Michael Vi

Palantir (NYSE:PLTR) is one of the most controversial companies in America. Either you love it, hate it, or have no idea what the company does. I love Palantir, and I’ll tell you why. Palantir is a unique, dominant, market-leading company with excellent growth prospects and remarkable long-term profitability potential. Additionally, many investors may view Palantir as a government contractor, but the company’s immense growth and profitability potential are in the private sector.

Moreover, Palantir’s technical image looks increasingly bullish, and sentiment should improve soon. Palantir is releasing its Q3 earnings on November 7th, and while the company missed estimates slightly in the Q2 quarter, I believe the Q3 quarter will be much better. Therefore, we could see Palantir’s share price rise sharply post-earnings, and we should see Palantir’s stock appreciate considerably as the company advances in future years.

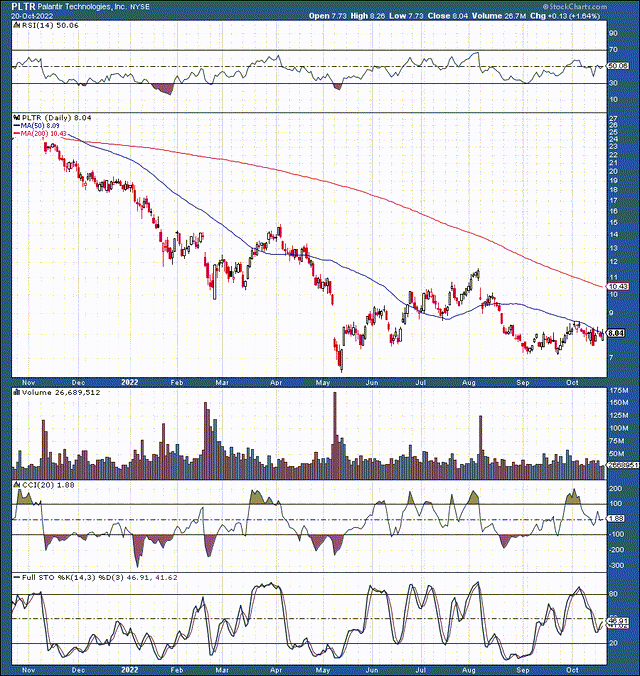

Technical Image – Getting Bullish Now

Palantir hit a low of around $6 back in May. The stock was grossly oversold then and hasn’t gone that low since, despite the broader market dropping significantly. Remarkably, when the stock hit its low of around $6, it was down by roughly 87% from its post-IPO high, and even at today’s price, Palantir is still 82% below its early 2021 levels. Now we see the trend evening out, and Palantir has gone sideways in the last six months while the broader market has been making new lows. This divergence is very constrictive, which implies that the ultimate low was likely achieved in May. We also see significant improvements in technical indicators like the CCI and the full stochastic, illustrating that momentum and sentiment are improving. The overall technical image suggests that the worst is behind Palantir, and the stock could rise sharply soon.

Last Quarter – Better Than It Seems

Palantir missed its consensus EPS estimate by 4 cents. In my last Palantir article, I wrote that investors should be focused more on long-term prospects than “counting pennies.” Palantir is a hyper-growth company with remarkable long-term profitability potential. Does it matter if Palantir now makes 3 cents per share or loses 1 cent per share? I think there are more important factors to consider.

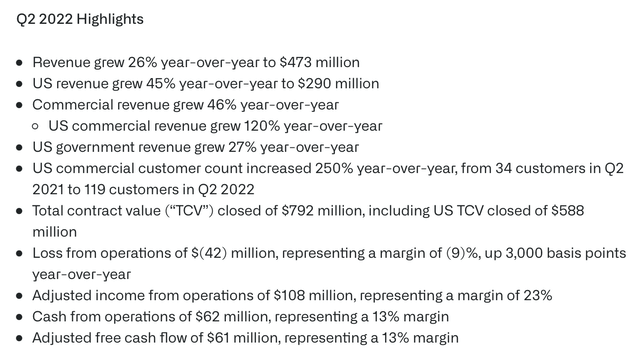

For Instance: Palantir’s Q2 Highlights

Q2 highlights (investors.palantir.com)

YoY revenue surged by 26%. Moreover, U.S. revenue skyrocketed by 45% YoY. I want to stress a crucial point here. Some market participants may believe that Palantir’s potential relies primarily on government contracts. However, I view Palantir much differently. While Palantir is a great friend of the government and receives stellar contracts, the company’s true potential is in the private sector.

Commercial revenue grew by 46% YoY. Remarkably, U.S. commercial revenue soared by 120% YoY. Additionally, U.S. government revenue growth remained robust, coming in at 27% YoY. Perhaps the most staggering statistic is that Palantir’s U.S. commercial customer count increased by a mind-boggling 250% YoY, from 34 customers in Q2 2021 to 119 customers in Q2 2022. This dynamic illustrates that Palantir’s commercial business is expanding very rapidly. Moreover, Palantir has yet to show revenues and earnings pertaining to its business’s rapidly growing commercial segment. Therefore, Palantir’s commercial growth should continue, and the company’s future revenues and profits could be well above most analyst estimates.

Outlook For Next Quarter

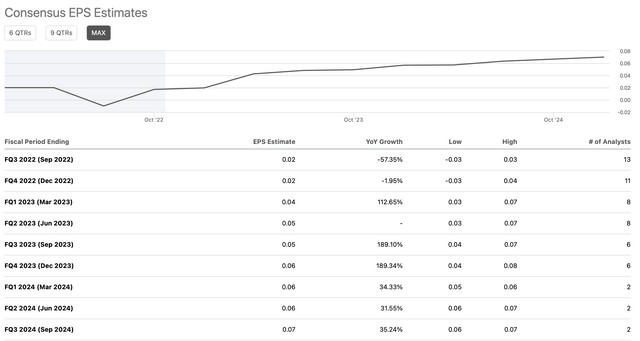

EPS estimates (SeekingAlpha.com)

Most analysts are looking for approximately 2 cents in EPS and around $475 million in revenues for the last quarter. However, Palantir can probably surpass these estimates. Many analysts have been overly pessimistic about Palantir, and its prospects and consensus figures may be lowballed at this point. I believe Palantir can deliver 3 cents per share and roughly $480 million in revenues for the third quarter. While a one-cent beat is nothing to get too excited about, it should demonstrate that Palantir will likely become more profitable sooner than expected. Also, even a small beat could send Palantir’s badly beaten-down stock substantially higher from current levels.

Palantir’s Tremendous Long-Term Potential

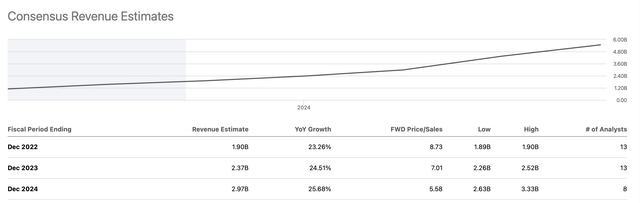

Revenue Estimates

Revenue estimates (SeekingAlpha.com)

Consensus estimates imply that Palantir’s revenues are set to rise to approximately $2.4 billion next year and roughly $3 billion in 2024. However, revenue estimates may be lowballed here, and I expect Palantir to deliver closer to $2.5 billion in revenues next year and roughly $3.3 billion in 2024. Due to Palantir’s remarkably long growth runway, the company can probably deliver 25-30% YoY revenue growth through 2030. Given that Palantir’s market cap is only around $16 billion, it’s trading at fewer than five times 2024 sales estimates, which is remarkably cheap for a hyper-growth company.

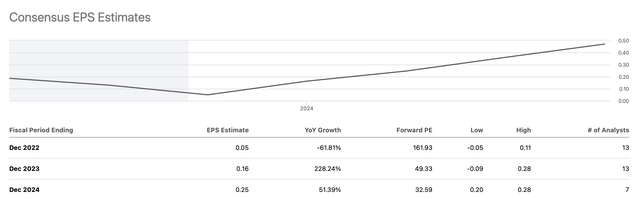

EPS Estimates

EPS estimates (SeekingAlpha.com)

We see Palantir’s consensus EPS estimates going from just 5 cents this year to 16 cents next year and 25 cents in 2024. I also believe that current estimates are lowballed, and we may see closer to 25 cents in EPS next year. After 2023 we can probably see sustainable YoY EPS growth of 30-50% for several years, plausibly through 2030.

Here is what Palantir’s financials could look like in future years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $1.9 | $2.5 | $3.3 | $4.3 | $5.6 | $7.3 | $9.3 | $11.2 | $14.7 |

| Revenue growth | 24% | 31% | 32% | 31% | 30% | 29% | 28% | 27% | 25% |

| EPS | $0.05 | $0.25 | $0.38 | $0.56 | $0.84 | $1.26 | $1.83 | $2.66 | $3.73 |

| Forward P/E | 32 | 35 | 37 | 40 | 40 | 40 | 38 | 37 | 35 |

| Stock price | $8 | $13 | $21 | $34 | $50 | $75 | $101 | $138 | $150 |

Source: The Financial Prophet

While my estimates may appear slightly aggressive, my near-term projections align with higher-end analysts’ estimates. Also, Palantir has commanded a relatively high P/E ratio in the past, and given the company’s unique dynamics, a forward P/E topping out at around 40 does not seem unreasonable. Furthermore, we must consider that Palantir’s commercial side of the business is the key to Palantir’s long-term growth, profitability, and success. Given the recent growth statistics, Palantir’s superior products, and the sticky nature of its services, the company should continue expanding its commercial operations rapidly and its stock should appreciate considerably in the coming years.

Risks to Palantir

Despite my bullish outlook for Palantir, market participants should consider several potential risks associated with this investment. While the growth story is strong at Palantir, shares are not cheap by traditional metrics. Furthermore, the company’s earnings are minimal and may not increase as much as I envision. Moreover, if the company’s growth picture were to turn less bullish, the stock could head in the wrong direction. For instance, if Palantir lost favor with the government or had a data breach, the stock could experience a notable decline. Please consider these and other risks carefully before investing in Palantir.

Be the first to comment