gsheldon/iStock Editorial via Getty Images

Investment Thesis

Utz (NYSE:UTZ) is a solid brand with good expansion opportunities. The company is combating inflation with price increases, even as volume lags. But the business is struggling with profitability, and free cash flow is negative. Shares are trading at an expensive valuation. I believe that the risk to reward is unfavorable.

Profitability And Free Cash Flow

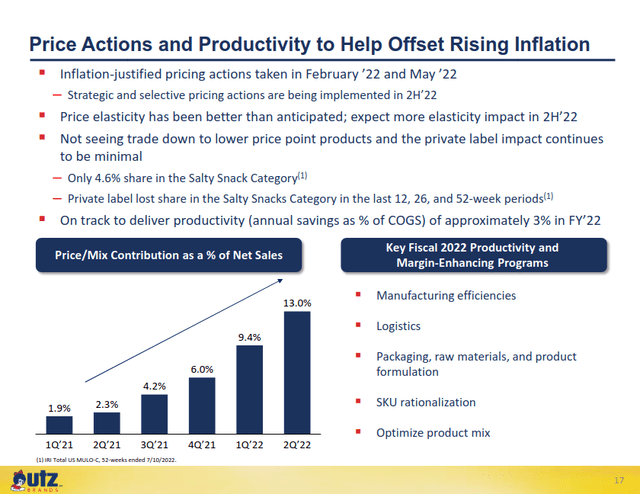

Utz reported a solid beat and raise quarter. The company has been effective at offsetting inflation through increased prices. Most of the company’s topline gains were driven by price actions. Of the 13.6% organic sales growth in the last quarter, 13% was attributable to price increases and only 0.6% to volume. Utz raised its topline guidance to 13% to 15%. The company projects 2% to 5% adjusted EBITDA growth for the year.

Utz Second Quarter 2022 Earnings Presentation

The company is still struggling with profitability. Adjusted EBITDA margins declined by 270 basis points between the start of 2021 and the first half of 2022. GAAP profit margins were about breakeven. This is still an improvement, as margins ticked up sequentially in the last quarter. Management provided a more upbeat forward outlook on their last earnings call.

Hey. So, I think the way — I’ll repeat the question back to you the way I understood it. I think you’re talking about supply chain disruptions and the environment we were in last year. I think things are getting better there. We are not out of the woods, but things have stabilized. And we have built a lot of muscle around how to tackle that.

In our supply chain, manufacturing, logistics, distribution, we made people investments. And we are also optimizing enhancing our manufacturing footprint. So, all of those things, all the actions that we have taken have really helped us from a cost and financial standpoint. The second quarter results really show that we delivered pricing and productivity to offset inflation. And those two things are working now in tandem. And from here on out, we should expect sequential growth in our margins in the next couple of quarters.

But there are some issues with the forward outlook. Management’s current guidance implies a consumer spending slowdown. Volumes are expected to drop year over year in the second half.

Utz’s guidance for positive adjusted EBITDA sounds good. But the business is struggling to convert this into free cash flow. Of the company’s LTM $161.3 million in adjusted EBITDA, it has only managed to convert 14% into operating cash flow. In the first half, the company lost over $26 million on its core operations. In the past two years, the company has reported negative FCF in five of the last eight quarters.

High capital expenditures continue to be an issue for the company. During the last two quarters, the company spent $60.2 million on capital expenditures. The company expects to spend $88.4 million on capital expenditures for the full year. The business is also spending heavily on acquisitions of other companies. Since 2019, the company has spent over $850 million on cash acquisitions.

Good Growth Potential

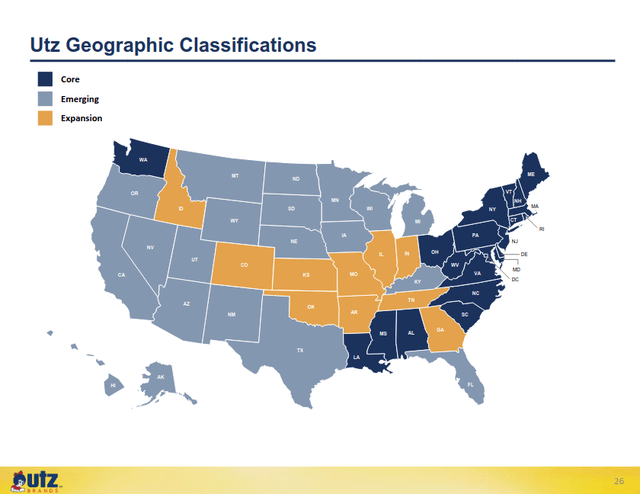

Even with these financial headwinds, I think that Utz has a path to long-term revenue growth. I see a lot of potential in the company’s ability to expand distribution to new areas.

Utz Second Quarter 2022 Earnings Presentation

Utz defines its primary markets as its core geographies. These are primarily concentrated in the Northeast and Mid-Atlantic regions. The company has a 9% market share across these 20 states. In the company’s secondary expansion markets, it has a 4.5% market share. It holds a 2.4% market share in its tertiary emerging markets. This provides a clear path to expansion. Utz can grow its topline by expanding proven products to new geographies. To do this, Utz is adding new manufacturing capabilities to grow its main brands.

Utz’s brands create a competitive advantage for the company. Private label snacks are not very competitive in the company’s key categories. This is what lets Utz significantly hike prices without losing market share. I think that the business should be stable in its core geographies.

Financial Health And Valuation

Utz is trading at an LTM GAAP P/E of 102 times and a forward EV/EBITDA of 17.7 times. The company has negative free cash flow for the last twelve months. I think that this is expensive for a company with these growth prospects. This is exacerbated by Utz’s flat to negative volume growth.

The company has solid liquidity. It has $20 million in cash on hand and $83 million remaining on its revolver. But Utz also has a very heavy debt burden. Its balance sheet contains over $900 million in debt and other obligations. This is extremely high, equal to about six times LTM adjusted EBITDA. This debt could compromise the company’s financial position in the future.

The company is also slowly diluting its shares. The business increased its shares outstanding by 5.6% in the two years since its IPO. Recent acquisitions such as Utz’s Kings Mountain facility were funded by private placements. This isn’t a huge amount, but I don’t think it’s promising. Other competitors are reporting better growth and reducing their shares outstanding. Besides the almost 81 million class A shares outstanding, Utz has almost 60 million extra class V shares outstanding. These class V shares can be converted to class A shares, diluting investors further.

The business pays out a regular dividend yielding 1.5%. This requires $17.5 million in cash each year. But these dividends are currently not well covered by the company’s free cash flow. It looks like the business is usually paying these out of cash on hand.

Final Verdict

Utz is an interesting company with decent expansion opportunities. But I believe that the company’s risks outweigh the potential rewards. The business’s debt burden and poor cash flows are serious concerns.

I think that the business could continue to grow in spite of these headwinds. But I see limited potential for intrinsic upside at the current valuation. Because of this unfavorable risk to reward, I’m avoiding the stock right now.

Be the first to comment