de-nue-pic/iStock Editorial via Getty Images

The shares of Match Group (NASDAQ:MTCH) have lost their game. At least for now. But change is on the way. It is our belief that the new CEO, who at Zynga delivered, will make a difference. If growth has decelerated and profitability eroded, a combination of new strategic endeavors, a leading competitive edge, powerful network effects, more favorable valuation, and top brands, seems to constitute, despite numerous risks, the foundations for a compelling bullish case.

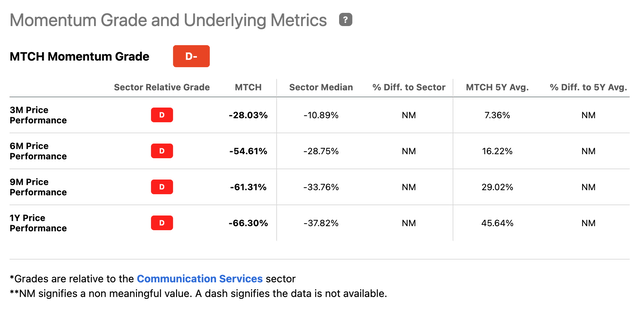

Match Shares Have Collapsed; Momentum Is Negative

Check out the graph below:

E*Trade

Isn’t there a saying about falling a catching knife – in a market that punishes nearly any longs on top? After reaching an all-time high of $182 on October 18, 2021, the shares of Match Group, Inc. have lost almost 75% of their value. Quite a hair cut in just under one year.

Momentum is clearly to the downside, with the shares retreating in all four following time capsules:

Seeking Alpha – Momentum

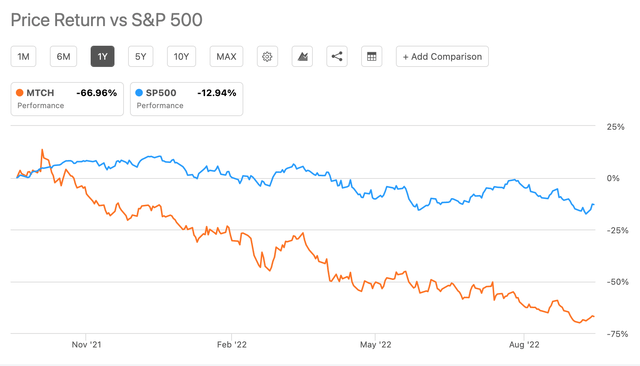

Worse, the shares have underperformed the S&P 500 by a wide margin, as follows:

Seeking Alpha -Momentum

They key question now becomes: Can the shares, which until the end of 2020 seemed to be headed for greatness, aka the moon, regain altitude? Do they present investors with a solid long-term opportunity? We make the case that they indeed constitute a solid buy at current price.

Not that at first blush, Match reveals itself to be a no-brainer or a winner at all.

Growth Has Decelerated and Profitability Eroded

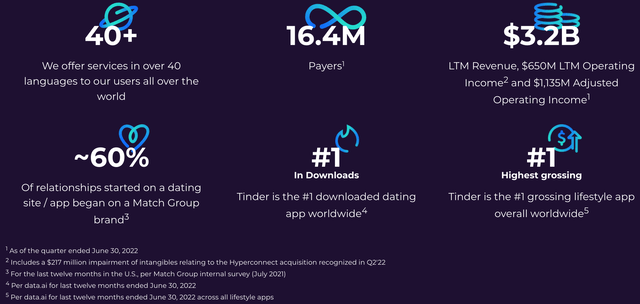

In Q2 ’22, Match saw total revenue grow 12% over Q2 ’21 to $795 million [granted, that’s good for 19% growth on a foreign exchange (“FX”) neutral basis]. Payers increased 10% to 16.4 million, up from 15.0 million in Q2 ’21. Revenue per payer (RPP) increased 3% over the same period to $15.86. Tinder’s revenue growth of 13% over Q2 ’21 (driven by 14% Payers growth to 10.9 million, partially offset by a RPP decline of 1%) is also good, not great. All other brands grew direct revenue 12% year-over-year – via a combination of 10% RPP growth and 2% Payers growth to 5.5 million. Most of these numbers are decent, but overall the firm is not experiencing a boom or blast; it’ll likely fail to impress the aggressive growth investor. Put another way, Cathy Wood and her ARK family of ETF’s does not own Match.

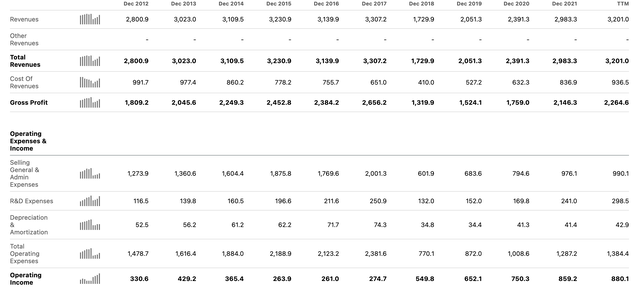

The yearly trends don’t seem to look much better. Check out the top line of the income statement:

Seeking Alpha Financials

The firm does not seem to be growing much at all.

Further, in Q2’22 Match incurred an operating loss of $10 million (granted, driven by a $217 million impairment of intangibles relating to its Hyperconnect acquisition). Adjusted Operating Income was $286 million, an increase of 9% over Q2 ’21, good for an Adjusted Operating Income Margin of 36%.

Year-to-date 2022 Operating Cash Flow and Free Cash Flow were $20 million and negative $7 million, respectively (granted, driven by a $441 million payment related to a Tinder litigation settlement).

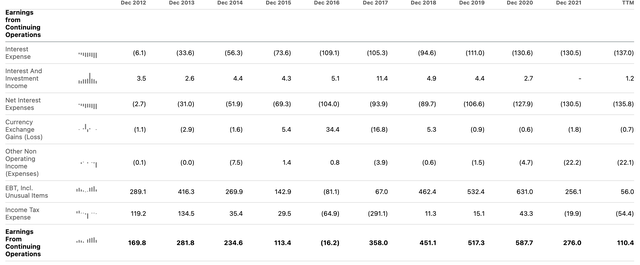

Check out the bottom line (as figures in the income statement) below.

Seeking Alpha Financials

Seeking Alpha Financials

Both earnings from continuing operations and net income show a clear yearly deterioration. Even the Cash Flow Statement shows cash from operations recently retreating and turning negative.

The firm’s outlook fails to impress, as well. Per Match Group’s Shareholder Letter, Q2 ’22, August 2, 2022:

We expect muted top-line growth in the second half of 2022. Our Q3 Total Revenue outlook of $790 to $800 million is essentially flat year-over-year. We expect FX to have an 8-point impact on year-over-year revenue growth in Q3. For Tinder, we expect year-over-year Direct Revenue growth to be in the mid single-digits (low teens on an FX neutral basis). We expect Hinge, BLK and Chispa to continue to perform strongly and help offset declines at the Established Brands.

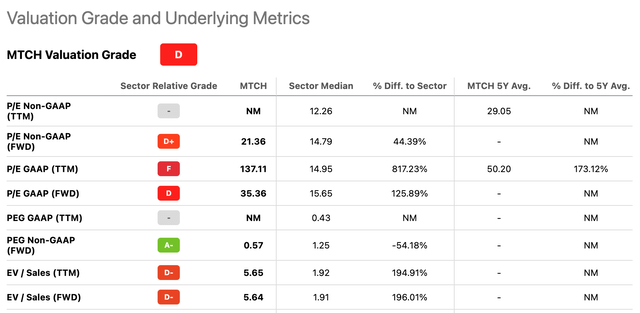

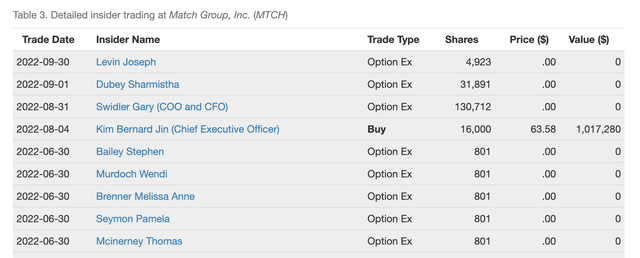

A First Look at Valuation Does not Seem To Scream Opportunity Either

Check out the valuation grade below. Most metrics including PE/GAAP (Trailing 12 months of 137 and Enterprise Value over sales of 5.65) seem aggressive. Price over sales or book shows similar results. Tough to make the case for value. Warren Buffett does not own Match and is likely not buying anytime soon.

Seeking Alpha – Valuation

Seeking Alpha – Valuation

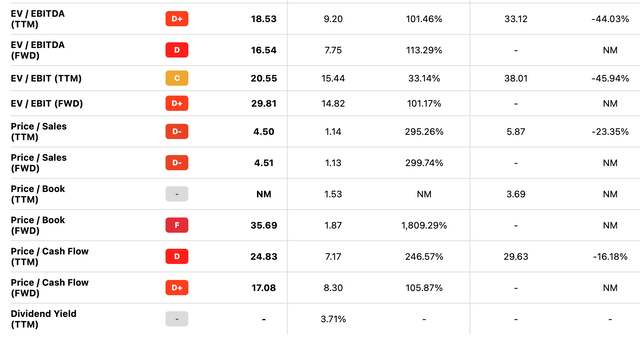

The Quant Rating Sums it All Up. To Embrace a Bullish Stance on Match Is… a Challenge

The quant rating, with its distinctive predictive attributes, captures the essence of the dynamics at play here.

Seeking Alpha – Quant Rating

The balance sheet does show that Match has a significant amount of long-term debt, adding to the challenge.

Indeed, investing in Match requires constructing no less than a contrarian scenario. Can the shares, which have been in a heavy downtrend for the past year, regain altitude? We believe that they can, and that there is a good chance they will.

Let’s dig in and build the bullish case.

New Management May Rock the Boat

Never a bad idea to start with the people who steer the boat. As it happens, there is fresh blood. Bernard Kim started as new CEO, effective May 31, 2022. He’s thus been at his new job for close to six months. He’s already made significant changes in management, as reported in Match’s Shareholder Letter, and his leadership may start to impact both the business and the stock soon; that’s usually how long it takes for new management’s mark to materialize and the ramifications of strategic changes to take.

Interestingly, Kim served as President of Zynga from 2016 to 2022, overseeing revenue, product management, user acquisition, global marketing, mergers and acquisitions, and more. Under his leadership, Zynga expanded into new markets such as blockchain and new platforms like smart home devices.

Now check Zynga’s stock chart under Kim’s leadership:

Barchart

Kim’s arrival at Zynga in 2016 pretty much coincides with the stock’s bottom. Between 2016 and 2022, Kim helped quadruple Zynga’s market cap, leading to its $12.7 billion acquisition by Take-Two, which was announced in January 2022. Good for a four-bagger in 5+ years. Not bad at all.

Clearly, he delivered. Of course, past performance is no indication of future performance, and Match is no Zynga. But surely, Kim can deliver both solid business performance records and stock price appreciation to match (no pun intended).

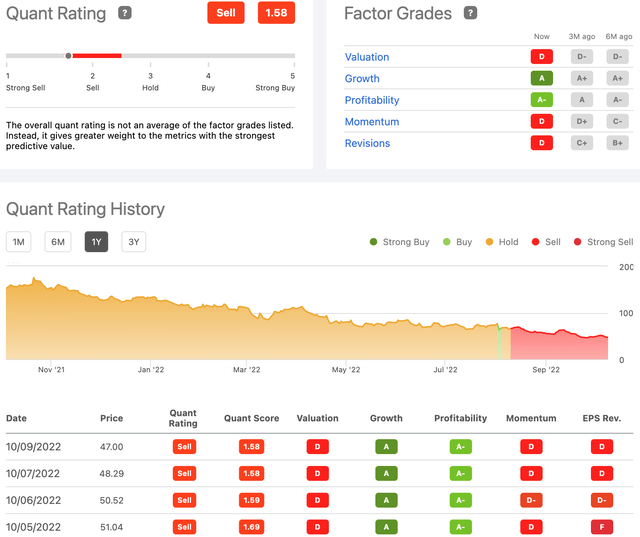

The CEO Buys the Shares; Nothing Like the Top Insider Buying to Signal Management Cares

CEO Kim purchased about $1 million worth of Match shares on August 4, 2022. This is no guarantee the stock will be a long-term winner, of course. I’ve seen my share of top insiders buying their stock only for the company to underperform, if not go under. But it shows that the new CEO 1) believes or at least hopes the stock will go up; 2) further aligns his interests with public shareholders’; and 3) sends a clear, unmistakable signal that he cares. Many of us will relate.

Insider Monitor

Even better, courtesy of the bear market hitting most stocks outside of oil today, the stock recently closed at $48.29 (delayed quote: Oct 07, 2022, 4:00 PM ET). Kim bought at an average price of $63.58. Investors can now get them at a 24% discount.

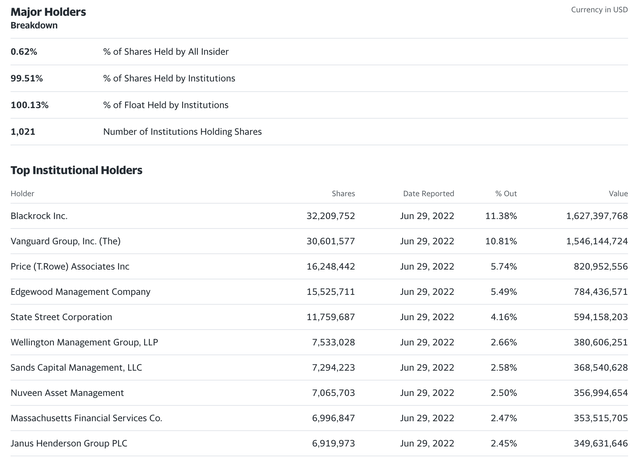

By the way, institutions like the shares too, as institutional ownership is very high. BlackRock and Vanguard each own more than 10% of the stock, and T. Rowe Price more than 5%.

Yahoo Finance

The CEO bought shares and institutions are staying onboard for a reason. There is an increasing probability the shares will turn around in the foreseeable future, or so they seem to believe.

A new strategic focus and its business ramifications, a number of entrenched competitive advantages, and several market trends, are likely to combine to reboot the share price and propel the stock higher.

Match Enjoys Market Leadership and a Competitive Moat

Match Group has more than 45 brands of online dating sites and/or apps, including Tinder, Hinge, Match.com, and OkCupid. Its dating apps portfolio includes four of the five market-leading brands in North America. Tinder is the world’s number-one downloaded dating app. Match’s website articulates it best:

Match Group Website

The firm constitutes a conglomerate of online dating apps, each of which targets a particular segment of the dating world (based on specific geographies, demographics, psychographics, etc.), and the sum of which creates a network effect across the entire portfolio of services. This helps reinforce the firm’s competitive advantage and market leadership, enhance its reputation, and improve scalability via superior network technological infrastructure leverage. There is a strong possibility that this will help the firm generate excess returns for at least the next few years.

New management and a leading market stance and product and technological edge are not enough if the market is declining. As it turns out, it is not even close to stagnating.

The Dating Market Itself Is Expected to Grow at a Healthy Clip

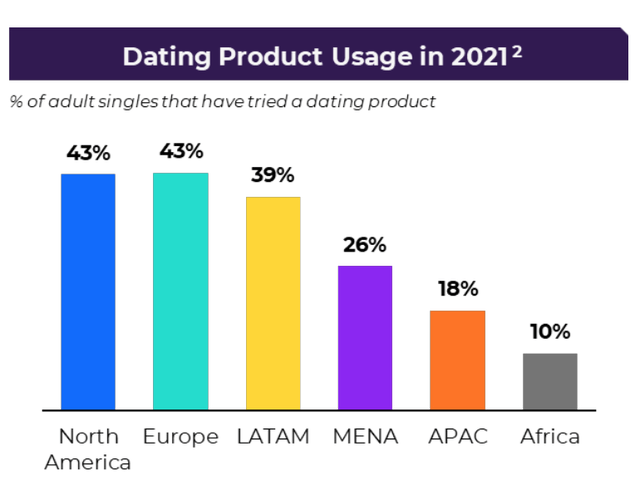

The global online dating market was estimated at US$12.37 billion in 2021, and is expected to be worth US$28.36 billion in 2027 – thus growing at a still impressive CAGR of 14.84% over the forecasted period of 2022-2027. To quote ReportLinker:

One of the key drivers of the market’s expansion is an increase in single adult population. The number of adults which are single and looking for a potential relationship is a major driver for the growth of the online dating market. A large proportion of the single population uses one or more dating services. The millennials are comparatively more career oriented than their older counterparts and their decision to stay single for a long time could be one of the factors behind the rapid growth of the adult single population. Other significant growth factors of the market include rising internet users, increasing smartphone penetration, changing perception of online dating and delayed marriages among the youth, etc.

(…) The market is projected to grow at a fast pace during the forecast period, due to increasing use of block technology and big data and rising adoption among older generation. Online dating websites and apps have been troubled by the issue of profile authenticity since their inception. The blockchain technology helps in identity verification, data safety and security and improving the overall matchmaking process. Blockchain technology is built on the idea of transparency, which acts as a boon for the online dating market as it enables the service providers to identify fake profiles and dating scammers. The rising use of blockchain technology by online dating service providers would increase transparency among the users and would thus encourage more users to use their services, thereby leading to market growth.

In its Shareholder Letter, Q2 ’22, Match Management (read, CEO Kim) adds:

It’s apparent that there’s significant runway remaining for our businesses in all of our markets. More than half of singles in developed markets such as the U.S. and Western Europe have yet to try dating apps. In APAC and other parts of the world, an even larger percentage of people have yet to try them and, even though cultural barriers and stigma are higher, these regions present an enormous opportunity for growth. While we can grow our user base globally, we also can expand the portion of our user base which pays for our products, which today is just above 15%. I’ve spent my career driving à la carte monetization in free-to-play gaming, and I’m excited to bring those learnings and expertise to our brands to drive more value. I’m confident that there is significant opportunity in this area for Match Group, including the ability to more fully monetize power users.

Match Group Shareholder Letter, Q2 ’22

Solid management leads the online dating tech leader to confront a healthily expanding market. The outlook suddenly seems to hold much more promise. Let’s keep the momentum going.

A new strategic focus is key.

New Management’s New Strategic Focus Should Yield New Results

The CEO and emerging new management team are focused on rebooting many of Match’s brands by shipping new features at increased speed to increase monetization. Tinder is a prime example. To quote the Letter to Shareholders again:

In the near-term, the Tinder product roadmap remains focused on some of the key initiatives we previously laid out including to better serve our female users. To that end, we’ll be rolling out a new subscription package based on curated recommendations that we believe will appeal particularly to women. We also plan to introduce several features to get users’ friends more involved, such as a new patented Swipe Party™ feature, increasing the utility of Tinder and expanding its TAM. Additionally, we intend to introduce a shorter-term subscription package, which we think will appeal to newer Tinder users and drive incremental revenue.

This, in addition to management changes, should help the company regain its footing. Further international expansion of specific brands (Hinge) constitutes another key strategic endeavor.

Match is also looking to add new apps that serve key demographic groups. Per the same Shareholder Letter:

We’ve done so for the Black community with the BLK® app and the Hispanic community with the Chispa™ app, and we now have moved onto the Christian community with the Upward® app and single parents with the Stir® app. Collectively, these new brands are expected to add ~$75 million of revenue to the company in 2022, compared to zero revenue three years ago. In addition, we’ve experienced much success in adding live streaming to our Plenty of Fish business, which is our first successful foray into monetization beyond dating and has demonstrated to us the value in monetizing power users.

A few weeks ago, we closed the acquisition of The League®, which enables us to serve a new vertical of highly ambitious, career-oriented singles. We’ve never offered an ultra premium product that caters to this valuable niche market. We’re confident we can generate synergies by bringing The League onto our platform. We have a track record with prior dating acquisitions of maximizing value by leveraging our expertise in marketing and monetization, and there is plenty of opportunity to grow The League’s small but avid user base and its overall revenue. (…)

The above may result in a simultaneous increase in paid users, revenue per user, and share of a still expanding market (particularly, international markets), in turn attracting more ad-sensitive market segments and thus ad dollars. If hoping for a 15% five-year CAGR in revenue growth remains a bit of a stretch, it suddenly no longer seems like an unreasonable goal to shoot for.

For other more established brands including Match and OkCupid, one key strategic focus is to maximize cash flow, remain disciplined with costs, especially marketing, and optimize ROI.

The Company Maintains Strong Financial Discipline

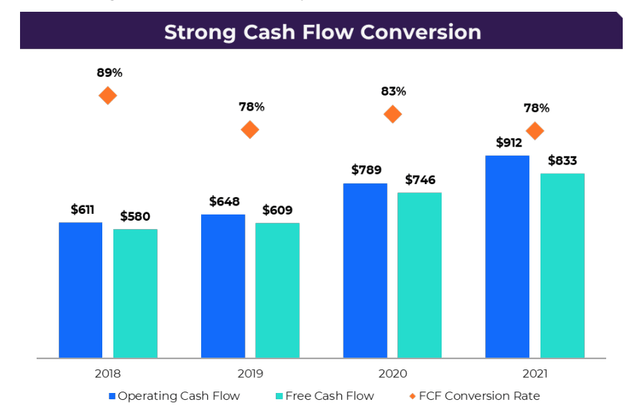

If the trend is not good, note, however, that the challenge is not for the firm to survive; rather, it is to reboot the business so it can resume growing profitably. Match continues to generate free cash flow.

Per the Letter to Shareholders:

Our portfolio generates significant free cash flow (“FCF”), with limited capex and strong Adjusted Operating Income to FCF conversion rates. FCF conversion rates have been 78% or better consistently since 2018, and we expect FCF conversion to be at similar levels in 2022 (excluding the Tinder litigation settlement).

Match Group (MTCH) Letter to Shareholders Q2 ’22

The letter continues:

In all environments, but especially in the currently challenging one we are all facing, we expect to remain laser-focused on cost discipline. We’ve reduced our hiring plans for 2022 and have also cut back on marketing spend where it made sense to do so. We have a strong margin profile and see further upside as App Store fee relief takes hold globally, particularly in response to the Digital Markets Act becoming effective in Europe in early 2023. We also remain very disciplined in terms of stock-based compensation (“SBC”), with our estimated SBC expense/revenue ratio of ~7% for 2022 being among the lowest in our peer group.

Further, the company remains committed to strengthening its balance sheet. Per the same source:

We remain committed to (…) being steadfast stewards of our capital. We’ve delivered on our promise to de-lever to 3x net leverage, and favor conservative leverage levels, especially in light of current macroeconomic headwinds and uncertainty.

A large net debt balance may limit access to capital for additional growth-driving acquisitions. Any focus on de-levering can only help Match Group’s regain agility and flexibility.

Valuation Is Now Favorable

Before crashing, Match’s stock was trading at a very high forward P/E and EV to forward EBITDA – this for a growth stock not growing, or whose growth was about to stall anyway. Now the valuation premium is gone. The stock trades >70% down, and the business may very well resume growing. Food for thoughts already.

The guidance remains weak, but a lot of factors are starting to combine that are setting up the investor for major surprises, this time positive. The barrage or virtuous circle of revisions lowering consensus estimates and contractions hitting earnings multiples may soon break.

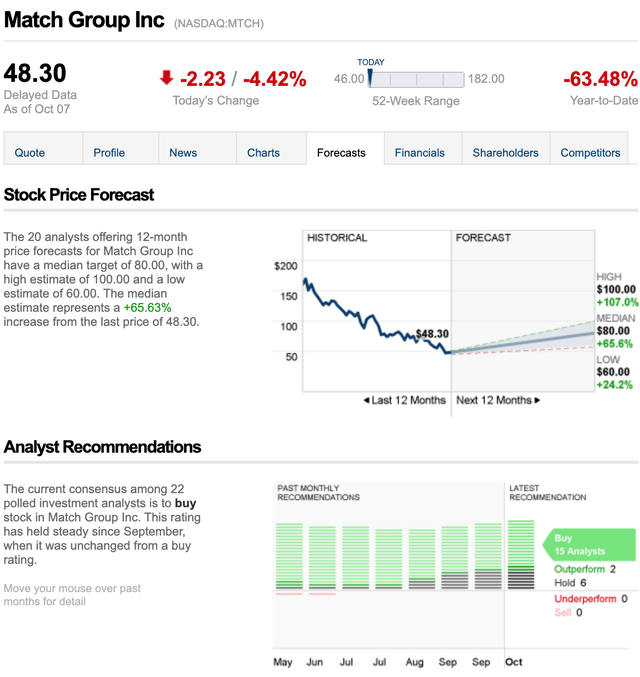

The 20 analysts offering 12-month price forecasts for Match have a median target of 80.00, with a high estimate of 100.00 and a low estimate of 60.00. The median estimate represents a +65.63% increase from the last price of 48.30.

CNN Business

Morningstar has a fair value estimate is $83 per share, equivalent to 2022 enterprise value/sales and enterprise value/ adjusted EBITDA multiples of nearly 9 and 25, respectively. To quote Morningstar Equity Analyst Report:

We have modeled revenue growth and margin expansion through 2026. Our projections represent a five-year compound annual growth rate of 13% for revenue and a five-year average operating margin of 33%. (…)”

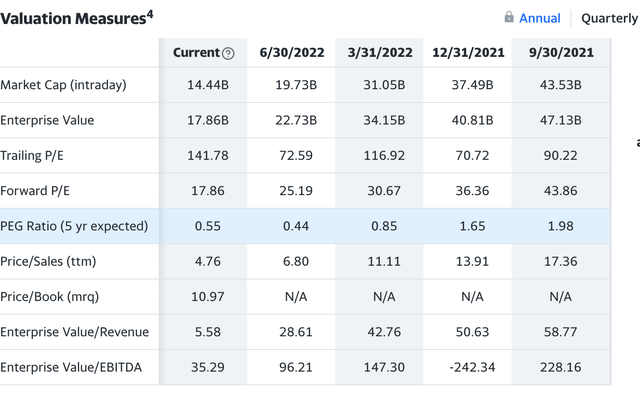

Check out the table of valuation metrics below, in particular the PEG ratio, which enhances the P/E ratio by adding expected earnings growth into the calculation, for added perspective.

Yahoo Finance

In general, a favorable PEG ratio has a value lower than 1.0. PEG ratios greater than 1.0 suggest a stock is overvalued. Match’s ratio’s been going down sharply and now figures well under 1.

Match’s valuation thus looks more attractive.

Risks

The emergence of a bullish scenario does not mean that there are no risks involved in investing in Match. This a contrarian investment. By definition, it is a high-risk venture, especially in a bear market. Any prospective shareholder should read Match Group’s 10k to get a full sense for the risks involved in investing in the firm’s shares. I’ll narrow it down to a few that I believe matter most.

A number of Match’s brands including Match.com and even star Tinder are reaching maturity in the marketplace. Faster deceleration in top-line growth is always a concern. New management has a real shot at rebooting them, but the challenge is real, and the impact on margins no less. In addition, over time, if different brands attract similar users, cannibalization of one brand by another could be detrimental to overall results.

Match faces social and governance risk related to data privacy and security. Users on the Match platforms submit a lot of personal information to attract other users. Match and its strategic units collect extensive user behavior data, as well. Users and governments are pushing for data privacy enforcement. Legal, compliance, and other costs may creep up.

Potential competitors including established social media companies and other large players that could devote greater resources to the promotion of their services, constitute another key threat. These rivals could also leverage acquisitions to gain share. Per the 10k:

For example, Facebook has introduced a dating feature on its platform, which it has rolled out globally and has grown dramatically in size supported by Facebook’s massive worldwide user footprint. These social media and mobile platform competitors could use strong or dominant positions in one or more markets, and ready access to existing large pools of potential users and personal information regarding those users, to gain competitive advantages over us, including by offering different features or services that users may prefer or offering their services to users at no charge, which may enable them to acquire and engage users at the expense of our user growth or engagement.

Match also relies on a number of third-party platforms, in particular, mobile app stores, to distribute its services. If these third parties tweak features or otherwise change their policies in any significant fashion, it could adversely impact Match’s business.

Conclusion

Match Group may constitute a significant wealth creation opportunity for long-term investors. The firm qualifies as:

- a market and technology leader with new management and top brands in an expanding space,

- Growth-challenged but new strategic endeavors combined with financial discipline and fundamentals more favorable than it seems at first blush offer significant hope.

- Negative momentum and market sentiment have punished the stock, presenting investors with a relative bargain.

Solid appreciation potential exists within the next five years. Bullish investors should start accumulating decisively. The more cautious ones – i.e., those waiting for the start of the next bull market or greater visibility into Match’s future cash flows and earnings – might prefer to dollar average.

Be the first to comment