Brycia James

Investment Thesis

The Covid-19 pandemic had a lasting impact on many publicly traded companies. Depending on the business and industry, some had demand pulled forward while others had demand pushed back. Some were able to adapt while others were not. A lot of companies permanently changed for the better, and I believe Williams-Sonoma, Inc. (NYSE:WSM), the specialty retailer and owner of such brands as Pottery Barn and West Elm, to be one of those companies.

Prior to the pandemic, Williams-Sonoma was primarily a brick-and-mortar retailer with little focus on ecommerce sales. Operating margins rarely hit 10% and the market remained unimpressed for years. At the end of 2013, Williams-Sonoma’s market cap sat at $4.30 billion. Fast forward to year-end 2019 and Williams-Sonoma’s market cap had gone literally nowhere, sitting at $4.29 billion. Then entered the pandemic where the company benefited from mandatory lockdowns which caused pent-up demand for home goods and furnishings. The stock peaked near $224 in November 2021, just shy of a $15 billion market cap.

Hidden behind the curtain though was a change in Williams-Sonoma’s DNA. The company strategically reduced expenses through permanent store closures, invested heavily in ecommerce, and focused on product quality and pricing. In 2021, Williams-Sonoma’s operating margin improved to 17.6% and in their Q1 2022 results, the company posted an operating margin of 17.1% in face of supply chain and inflationary pressures. Their operational improvements are paying dividends.

With an eye on $10 billion in revenue by 2024 and operating margins in line with 2021’s (near 17%), I believe Williams-Sonoma is a steal at $119. The company has strong fundamentals, pays a dividend, repurchases shares, and has a reasonable path to reach its long-term guidance. Savvy investors should take notice.

Strategic Store Closures

In Q1 2021, Williams-Sonoma CFO Julie Whalen informed investors the company planned to close 25% of its retail fleet over the next 5 years. To quote:

Occupancy leverage of approximately 410 basis points in the quarter resulted from higher sales and another quarter of relatively flat year-over-year occupancy dollars at approximately $176 million, as compared to $175 million last year.

Our ongoing efforts to optimize our retail fleet by either renegotiating rent or closing less profitable stores has enabled us to minimize our occupancy dollar growth and to deliver this occupancy leverage. As a reminder, we closed a total of net 33 stores last year and expect to close 25% of our total retail fleet in the next five years.

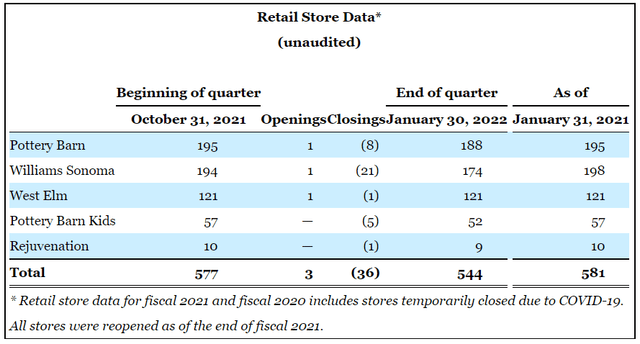

This means Williams-Sonoma will continue closing less profitable stores through 2026, likely reducing their physical footprint by 150 stores in total from a starting point of 581.

WSM Store Count 2021 (WSM IR Website)

What’s attractive about this strategy is the company is reducing expenses while increasing revenue. Analysts don’t believe Williams-Sonoma as evidenced by their consensus estimates, but Williams-Sonoma is guiding to 2024 revenue of $10 billion. This assumes revenue will continue growing the next couple years, even while the number of stores decreases. This is largely due to a drastic shift in direct-to-consumer ecommerce.

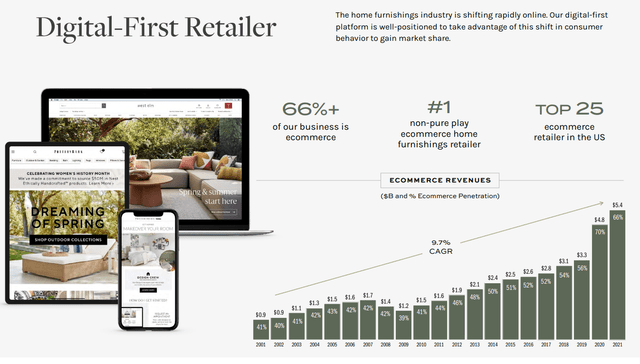

Digital First, Not Digital Only

“Digital first, not digital only” is a catchphrase commonly used by Williams-Sonoma CEO Laura Alber. In my opinion, the spirit of the phrase says the company is focused primarily on ecommerce, but not to the demise of retail stores. A quick glance at the below chart indicates Williams-Sonoma is doing an excellent job executing the digital-first strategy.

In 2021, ecommerce accounted for 66% of total revenue compared to 2013 where it accounted for 48%. The conversion to ecommerce isn’t lightning speed, but coupled with the improved margins that come along with it, the impact to the bottom line has been substantial. Williams-Sonoma increased net income by 3x since fiscal 2019.

WSM Ecommerce Sales (WSM IR Website)

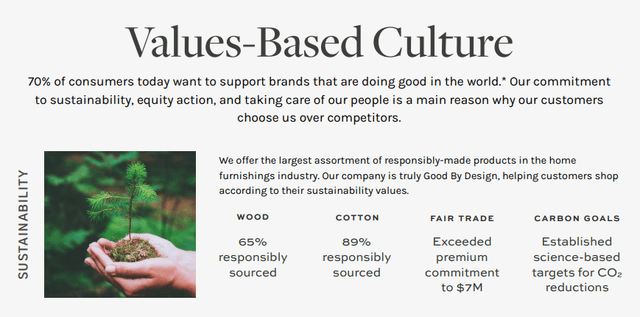

Profiting From Sustainability

We live in a world that is increasingly environmentally conscious. Nearly two-thirds of US consumers are willing to pay a premium for sustainable products. It just so happens Williams-Sonoma specializes in sustainable products, sourcing 65% of its wood and 89% of its cotton from responsible sources.

If you’ve ever been to Pottery Barn or Williams-Sonoma, you know stuff isn’t cheap. Part of Williams-Sonoma’s success has been in selling high quality, sustainable products priced at a premium and minimizing sitewide promotions. CFO Julie Whalen had this to say in her prepared remarks of Williams-Sonoma’s Q1 2022 earnings call:

Gross margin came in at a record 43.8%, an 80 basis point expansion over last year, driven primarily by the strength of our merchandise margins where we’re able to continue to preserve our pricing integrity without utilizing sitewide promotions. The demand for our full-priced products once again allowed us to more than offset higher product and freight costs while still delivering record margins and strong top line sales.

Keep in mind, this is in face of a very tough supply chain and inflationary market that’s weighing on consumers.

WSM Sustainability (WSM IR Website)

Valuation

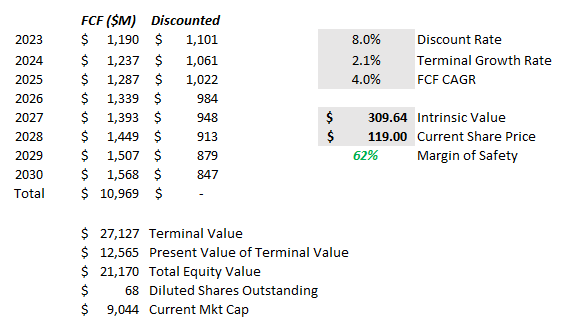

I performed a DCF analysis as well as a market multiple valuation for Williams-Sonoma. At $119, the stock looks cheap no matter how I slice it.

Using the DCF, I arrive at an intrinsic value of $310. I used an 8% discount rate, 2.1% terminal growth rate, 4% FCF CAGR, and a -1.5% annual reduction in shares outstanding.

DCF Analysis (Author’s personal data)

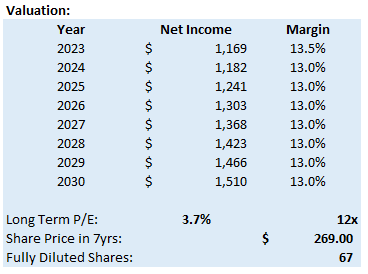

Using the market multiple approach (P/E), I arrive at a 2030 price target of $269, which equates to a near 12.5% share CAGR from today’s price of $119. I assumed a long-term P/E of 12, 4.3% revenue CAGR, 3.7% net income CAGR, and a -1.5% annual reduction in shares outstanding.

P/E Valuation (Author’s personal data)

Bear Case

My bear case for Williams-Sonoma centers around a longer-than-anticipated recession, which is likely to have a broad impact on nearly all companies. In such an environment, Williams-Sonoma won’t be spared. I fully expect Williams-Sonoma to survive in economic hard times, but with consumers pinching pennies, it’s possible the company halts its share repurchase program and cuts the dividend. EPS is sure to take a hit if this happens and, while not negating the thesis altogether, it certainly increases the amount of time needed for it to play out.

Conclusion

For me, Williams-Sonoma checks all the boxes I’m looking for in an investment. It has decent growth ahead of it, strong fundamentals, is shareholder friendly, and is executing at a high level. Shares appear undervalued from a DCF and P/E perspective and, at $119 per share, I think it’s a steal.

Do I think Williams-Sonoma will trounce the S&P 500 over the long term? No, but I think it has a decent chance of beating the market by a few percentage points each year. And a few percentage points over 5 to 10 years equates to a substantial amount of money.

Be the first to comment