Darren415

In my view, J.Jill (NYSE:JILL) is currently undergoing a period of transformation, which could be very beneficial for the future free cash flow in the coming years. Keep in mind that management already announced a ‘Welcome Everybody’ campaign, under which it expects to transform the shopping experience. In my view, correct assessment of the company’s database of clients and identification of suppliers could bring more free cash flow than expected by the market. Even considering the risks, I believe that JILL is significantly undervalued at its current market price.

J.Jill Is Reshaping The Business And Redesigning New Campaigns

Headquartered outside Boston, J.Jill bills itself as a premier omnichannel retailer and women’s apparel brand. Already with more than 250 stores and an ecommerce platform, management appears to be reshaping the organization to enhance profitability.

Management has offered a significant number of communications explaining how the company’s strategy is being redesigned to enhance shopping experience. I believe that the company is undergoing a period of transformation, which could be significantly beneficial in the coming years. In this regard, let’s read the following words about the company’s new ambitions:

We recently announced our ‘Welcome Everybody’ campaign focused on delivering an elevated shopping experience online and in stores, that celebrates the totality of all women. We remain confident in our ability to deliver against our objectives and expect to leverage the operating disciplines and stronger foundation we now have in place to continue to drive results. Source: J.Jill Inc. – J.Jill, Inc. Announces Second Quarter 2022 Results

Impressive Results And Beneficial Expectations

In 2022, management has reported quite impressive results, much better than that in the same period in 2021. I believe that the efforts are already paying off.

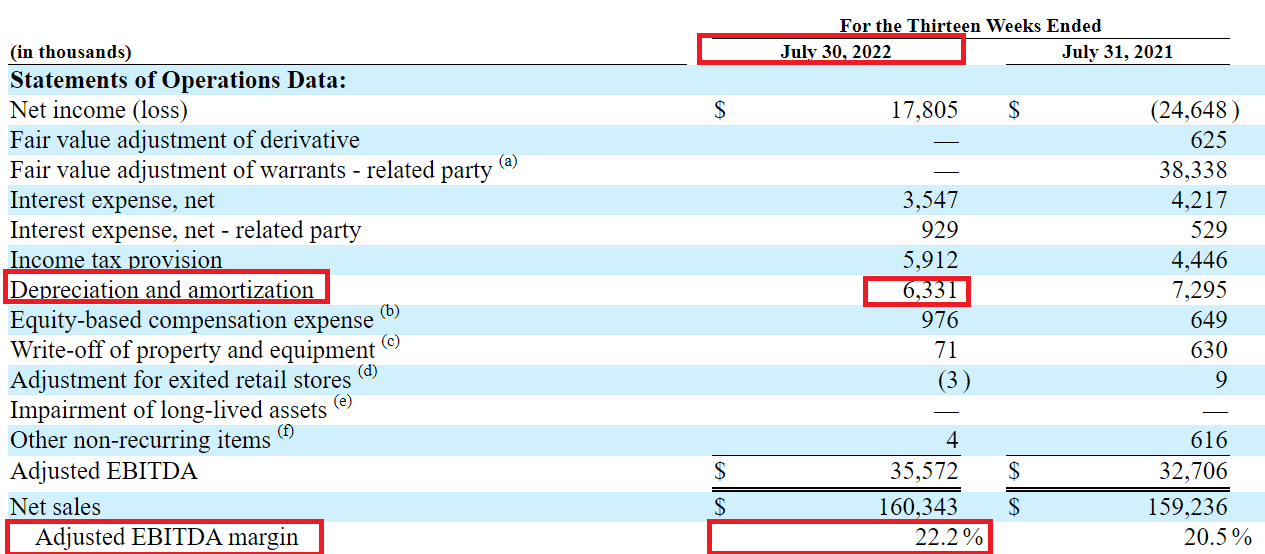

For the thirteen weeks ended July 30, 2022, the company reported a net income of $17.8 million and an interest expense of $3.5 million, together with an income tax provision of $5.9 million. In addition to reporting a depreciation and amortization of $6.3 million, the company noted an adjusted EBITDA of $35.572 million with an adjusted EBITDA margin of 22.2%. I used these numbers in my financial models, so I would recommend readers to have a look. My assumptions are not far from the numbers reported by management in 2022.

Source: J.Jill Inc. – J.Jill, Inc. Announces Second Quarter 2022 Results

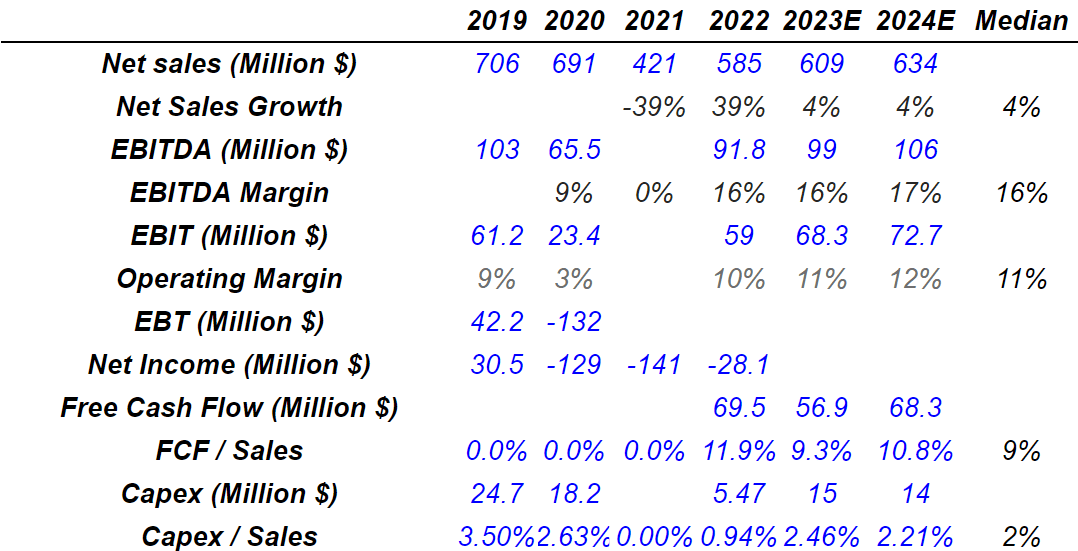

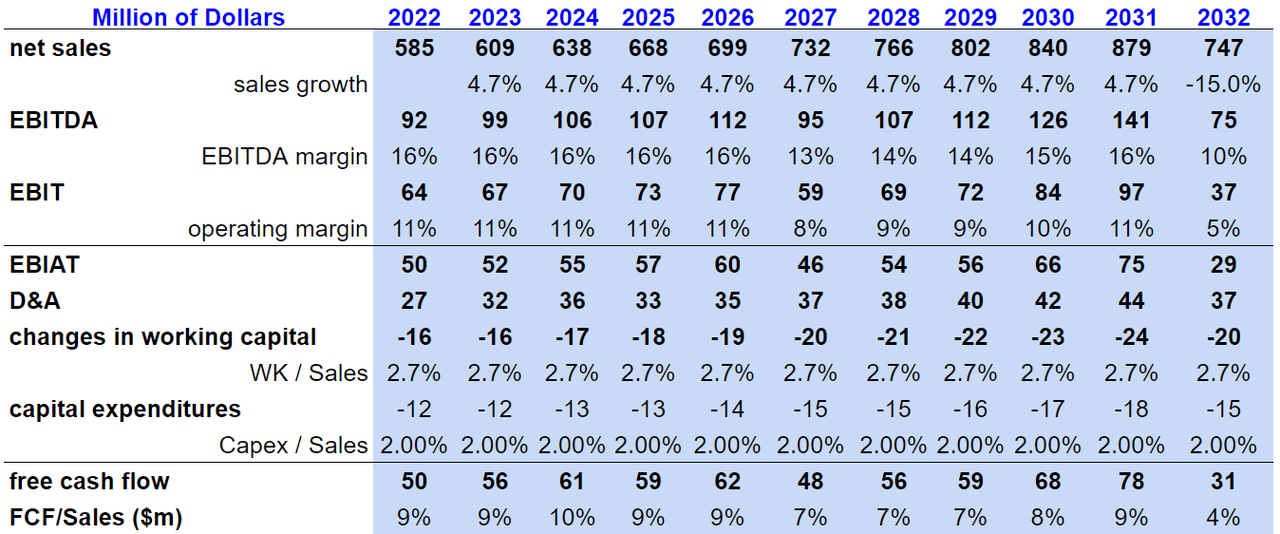

With the numbers reported in 2022, many analysts reported a beneficial guidance for the following years. Analysts expect the company’s total sales for 2024 to be $634 million with net sales growth close to 4%. The company may also have a 2024 EBITDA of $106 million with a 2024 EBITDA margin of 17% and a median EBITDA of 16%. They also expect 2024 EBIT of $72.7 million with an operating margin of 12% and a median EBIT of 11%. 2024 free cash flow expectations would stand at $68.3 million, with FCF/sales at 10.8% and a median FCF/Sales of 9%.

Marketscreener.com

Balance Sheet: From Here, Debt Does Not Seem A Problem

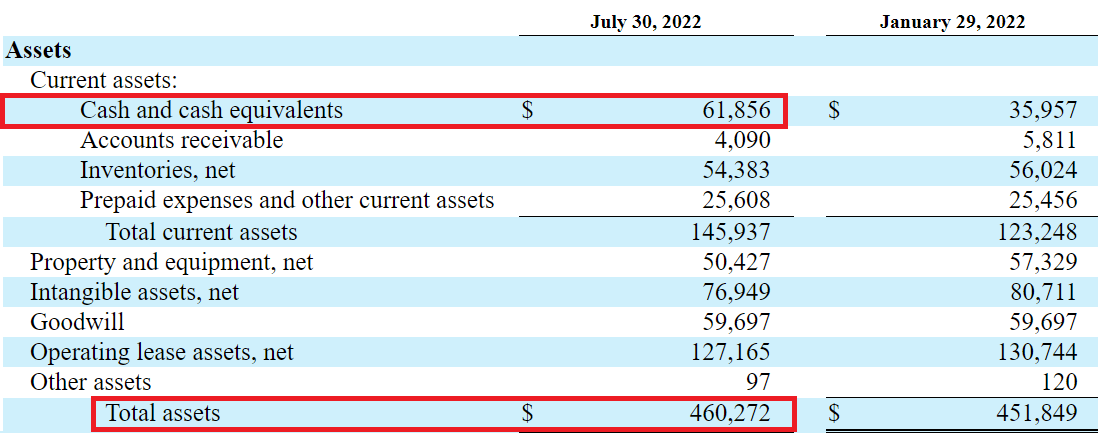

As of July 30, 2022, the company reported $61 million in cash and cash equivalents, with total assets of $460 million. The asset/liability ratio is under one, which may not be appreciated by certain analysts. In my view, if free cash flow continues to trend north, I wouldn’t worry much.

Source: J.Jill Inc. – J.Jill, Inc. Announces Second Quarter 2022 Results

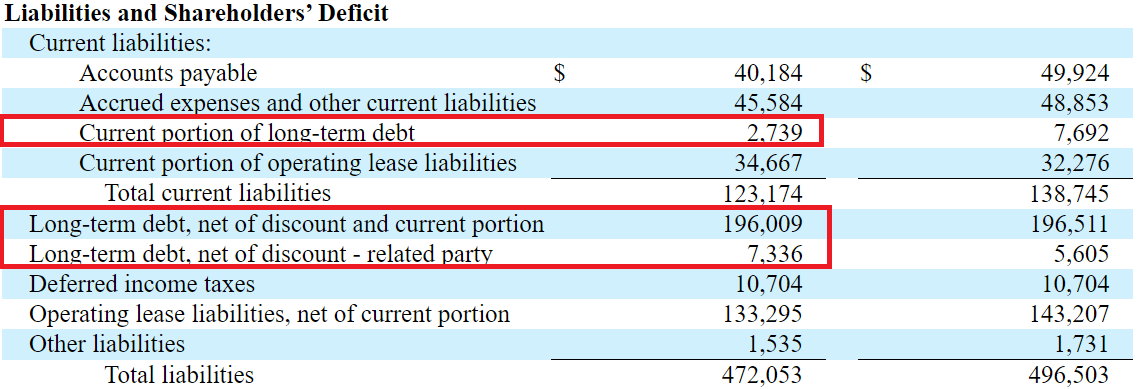

The company reports a current portion of long-term debt of $2.7 million and long-term debt close to $213 million. I expect free cash flow to be close to $50 million, so I don’t believe that the total amount of debt appears too elevated.

Source: J.Jill Inc. – J.Jill, Inc. Announces Second Quarter 2022 Results

Data Science, Customers With Significant Spending Power, And Correct Identification Of Suppliers Could Lead To A Valuation Of $51 Per Share

J. Jill appears to run a complete database about each client, which helps offer special promotions, and chooses new product categories. Considering that ecommerce is becoming more and more relevant, it is appealing that J. Jill knows quite a bit about data science and runs a large dataset. Under normal conditions, I believe that further beneficial analysis of client behavior will likely bring revenue growth:

We believe we have industry-leading data capture capabilities that allow us to match approximately 98% of transactions to an identifiable customer. We use our extensive customer database to track and effectively analyze customer information (e.g., name, address, age, household income and occupation) as well as contact history (e.g., catalog and email). We also have significant visibility into our customers’ transaction behavior (e.g., orders, returns, order value, including purchases made across our channels). Source: 10-K

It is also worth noting that the company does not target everybody. Management chose to sell mainly to clients with average annual household income of approximately $150,000. In my view, if J. Jill continues to grow customer loyalty with that segment of the population, revenue growth can be expected. In my opinion, you want your clients to have enough money to pay for your products.

We target an attractive demographic of affluent women 45 years and older. With an average annual household income of approximately $150,000, our customer has significant spending power. Our private label credit card program also drives customer loyalty and encourages spending. We believe we will continue to develop long-term customer relationships that can drive profitable sales growth. Source: 10-K

Finally, under this case scenario, I assumed that the company would successfully choose and work with good agents. Keep in mind that a significant part of the company’s products was sourced from certain agents. In my view, identifying good suppliers will be extremely important for the company to remain profitable:

In Fiscal Year 2021 approximately 80% of our products were sourced through agents and 20% were sourced directly from suppliers and factories. We currently work with three primary agents that help us identify quality suppliers and coordinate our manufacturing requirements. Source: 10-K

In 2032, I expect that sales will be close to $747 million. In addition to sales growth of -15%, the company will have 2032 EBITDA of $75 million and an EBITDA margin of 10%. EBIT is expected to be $37 million along with an operating margin of 5%. I anticipate 2032 EBIAT of $29 million with D&A of $37 million, changes in working capital of $20 million, changes in working capital/sales ratio of 2.7%, and capital expenditures of $15 million. In 2032, the free cash flow may also be close to $31 million, and the FCF/Sales ratio would stand at around 4%.

Author’s DCF Model

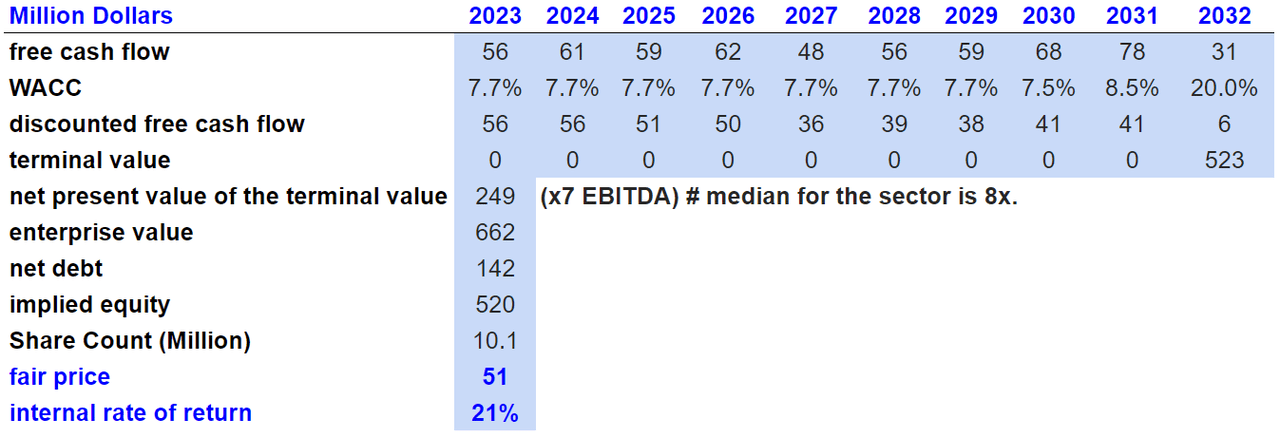

In 2032, my results include a 2032 free cash flow of $31 million. With a WACC of 20% and an EV/EBITDA of 7x, I projected terminal value of $523 million and a NPV of $249 million. The enterprise value would be around $662 million, and the net debt would be close to $142 million, which would result in an implied equity of $520 million. Finally, I obtained a fair price of $51, together with an internal rate of return of 21%.

Author’s DCF Model

Risk Factors And Worst Case Scenario

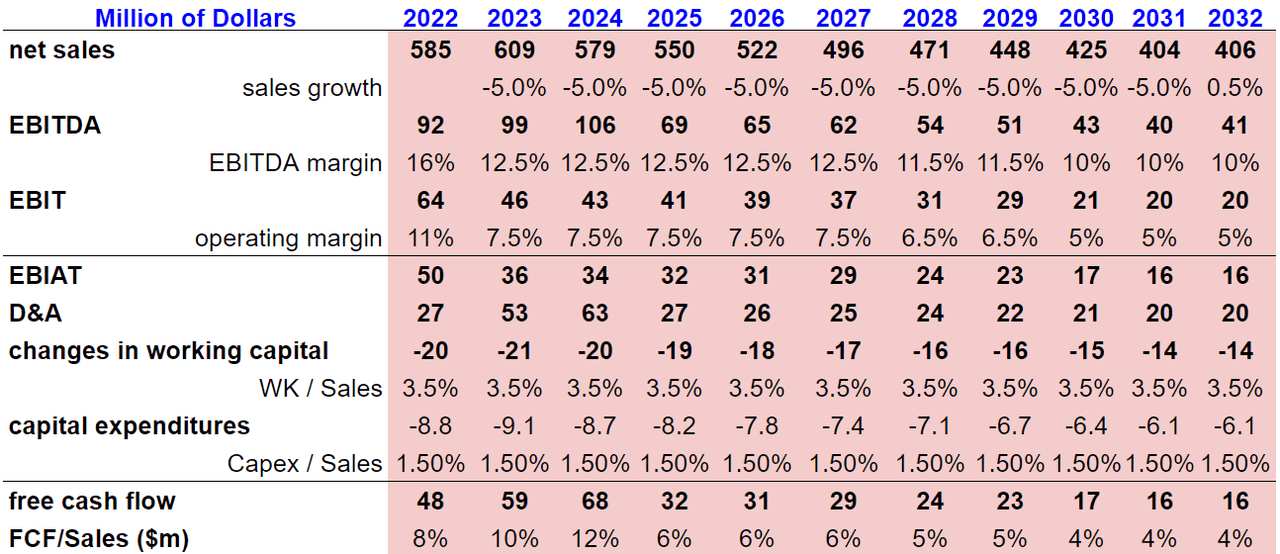

The company operates in the retail industry, which often underperforms during recessions and detrimental macroeconomic periods. Under this scenario, I assumed that in the next decade, economic conditions may not be the best. As a result, both sales growth and the company’s profitability would decline.

Factors impacting discretionary consumer spending include general economic conditions, wages and employment, consumer debt, reductions in net worth based on severe market declines, residential real estate and mortgage markets, taxation, volatility of fuel and energy prices, interest rates, consumer confidence, political and economic uncertainty and other macroeconomic factors. Source: 10-K

I also assumed that the company’s brand image and reputation, for some reason, could deteriorate, which would lead to a decline in FCF. Among the issues that the company encounters, there is a decrease in the quality offers or negative publicity, which may lower the demand for the company’s products.

Our ability to maintain our brand image and reputation is integral to our business, as well as the implementation of our strategy to grow. Maintaining, promoting and growing our brand will depend largely on the success of our design, merchandising and marketing efforts and our ability to provide a consistent, high-quality customer experience. Our reputation could be jeopardized if we fail to maintain high standards for merchandise quality and integrity and any negative publicity about these types of concerns may reduce demand for our merchandise. Source: 10-K

In line with the previous risk, let’s note that management could be specially affected by unfavorable publicity in the social media. The company cannot control most of the posts distributed by social media participants, so it appears to be a risk for shareholders of J. Jill. Management discussed these risks in the last annual report:

Information distributed via social media could result in immediate unfavorable publicity for which we, like our competitors, do not have the ability to reverse. This unfavorable publicity could result in damage to our reputation and therefore have a material adverse effect on our business, financial condition and results of operations. Source: 10-K

Finally, I assumed that management wouldn’t be able, for some reason, to run all of its stores in a profitable manner. If management loses money with existing stores or has to close stores, I believe that future free cash flow will not grow as expected. In the worst case scenario, a decline in the company’s valuation could be expected.

We may not be able to optimize our store base by profitably operating stores and closing stores that are unprofitable, and this could have a material adverse impact on our business, financial condition and results of operations. Source: 10-K

Under this scenario, the company is expected to report net sales of $406 million in 2032 and a sales growth of 0.5%. I also expect an EBITDA of $41 million along with an EBITDA margin of 10%. 2032 EBIT would be $20 million with an operating margin of 5%. Regarding the EBIAT, $16 million is expected in addition to a D&A of $20 million. I also forecasted capital expenditures of -$6.1 million, with a capex/sales ratio of 1.5%. In terms of free cash flow, I expect FCF of $16 million and FCF/sales of 4%.

Author’s DCF Model

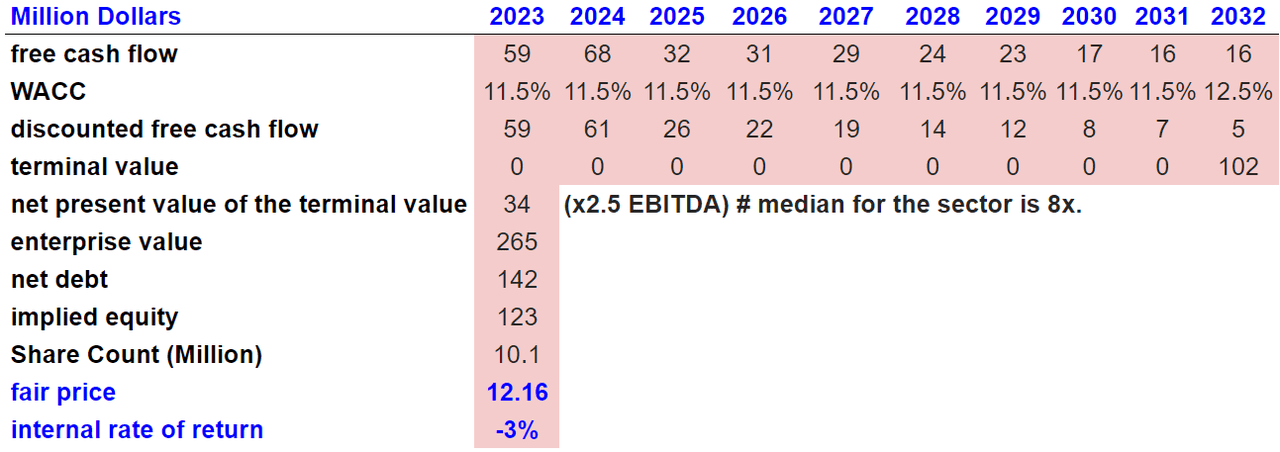

In 2032, I expect free cash flow close to $16 million. If we assume a WACC close to 12% and an exit multiple of 2.5x, the enterprise value may be close to $265 million, with an implied equity of $123 million. Finally, with a share count of 10 million, I expect a fair price of $12.16 million and an internal rate of return of -3%.

Author’s DCF Model

My Takeaway

JILL does look significantly undervalued if we consider the expectations of other financial analysts. In my view, successful management of the company’s database, promotions, and correct targeting of clients will likely lead to revenue growth. Besides, if the company manages to close unprofitable stores besides launching efficient ecommerce campaigns, both the EBITDA margin and free cash flow margin will likely increase. I do believe that there are risks from eventual damage of the brand. If suppliers are not correctly identified and quality lowers, revenue growth may be lower than expected, or could be even negative. With all that being said, I believe that JILL’s stock valuation is worth much more than the current market price.

Be the first to comment