Brandon Bell/Getty Images News

Arcos Dorados (NYSE:ARCO) is McDonald’s (MCD) licensee in Latin America. The company operates 1600 restaurants and sub-franchises another 700, becoming in aggregate the largest McDonald’s franchisee in the world.

The company has returned to pre-pandemic profitability, therefore justifying a little more its price than it did last year, when I wrote about it.

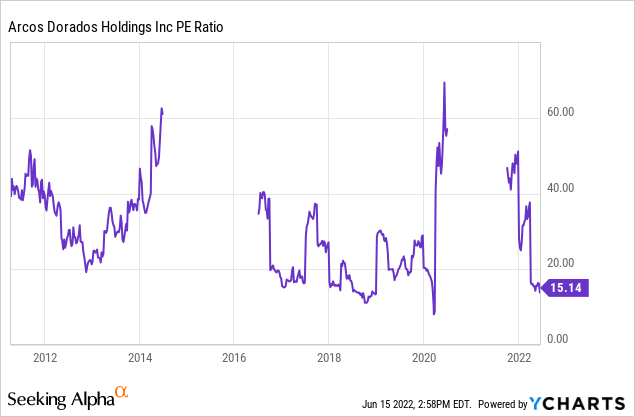

From a buy and hold perspective, I consider the stock too expensive. ARCO currently trades at a PE of 15 or more to pre-pandemic earnings, too low a return given that Latin America’s risk is high. I also have doubts about the profitability and incentives of ARCO’s business model and relation to MCD.

However, while MCD is considered defensive, ARCO is considered discretionary, and a growth stock. The reason is that in Latin America McDonald’s is an aspirational product. ARCO has geared its strategy towards economic growth, therefore it leverages up a speculative play on the region’s growth.

Note: Unless otherwise stated, all information has been obtained from ARCO’s filings with the SEC.

ARCO’s business model is not MCD’s

ARCO is the sole licensee of MCD’s products in most of Latin America and some of the Caribbean islands (excluding Paraguay, Bolivia, Guatemala, Salvador, Honduras and Nicaragua).

An agreement with MCD regulates ARCO’s obligations as licensee. Most importantly, ARCO pays a 5% fee on gross sales as license royalties, and collects the same percentage from its sub-franchisees in the name of MCD. The company and its franchisees also have to pay a marketing fee that averages another 5% of sales. Finally, ARCO has to agree on investment plans with MCD for the renovation of existing restaurants and opening of new ones. ARCO also has to comply with policies on suppliers, employment, ESG, etc.

The conditions in the preceding paragraph set out the divisory line between ARCO and MCD, whose incentives regarding ARCO’s operations are different. From ARCO’s perspective, an increase in investment is only worth its increase in net profits. From MCD’s perspective, an increase in investment is worth its increase in sales, the goal is to increase ARCO’s sales as much as possible, but for ARCO the same is not necessarily true. From MCD’s perspective, there is also an international standard in terms of service and quality that has to be maintained in Latin America.

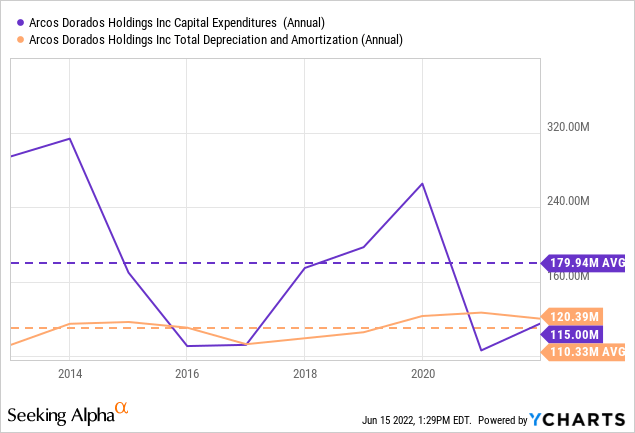

This difference shows itself clearly in terms of investment in restaurants. As the chart below shows, ARCO has spent an average of $180 million a year on existing and new restaurants and has depreciation expenses in excess of 10% of PP&E, meaning it depreciates its assets rather fast.

This level of investment has shown itself in more restaurants. According to the 20-F annual report from 2011, ARCO franchised a total of 1840 restaurants, 302 cafes, and 1694 dessert centers then. By 2019, it had reached a total of 2293 restaurants, 243 cafes, and 3314 dessert centers according to the corresponding 20-F.

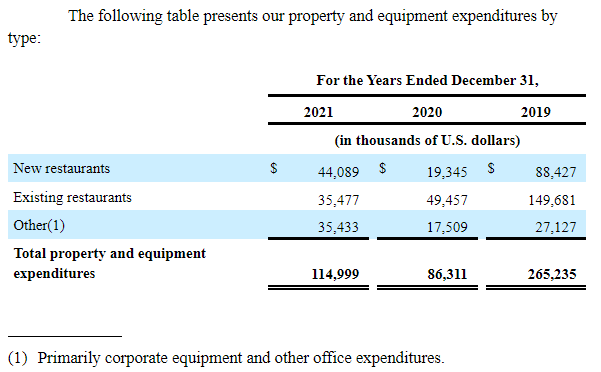

Investment has also been used for renovations in existing restaurants, sometimes accounting for more investment than for new restaurants. It is here where the excess of investment over what is advisable from a profit perspective shows up more clearly. As a side note, it called my attention that the company had spent $80 million in corporate equipment in three years, it seems excessive from my perspective.

ARCO’s PP&E expenditure by use (ARCO’s 2021 20-F annual report)

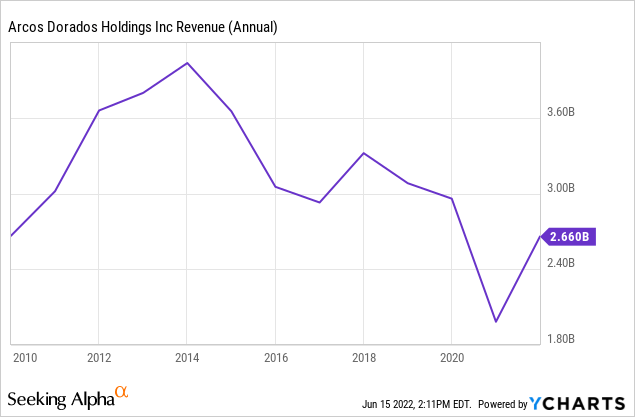

Unfortunately, these investments did not increase ARCO’s sales, which have been stagnant if not falling throughout the decade.

Personally, I think ARCO’s strategy is not good for a relatively poorer and not growing region like Latin America. In Latam, MCD’s products are considered discretionary, and the region’s GDP has not surpassed 2014 levels yet (coincident with ARCO’s peak revenues). Under that context, ARCO is over investing on quality of restaurants and service.

However, investing so much in locations and branding builds up a lot of leverage for a growth period in the region. By investing, ARCO has kept MCD’s aspirational qualities in the region, meaning that consumers may increase spending above income growth if they can and times are good.

Maybe the company’s strategy is to concentrate on the long term, waiting to reap rewards when the region starts growing. As I mentioned in a previous article, if ARCO’s restaurants generated as much revenue per restaurant as they did in 2011 (about $2 million) the company would be able to reach almost $5 billion in revenue. However, that is a risky bet, considering the region is still struggling to find a growth path.

An alternative strategy is to have slightly older, slightly uglier looking restaurants that are more profitable and that cater to a larger public when economic conditions are not as good. With less renovations in equipment, depreciation is lower and profitability improves. Of course this is just daydreaming because MCD would not allow it and also because it is not clear ARCO could compete on a lower segment, against cheaper food options in the continent.

ARCO is committed to its high end strategy. On its 20-F report for last year, ARCO announced that it had agreed on investments for $650 million through 2024.

The ‘resist until things improve’ philosophy can also be seen on the decision to keep the Venezuelan operations running. According to ARCO’s annual report for last year, the company was losing $5 million on an operating basis from the country, with revenues of less than $10 million.

Returning to pre-pandemic profitability

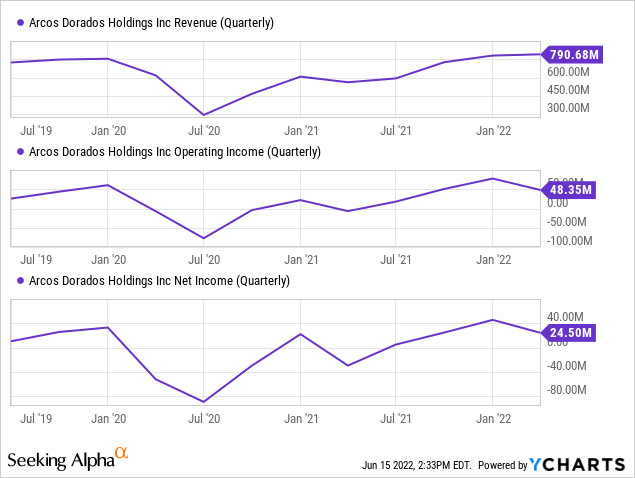

In 2021, ARCO returned to levels of revenue and profitability that are comparable to the ones obtained in 2019.

According to the company’s 2021 20-F annual report, ARCO generated almost $2.7 billion in revenues in 2021 against almost $3 billion in 2019. Operating profits moved in line, reaching $140 million compared to $160 million respectively.

Below operating profits, the two years differ because of hedge and foreign exchange accounting, which can be positive some years and negative others. If we ignore those adjustments and consider that interest expenses stood at $50 million both years, the company is back to 2019 profitability levels, or quite close at least.

In fact, given that the region is enjoying some economic growth, figures kept improving through 1Q22, according to the company’s interim reports for the quarter. ARCO does not mention seasonality as a significant factor on its revenues or profits.

Financially the company is sustainable. This year, ARCO repurchased $150 million of its 2027 notes, announced an offer to repurchase up to $123 million of its 2023 notes, and issued $350 million in 2029 notes.

According to my calculations, ARCO’s debt should stay between $750 and $800 million, with an average interest rate of 6%, therefore interest expenses should remain at a level between $45 and $50 million. This is sustainable compared to operating profits well above $100 million before the pandemic.

Also, ARCO stands on top of very valuable land and buildings. To put an example, ARCO mentions on its 20-F annual report for 2021 that it owns the land of 490 restaurants, or an equivalent of 1.1 million square meters. This land is carried at a cost of $123 million, meaning approximately $100 per square meter. Just as a comparison, the average square meter price for a city center apartment almost anywhere in Latin America is above $1,500 according to Numbeo, and sometimes much higher than that. Of course, apartments are not restaurants, but the comparison shows how different the cost basis and the real value of the land might be. Again, ARCO would not sell this land under its current strategy, but it can extract value out of it in the future if the economy improves and it can definitely sell it if it is needed to repay debts.

Expensive for conservatives, fair for speculation

ARCO has normally traded at growth prices. Its current PE ratio is consistent with the level the stock has traded after 2014, when the economy receded and the company stopped growing. It is still a growth price, albeit a little bit lower than when the company was growing.

My thesis is that ARCO can only grow in a growing region, its strategy is geared towards that. I argue that it has built brand leverage towards growth, meaning that in a good economic context, people are attracted towards ARCO’s restaurants because they are an aspirational product.

Therefore the question is, how much risk is there in the statement ‘Latin America will keep growing sustainably’, and how does that risk relate to ARCO’s price?

To the first question, I have no answer. I do not know if the region will continue stagnant or if it will grow. For that reason, I prefer to recommend a hold rating on ARCO. The company does not produce enough profits in the prevalent context to justify its purchase as is, its growth drivers are exogenous, and difficult to determine from my perspective. I have written about Latin American stocks that, although would not grow as much in a growing region, promise a better payment today. I prefer that kind of investment if the bet is on the region and not on the company.

However, I understand that if a reader has its own opinions on Latin America’s prospects, and is bullish, then ARCO can be an interesting option. Not only is the company prepared to grow faster than the region in an appropriate context, its multiple may also recover, providing a double channel to profits. Risks are that the region keeps being stagnant, with the investor obtaining a meager return, or worse, that its GDP slowly drifts, with slowly falling earnings and multiples for ARCO, as it has been the case since 2014.

The choice is yours to make.

Be the first to comment