ValeryEgorov

Step One: Wide-moat stocks with 5-star and 4-star ratings

Historical evidence says that while quality alone is a poor indicator of outperformance, when combined with a decent valuation filter, Morningstar’s moat rating proves to be more than useful. Based on the available data, stocks with a wide-moat rating that also fit into the 4- or 5-star category deserve to be the subject of further analysis. See the detailed explanation and the underlying evidence of our first step in this article.

We focus on those companies that are covered by a Morningstar analyst as assigning a wide-moat rating without thorough analysis is a questionable practice in our opinion. As of October 7, there were 184 wide-moat stocks meeting our criteria, unchanged from last month.

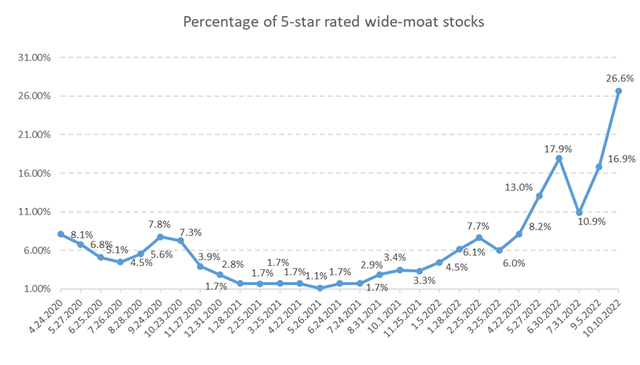

Only 26.6% (49 stocks) of this wide-moat group earned a 5-star (most attractive) valuation rating. Here are they:

|

Company Name |

Ticker |

|

3M Co |

|

|

Adobe Inc |

|

|

Alphabet Inc A |

|

|

Amazon.com Inc |

|

|

Applied Materials Inc |

|

|

BlackRock Inc |

|

|

Cisco Systems |

|

|

Comcast Corp Class A |

|

|

Compass Minerals International |

|

|

Dominion Energy Inc |

D |

|

Ecolab Inc |

|

|

Emerson Electric Co |

|

|

Equifax Inc |

|

|

Meta Platforms Inc |

|

|

Guidewire Software Inc |

|

|

Intercontinental Exchange Inc |

|

|

International Flavors & Fragrances |

|

|

Lam Research Corp |

|

|

Masco Corp |

|

|

Microsoft Corp |

|

|

Nike Inc B |

|

|

Polaris Inc |

|

|

ServiceNow Inc |

|

|

Teradyne Inc |

|

|

The Walt Disney Co |

|

|

Tradeweb Markets Inc |

|

|

TransUnion |

|

|

Tyler Technologies Inc |

|

|

U.S. Bancorp |

|

|

John Wiley & Sons Inc Class A |

|

|

Yum China Holdings Inc |

|

|

Zimmer Biomet Holdings Inc |

|

|

ABB Ltd |

|

|

Airbus SE |

|

|

Alibaba Group Holding Ltd |

|

|

Anheuser-Busch InBev SA/NV |

|

|

ASML Holding NV |

|

|

Bayer AG |

|

|

Core Laboratories NV |

|

|

Experian PLC |

|

|

GlaxoSmithKline PLC |

|

|

Imperial Brands PLC |

|

|

James Hardie Industries PLC |

|

|

JD.com Inc |

|

|

Medtronic PLC |

|

|

Roche Holding AG |

|

|

Sanofi SA |

|

|

Taiwan Semiconductor Manufacturing Co Ltd |

|

|

Tencent Holdings Ltd |

We believe that the percentage of 5-star-rated wide-moat stocks is a good indicator of market sentiment. When this percentage is high, even the best companies are on sale. When the percentage is extremely low, market conditions may warrant caution. (Please note that this is not an indicator for market timing!)

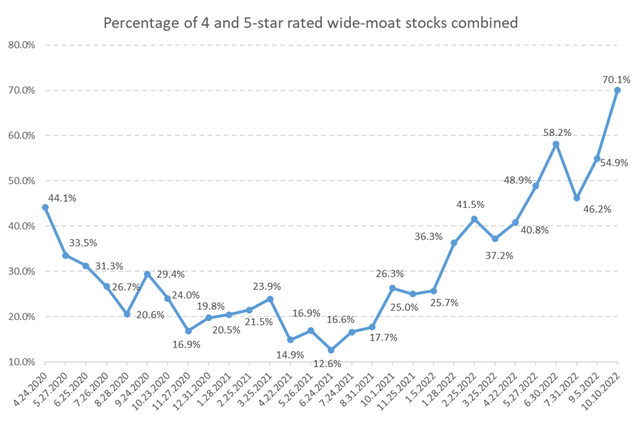

As these best of breed companies may be worth a closer look even when they are just slightly cheaper than their fair value but are not in the bargain bin, we also list the 4-star-rated wide-moat stocks as of October 7:

|

Company Name |

Ticker |

|

Altria Group Inc |

|

|

American Express Co |

|

|

Amgen Inc |

|

|

Analog Devices Inc |

|

|

Autodesk Inc |

|

|

Bank of America Corp |

|

|

Bank of New York Mellon Corp |

|

|

Berkshire Hathaway Inc B |

|

|

Biogen Inc |

|

|

Blackbaud Inc |

|

|

Boeing Co |

|

|

Brown-Forman Corp Class B |

|

|

Campbell Soup Co |

|

|

Clorox Co |

|

|

CME Group Inc Class A |

|

|

Coca-Cola Co |

|

|

Colgate-Palmolive Co |

|

|

Constellation Brands Inc A |

|

|

CSX Corp |

|

|

Domino’s Pizza Inc |

|

|

Expeditors International of Washington Inc |

|

|

Etsy Inc |

|

|

Fortinet Inc |

|

|

Gilead Sciences Inc |

|

|

Graco Inc |

|

|

Harley-Davidson Inc |

|

|

Honeywell International Inc |

|

|

Intuit Inc |

|

|

JPMorgan Chase & Co |

|

|

Kellogg Co |

|

|

Keysight Technologies Inc |

|

|

KLA Corp |

|

|

MarketAxess Holdings Inc |

|

|

Mastercard Inc A |

|

|

MercadoLibre Inc |

|

|

Microchip Technology Inc |

|

|

Mondelez International Inc |

|

|

Monolithic Power Systems Inc |

|

|

Moody’s Corporation |

|

|

Norfolk Southern Corp |

|

|

Northern Trust Corp |

|

|

NVIDIA Corp |

|

|

Otis Worldwide Corp |

|

|

Pfizer Inc |

|

|

Philip Morris International Inc |

|

|

Raytheon Technologies Corp |

|

|

Rockwell Automation Inc |

|

|

Roper Technologies Inc |

|

|

S&P Global Inc |

|

|

Salesforce.com Inc |

|

|

Starbucks Corp |

|

|

State Street Corporation |

|

|

T. Rowe Price Group Inc |

|

|

Thermo Fischer Scientific Inc |

|

|

The Estee Lauder Companies Inc |

|

|

The Western Union Co |

|

|

TransDigm Group Inc |

|

|

United Parcel Service Inc |

|

|

Veeva Systems Inc Class A |

|

|

VeriSign Inc |

|

|

Visa Inc Class A |

|

|

Wells Fargo & Co |

|

|

West Pharmaceutical Services Inc |

|

|

Workday Inc Class A |

|

|

Yum Brands Inc |

|

|

Zoetis Inc Class A |

|

|

Amphenol Corp Class A |

|

|

Allegion PLC |

|

|

Ambev SA ADR |

|

|

AstraZeneca PLC |

|

|

Baidu Inc |

|

|

British American Tobacco PLC A |

|

|

Dassault Systemes SE |

|

|

Fanuc Corp |

|

|

Nestle SA |

|

|

Novartis AG |

|

|

Reckitt Benckiser Group PLC |

|

|

Royal Bank of Canada |

|

|

The Toronto-Dominion Bank |

|

|

Unilever PLC |

All in all, we have 129 firms that pass our very first criteria. (Up from 101 a month ago.)

Step Two: Historical Valuation in the EVA Framework

We believe that the most widely used valuation multiples are terribly flawed. See this article on why we consider the Future Growth Reliance metric the best-of-breed sentiment indicator that addresses accounting distortions, thus gives us a true picture of which wide-moat companies seem attractively valued in historical terms. We want to buy our top-quality targets when the baked-in expectations are low, since that is when surprising on the upside has the highest probability. As investment is a game of probabilities, all we can do is stack the odds in our favor as much as possible.

73 of the 129 stocks survived this second step. Here’s the list:

|

Company Name |

Ticker |

|

3M Co |

|

|

ABB Ltd |

|

|

Adobe Inc |

|

|

Airbus SE |

|

|

Alphabet Inc A |

|

|

Amazon.com Inc |

|

|

American Express Co |

|

|

Amphenol Corp Class A |

|

|

Anheuser-Busch InBev SA/NV |

|

|

Applied Materials Inc |

|

|

Autodesk Inc |

|

|

Bank of America Corp |

|

|

Blackbaud Inc |

|

|

BlackRock Inc |

|

|

Brown-Forman Corp Class B |

|

|

Cisco Systems |

|

|

CME Group Inc Class A |

|

|

Coca-Cola Co |

|

|

Colgate-Palmolive Co |

|

|

Comcast Corp Class A |

|

|

CSX Corp |

|

|

Domino’s Pizza Inc |

|

|

Emerson Electric Co |

|

|

Equifax Inc |

|

|

Expeditors International of Washington Inc |

|

|

Experian PLC |

|

|

Fanuc Corp ADR |

|

|

GlaxoSmithKline PLC |

|

|

Harley-Davidson Inc |

|

|

Imperial Brands PLC |

|

|

Intercontinental Exchange Inc |

|

|

JPMorgan Chase & Co |

|

|

KLA Corp |

|

|

Lam Research Corp |

|

|

MarketAxess Holdings Inc |

|

|

Masco Corp |

|

|

Mastercard Inc A |

|

|

MercadoLibre Inc |

|

|

Meta Platforms Inc |

|

|

Microchip Technology Inc |

|

|

Mondelez International Inc |

|

|

Monolithic Power Systems Inc |

|

|

Nestle SA ADR |

|

|

Nike Inc B |

|

|

Norfolk Southern Corp |

|

|

Northern Trust Corp |

|

|

Novartis AG ADR |

|

|

Pfizer Inc |

|

|

Philip Morris International Inc |

|

|

Polaris Inc |

|

|

T. Rowe Price Group Inc |

|

|

Reckitt Benckiser Group PLC AD |

|

|

Roche Holding AG |

|

|

Royal Bank of Canada |

|

|

Salesforce.com Inc |

|

|

Sanofi SA |

|

|

ServiceNow Inc |

|

|

Starbucks Corp |

|

|

State Street Corporation |

|

|

Taiwan Semiconductor Manufacturing Co Ltd |

|

|

Tencent Holdings Ltd |

|

|

Teradyne Inc |

|

|

Thermo Fischer Scientific Inc |

|

|

The Toronto-Dominion Bank |

|

|

Unilever PLC ADR |

|

|

United Parcel Service Inc |

|

|

U.S. Bancorp |

|

|

VeriSign Inc |

|

|

Visa Inc Class A |

V |

|

West Pharmaceutical Services Inc |

|

|

The Western Union Co |

|

|

Workday Inc Class A |

|

|

Yum Brands Inc |

We are rather strict when it comes to historical valuation. There are stocks that unquestionably fail both or short- and long-term tests. There are some targets, however, that may look attractively valued if you only focus on the short-term (like the last 5 years), but the longer you zoom out, the more you lose your appetite. It comes down to personal preference where you draw the line. For us, only those stocks are allowed to appear on the heat map in our third step that seem attractively valued in both a short-term and long-term context. (We go back as far as 20 years, calculate averages and medians on different time frames and let our algorithm do the ruthless work.)

Step Three: The Heat Map of the most investable wide-moat stocks

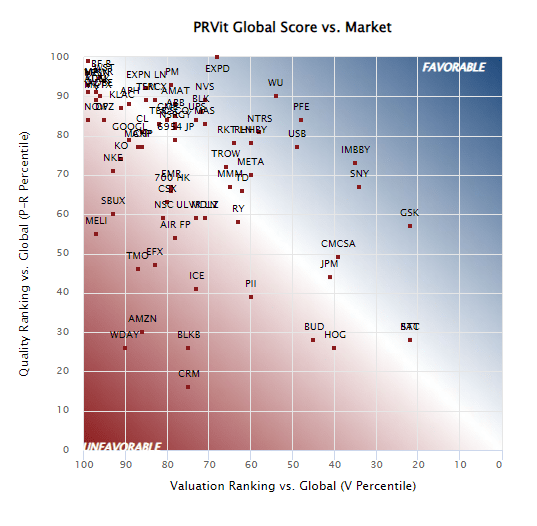

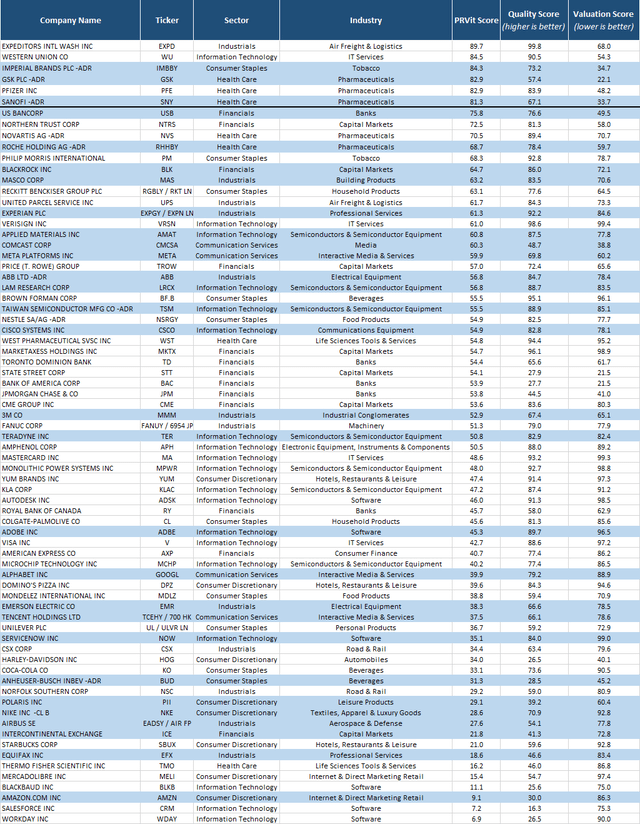

Seeing the stocks of our shortlist on a heat map with a quality and valuation axis is something that can prove very useful when we need to make a decision on which candidates to analyze thoroughly. As explained in our previous article, we use the PRVit (Performance-Risk-Valuation investment technology) model of the EVA Dimensions team.

All in all, PRVit is a multifactor quantitative stock selection model based on EVA-centric measures of Performance, Risk, and Valuation. It first estimates the fundamental value of a company based on its risk-adjusted EVA performance (shown on the vertical axis) and then compares it to its actual valuation (shown on the horizontal axis). All factors in this model were chosen heuristically based on common sense, and not by data mining, yet strong and statistically significant backtests prove the soundness of the PRVit approach both in the U.S. and globally. (See the details here.)

Here is the heat map as of October 7:

Institutional Shareholder Services Inc.

We also present the results in a table format to make your decision easier.

Institutional Shareholder Services Inc., Morningstar

(Stocks highlighted in light blue are Morningstar’s 5-star-rated wide-moat names that survived the second step of our process.)

In PRVit, the factors are grouped into three categories: Performance, Risk, and Valuation. Each company has a composite 0-100 score in each category, where higher is better for Performance and lower is better for Risk and Valuation. We believe that stocks in the upper quintile of the PRVit ranking (with a PRVit score above 80) are worth a closer look.

We plan to run this three-step process on a monthly basis and publish the shortlist of targets it produces.

Be the first to comment