Google Finance)

As you can see, munis are in correction mode for the year and the PIMCO options are firmly in bear market territory. I included NEA because that is a fund I own and it has similar performance. So while the PIMCO Municipal Income Fund (PMF), the PIMCO Municipal Income Fund II (PML), and PMX are all in trouble this year, that is far from a unique experience for muni funds.

I personally look at this as an opportunity. When sectors (or funds) are this unpopular it is often a potential rewarding contrarian play. I view that to be the case here given that defaults remain low and tax revenues have been resilient.

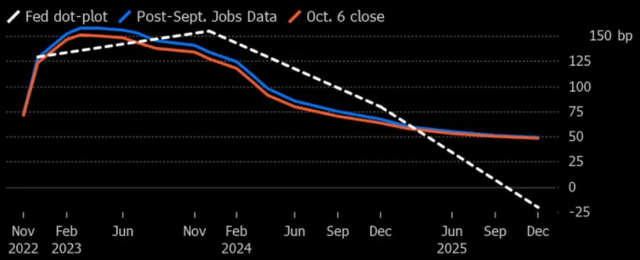

However, I want to manage expectations with a pointed reflection of the continued risk products like PMX face in particular. As a leveraged fund, PMX is heavily exposed to a continued downtrend in the muni sector. If the pain continues then PMX will be disproportionately hurt (as has been the case in 2022 thus far). Further, rising interest rates make the borrowing more expensive for these funds and also pressure the value of all bonds – munis is not an exception to this. The market is indeed expecting rates to keep rising through the year-end, and the Fed’s own dot-plot suggests a declining rate environment won’t happened until 2024:

Interest Rate Projections (CME Group)

What this means to me is that while PMX may look tempting at these levels it is by no means a risk-free option. Not only could losses continue, they could be quite large if the economic backdrop deteriorates and/or the Fed stays more aggressive for longer. Readers need to evaluate these risks, their own personal assessment of them, as well as their tolerance for more declines, before diving into positions now.

PMX CEF Has Relative Value, Usually A Good Sign

With that word of caution under our belt, let us examine some of the metrics that support a buy case. One is relative value for PMX. This is not against the broad muni CEF landscape, but on a more micro-level. What I mean is, PMX is not “cheap” by any standard, and there are a plethora of muni CEFs trading in discount territory. By contrast, PMX trades at a small premium to NAV. This must be understood. But the potential lies with how PMX compares to its two sisters, PMF and PML. These funds see their valuations swing wildly over time, and right now PMX has a distinct relative advantage:

| Fund | Premium to NAV |

| PMX | 6% |

| PMF | 14% |

| PML | 14% |

Source: PIMCO

I view this in two ways. One, it makes it very difficult to see a buy thesis for either PMF or PML when they face the same risks as PMX but trade at a premium that is 2.5 times greater. Two, PMX has a good opportunity of drawing in PIMCO CEF investors looking for a national muni CEF. While cheaper options exist outside PIMCO, those committed to the PIMCO family will have a strong incentive to choose PMX over the others. This opens up a window of opportunity for PMX at the expense of the others. That gets me interested.

Munis As A Whole Have Seen Yields Spike, PMX’s Has Neared 7%

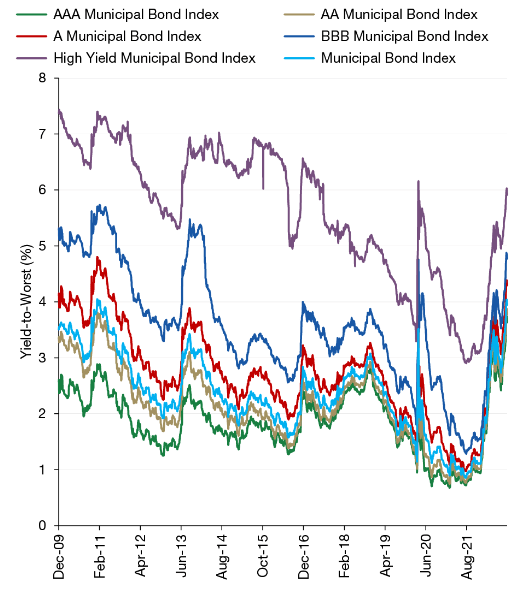

Expanding on the value proposition, the current yields for munis and for PMX both seem to support optimism for new positions. The downside to this is that is has not been become of a lot of new issues at higher yields. Muni issuance has been low in the face of higher borrowing costs, making it more difficult for funds to pick up higher-yielding securities. However, current yields have risen markedly all the same because prices of bonds and the funds that hold them have dropped so much.

While this is an obvious side-effect of declining prices, the point of note is how high the yields have gotten. For each rating class within the muni universe, the current yields are reaching multi-year highs:

Current Yields (Lord Abbett)

Again, this doesn’t mean yields could not go higher still (from bond prices going lower). But I have to take signs like this as encouragement for a more bullish outlook. Trends like this do not last forever. While timing a true “bottom” is a very difficult task, staggering in when we see multi-year highs in yields seems like a prudent course of action to me.

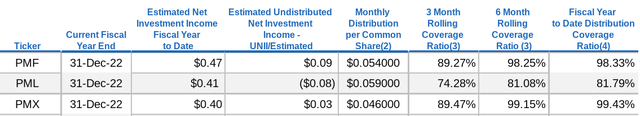

With respect to PMX, the yield story is consistent here. With the fund down 30% in 2022, the distribution yield has neared the 7% mark. The distribution level yields 6.7% at current prices:

Distribution Rate (Seeking Alpha)

My thought here is that when investors consider the tax-exempt status of these distributions, it is hard not to like the income stream. Even with inflation running red hot, this seems like a gamble worth taking.

Income Metrics Are Solid Enough

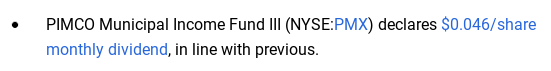

Digging deeper into the income story, let us now consider how supported this current rate is. After all, a high yield is not nearly enticing if it is about to get cut! In that light, let us take some comfort in the most recent UNII figures for PMX, published by PIMCO. As seen in the chart below, all three national muni CEFs have supported distributions at the moment:

In my opinion, the only distribution at immediate risk is PML, further confirming PMX is a better play. However, I would caution that many muni CEFs have seen cuts throughout 2022 – including from managers Nuveen and BlackRock (BLK), among others. PIMCO CEFs are not immune to the challenges facing the broader market, so investors need to factor this into their forward outlook. The good news is that with current yields where they are, funds like PMX, PML, and PMF could see modest cuts and still offer investors a compelling distribution rate.

Other Risks To Keep In Mind

I have mentioned that I believe PMX’s large decline in price, attractive distribution rate and solid income metrics, and the relative valuation of the fund are reasons to initiate or build on positions. But I reiterate again that this is an idea for those who can withstand some risk. Munis have been out of favor this year and there are signs that could continue going into 2023. So what once was a boring, stable sector has become an area that requires more due diligence. Readers should therefore make sure their portfolio can handle that.

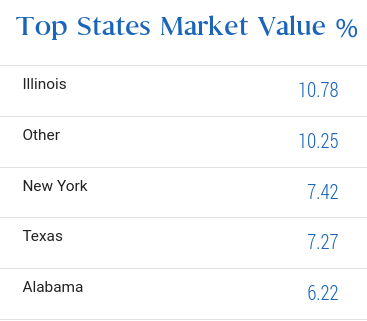

With respect to that caution, one key reason why I feel that way has to do with the top states PMX holds. In particular are Illinois and New York. For perspective, consider that these two states make up over 18% of total assets:

PMX – Top State Exposures (PIMCO)

I am not against exposure to these states inherently. But they present unique risks. Illinois and New York are both known for higher disproportionately high pension costs, relative to the rest of the country. This is due to legacy costs and continued generous benefits for city and state employees that most jurisdictions across the nation simply don’t match. As a result, a larger share of these state budgets are eaten up by current pension obligations, and are continued to be a burden on state revenues for the foreseeable future.

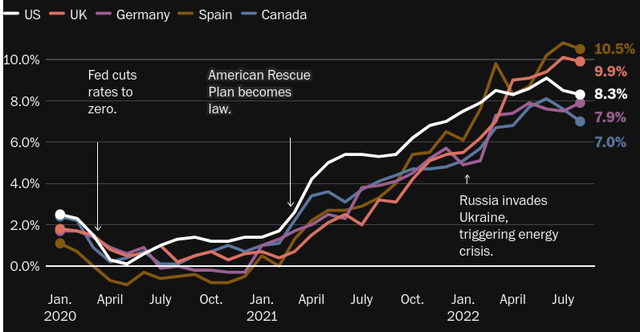

This is a unique risk right now primarily because of the inflation rate. In fairness, excess pension costs are a long-term concern for me when evaluating muni exposure from these states. But in this climate, the risk is amplified.

A key reason why is that for many publicly sponsored plans within Illinois and New York, benefit payments are impacted by cost of living adjustments. These are often indexed to inflation and, as we know, inflation has been well above historical norms for the past year. Rising inflation translates to growing benefit payments, putting more pressure on pension assets and on state and city revenues. While inflation remains a global problem, that offers little comfort to governments contending with the prospect of higher pension outlays:

Global Inflation Rates (World Bank)

The conclusion I draw here is to approach a fund like PMX with cautious optimism. Pension payments are not going to break the bank in the short-term. This is a long-term risk with long-term implications. But it could cause a higher level of volatility in the muni bonds backed by the states most at risk – such as New York and Illinois. Therefore, I would suggest paying close attention to headlines regarding pension obligations, inflation readings, and whether state governments are taking any steps to manage the rising obligations they will face going into new fiscal years.

Bottom-line

PMX has performed very poorly since I last looked at it. While the fund has a high level of income, and a chance for a strong move higher if inflation cools and the fund reverts back to more normalized trading levels. As long as investors are aware of the risks and can handle them, I see merit to a bull thesis right now. I will personally be looking to start a position to capitalize what I see as a drop that has been too far, too fast. As a result, I suggest readers give this idea some consideration at this time.

Be the first to comment