Morsa Images/DigitalVision via Getty Images

Investment thesis

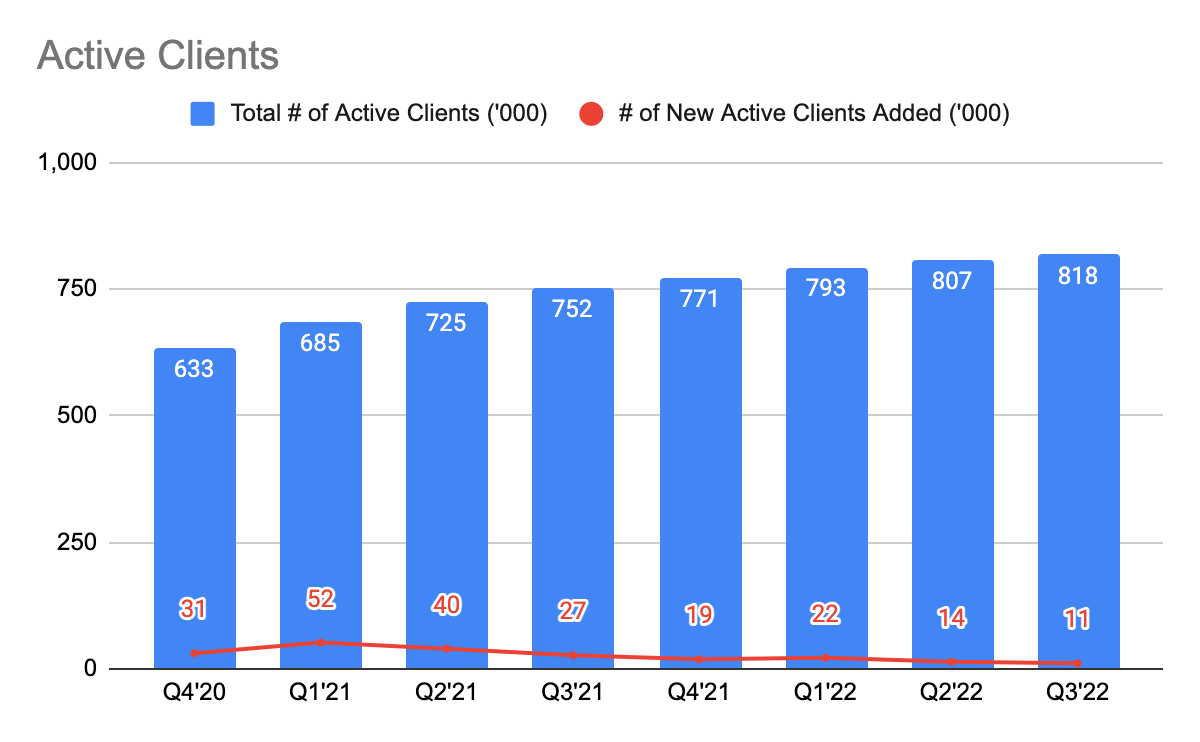

Upwork (NASDAQ:UPWK) is a third-party marketplace that connects clients to freelancers, and it aims to deliver a better customer experience by disrupting the traditional way of hiring freelancers, such as through recruiting agencies. As the largest work marketplace, it serves as a critical intermediary for clients that are looking for skilled freelancers, and today, it has over 818,000 clients (and growing) on the platform.

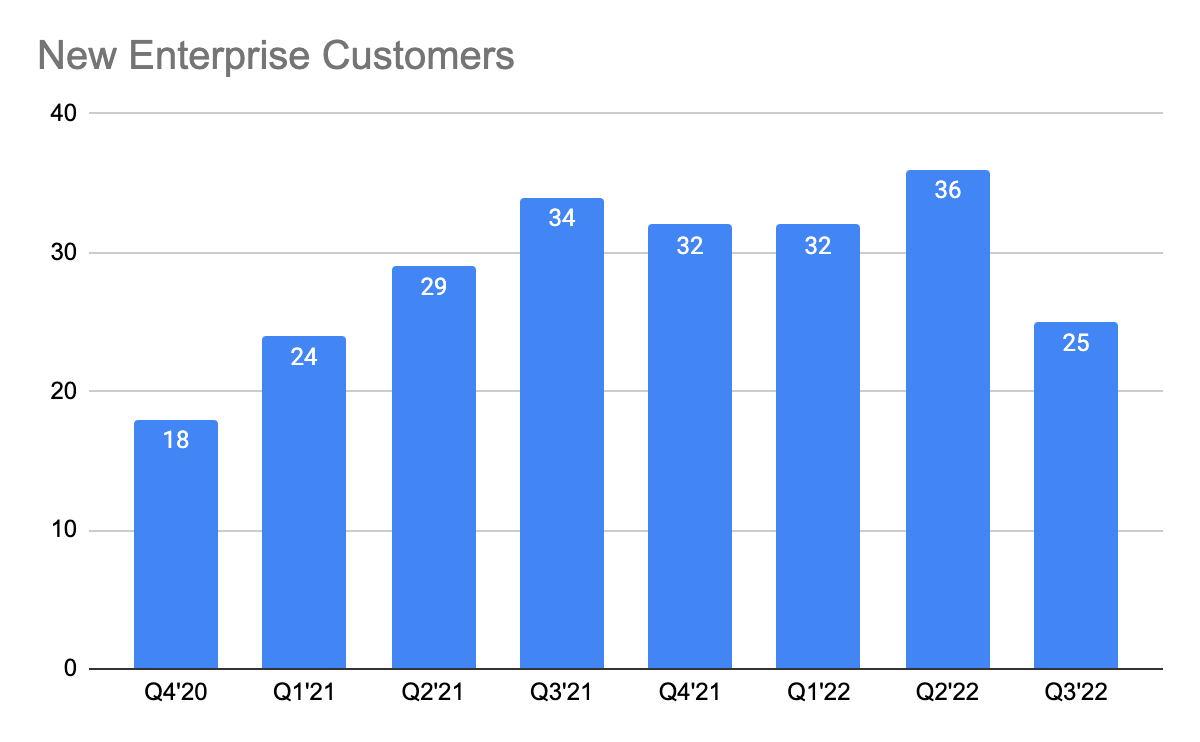

I went through its most recent 3Q22 results and thought that it was a decent quarter. Its active client base continues to grow, although at a slower pace, which the management attributed to the tough macro. And more particularly, its weak sales execution has resulted in a drastic decline in new enterprise clients. Its gross service volume (“GSV”) as a result has declined sequentially from the previous quarter. The more pressing issue I have is the lack of profitability as they do not seem to extract operating efficiency despite its heavy reinvestments. During the call, the management also emphasized being more cost disciplined and investing in a more sustainable manner.

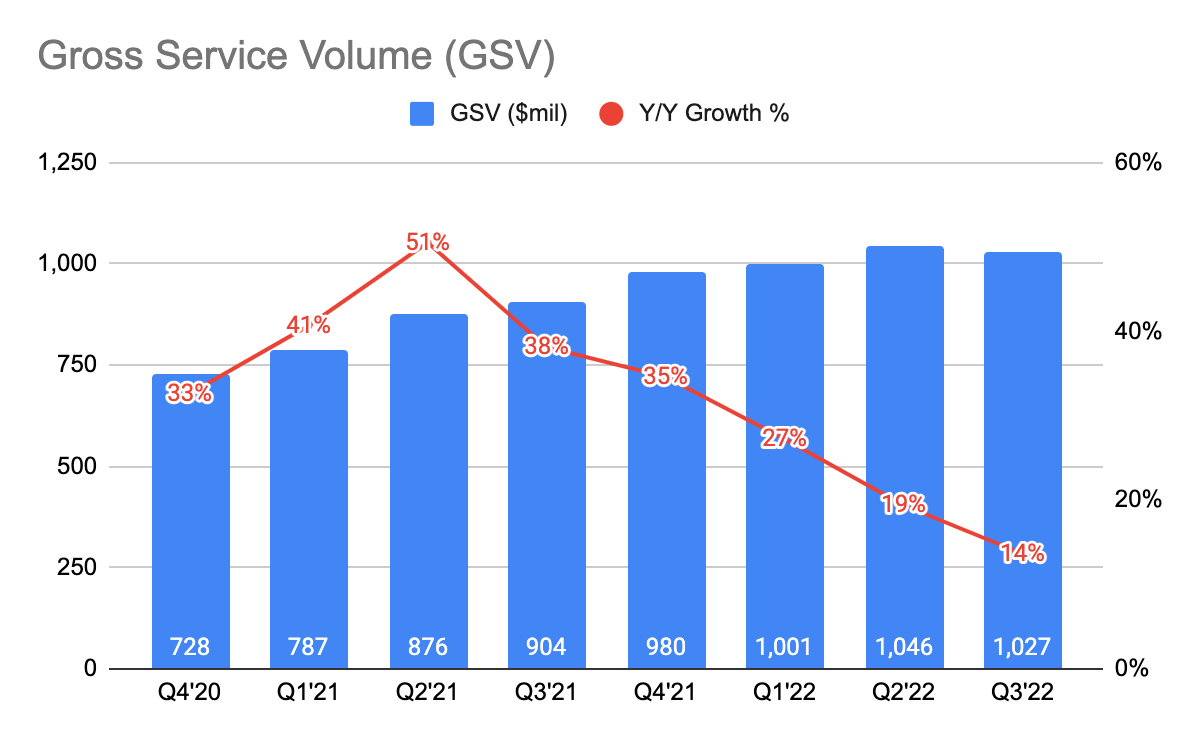

The decline in GSV, and slowdown in customer acquisition rate

UPWK 10-Q

This quarter, Upwork’s GSV grew 14% Y/Y but declined -2% sequentially from 2Q22. This is due to its weaker-than-expected growth in user base, customers pulling back on their spending, and being more prudent at where they are spending at. According to the management during the 3Q22 earnings call:

“…revenue impact in the third quarter from these conditions was in-line with our previously shared expectations. We have seen the softer client acquisition and retention trends that we observed in the second quarter stabilized in the third quarter, with the softness continuing to be more pronounced in Europe and with small and medium sized businesses…every company as they go through Q4 is going to continue to be very guarded with their spend, very measured with their spend.”

UPWK 10-Q UPWK 10-Q

Despite the softer customer acquisition this quarter, Upwork continues to bring in 11,000 new active clients to its platform. And more specifically, the pace of adding new enterprise clients has slowed down drastically during the quarter as a result of weak sales execution. The management expects to take another quarter to recover:

“…we did hit a hiccup with our land team in the quarter and that was actually driven more by internal execution than by the macro, although we did see fuel cycles elongate for some accounts…I think it could take a quarter to like a little bit of time for us to get back to where we want to be. And the macro does present a bit of uncertainty around exactly what that timeframe is.”

UPWK 10-Q

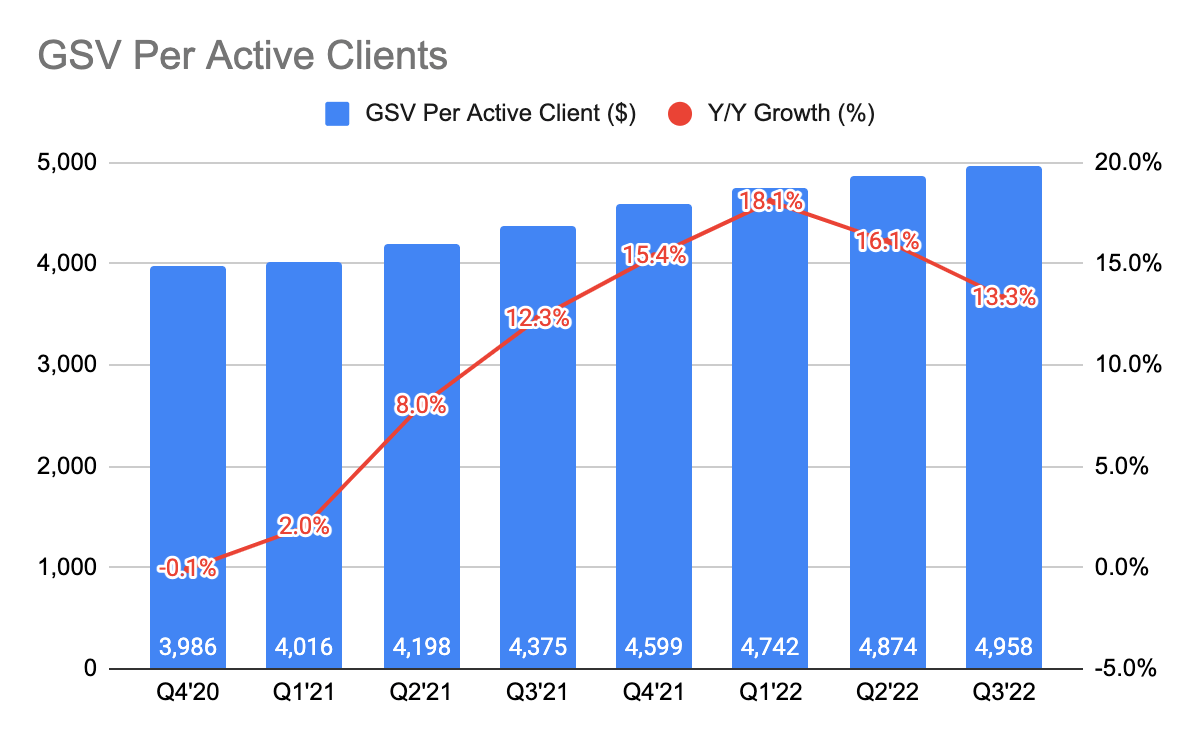

On the other hand, the GSV per active client continues to grow 13.3% Y/Y in 3Q22. In fact, this metric has been on an increasing trend from 4Q20 to 1Q22, which continued to grow till today. This indicates to me that once these customers are onboarded, Upwork has been successful in executing its land-and-expand strategy to increase spending from both existing and new clients.

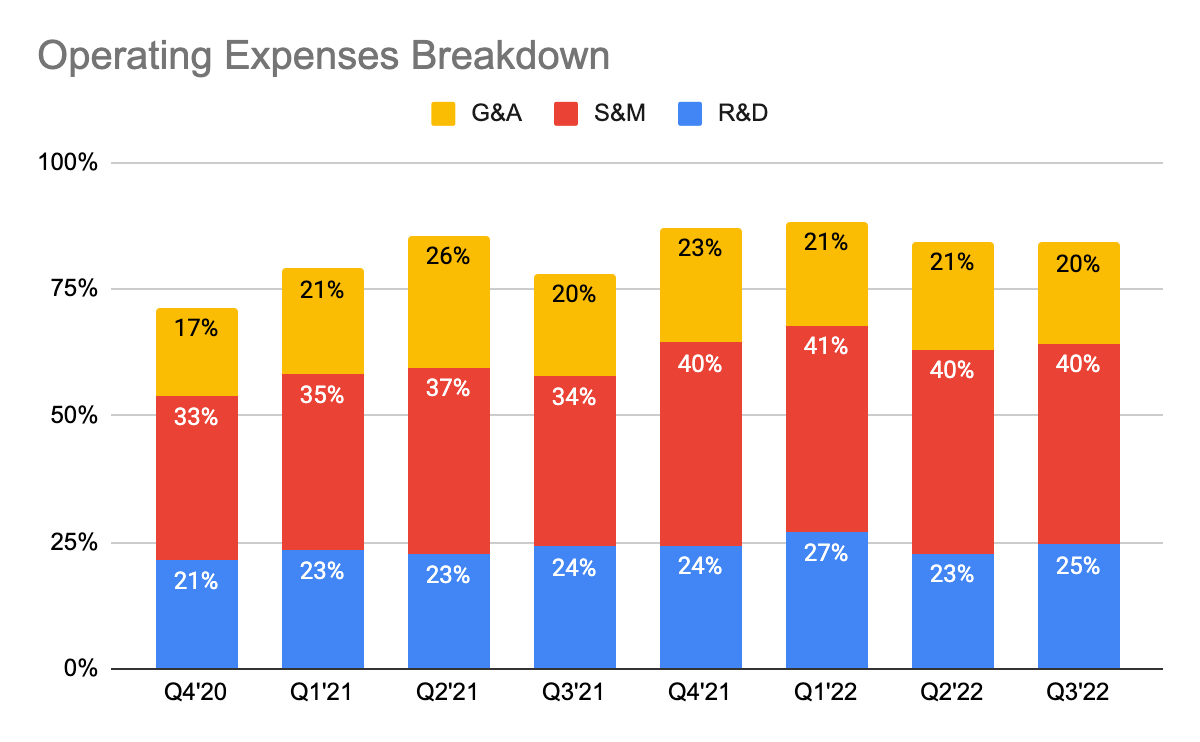

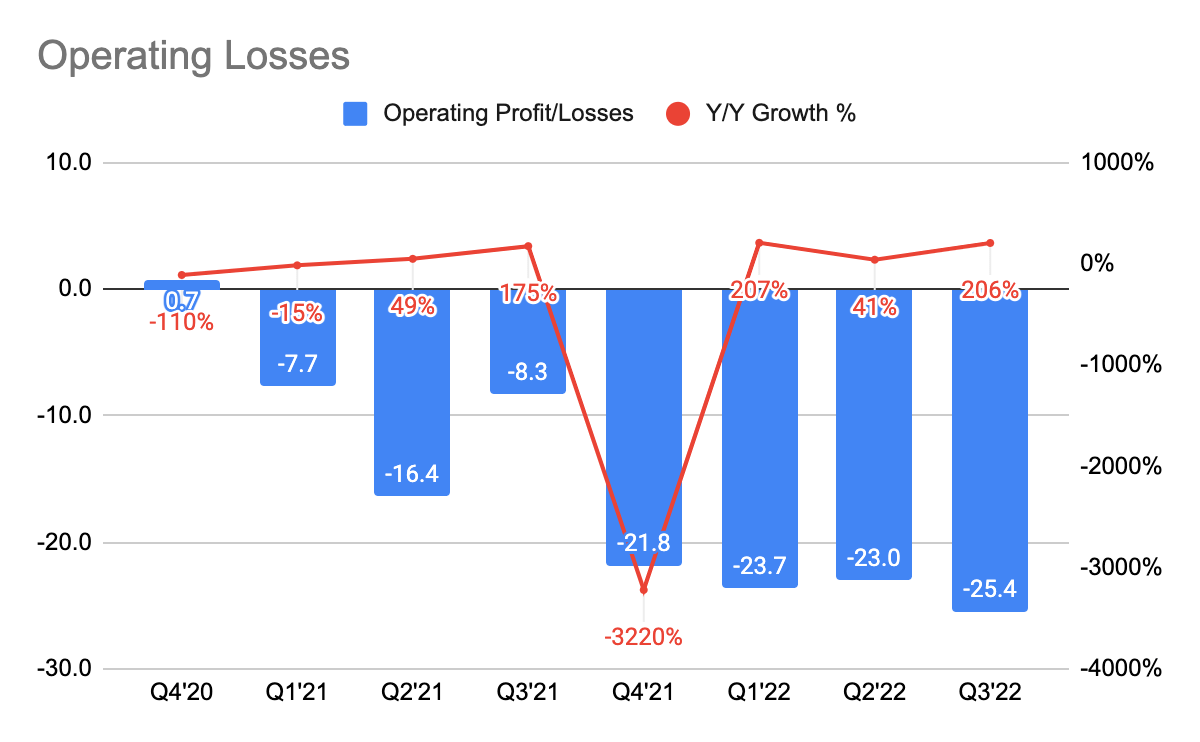

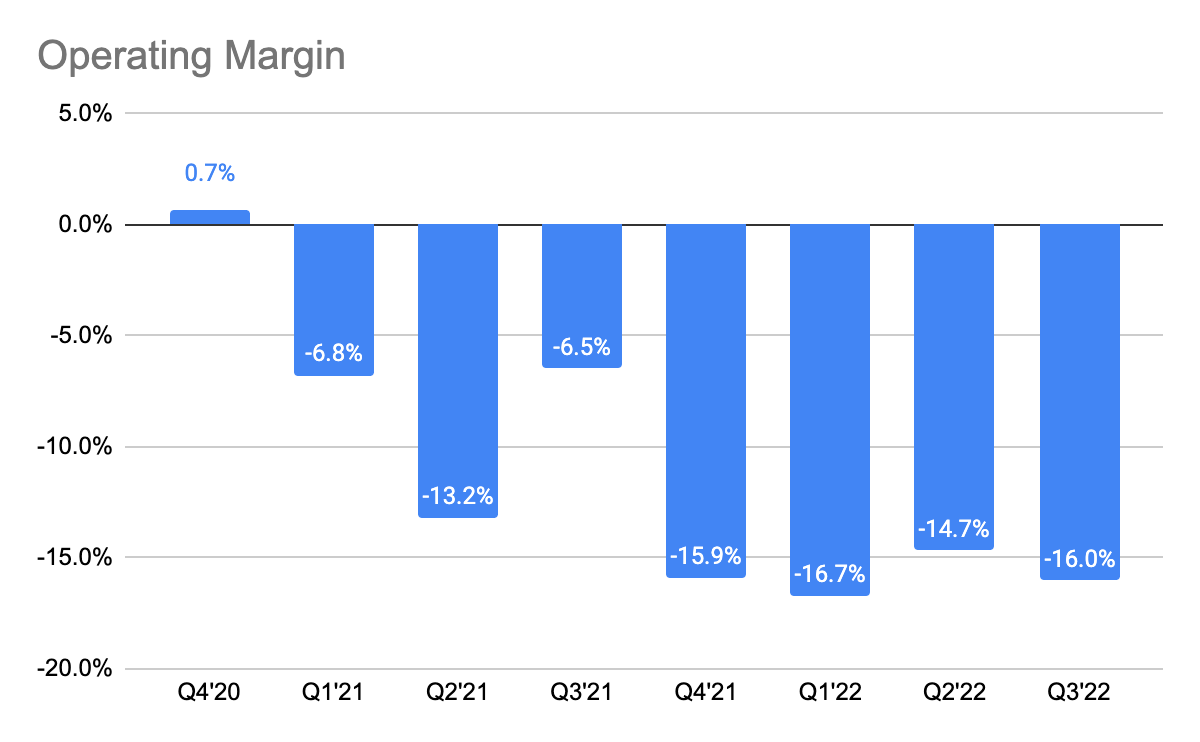

Lack of operating efficiency and concern over its increasing operating losses

UPWK 10-Q

UPWK 10-Q

UPWK 10-Q

A lot of investors that I see have been treating Upwork’s adjusted EBITDA as its profitability, and in my view, I’d argued against using so. This is because the company incurs huge stock-based compensation (“SBC”) expenses and excluding them will only inflate its profitability. I generally do not agree that a high SBC expense is a concern, so long as its EPS or FCF per share is growing. But, this clearly does not seem to be the case for Upwork given the huge operating losses they are incurring. Therefore, I prefer to use its operating profit over the adjusted EBITDA figure.

As expected and disappointingly, its operating losses have seen little to no improvements as operating losses continue to worsen as it grew 206% Y/Y. So far, it has failed to extract operating efficiency despite its heavy reinvestment into brand marketing this year as operating expenses, broken down into various segments (i.e., R&D, G&A, and S&M), continue to make up a large chunk of its revenue. Its operating margin, as a result, continues to be concerning at -16%. During the call, the management stated to focus on cost discipline, which I believe is key:

“Being prudent with resources has always been a guiding principle up work. And as the economic outlook evolves, we have several measures underway, including evaluate aiding our budgets, adjusting hiring, timing and prioritizing roles more aggressively reviewing and reducing vendor spend and ensuring we have a tight operating cadence around cost management with a high degree of visibility and internal partnership toward our goals.”

This seems rather strange to me as I’d think that operating efficiency is likely to show up to reflect an increase in margins, and the question is if they are facing an issue in acquiring customers. At this moment, I’d rather much prefer the management to slow down its investments while prioritizing cost reduction.

Valuation

I remain my stance that Upwork continues to be priced at a premium. Unless the company could show that it can grow while extracting operating efficiency, and thus, showcasing that it can improve and achieve similar margins to those of other similar marketplace businesses like eBay (EBAY), I have a hard time justifying the valuation.

Conclusion

Despite the tough macro and weak sales execution this quarter, though, Upwork has shown that once these customers are onboarded, they will spend increasingly more on the platform. However, I do think that as many companies are facing increasing uncertainty over the macro environment, Upwork’s GSV and client acquisition rate is likely to be impacted.

It is also frustrating to see that Upwork has never seemed to have a path to profitability, despite all the reinvestments they have done so far. Its growth rates have always come at the expense of higher operating losses, which in my view, does call for concern. As a result, I find it hard to justify the valuation it’s trading at today unless it could show me that there is a clear path to profitability.

Be the first to comment