Davel5957/iStock via Getty Images

Introduction

Alstom SA (OTCPK:ALSMY) is the second largest train manufacturer in the world, but considering that world number one CRRC is a Chinese entity, I see Alstom as the global leader. Alstom’s capabilities go beyond the manufacture of rolling stock, and they have a diverse range of assets in rail-line infrastructure and operation as well. There are multiple catalysts to consider for the bull case, most having to do with Alstom’s moat within the industry. But, it will be important to remember that Alstom is working in a slow moving, low margin industry, and taking advantage of cyclicality will be the best way to find the best returns.

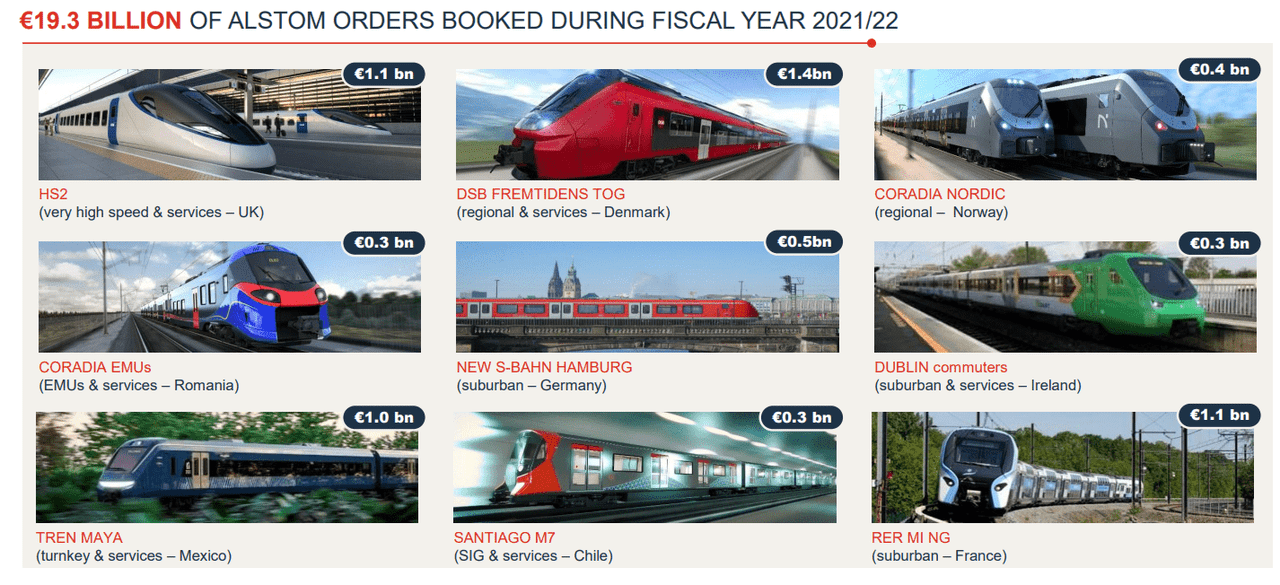

As a civil engineering company that must deal with public contracts, growth has been slow over the past few years as the pandemic paused investments. With financial performance stuttering, the Seeking Alpha Quant rating signals a very bearish analysis at a 1.54, and the single Wall St analyst is also bearish. However, 2021 saw a large increase in new contracts across the world, and management expects profitability to improve moving forward. Recent underperformance and negative sentiment can now be used as a benefit for investors to capitalize on a turnaround through the latter half of the decade.

I will now discuss the major catalysts.

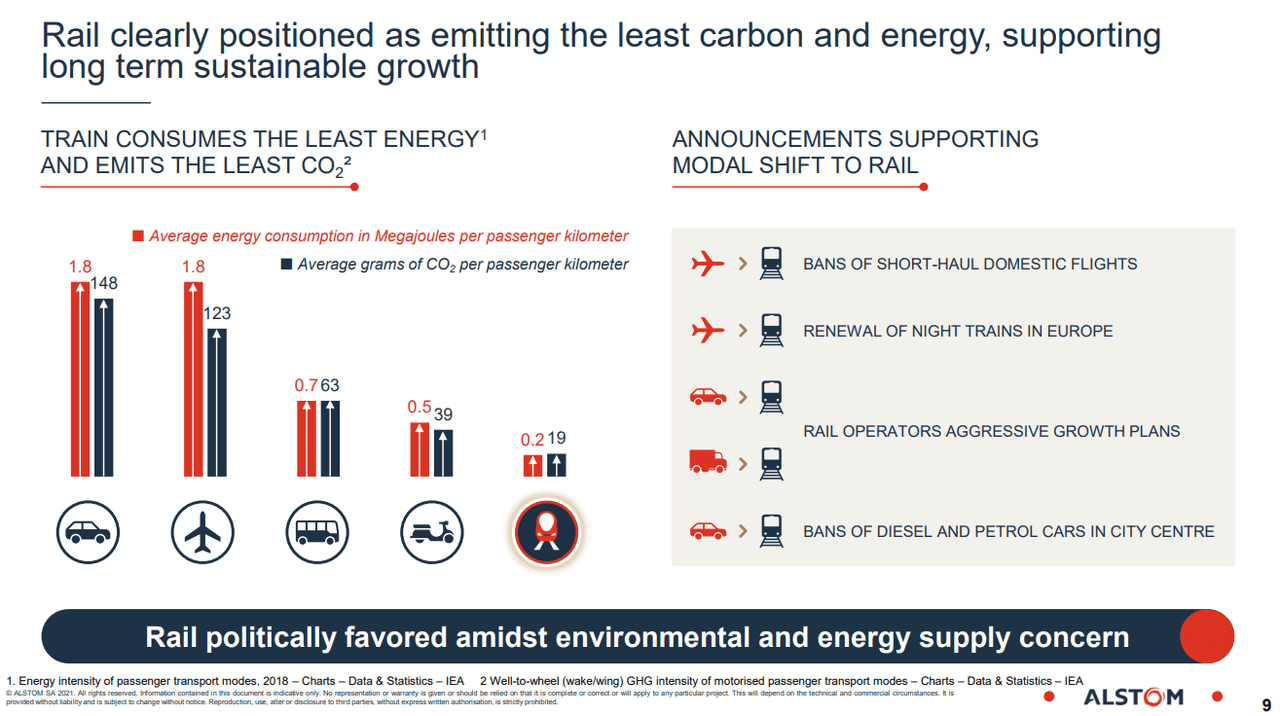

Benefits of Light and Commuter Rail

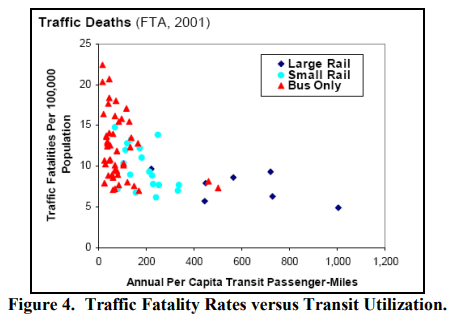

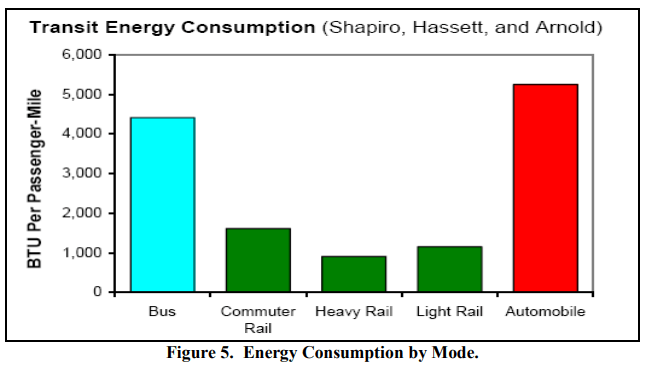

Most important is the safety of Alstom’s industry: light and commuter rail. As the global leader, investors know they will have exposure to nearly all train transport systems in the world, at least outside of Japan and China. Rail transport also has significant advantages in efficiency and economics, but sadly relies on navigating bureaucracy to grow projects. While growth is not the name of the game, there is a secular growth trend that will allow for forward momentum.

Other unique benefits include a high safety rating compared to the other major form of public transport: buses. When combined with the ability to transport many more passengers and with electric power systems, light and commuter rail offer the lowest energy consumption compared to buses and autos. Considering the current energy crisis, rail will be the place for investment for public entities that truly want a forward-thinking infrastructure system. These factors, along with thoughtful designs and impact assessments, will reduce the downsides of rail systems (land availability, initial capex, etc.) and stimulate a bull cycle over the coming years.

Alstom Texas Transport Institute Texas Transportation Institute

Economic assessments are almost all in favor of viewing rail systems as favorable. Key financial impacts include: increased property value around stations, community redevelopment and stimulus, and reduced traffic and improved health, all while remaining cost effective in the long run. We can already see that Alstom’s backlog is increasing YoY and this will help improve investor sentiment over the next few months.

One fruitful stimulus may be from U.S. Infrastructure Spending that is set to support various U.S. projects. In particular, there is the Avelia Liberty (Acela Express II), with service beginning in 2023 along the Northeast Corridor. Although, it is unknown how the $1 billion+ in further funding will directly impact Alstom.

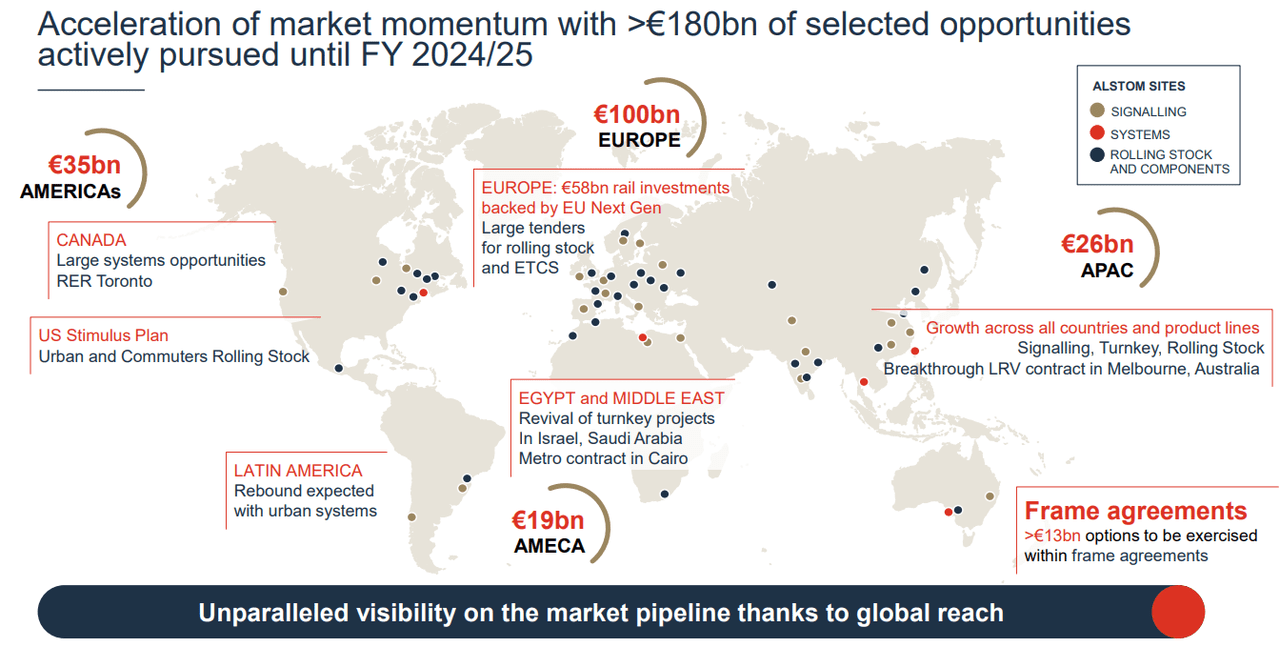

Alstom

Due to Alstom’s global scale, and potential for free-flowing cash from the U.S. in the coming years, we should expect favorable currency benefits for the company thanks to the weak Euro. Diversification also helps to offset any spending weakness in Europe, but the EU and UN seem to be favoring stimulus for public rail transport measures thanks to the reduction in emissions (to meet climate change goals). With management pushing increases in more profitable services and revenue segments and limited access to other weak currencies such as the yen, I believe we should see close to a 5% boost in revenues purely from the approximately 20% U.S. revenue exposure.

I would also look to the emerging and developing markets as the main drivers of secular growth for Alstom, particularly India, South America, and Africa. I would also say that the U.S. plan to fight back against China’s Belt and Road Initiative in Africa and Southern Asia is another catalyst to consider, but the Partnership for Global Infrastructure and Investment is still under development. In the event of a European and American recession, there are still many other countries that will continue spending and provide a safeguard in terms of revenue downside potential.

Alstom

Financial Impacts

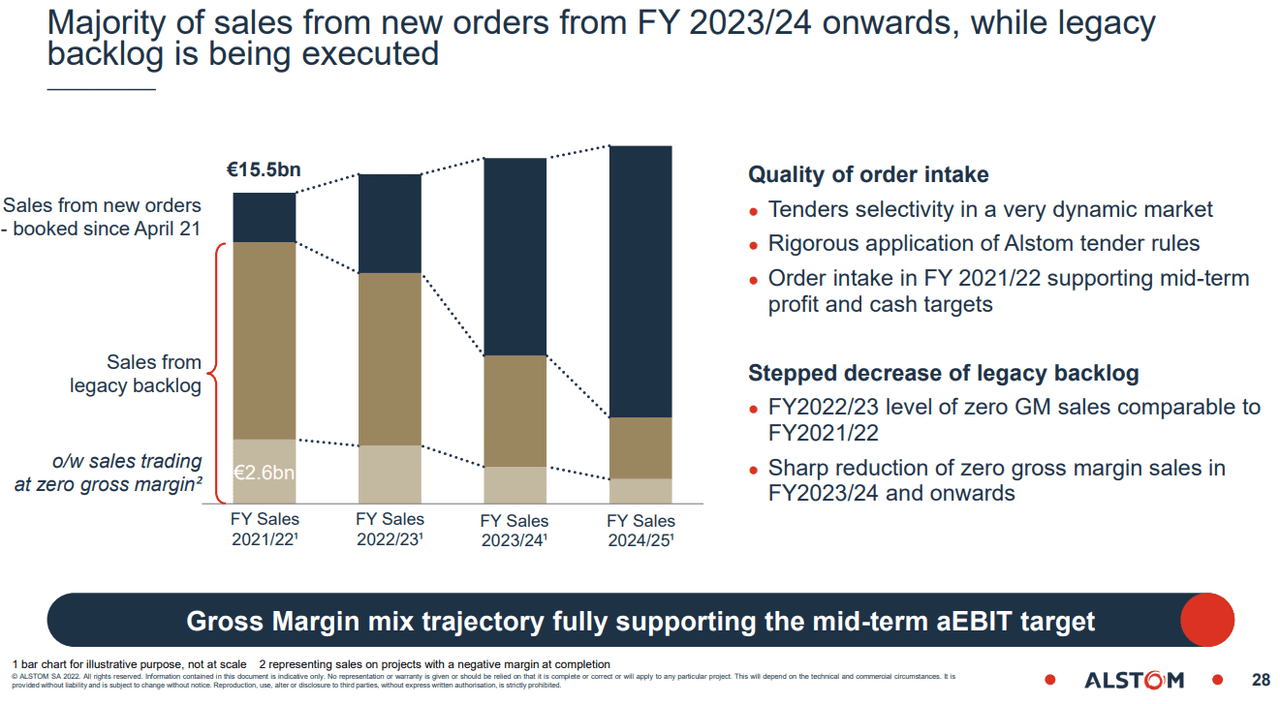

That brings me to my financial outlook for Alstom. While there are economic difficulties that must be considered, many new contracts have boosted the current backlog for the coming years. At the same time, the company is finishing legacy sales contracts that have been boosted by the acquisition of Bombardier. With management looking to have almost no exposure to negative margin projects by 2024/25, current profit margins will sharply increase. Recent investments in acquisitions, advanced manufacturing techniques, and operational synergies should be leveling off compared to the last year or two, and this will also have positive benefits on cash flows coming in.

Alstom

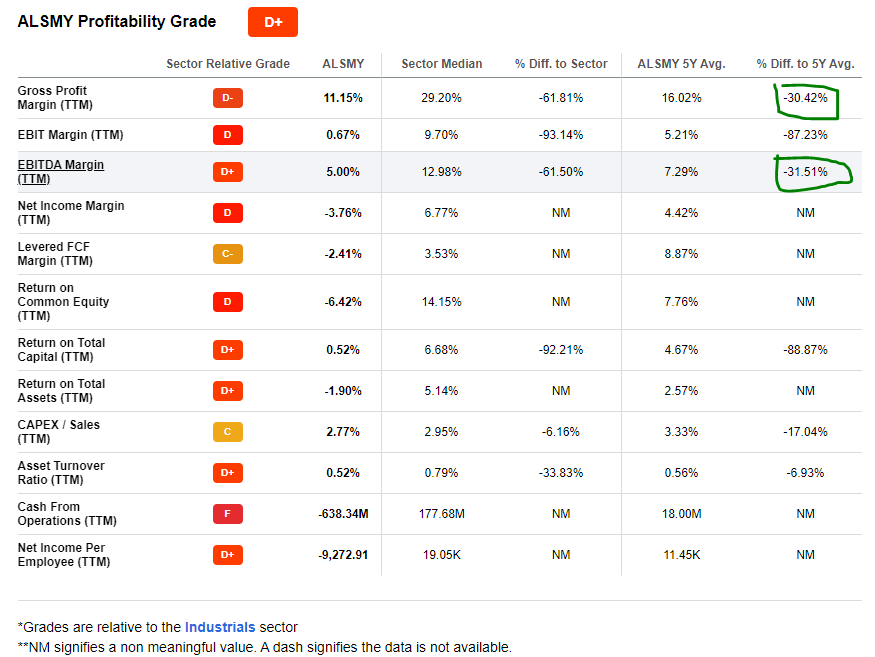

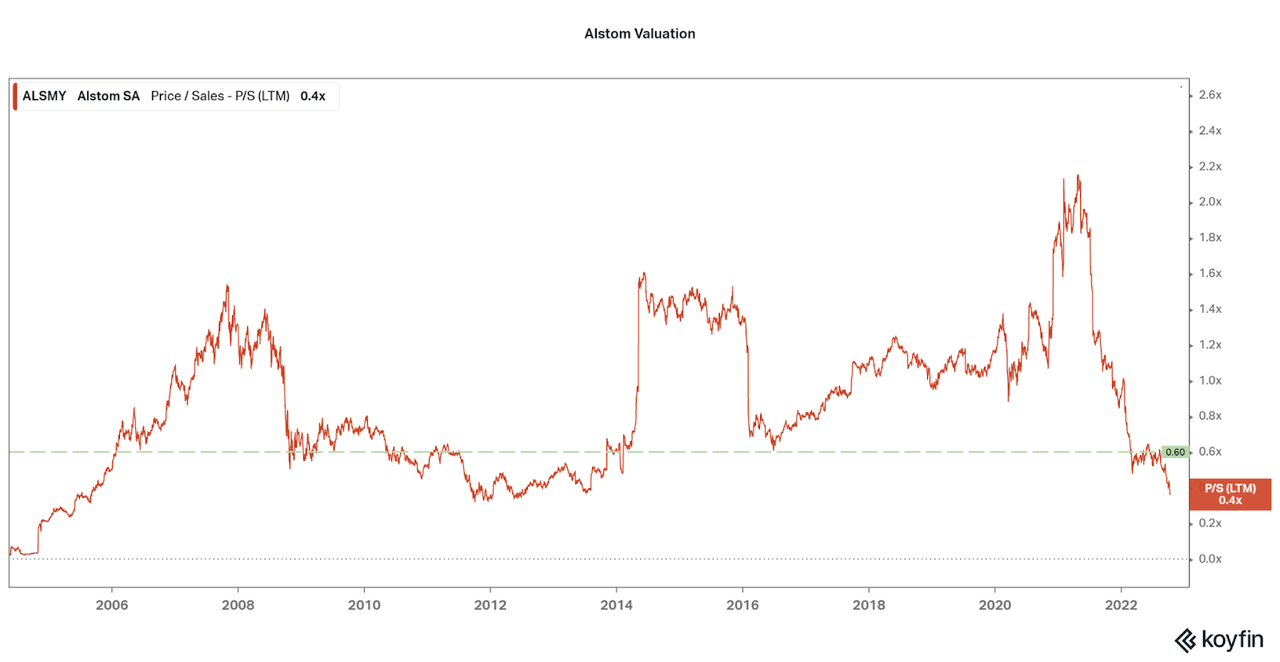

Therefore, I expect a reversion to historical performance is more than likely. Then, with favorable infrastructure spending, I believe expectations will be beat. This would account for at least a 30% return in terms of EBITDA or gross profit gains. In terms of valuation, the historical price to sales ratio was between 0.5-0.7 since 2008, with significant swings in between. This again would account for an additional upside of at least 25% to historical averages. I would expect it would take one to two years for the complete return to historical performance or valuation, but the risk/reward looks favorable.

Seeking Alpha

Koyfin

Conclusion

While Alstom is not perfect, the close to record-low valuation is enticing considering the now global positioning compared to prior bear markets. Also, USD-based investors get to have a 20% discount already priced into the shares thanks to the weak euro, and this is a further catalyst for returns if the ECB returns to low interest rates before the U.S. does. In terms of downside, there is little room due to the fact that revenues are set to increase, and the valuation has bottomed out.

I would, however, recommend adding on a recurring basis and being patient with the turnaround as it relies on multiple macro factors. As those occur, I would expect that Alstom works hard to reign in losses and improve margins. Although, upon a successful return to prior form, and the subsequent rise in valuation, I believe a strong cyclical bull run is possible. It is best to load up now before that occurs.

Do not fear the negative investor and consumer sentiment, data suggesting a recession in Europe, and Russian aggression. All these risk points allow for a solid entry point into a company that is set to control a majority of public transport for decades to come. Want a more low-risk play on rail lines? Perhaps take a look at JR Central (CJPRF, CJPRY) and leverage the turnaround opportunity as Japan opens up for the first time in two and a half years, all while the yen is weaker by 40% YoY.

Thanks for reading.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment